Global Iot In Automobile Market

Market Size in USD Billion

CAGR :

%

USD

51.96 Billion

USD

256.71 Billion

2025

2033

USD

51.96 Billion

USD

256.71 Billion

2025

2033

| 2026 –2033 | |

| USD 51.96 Billion | |

| USD 256.71 Billion | |

|

|

|

|

IoT in Automobile Market Size

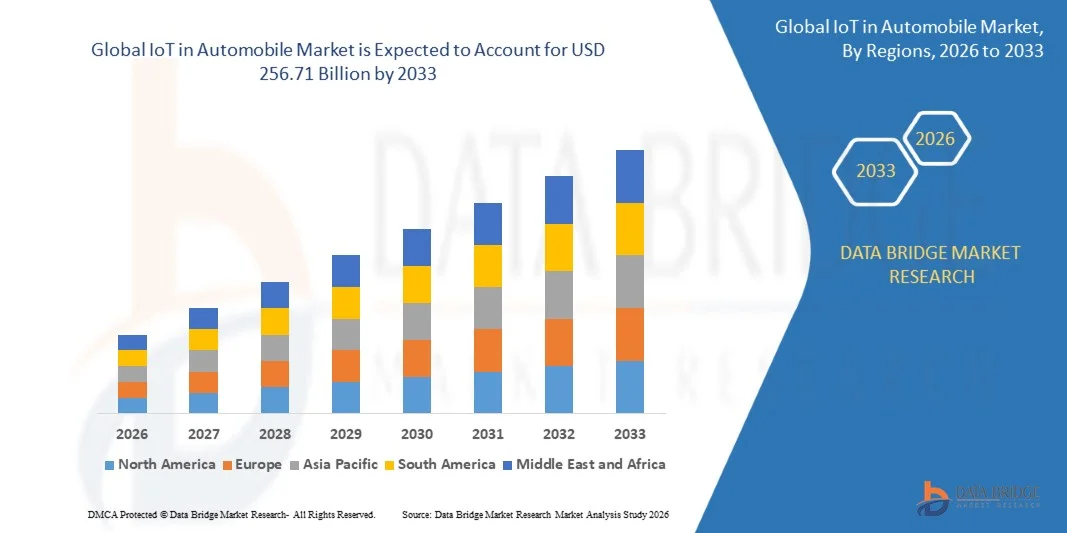

- The global IoT in automobile market size was valued at USD 51.96 billion in 2025 and is expected to reach USD 256.71 billion by 2033, at a CAGR of 22.10% during the forecast period

- The market growth is largely fuelled by the increasing adoption of connected vehicles, rising demand for real-time vehicle diagnostics, and growing integration of advanced telematics systems

- Expansion of smart city initiatives and the rise of autonomous driving technologies are further accelerating the market growth

IoT in Automobile Market Analysis

- IoT adoption in automobiles is transforming the industry by enabling vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, improving traffic management, and reducing accidents

- The market is witnessing strong investment in AI, cloud computing, and edge computing solutions to support connected car ecosystems and real-time data analytics

- North America dominated the IoT in automobile market with the largest revenue share of 38.45% in 2025, driven by the increasing adoption of connected vehicles, advanced telematics, and autonomous driving technologies

- Asia-Pacific region is expected to witness the highest growth rate in the global IoT in automobile market, driven by disposable incomes, rapid adoption of EVs, expanding automotive manufacturing, and supportive government policies for intelligent transportation systems

- The hardware segment held the largest market revenue share in 2025, driven by the increasing adoption of sensors, telematics devices, and connectivity modules in modern vehicles. Hardware components form the backbone of IoT systems, enabling real-time data collection and vehicle monitoring

Report Scope and IoT in Automobile Market Segmentation

|

Attributes |

IoT in Automobile Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

IoT in Automobile Market Trends

“Rising Adoption of Connected And Smart Vehicle Technologies”

• The increasing integration of IoT solutions in vehicles is significantly shaping the automotive market, as consumers and manufacturers seek connected, smart, and safer driving experiences. IoT applications such as vehicle-to-everything (V2X) communication, telematics, and predictive maintenance are driving the adoption of connected car technologies, enabling real-time monitoring and enhanced vehicle performance

• Growing emphasis on safety, efficiency, and convenience is accelerating IoT implementation in passenger and commercial vehicles. Features such as remote diagnostics, over-the-air updates, and driver assistance systems are becoming standard in modern vehicles, encouraging automakers to adopt IoT platforms that optimize performance and improve user experience

• Increasing investment in smart mobility, autonomous vehicles, and fleet management solutions is fostering IoT integration. Governments and private players are promoting digitalization, connected infrastructure, and vehicle-to-cloud communication, supporting innovation and driving adoption across regions

• For instance, in 2024, Tesla in the U.S. and BMW in Germany expanded their connected vehicle offerings by integrating IoT-enabled sensors, telematics, and infotainment systems. These developments enhanced driver safety, vehicle efficiency, and predictive maintenance capabilities, strengthening brand loyalty and market penetration

• While IoT adoption is growing, the pace of expansion depends on network connectivity, data security, and interoperability across vehicle platforms. Manufacturers are focusing on developing scalable, secure, and cost-efficient IoT solutions to meet global demand and improve vehicle intelligence

IoT in Automobile Market Dynamics

Driver

“Increasing Demand For Connected Vehicles And Smart Mobility Solutions”

• Rising consumer and manufacturer interest in connected vehicles is a major driver for the IoT in automobile market. Automakers are leveraging IoT platforms to provide real-time vehicle monitoring, predictive maintenance, and infotainment features, enhancing safety and user experience while reducing operational costs

• Growing focus on autonomous and semi-autonomous vehicle technologies is further supporting market growth. IoT enables advanced driver assistance systems (ADAS), V2X communication, and remote vehicle control, facilitating safer, more efficient, and intelligent mobility solutions

• Expansion of smart infrastructure, such as connected highways and intelligent traffic management systems, is boosting the adoption of automotive IoT. Integration with cloud-based services allows manufacturers and fleet operators to optimize routes, reduce downtime, and improve operational efficiency

• For instance, in 2023, Ford in the U.S. and Hyundai in South Korea implemented IoT-enabled telematics, sensors, and V2X communication in their vehicle fleets. These initiatives enhanced driver safety, vehicle diagnostics, and fleet monitoring capabilities, while supporting predictive maintenance and real-time decision-making

• Increasing government initiatives and private investments in smart cities, autonomous vehicles, and connected transportation ecosystems are continuously driving the IoT in automobile market, promoting innovation and adoption across regions

Restraint/Challenge

“High Implementation Costs And Data Security Concerns”

• The significant cost of IoT-enabled systems and connected vehicle infrastructure remains a key challenge, limiting adoption among small and mid-sized automakers. High investment in sensors, cloud platforms, and telematics solutions increases the total cost of ownership, affecting affordability for consumers

• Data privacy and cybersecurity concerns also pose challenges, as connected vehicles generate vast amounts of sensitive data. Ensuring secure communication, preventing hacking, and maintaining compliance with regional regulations require continuous investment in security protocols and monitoring systems

• Integration complexities across multiple vehicle platforms and legacy systems can slow adoption. Manufacturers must ensure interoperability between IoT modules, telematics systems, and cloud services while maintaining high reliability and performance standards

• For instance, in 2024, some European and U.S. automakers reported slower IoT deployment due to high system costs and concerns over data protection and integration with older vehicle models. These challenges necessitated additional investment in secure infrastructure and training for maintenance personnel

• Overcoming these challenges will require cost-effective IoT solutions, enhanced cybersecurity measures, and standardized protocols. Collaboration between automotive OEMs, technology providers, and regulatory bodies will be critical to unlocking long-term growth potential in the global IoT in automobile market

IoT in Automobile Market Scope

The market is segmented on the basis of offering, connectivity form factor, communication type, and application.

• By Offering

On the basis of offering, the IoT in automobile market is segmented into hardware, software, and services. The hardware segment held the largest market revenue share in 2025, driven by the increasing adoption of sensors, telematics devices, and connectivity modules in modern vehicles. Hardware components form the backbone of IoT systems, enabling real-time data collection and vehicle monitoring.

The software segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by the rising demand for analytics platforms, vehicle management software, and AI-powered applications that enhance vehicle performance and passenger experience. Software solutions are crucial for processing collected data, enabling predictive maintenance, and integrating infotainment and safety features seamlessly.

• By Connectivity Form Factor

On the basis of connectivity form factor, the market is segmented into tethered connectivity, integrated connectivity, and embedded networks. The integrated connectivity segment held the largest market revenue share in 2025 due to its ability to provide continuous, wireless communication between vehicle components and external networks. Integrated solutions facilitate remote diagnostics, over-the-air updates, and enhanced in-vehicle services.

The embedded networks segment is expected to register the fastest growth from 2026 to 2033, driven by the adoption of sophisticated in-vehicle networks and ECUs that support real-time communication, autonomous driving, and vehicle-to-everything (V2X) applications. Embedded networks reduce latency and enhance data security within connected vehicles.

• By Communication Type

On the basis of communication type, the market is segmented into in-vehicle communication, vehicle-to-vehicle (V2V) communication, and vehicle-to-infrastructure (V2I) communication. In-vehicle communication held the largest market share in 2025, as vehicles increasingly rely on internal networks for efficient operation of infotainment, telematics, and driver-assistance systems.

The V2V communication segment is expected to witness the fastest growth from 2026 to 2033, propelled by the development of autonomous driving technologies, collision avoidance systems, and traffic flow optimization. V2V communication enables vehicles to share real-time information on speed, position, and road conditions, improving overall road safety.

• By Application

On the basis of application, the market is segmented into infotainment, telematics, navigation, fleet management, predictive maintenance, vehicle security, automatic driver assistance system, traffic management, and others. The telematics segment held the largest market revenue share in 2025, driven by the growing demand for connected vehicle services, fleet tracking, and real-time diagnostics.

The automatic driver assistance system segment is expected to register the fastest growth from 2026 to 2033, fueled by increasing investments in ADAS technologies, autonomous driving features, and advanced safety systems. These systems rely heavily on IoT connectivity to enhance vehicle intelligence and passenger safety

IoT in Automobile Market Regional Analysis

• North America dominated the IoT in automobile market with the largest revenue share of 38.45% in 2025, driven by the increasing adoption of connected vehicles, advanced telematics, and autonomous driving technologies

• Consumers in the region highly value real-time vehicle monitoring, predictive maintenance, and enhanced infotainment systems enabled by IoT solutions

• This widespread adoption is further supported by strong automotive infrastructure, high disposable incomes, and the growing preference for smart mobility solutions, establishing IoT-enabled vehicles as a preferred choice for both personal and commercial transportation

U.S. IoT in Automobile Market Insight

The U.S. IoT in automobile market captured the largest revenue share in 2025 within North America, fueled by the rapid deployment of connected car technologies and growing consumer demand for smart mobility solutions. Vehicle owners are increasingly prioritizing safety, connectivity, and seamless integration with mobile and cloud-based platforms. The rising adoption of fleet management solutions, telematics, and over-the-air software updates further propels market growth. In addition, the integration of IoT systems with advanced driver-assistance systems (ADAS) and infotainment platforms is significantly contributing to market expansion.

Europe IoT in Automobile Market Insight

The Europe IoT in automobile market is expected to witness the fastest growth rate from 2026 to 2033, driven by stringent automotive safety regulations and the growing emphasis on connected and autonomous vehicles. Increasing urbanization, rising demand for smart mobility services, and investments in EV infrastructure are fostering IoT adoption. European automotive manufacturers are also focusing on integrating IoT solutions for predictive maintenance, fleet monitoring, and enhanced in-vehicle experiences.

U.K. IoT in Automobile Market Insight

The U.K. IoT in automobile market is expected to witness the fastest growth rate from 2026 to 2033, fueled by government initiatives supporting intelligent transport systems and connected vehicle programs. The adoption of IoT solutions in passenger vehicles and commercial fleets is accelerating, driven by the demand for improved safety, efficiency, and real-time vehicle analytics. The region’s advanced automotive ecosystem and strong focus on EVs and autonomous driving are further boosting market growth.

Germany IoT in Automobile Market Insight

The Germany IoT in automobile market is expected to witness the fastest growth rate from 2026 to 2033, supported by the country’s well-developed automotive sector and emphasis on Industry 4.0 technologies. Increasing consumer awareness of vehicle safety, smart mobility solutions, and predictive maintenance is driving IoT adoption. German OEMs are integrating IoT-enabled systems into connected and autonomous vehicles, enhancing performance, energy efficiency, and driver experience.

Asia-Pacific IoT in Automobile Market Insight

The Asia-Pacific IoT in automobile market is expected to witness the fastest growth rate from 2026 to 2033, driven by rapid urbanization, rising disposable incomes, and technological advancements in countries such as China, Japan, and India. The region’s focus on smart transportation, EV adoption, and government-supported intelligent transport initiatives is propelling market growth. In addition, APAC is emerging as a hub for automotive IoT components and systems, making solutions more affordable and accessible to both manufacturers and consumers.

Japan IoT in Automobile Market Insight

The Japan IoT in automobile market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s strong automotive technology ecosystem, high adoption of connected vehicles, and demand for advanced driver-assistance systems. IoT solutions for fleet management, vehicle-to-everything (V2X) communication, and predictive maintenance are driving growth. Moreover, Japan’s aging population is likely to increase demand for easier-to-use, safety-focused connected vehicle solutions.

China IoT in Automobile Market Insight

The China IoT in automobile market accounted for the largest revenue share in Asia-Pacific in 2025, driven by rapid urbanization, a growing middle class, and strong government initiatives supporting smart transportation and EV infrastructure. China is one of the largest markets for connected vehicles, and automotive IoT solutions are becoming increasingly integrated into both personal and commercial fleets. The push towards smart cities, domestic innovation, and availability of cost-effective IoT systems are key factors propelling the market in China.

IoT in Automobile Market Share

The IoT in Automobile industry is primarily led by well-established companies, including:

- Texas Instruments Incorporated (U.S.)

- NXP Semiconductors (Netherlands)

- Microsoft (U.S.)

- Intel Corporation (U.S.)

- IBM (U.S.)

- TomTom International BV (Netherlands)

- Cisco Systems, Inc. (U.S.)

- Google LLC (U.S.)

- AT&T Intellectual Property (U.S.)

- Apple Inc. (U.S.)

- Robert Bosch GmbH (Germany)

- Thales Group (France)

- Vodafone Limited (U.K.)

- General Motors (U.S.)

- AUDI AG (Germany)

- Ford Motor Company (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Qualcomm Technologies, Inc. (U.S.)

- Oracle (U.S.)

- ABB (Switzerland)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.