Global Insurance and Managed Care Market, By Type (Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs), Preferred Provider Organizations (PPOs), Point of Service Plans (POS)), Applications (General Utilization Management, Large Case Management, Speciality Utilization Management, Disease Management, Rental Networks and Workers Compensation Utilization Management), End User (Corporates, Individuals, Others), Distribution Channel (Direct Sales, Financial Institutions, E-commerce, Hospitals, Clinics, Others) – Industry Trends and Forecast to 2029.

Insurance and Managed Care Market Analysis and Size

In 2019, the Preferred Provider Organization (PPO) segment led the healthcare insurance market with a 28.0% revenue share. The Affordable Care Act (ACA) implemented in the United States focuses on expanding health coverage to low-income individuals. The act's goal is to improve the quality of healthcare services while lowering the cost of care, thereby expanding insurance coverage. The federal government plays a key role in shaping all aspects of the health-care sector.

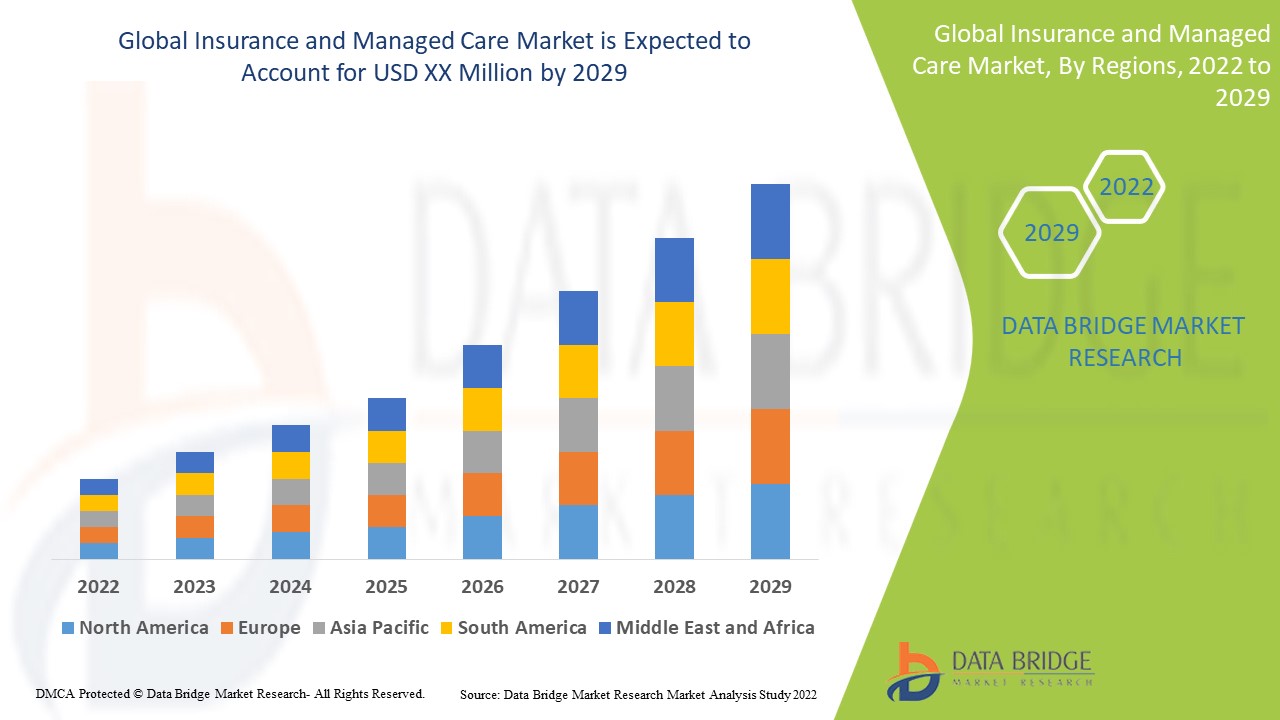

Data Bridge Market Research analyses that the insurance and managed care market which is expected to reach at a healthy CAGR of during the forecast period 2022 to 2029. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Insurance and Managed Care Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs), Preferred Provider Organizations (PPOs), Point of Service Plans (POS)), Applications (General Utilization Management, Large Case Management, Speciality Utilization Management, Disease Management, Rental Networks and Workers Compensation Utilization Management), End User (Corporates, Individuals, Others), Distribution Channel (Direct Sales, Financial Institutions, E-commerce, Hospitals, Clinics, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Anthem Insurance Companies, Inc (U.S.), Kaiser Foundation Health Plan, Inc (U.S.), Centene Corporation (U.S.), Amerigroup Corporation (U.S.), Humana Inc (U.S.), Bupa (U.K.), Now Health International (China), Cigna (U.S.), Aetna Inc. (U.S.), AXA (France), HBF Health Limited (Australia), Vitality (U.K.), Centene Corporation (U.S.), International Medical Group, Inc. (U.S.), Broadstone Corporate Benefits Limited (U.K.), Allianz Care (France), Assicurazioni Generali S.P.A. (Italy), Aviva (U.K.), Vhi Group (Ireland), UnitedHealth Group (U.S.), MAPFRE (Spain), AIA Group Limited (Hong Kong) |

|

Market Opportunities |

|

Market Definition

Managed care plans are a type of health insurance contract with healthcare providers and medical facilities to provide patients with hospital care at a lower cost. These providers build the managed care network, which determines how much patients' planned care will cost. Managed care is primarily intended to reduce unnecessary health care costs through various mechanisms such as incentives for physicians and patients to choose less expensive forms of care, programmes for reviewing medical relevance for specific services, increased beneficiary cost sharing, controls on inpatient admissions and stay time, and the implementation of cost-sharing incentives for outpatient surgery.

Global Insurance and Managed Care Market Dynamics

Drivers

- Increasing cost of medical services

Health insurance provides financial assistance for a serious illness or accident. The rising cost of medical services such as surgeries and hospital stays has created a new financial crisis around the world. The cost of medical services includes the cost of surgery, doctor fees, hospital stay costs, emergency room costs, and diagnostic testing costs. As a result, the rise in the cost of medical services drives the market growth.

- Growing number of daycare procedures

Daycare procedures are medical procedures or surgeries that require only a short stay in the hospital. Patients are required to stay in the hospital for a short period of time during the daycare procedure. The majority of health insurance companies now cover daycare procedures in their insurance plans, and there is no requirement to spend 24 hours in the hospital, which is the minimum stay in the hospital to claim insurance. While the majority of health insurance plans cover hospital stays and major surgeries, policyholders can also claim daycare procedures through their health insurance policy, which drives the market demand.

Opportunities

- Advantages of health insurance policies

Global health spending is increasing at a faster rate. According to a World Health Organization (WHO) report, global health spending is rising. Over the last two decades, global health spending has more than doubled, reaching USD 8.5 trillion in 2019, or 9.8% of global GDP. It was, however, unequally distributed, with high-income countries accounting for roughly 80% of global health spending. In low-income countries, health spending was primarily funded by out-of-pocket spending (OOPS; 44%) and external aid (29%), whereas government spending dominated in high-income countries (70%). As a result, rising healthcare costs are expected to create opportunities in the global health insurance market.

Restraints/Challenges

- High cost of insurance premiums

Health insurance covers all types of medical treatment costs. It provides financial support to the policyholder by covering all medical expenses when the policyholder is hospitalized for treatment. Health insurance also covers pre- and post-hospitalization expenses. To keep a health insurance policy active, the policyholder must pay insurance premiums on a regular basis. The cost of insurance premiums is high in the majority of cases, depending on the insurance plan, impeding market growth.

- Lack of experienced professionals

The lack of experienced professionals only attracts generally healthy populations, which will act as a restraint and further challenge the growth of the insurance and managed care market during the forecast period.

This insurance and managed care market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the insurance and managed care market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

COVID-19 Impact on the Insurance and Managed Care Market

COVID-19 had a positive impact on the insurance and managed care market. People are investing in healthcare plans as a result of the COVID-19 pandemic. People realize that purchasing a healthcare plan is a better option to be financially secure. To compete, service providers are also offering customised plans and services. COVID-19 is also covered in the insurance policies of the companies. AI and digital tools are being used by providers to gradually transition to a more efficient and digitally integrated ecosystem. These sophisticated platforms enable insured individuals to pay online using various models. Online portals, telemedicine, predictive and behavioural analytics enable providers to focus on customer expectations while lowering healthcare costs in a transparent manner.

Global Insurance and Managed Care Market Scope

The insurance and managed care market is segmented on the basis of type, applications, end-user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

- Preferred Provider Organizations (PPOs)

- Point of Service Plans (POS)

Applications

- General Utilization Management

- Large Case Management

- Speciality Utilization Management

- Disease Management

- Rental Networks and Workers Compensation Utilization Management

End User

- Corporates

- Individuals

- Others

Distribution Channel

- Direct Sales

- Financial Institutions

- E-commerce

- Hospitals

- Clinics

- Others

Insurance and Managed Care Market Regional Analysis/Insights

The insurance and managed care market is analyzed and market size insights and trends are provided by country, type, applications, end-user and distribution channel as referenced above.

The countries covered in the insurance and managed care market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the insurance and managed care market because of the region's well-developed healthcare infrastructure and favourable reimbursement policies.

Asia-Pacific is expected to grow at the highest growth rate in the forecast period of 2022 to 2029 because of increased public and private health expenditures, penetration of insurance services in rural and urban areas, and favourable government policies.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The insurance and managed care market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for insurance and managed care market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the insurance and managed care market. The data is available for historic period 2010-2020.

Competitive Landscape and Insurance and Managed Care Market Share Analysis

The insurance and managed care market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to insurance and managed care market.

Some of the major players operating in the insurance and managed care market are:

- Anthem Insurance Companies, Inc (U.S.)

- Kaiser Foundation Health Plan, Inc (U.S.)

- Centene Corporation (U.S.)

- Amerigroup Corporation (U.S.)

- Humana Inc (U.S.)

- Bupa (U.K.)

- Now Health International (China)

- Cigna (U.S.)

- Aetna Inc. (U.S.)

- AXA (France)

- HBF Health Limited (Australia)

- Vitality (U.K.)

- Centene Corporation (U.S.)

- International Medical Group, Inc (U.S.)

- Broadstone Corporate Benefits Limited (U.K.)

- Allianz Care (France)

- Assicurazioni Generali S.P.A. (Italy)

- Aviva (U.K.)

- Vhi Group (Ireland)

- UnitedHealth Group (U.S.)

- MAPFRE (Spain)

- AIA Group Limited (Hong Kong)

SKU-