Global Risk Management Software Market, By Type (Web, Android Native, iOS Native, Other), Service (Managed Service, Professional Service), Deployment (On- Premises, Cloud), End- User (Banking, Insurance, Asset Management, Energy and Utilities, Educational Institutions, Healthcare, Telecom, Information Technology, Oil and Gas, Retail, Life Sciences), Types of Software (Enterprise Risk Management Software, Financial Risk Management Software, Integrated Risk Management Software, Application Risk Management Software, Market Risk Management Software, Credit Risk Management Software, Information Technology Risk Management Software, Quantitative Risk Management Software, Project Risk Management Software) – Industry Trends and Forecast to 2029

Risk Management Software Market Analysis and Size

Risk management software will aid in understanding an organization's potential risk. The analysis performed by this risk management software will assist the company in adhering to certain standards in order to avoid future conflicts. The use of risk management software will also assist project managers in delegating tasks while maintaining complete control. Risk-based auditing is important for an organisation because it aids in identifying unanticipated risks. The software aids in the development of a clear strategy for risk-based auditing by making it more systematic and organised. It aids in maintaining consistency and clear communication.

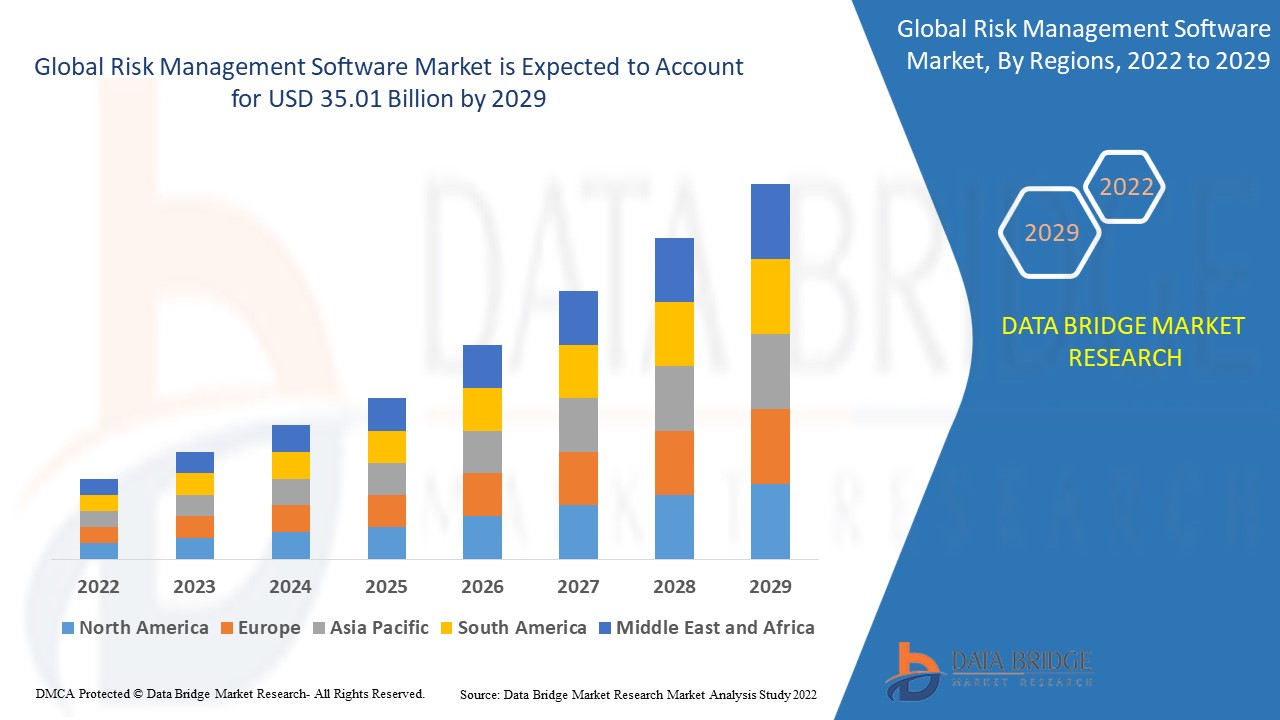

Data Bridge Market Research analyses that the risk management software market was valued at USD 31.33 billion in 2021 and is expected to reach the value of USD 35.01 billion by 2029, at a CAGR of 9.75% during the forecast period. The major factors driving the growth of the farm management software market are an increase in the rate of digitization, particularly in developing economies, growing adoption of risk management software solutions by small and medium-sized businesses, and an increase in the proliferation rate of smartphones.

Market Definition

Risk management software, as the name suggests, is a technological system used by risk managers to manage administrative and financial tasks with a single click. Risk management software makes it possible to perform and manage many risk-related activities and operations in real time, such as document storage and sharing, financial reporting, and integrated banking.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Type (Web, Android Native, iOS Native, Other), Service (Managed Service, Professional Service), Deployment (On- Premises, Cloud), End- User (Banking, Insurance, Asset Management, Energy and Utilities, Educational Institutions, Healthcare, Telecom, Information Technology, Oil and Gas, Retail, Life Sciences), Types of Software (Enterprise Risk Management Software, Financial Risk Management Software, Integrated Risk Management Software, Application Risk Management Software, Market Risk Management Software, Credit Risk Management Software, Information Technology Risk Management Software, Quantitative Risk Management Software, Project Risk Management Software) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America. |

|

Market Players Covered |

Adobe (US), Oracle (US), HubSpot, Inc. (US), SAS Institute Inc. (US), HP Development Company, L.P. (US), SimplyCast (Canada), Act-On Software, Inc. (US), Infor (US), Yesware, Inc. (US), Sailthru. Inc. (US), Vivial Inc. (US), Keap (US), IBM (US), SAP SE (Germany), Microsoft (US), ThriveHive (US), Demandbase, Inc. (US), WordStream (US), CAKE (US), and Chetu Inc. (India), among others |

|

Opportunities |

|

Risk Management Software Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Surge in volume of organisational data

The increasing volume of critical organisational data will emerge as a major market growth driver. The increasing focus of product developers on the adoption of new and advanced secure technology, particularly in developing economies,

- Rising cases of identity theft

Rising instances of identity theft, rising adoption by financial institutions, and the strengthening of the IT industry in developing economies such as India and China will exacerbate market growth.

Opportunity

Rising adoption of cloud-based security solutions to improve productivity and efficiency, rising instances of security breaches and data breaches, and an increase in the number of research and development capabilities by major players are some of the other factors driving market growth.

Restraints

Lack of technological expertise in developing and underdeveloped economies, as well as the complexity associated with software installation and configuration, will act as growth restraints for the market. Furthermore, the decline in awareness and in backward economies, as well as the high costs of deploying software, will slow the market's growth rate yet again. The lack of strong infrastructure in backward economies will also pose a challenge to market growth rates.

This risk management software market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the risk management software market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Post COVID-19 Impact on Risk Management Software Market

Spending on risk management software is expected to rise compared to pre-pandemic levels, owing to a variety of factors including an increase in work-from-home culture across industries and an increase in the risk of cyber-attacks and other security issues. Furthermore, the COVID-19 pandemic has caused significant changes in people's daily lives, workplaces, and the surrounding environment. The current estimate for 2027 is significantly higher than the pre-COVID-19 estimates. The risk management market is expected to recover by the end of 2020; however, it is expected to grow significantly faster in the coming years as a result of work from home (WFH), social distancing, and business digital transformation.

Recent Development

- Riskonnect Inc. launched Riskonnect ClearSight 19.0, an addition to its integrated risk management platform, in June 2019.

- RLDatix entered into an agreement to acquire iContracts (US) in May 2019, which provided RLDatix with more significant opportunities.

- Verge Health announced a partnership with the Texas Hospital Association (US) in February 2019 to strengthen its governance, risk, and compliance platform.

Global Risk Management Software Market Scope

The risk management software market is segmented on the basis of type, service type, deployment, end- users and types of software. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Web

- Android native

- iOS native

- other

Service type

- Managed service

- Professional service

Deployment

- On-premise

- Cloud

Type of software

- Enterprise risk management software

- Financial risk management software

- Integrated risk management software

- Application risk management software

- Market risk management software

- Credit risk management software

- Information technology risk management software

- Quantitative risk management software

- Project risk management software

End user

- Banking

- Insurance

- Asset management

- Energy and utilities

- Educational institutions

- Healthcare

- Telecom

- Information technology

- Oil and gas

- Retail and life sciences

Risk Management Software Market Regional Analysis/Insights

The risk management software market is analysed and market size insights and trends are provided by country, type, service type, deployment, end- users and types of software as referenced above.

The countries covered in the risk management software market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the risk management software market and will maintain its dominance throughout the forecast period due to the rise of cybersecurity threats, rapid adoption of risk management software by various banks and fin-tech industries to manage various types of risk, and the presence of prominent key players. Asia-Pacific will have the highest growth rate due to the region's high rate of adoption of by various industries, surging investments in the development of IT infrastructure in this region, favourable government regulations regarding risk management software, and an increase in the rate of industrialization.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Risk Management Software Market Share Analysis

The risk management software market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to risk management software market.

Some of the major players operating in the risk management software market are:

- Adobe (US)

- Oracle (US)

- HubSpot, Inc. (US)

- SAS Institute Inc. (US)

- HP Development Company, L.P. (US)

- SimplyCast (Canada)

- Act-On Software, Inc. (US)

- Infor (US)

- Yesware, Inc. (US)

- Sailthru. Inc. (US)

- Vivial Inc. (US)

- Keap (US,

- IBM (US)

- SAP SE (Germany)

- Microsoft (US)

- ThriveHive (US)

- Demandbase, Inc. (US)

- WordStream (US)

- CAKE (US)

- Chetu Inc. (India)

SKU-