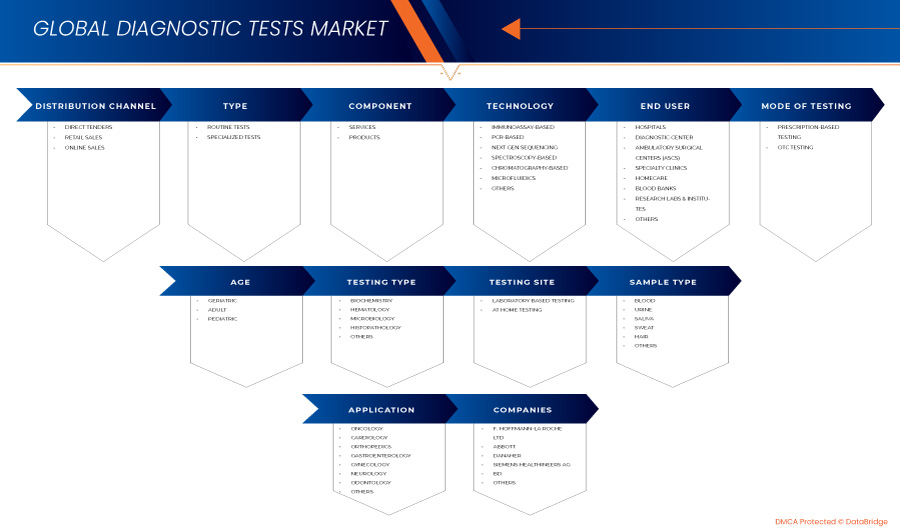

Global Diagnostic Tests Market, By Type (Routine Tests and Specialized Tests), Component (Services and Products), Technology (Immunoassay-Based, PCR-Based, Next Gen Sequencing, Spectroscopy-Based, Chromatography-Based, Microfluidics, and Others), Mode of Testing (Prescription-Based Testing and OTC Testing), Application (Oncology, Cardiology, Orthopedics, Gastroenterology, Gynecology, Neurology, Odontology, and Others), Sample Type (Blood, Urine, Saliva, Sweat, Hair, and Others), Testing Site (Laboratory Based Testing and At Home Testing), Testing Type (Biochemistry, Hematology, Microbiology, Histopathology, and Others), Age (Geriatric, Adult, and Pediatric), End User (Hospitals, Diagnostic Center, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Homecare, Blood Banks, Research Labs & Institutes, and Others), Distribution Channel (Direct Tenders, Retail Sales, and Online Sales) - Industry trends and forecast to 2031.

Diagnostic Tests Market Analysis and Size

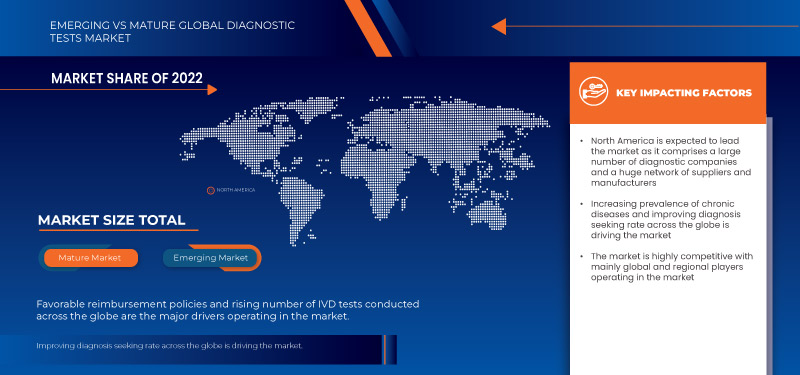

One of the primary factors driving the growth of the market is the rising prevalence of chronic diseases. In addition, the rising number of IVD tests conducted across the globe is another key driver for market growth. Favorable reimbursement policies also influence the market. However high cost associated with diagnostic kits is restraining the market growth. Strategic initiatives by the market players act as an opportunity for market growth. However, stringent rules and regulations for the approval of diagnostic test kits may create a challenge for the market.

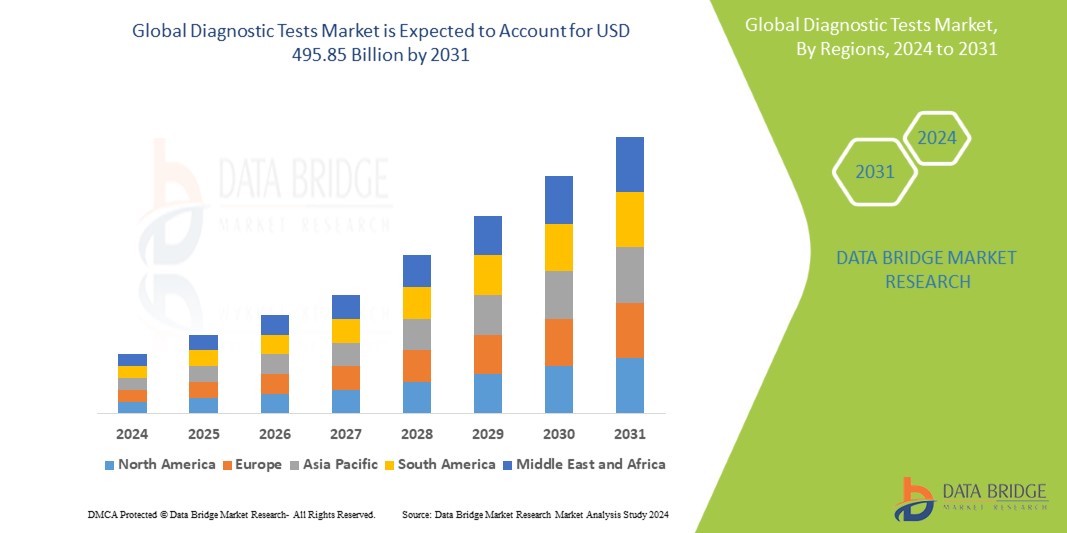

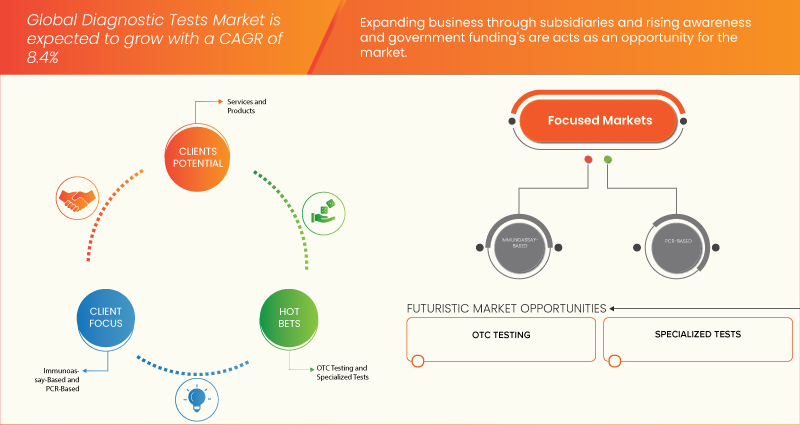

Data Bridge Market Research analyzes that the global diagnostic tests market is expected to reach the value of USD 495.85 billion by 2031, from USD 264.17 billion in 2023, growing at a CAGR of 8.4% during the forecast period of 2024 to 2031.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

Type (Routine Tests and Specialized Tests), Component (Services and Products), Technology (Immunoassay-Based, PCR-Based, Next Gen Sequencing, Spectroscopy-Based, Chromatography-Based, Microfluidics, and Others), Mode of Testing (Prescription-Based Testing and OTC Testing), Application (Oncology, Cardiology, Orthopedics, Gastroenterology, Gynecology, Neurology, Odontology, and Others), Sample Type (Blood, Urine, Saliva, Sweat, Hair, and Others), Testing Site (Laboratory Based Testing and At Home Testing), Testing Type (Biochemistry, Hematology, Microbiology, Histopathology, and Others), Age (Geriatric, Adult, and Pediatric), End User (Hospitals, Diagnostic Center, Ambulatory Surgical Centers (ASCs), Specialty Clinics, Homecare, Blood Banks, Research Labs & Institutes, and Others), Distribution Channel (Direct Tenders, Retail Sales, and Online Sales) |

|

Countries Covered |

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Poland, Turkey, Netherlands, Switzerland, Norway, Hungary, Austria, Lithuania, Ireland, Rest of Europe, China, Japan, India, South Korea, Australia, Malaysia, Singapore, Thailand, Indonesia, Philippines, Vietnam, Rest of Asia-Pacific, Brazil, Argentina, Peru, Colombia, Venezuela, Rest of South America, South Africa, Saudi Arabia, U.A.E., Egypt, Israel, Kuwait, and Rest of Middle East and Africa |

|

Market Players Covered |

F. Hoffmann-La Roche Ltd, Abbott, Danaher, Siemens Healthineers AG, BD, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., EKF Diagnostics, ACON Laboratories, Inc., and BIOMEDOMICS INC. among others |

Market Definition

Diagnostic tests are medical procedures or devices designed to identify and determine the presence or absence of specific diseases, conditions, or markers in individuals. These tests play a crucial role in healthcare by aiding in the early detection, diagnosis, and monitoring of various medical conditions.

Global Diagnostic Tests Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing Prevalence of Chronic Diseases

The encumbrance of chronic disease is continuously increasing across the globe. According to the WHO (World Health Organization), during 2021, the contribution of chronic disease was about 60%, which accounted for the number of deaths. In most Western countries, the increase in the number of chronic diseases is due to the rise in the number of the aged population. These increasing rates of diseases are directly proportional to the growth of diagnostics tests, as they are used to diagnose almost all diseases.

As the rate of chronic disease grows with time, the factors associated with the disease rates also increase. With the increase of disease, the healthcare and the status of health is also improving over time, and this is due to the adoption and increase in diagnosis of multiple chronic diseases.

The increasing prevalence of chronic diseases worldwide is a major driving force behind the growth of the diagnostic tests market. The need for accurate, timely, and personalized diagnostics to manage chronic conditions effectively fuels innovation in diagnostic technologies and promotes the expansion of the diagnostic tests market to meet the evolving healthcare demands.

- Rising Number of IVD Tests Conducted Across the Globe

In vitro diagnostics are one of the most significant segments in the healthcare industry. They are considered to be the most significant tool in the diagnostic world that help in the early diagnosis and prevention of diseases that affect the emotional, and personal life of the patient and also drain out financially. They are used in the diagnosis of cancer the prediction of associated risks, and others.

The advancements associated with an increase in dependency due to the early detection of the diseases and the capability of predicting the disease before appearing & predicting the adverse effects of treatment due to the increase in the number of IVD tests are driving the market growth

Opportunity

- Strategic Initiatives by the Market Players

The increase in the burden load of chronic and non-chronic disease across the regions, with the increase in the geriatric population, has created more demand for developing new diagnostics kits and solutions with better efficacy and less time consumption. Their main aim is to improve the health management and diagnostics for quality performance. Their highest priority is to support the healthcare end users in diagnostics for better structural decisions. The market players are busy fulfilling the demands of healthcare professionals and spending a noticeable amount for better products, kits, and reagents among others.

These strategic initiatives by the government, including acquisition and focused segment product launches for different are helping them to expand the global reach and also helping them to expand and enhance the product portfolio of the company will ultimately lead to more revenue generation, hence these strategic initiatives by the market players are acting as an opportunity for market growth.

Restraint/Challenge

- Stringent Rules and Regulations for the Approval of Diagnostic Test Kits

The use of diagnostics kits across the globe is rapidly increasing, with the growth of the aged population and several diseases that are preventable by early diagnosis. At the same time, the players of the diagnostics kits and reagents in the market have to follow certain regulations to get approval from the upper authorities to launch the product in the market. These stringent guidelines need to be followed, and this is one of the most difficult tasks among all the steps.

Regulation of DNA test kits in the U.S. FDA, ensures the efficacy and safety of diagnostics kits, even during the manufacturing and at the time of storage of kits have specific guidelines; that is one of the major challenges for the players because kits need to be stored in a temperature range of -18 to -80 degree Celsius. If the FDA finds out that these guidelines are not mandated or followed, they may ban kits, which is considered one of the most stringent guidelines.

These guidelines by the FDA are one of the most challenging tasks for the players and also restrict other new plays from entering the market to satisfy these guidelines, it takes a good amount of capital which is very difficult to maintain for the mid and low level players, thus acting hampering the growth and acting as a challenge for global diagnostics market.

Recent Developments

- In May 2023, Roche officially announced the acquisition of Stratos Genomics. This acquisition led to the development of DNA based sequencing for diagnostics use. This enhanced the healthcare diagnosis segment of the company, thus leading to more revenue generation

- In April 2022, Bio-Rad Laboratories, Inc. officially announced that it acquired Celsee, Inc., which provides instruments for the analysis of cells and helps in diagnosis. This acquisition created an opportunity for both of them to launch new products, which will improve the company's product portfolio

- In September 2022, Abbott revolutionized continuous glucose monitoring (CGM) with the launch of the FreeStyle Libre 3 sensor. This sensor boasts a 14-day wear time, eliminating the need for finger pricking and offering patient’s real-time glucose data for better diabetes management. The Libre 3's extended wear time and improved user experience address major pain points for diabetic patients, potentially leading to increased market share and patient satisfaction.

- In March 2020, Roche got FDA approval for Elecsys GALAD. This approval enhanced the company's product segment and helped in the early diagnosis of carcinoma. This approval also enhanced the financials of the company

- In March 2020, Bio-Rad Laboratories, Inc. officially announced its partnership with Testing Labs Worldwide. This partnership helped in the diagnosis of various diseases, including COVID-19. This helped enhance the company's product portfolio.

Global Diagnostic Tests Market Scope

The global diagnostic tests market is segmented into eleven notable segments based on type, component, technology, mode of testing, application, sample type, testing site, testing type, age, end users, and distribution channel. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Routine Tests

- Specialized Tests

On the basis of type, the global diagnostic tests market is segmented into routine tests and specialized tests.

Component

- Services

- Products

On the basis of component, the global diagnostic tests market is segmented into services and products.

Technology

- Immunoassay-Based

- PCR-Based

- Next Gen Sequencing

- Spectroscopy-Based

- Chromatography-Based

- Microfluidics

- Others

On the basis of technology, the global diagnostic tests market is segmented into immunoassay-based, PCR-based, next gen sequencing, spectroscopy-based, chromatography-based, microfluidics, and others.

Mode of Testing

- Prescription-Based Testing

- OTC Testing

On the basis of mode of testing, the global diagnostic tests market is segmented into prescription-based testing and OTC testing.

Application

- Oncology

- Cardiology

- Orthopedics

- Gastroenterology

- Gynecology

- Neurology

- Odontology

- Others

On the basis of application, the global diagnostic tests market is segmented into oncology, cardiology, orthopedics, gastroenterology, gynecology, neurology, odontology, and others.

Sample Type

- Blood

- Urine

- Saliva

- Sweat

- Hair

- Others

On the basis of sample type, the global diagnostic tests market is segmented into blood, urine, saliva, sweat, hair, and others.

Testing Site

- Laboratory Based Testing

- At Home Testing

On the basis of testing site, the global diagnostic tests market is segmented into laboratory based testing and at home testing.

Testing Type

- Biochemistry

- Hematology

- Microbiology

- Histopathology

- Others

On the basis of testing type, the global diagnostic tests market is segmented into biochemistry, hematology, microbiology, histopathology, and others.

Age

- Geriatric

- Adult

- Pediatric

On the basis of age, the global diagnostic tests market is segmented into geriatric, adult, and pediatric.

End User

- Hospitals

- Diagnostic Center

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

- Homecare

- Blood Banks

- Research Labs & Institutes

- Others

On the basis of end user, the global diagnostic tests market is segmented into hospitals, diagnostic center, Ambulatory Surgical Centers (ASCs), specialty clinics, homecare, blood banks, research labs & institutes, and others.

Distribution Channel

- Direct Tenders

- Retail Sales

- Online Sales

On the basis of distribution channel, the global diagnostic tests market is segmented into direct tenders, retail sales, and online sales.

Global Diagnostic Tests Market: Regional Analysis/Insights

The global diagnostic tests market is analyzed and market size insights and trends are provided by country, type, component, technology, mode of testing, application, sample type, testing site, testing type, age, end users, and distribution channel.

The countries covered in this market report are U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Poland, Turkey, Netherlands, Switzerland, Norway, Hungary, Austria, Lithuania, Ireland, rest of Europe, China, Japan, India, South Korea, Australia, Malaysia, Singapore, Thailand, Indonesia, Philippines, Vietnam, rest of Asia-Pacific, Brazil, Argentina, Peru, Colombia, Venezuela, rest of South America, South Africa, Saudi Arabia, U.A.E., Egypt, Israel, Kuwait, and rest of Middle East and Africa.

North America is expected to dominate the global diagnostic tests market due to the increasing prevalence of chronic diseases. The U.S. is expected to dominate the North America diagnostic tests market owing to the higher level of investments by various manufacturers and increasing demand for pharmaceutical products manufacturing in the region. Germany is expected to dominate the Europe diagnostic tests market owing to the rising prevalence of chronic and infectious diseases. China is expected to dominate the Asia-Pacific diagnostic tests market owing to the increasing number of IVD tests across the globe.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Global Diagnostic Tests Market: Competitive Landscape and Share Analysis

The global diagnostic tests market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major market players operating in the global diagnostic tests market are F. Hoffmann-La Roche Ltd, Abbott, Danaher, Siemens Healthineers AG, BD, Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., EKF Diagnostics, ACON Laboratories, Inc., and BIOMEDOMICS INC. among others.

SKU-