Asia Pacific Base Oil Market

Market Size in USD Million

CAGR :

%

USD

8.17 Million

USD

15.34 Million

2024

2032

USD

8.17 Million

USD

15.34 Million

2024

2032

| 2025 –2032 | |

| USD 8.17 Million | |

| USD 15.34 Million | |

|

|

|

|

Base Oil Market Size

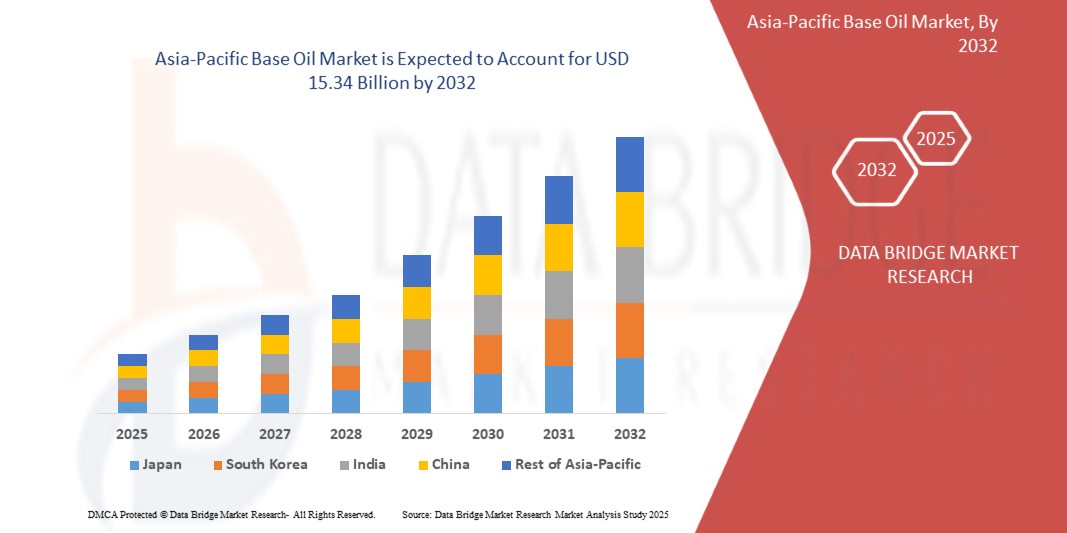

- The Asia-Pacific Base Oil Market was valued at USD 8.17 billion in 2024 and is expected to reach USD 15.34 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.2%, primarily driven by the escalating demand for high-grade lubricants in the automotive sector

- This growth is driven by factors such as expansion of the construction and automotive industries globally has led to increased consumption of paints and coatings, thereby boosting the demand for Base Oil

Base Oil Market Analysis

- The Asia-Pacific base oil market is experiencing significant growth, primarily driven by the escalating demand for high-grade lubricants in the automotive sector.

- Countries like China, India, and Japan are witnessing a surge in vehicle production, necessitating superior engine oils that offer enhanced performance and comply with stringent emission norms.

- This trend is propelling the shift from traditional Group I base oils to more advanced Group II and III variants, which provide better oxidation stability and fuel efficiency.

- China stands as the dominant player in the Asia-Pacific base oil market, accounting for a significant share due to its robust automotive industry and expansive industrial base.

Report Scope and Base Oil Market Segmentation

|

Attributes |

Base Oil Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Asia-Pacific

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Base Oil Market Trends

“Transition from Group I to Group II Base Oils”

- Stricter environmental regulations and the need for higher-performance lubricants have propelled the demand for Group II base oils, which offer better oxidation stability and lower sulfur content compared to Group I. This transition aligns with global efforts to reduce emissions and improve fuel efficiency.

- The market has seen a decline in Group I base oil production due to plant closures and upgrades. For instance, Eneos in Japan permanently shut down its Wakayama Group I plant in mid-October 2023, and its Mizushima A Group I plant underwent maintenance from September to November 2023. These developments have tightened Group I supply, prompting a shift towards Group II base oils, which are more readily available and meet current market requirements

- The narrowing price gap between Group I and Group II base oils has made the latter more economically viable.

- For instance, In Southeast Asia, consumers have increasingly favored Group II grades as the price differential has decreased, making them a cost-effective alternative without compromising on quality

- The Asia-Pacific base oil market is undergoing a structural transformation, with a clear move towards Group II base oils driven by regulatory, supply, and economic factors. This trend is expected to continue, reshaping the market landscape and influencing production and consumption patterns across the region.

Base Oil Market Dynamics

Driver

“The Escalating Demand for High-Grade Lubricants in the Automotive Sector”

- The Asia-Pacific region has witnessed a substantial increase in vehicle manufacturing. This uptick in production amplifies the need for high-quality lubricants to ensure optimal engine performance and longevity.

- Countries like India are experiencing rapid growth in their automotive sectors. In 2023, Exxon Mobil announced an investment of INR 9 billion (approximately USD 109.51 million) to establish a lubricants production plant in Maharashtra, India. Such investments underscore the region's commitment to meeting the rising demand for automotive lubricants.

- The automotive industry's shift towards more efficient and environmentally friendly vehicles necessitates advanced lubricants. The introduction of synthetic and semi-synthetic base oils caters to modern engines' requirements, offering better thermal stability and performance.

For instance,

- China produced over 27 million vehicles in 2022, marking a 3.4% rise from the previous year

Collectively, the burgeoning automotive industry, coupled with technological innovations and strategic investments, is significantly propelling the demand for high-grade base oils in the Asia-Pacific region. This trend is expected to continue, reinforcing the region's pivotal role in the global base oil market.

Opportunity

“Rising Demand for Bio-Based and Renewable Base Oils”

- Governments across the Asia-Pacific region are implementing stricter environmental regulations to reduce carbon emissions and promote sustainability. This has led to a surge in demand for eco-friendly alternatives to traditional mineral base oils.

- Innovations in base oil formulations are enabling the production of high-performance bio-based lubricants. Savsol Lubricants introduced Savsol Ester 5, a biodegradable lubricant designed for high-end automotive and railway applications. This product, made from edible oil fatty acids and featuring proprietary molecules developed in-house, exemplifies the trend towards sustainable alternatives in the base oil market.

- Consumer awareness about environmental issues is increasing, leading to higher demand for sustainable and eco-friendly products. This shift is prompting base oil producers to prioritize sustainability in their offerings. Additionally, there is a trend towards adopting circular economy principles in the base oil industry, such as recycling and reusing base oils, reducing waste, and improving lifecycle management.

For instance,

- In India, there is a growing emphasis on developing lubricants that produce fewer emissions and have a lower environmental footprint. Companies are investing in green technologies and cleaner production methods to minimize the environmental impact of base oil production

The Asia-Pacific base oil market is poised for significant growth in the bio-based and renewable segment, driven by environmental regulations, technological advancements, and increasing consumer demand for sustainable products. Companies that invest in the development and production of eco-friendly base oils are likely to gain a competitive edge in this evolving market landscape.

Restraint/Challenge

“Supply Chain Disruption”

- Geopolitical developments, notably sanctions, have disrupted the supply of base oil feedstocks. For instance, U.S. sanctions on Chinese refiners for purchasing Iranian oil have led to operational halts and logistical challenges in China's independent refining sector. These measures have affected shipping operations, with tankers being redirected and financial support from major Chinese banks being suspended. Such disruptions have a cascading effect on base oil production and distribution in the region.

- Unplanned outages and scheduled maintenance have further strained base oil supply. For example, South Korea's Hyundai and Shell Base Oil experienced production disruptions due to a fire at Hyundai Oilbank.

- In addition, Japan's Eneos permanently shut its 360,000 t/yr Group I plant in Wakayama and scheduled maintenance at its Mizushima A plant. Taiwan's Formosa also planned a two-month maintenance shutdown. These events have tightened supply, especially for Group I and II base oils.

- The Asia-Pacific base oil market's supply chain is under considerable strain due to geopolitical tensions, operational disruptions, and logistical challenges. These factors collectively contribute to supply shortages and increased costs, impacting the market's stability. Addressing these challenges requires strategic planning, diversification of supply sources, and investment in infrastructure to enhance resilience against future disruptions.

Base Oil Market Scope

The market is segmented on the basis of group, type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Group |

|

|

By Type |

|

|

By Application |

|

Base Oil Market Regional Analysis

“China is the Dominant Country in the Base Oil Market”

- China dominates the base oil market due to the rise in the production and sales of vehicles. Furthermore, the advancement of automotive industry along with the resultant demand for finished lubricants to improve the operational efficiency of the vehicle imparting longer life will further boost the growth of the base oil market in the region during the forecast period.

“Thailand is Projected to Register the Highest Growth Rate”

- Thailand is projected to register the highest compound annual growth rate (CAGR) in the Asia-Pacific base oil market. This growth is driven by increasing industrial activities, expanding automotive production, and rising demand for high-quality lubricants. The country's strategic initiatives to boost manufacturing and infrastructure development further contribute to this upward trend.

Base Oil Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Exxon Mobil Corporation (U.S.)

- Chevron Corporation (U.S.)

- Petroliam Nasional Berhad – Petronas (Malaysia)

- GS Caltex Corporation (South Korea)

- Nestlé (Switzerland)

- China Petrochemical Corporation – Sinopec (China)

- S-Oil Corporation (South Korea)

- Indian Oil Corporation Ltd. (India)

- China National Petroleum Corporation (China)

Latest Developments in Asia-Pacific Base Oil Market

- In March 2023, Reliance Industries announced an upgrade to its base oil facility in Jamnagar to increase production capacity and enhance supply chain efficiency. TotalEnergies continues to innovate by developing sustainable base oil solutions, reflecting the growing regional demand for eco-friendly products.

- In October 2022, SK Lubricants expanded its product offerings to cater to the rising electric vehicle market in Asia-Pacific.

- In January 2020, Nynas AB launched NYFLEX 201B and NYFLEX 2005, highly refined process oils designed for sealant formulations.

- In December 2019, Saudi Aramco acquired a 17% stake in Hyundai Oilbank for around USD 1.2 billion from Hyundai Heavy Industries Holdings, strengthening its global footprint.

- In October 2019, Texol Lubritech FZC, a subsidiary of Gandhar Oil Refinery India Ltd., inaugurated a manufacturing plant in Sharjah’s Hamriyah Free Zone to produce white oils, LLP, HLP, transformer oils, rubber-processing oils, and various industrial and automotive lubricants.

- In June 7, 2019, Nynas AB introduced NYNAS® S 3B, a new base oil compliant with FDA guidelines, offering high refinement suitable for use in the food packaging industry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Asia Pacific Base Oil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Asia Pacific Base Oil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Asia Pacific Base Oil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.