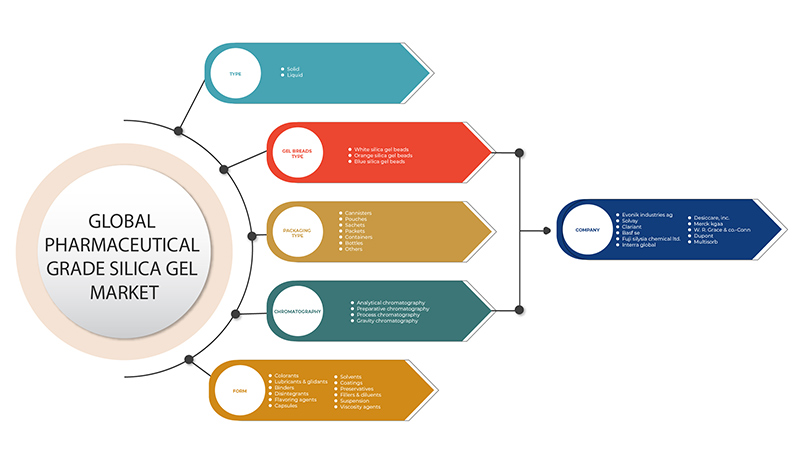

Global Pharmaceutical Grade Silica Gel Market, By Type (Liquid, and Solid), Gel Breads Type (White Silica Gel Breads, Orange Silica Gel Breads, and Blue Silica Gel Breads), Form (Colorants, Lubricants & Glidants, Binders, Disintegrants, Flavoring Agents, Capsules, Solvents, Coatings, Preservatives, Fillers & Diluents, Suspension, Viscosity Agents, and Others), Packaging Type (Canisters, Pouches, Sachets, Packets, Containers, Bottles, and Others), Chromatography (Analytical Chromatography, Preparative Chromatography, Process Chromatography, and Gravity Chromatography) Industry Trends and Forecast to 2029.

Market Analysis and Insights

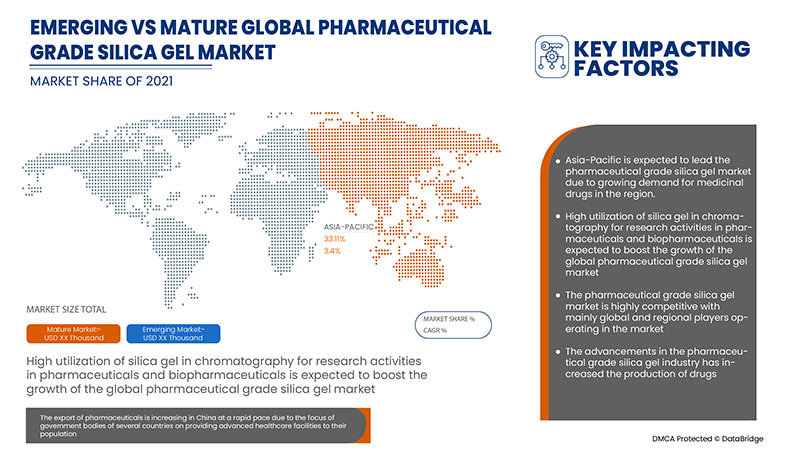

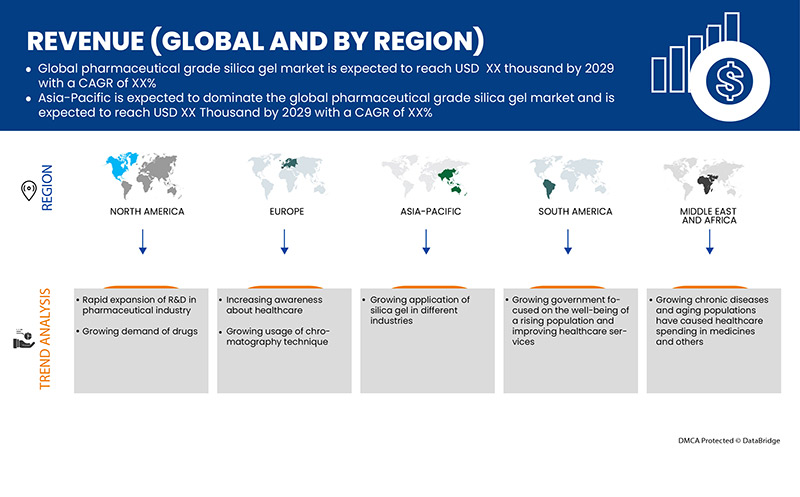

Global pharmaceutical grade silica gel market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 3.1% in the forecast period of 2022 to 2029 and is expected to reach USD 158,681.13 thousand by 2029. The major factor driving the growth of the pharmaceutical grade silica gel market are growing demand for medicinal drugs, Extensive deployment or R&D in the Pharma sector, and rising spending on biotechnology using chromatography for detecting molecular components.

Silica gel as a stationary phase is largely accepted as one of the top adsorbents used in column chromatography as well as other separation techniques. One of the major advantages is its tremendous affinity for adsorption. Additionally, it is commercially very readily available in several different sizes and types. The major significant reason for silica gel used as a stationary phase in column chromatography is that it has feasible to obtain the extract essential size of the particle size for a particular method.

Silica gel is a polar adsorbent that is slightly acidic and has a strong capacity to adsorb the basic substance. The silica gel is most widely used in reversed-phase partition chromatography and it has broad applications that consist of the separation of steroids, amino acids, lipids, alkaloids, and several pharmaceutical processes.

Global pharmaceutical grade silica gel market report provides details of market share, new developments, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Kilo Tons, Pricing in USD |

|

Segments Covered |

By Type (Liquid And Solid), Gel Breads Type (White Silica Gel Breads, Orange Silica Gel Breads, and Blue Silica Gel Breads), Form (Colorants, Lubricants & Glidants, Binders, Disintegrants, Flavoring Agents, Capsules, Solvents, Coatings, Preservatives, Fillers & Diluents, Suspension, Viscosity Agents And Others), Packaging Type (Canisters, Pouches, Sachets, Packets, Containers, Bottles, and Others), Chromatography (Analytical Chromatography, Preparative Chromatography, Process Chromatography, and Gravity Chromatography) |

|

Countries Covered |

U.S., Canada, and Mexico, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, Germany, Rest of Europe, Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia & New Zealand, Rest of Asia-Pacific, Brazil, Argentina, Rest of South America, South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel, and the Rest of the Middle East and Africa. |

|

Market Players Covered |

BASF SE, DuPont, Solvay, Merck KGAA, W. R. Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical |

Pharmaceutical Grade Silica Gel Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

Drivers

- Growing Demand for Medicinal Drugs

The growing pharmaceutical industry has propelled the growth of drug production, which has increased the consumption of silica gel over the years. The demand for silica gel is expected to increase further as chromatography can be performed using silica gel. Silica gel column chromatography is widely used in the pharmaceutical industry to collect or separate different drug components.

- Extensive Deployment of R&D in the Pharma Sector

The growing need for data integrity and automation has led to the integration of sophisticated software with contemporary chromatography systems. These advances in technology for the development of improved systems, innovative and disposable columns, better-performing resins, and other accessories may help the market to grow significantly.

- Rising Spending on Biotechnology using Chromatography for Detecting Molecular Components

Bioencapsulation involves the envelopment of tissues or biologically active substances in a semipermeable membrane to protect the enclosed biological structures such as cells, enzymes, drugs, and magnetic materials among others. The continuous research and development of silica gel based techniques like chromatography from the biotech end will lead to the growth of the global pharmaceutical grade silica gel market.

Opportunities

- Lucrative Outlook Towards In-House R&D

Chromatography is a continuously evolving technique and an increase in the demand for chromatography instruments and reagents for research and development is a major factor driving the growth and demand for the global pharmaceutical grade silica gel market.

- Easy Availability of Raw Materials through Well-Established Strategic Partners

The amorphous form of silicon dioxide is used to manufacture pharmaceutical-based silica gel. The enormous availability of different raw materials on the earth’s surface as well the ability to synthetically produce these raw materials along with the companies’ producing pharmaceutical grade silica gel well-established partnerships with various suppliers and partners, which continuously supply high-grade raw materials to these players for the production of silica gel.

Restraints/Challenges

- Stringent Regulations by the Government

USP's drug standards are enforceable in the U.S. by the Food and Drug Administration (FDA) and are also used in more than 140 countries across the globe. In the Pharmacy Act 1948 of India, there are various stringent regulations regarding the composition of drugs, which requires the pharmacists/chemists to follow various procedures and screening to get approved by the government. These stringent rules and regulations might be one of the biggest restraints faced by the global pharmaceutical-grade silica gel market.

- The Availability of Substitutes

Free silanols on the surface of silica are responsible for detrimental interactions of those compounds and the stationary phase. These show bad peak shape and low efficiency. This has also inclined manufacturers to opt for substitutes present in the market. For these reasons, several new stationary phases such as non-silica stationary phases, which have reduced and/or shielded silanols, are being introduced into the market.

- Pharmaceutical Items Meet Stringent Quality Control and Performance Standards

Across the globe, every government allocates a substantial proportion of its total health budget to medicines and pharmaceutical items. In developing countries, considerable administrative and technical efforts are directed to ensure that the patients and consumers receive effective medicines of good quality without any compromise on the quality.

- Limited Application Scope to Non-Volatile Compounds

The temperature of the system using silica gel for volatile compounds needs to be maintained at lower levels so that the compound does not vaporize very fast and there is a total loss of the sample before it is utilized and separated by the silica gel plate. Therefore, the scope of silica gel’s application is limited to non-volatile compounds, which may challenge the growth of the global pharmaceutical grade silica gel market.

Recent Development

- In February, DuPont launched a new online sales portal for the needs of bioprocessing industry purchasers. DuPont bioprocessing enables sophisticated separations and purification for therapeutics, with different DuPont brands such as AmberChrom and AmberLite being very well established in the biopharma industry.

Global Pharmaceutical Grade Silica Gel Market Scope

Global pharmaceutical grade silica gel market is categorized based on type, gel breads type, form, packaging type, and chromatography. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- Solid

- Liquid

On the basis of type, the global pharmaceutical grade silica gel market is segmented into solid and liquid.

Gel Breads Type

- White Silica Gel Breads

- Orange Silica Gel Breads

- Blue Silica Gel Breads

On the basis of gel breads type, the global pharmaceutical grade silica gel market is segmented into white silica gel breads, orange silica gel breads, and blue silica gel breads.

Form

- Fillers & Diluents

- Binders

- Disintegrants

- Lubricants & Glidants

- Colorants

- Flavoring Agents

- Preservatives

- Solvents

- Capsules

- Viscosity Agents

- Suspension

- Coatings

On the basis of form, the global pharmaceutical grade silica gel market is segmented into colorants, lubricants & glidants, binders, disintegrants, flavoring agents, capsules, solvents, coatings, preservatives, fillers & diluents, suspension, viscosity agents, and others hospitals and clinics, diagnostic centers, academic institutes and others.

Packaging Type

- Pouches

- Sachets

- Packets

- Cannisters

- Containers

- Bottles

- Others

On the basis of packaging type, the global pharmaceutical grade silica gel market is segmented into canisters, pouches, sachets, packets, containers, bottles, and others.

Chromatography

- Analytical Chromatography

- Preparative Chromatography

- Process Chromatography

On the basis of chromatography, the global pharmaceutical grade silica gel market is segmented into analytical chromatography, preparative chromatography, process chromatography, and gravity chromatography.

Pharmaceutical Grade Silica Gel Market Regional Analysis/Insights

The pharmaceutical-grade silica gel market is analysed and market size insights and trends are provided by country, type, gel breads type, form, packaging type, and chromatography as referenced above.

Global pharmaceutical-grade silica gel market is further segmented into North America, South America, Asia-Pacific, Europe, and the Middle East and Africa. North America is segmented into U.S., Canada, and Mexico. Europe is segmented into Germany, U.K., Italy, France, Spain, Russia, Switzerland, Turkey, Belgium, Netherlands, and the rest of Europe. Asia-Pacific is segmented into Japan, China, South Korea, India, Singapore, Thailand, Indonesia, Malaysia, Philippines, Australia, New Zealand, and the rest of Asia-Pacific. South America is segmented into Brazil, Argentina, and the rest of South America. The Middle East and Africa is segmented into South Africa, Egypt, Saudi Arabia, United Arab Emirates, Israel, and the rest of the Middle East and Africa.

Asia-Pacific dominates the pharmaceutical-grade silica gel market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the presence of major key players and well-developed healthcare infrastructure in the country.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Pharmaceutical Grade Silica Gel Market Share Analysis

Global pharmaceutical grade silica gel market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the pharmaceutical grade silica gel market.

Some of the prominent participants operating in the global pharmaceutical grade silica gel market are BASF SE, DuPont, Solvay, Merck KGAA, W. R. Grace & Co.-Conn, Evonik Industries AG, Multisorb Technologies, Clariant AG, Fuji Silysia Chemical.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Global Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-