Asia-Pacific Thin and Ultra-Thin Films Market, By Coating Methods (Gaseous State, Solutions State, Molten or Semi-Molten State), Type (Thin, Ultra-Thin), Deposition Techniques (Physical Deposition, Chemical Deposition), Application (Electronics & Semiconductor, Renewable Energy, Healthcare and Biomedical Applications, Automotive, Aerospace and Defense, Others), Country (Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Taiwan and Rest of Asia-Pacific) Industry Trends and Forecast to 2027

Market Analysis and Insights: Asia-Pacific Thin and Ultra-Thin Market

Market Analysis and Insights: Asia-Pacific Thin and Ultra-Thin Market

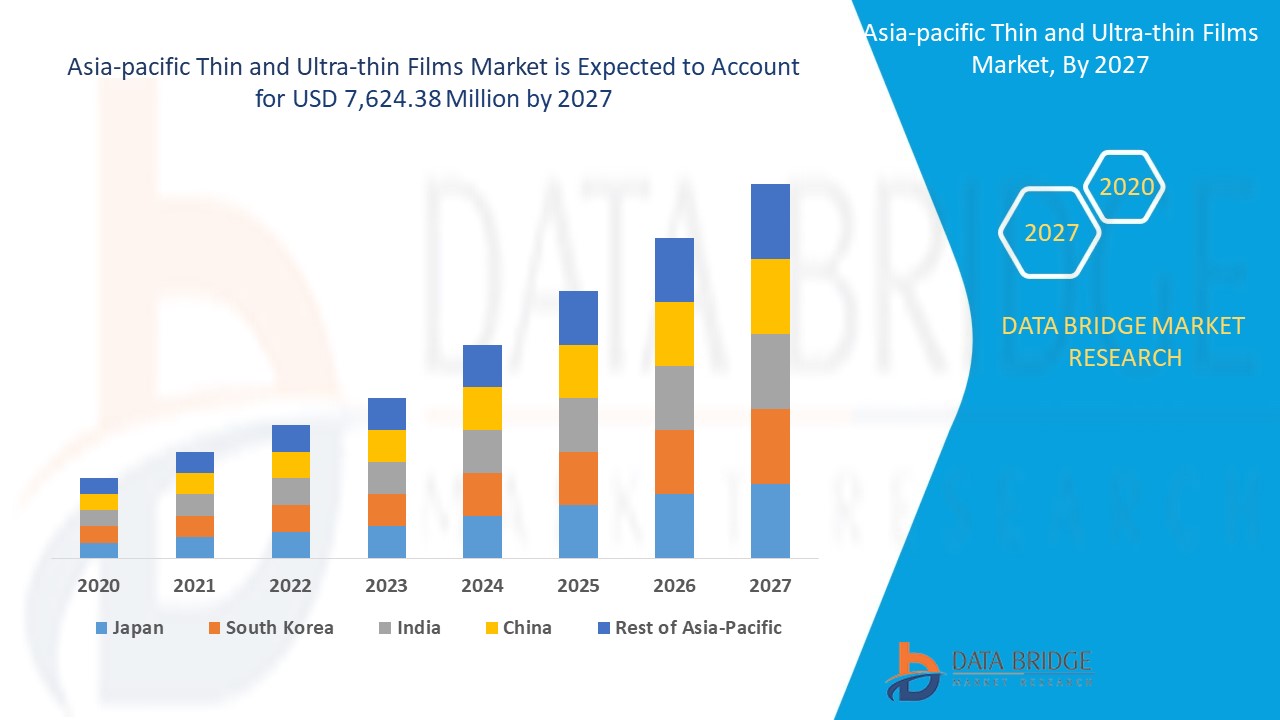

Thin and ultra-thin market is expected to gain market growth in the forecast period of 2020 to 2027. Data Bridge Market Research analyses that the market is growing with the CAGR of 16.4% in the forecast period of 2020 to 2027 and is expected to reach USD 7,624.38 million by 2027. The increasing growth in consumer electronics is boosting the growth of the market.

Asia-Pacific region has noted high development in electronics and semiconductor with increasing adoption in smartphones. The region is being highly penetrated by consumer electronics, there is a huge growth in OLED displays and other semiconductor devices which use thin and ultra-thin film coating for wear resistance and other such benefits acting as major driver for the growth of the market.

This thin and ultra-thin market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Asia-Pacific Thin and Ultra-Thin Market Scope and Market Size

Asia-Pacific Thin and Ultra-Thin Market Scope and Market Size

Thin and ultra-thin films market is segmented on the basis of coating methods, type, deposition techniques and application. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of coating methods, the thin and ultra-thin films market is segmented into gaseous state, solutions state and molten or semi-molten state. In 2020, coating methods segment is dominated by gaseous state segment and is expected to grow at higher rate as this method is widely used and is suitable for evaporation and CVD techniques which are mostly used in physical and chemical deposition respectively.

- On the basis of type, the thin and ultra-thin films market is segmented into thin and ultra-thin. In 2020, thin segment accounts for the largest chunk of market share in type segment due to more usage of thin films as thin films are old technology product, however, ultra-thin segment is growing at a higher rate as it is the latest type and is being rapidly adopted by solar panel manufacturers for end products.

- On the basis of deposition techniques, the thin and ultra-thin films market is segmented into physical deposition and chemical deposition. In 2020, deposition techniques segment is dominated by physical deposition segment and is expected to grow at higher rate as physical deposition is safe to operate and involves lower risk.

- On the basis of application, the thin and ultra-thin films market is segmented into electronics & semiconductor, renewable energy, healthcare and biomedical applications, automotive, aerospace and defense, and others. In 2020, electronics & semiconductor segment dominates the application segment as thin films are globally used for wrapping and coating of semiconductor materials for protection from wear and corrosion, however, renewable energy segment is growing at the higher rate as solar panels are the fastest growing renewable energy component which requires thin films.

Thin and ultra-thin Market Country Level Analysis

The thin and ultra-thin films market is analysed and market size information is provided by country, coating methods, type, deposition techniques and application as referenced above.

The countries covered in thin and ultra-thin market report are Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Taiwan and rest of Asia-Pacific.

China is dominating the market in Asia-Pacific region due to high manufacturing and adoption of consumer electronics in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of Virtual Reality

Thin and ultra-thin market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in Thin and ultra-thin and changes in regulatory scenarios with their support for the thin and ultra-thin market. The data is available for historic period 2010 to 2018.

Competitive Landscape and Thin and Ultra-Thin Market Share Analysis

Thin and ultra-thin market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to Asia-Pacific Thin and ultra-thin market.

The major players covered in the report are American Elements, LEW TECHNIQUES LTD, Denton Vacuum, KANEKA CORPORATION, Umicore, Materion Corporation, AIXTRON, Kurt J. Lesker Company, Vital Materials Co., Limited, AJA INTERNATIONAL, Inc., Praxair S.T. Technology, Inc., PVD Products, Inc., GEOMATEC Co., Ltd., INTEVAC, INC., Plasma-Therm, Arrow Thin Films, Inc., Super Conductor Materials, Inc., Angstrom Engineering Inc., ThinFilms Inc., Orange Thin Films among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of Thin and ultra-thin market.

For instance,

- In June 2020, Materion Corporation announced the acquisition of Optics Balzers, AG, a company engaged in providing thin film optical coatings. The strategic acquisition will enhance thin film optical coatings portfolio with increasing its geographic reach to Europe and Asia. The acquisition provided by the company with the end market mix and larger customer base.

- In March 2020, Praxair S.T. Technology, Inc. joined hands with Siemens, a company focusing in Gas and Power industry. The strategic partnership provided Siemens with coating services for various industrial gas turbine and aerospace components. The partnership increased the customer base of the company.

Partnership, joint ventures and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for thin and ultra-thin films products through expanded range of size.

SKU-