Brazil Pharmacy Automation Market

Market Size in USD Million

CAGR :

%

USD

263.32 Million

USD

452.44 Million

2024

2032

USD

263.32 Million

USD

452.44 Million

2024

2032

| 2025 –2032 | |

| USD 263.32 Million | |

| USD 452.44 Million | |

|

|

|

|

Brazil Pharmacy Automation Market Size

- The Brazil pharmacy automation market size was valued at USD 263.32 million in 2024 and is expected to reach USD 452.44 million by 2032, at a CAGR of 7.00% during the forecast period

- The market growth is largely fueled by the increasing healthcare expenditure and technological advancements within the healthcare infrastructure, leading to increased digitalization in pharmacy settings

- Furthermore, rising demand for accuracy in medication dispensing and efficient pharmacy operations is establishing automation as the modern pharmacy management system of choice. These converging factors are accelerating the uptake of pharmacy automation solutions, thereby significantly boosting the industry's growth

Brazil Pharmacy Automation Market Analysis

- Pharmacy automation, providing technological solutions for various pharmacy tasks, is an increasingly crucial aspect of modern healthcare systems in both hospital and retail settings due to its enhanced efficiency, accuracy in dispensing, and improved inventory management

- The escalating demand for pharmacy automation is primarily fueled by the growing need to reduce medication errors, increasing labor costs in the healthcare sector, and a rising focus on streamlining pharmacy workflows for better patient care

- Automated medication dispensing systems dominates the Brazil pharmacy automation market with a market share of 35.1% in 2024, driven by its critical role in minimizing medication errors and enhancing the efficiency of prescription dispensing processes in both hospital and retail pharmacies

Report Scope and Brazil Pharmacy Automation Market Segmentation

|

Attributes |

Brazil Pharmacy Automation Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Brazil Pharmacy Automation Market Trends

“Enhanced Efficiency Through Advanced Software and Data Analytics Integration”

- A significant and accelerating trend in the Brazil pharmacy automation market is the increasing integration of advanced software and data analytics for enhanced operational efficiency and inventory management. This fusion of technologies is significantly improving workflow and reducing costs for pharmacies

- For instance, some pharmacy management software in Brazil now includes AI-powered features for optimizing inventory levels and predicting medication demand, leading to reduced waste and better stock availability. Similarly, robotic dispensing systems are being integrated with sophisticated tracking software for real-time inventory updates

- AI integration in pharmacy automation enables features such as automated prescription verification (with pharmacist oversight), optimized dispensing workflows based on prescription volume, and intelligent alerts for potential drug interactions or discrepancies. Furthermore, advanced analytics provides pharmacists with data-driven insights into medication Usage patterns and patient adherence

- The seamless integration of automation systems with pharmacy management software and national healthcare databases facilitates centralized control over various aspects of the pharmacy operation. Through a single interface, pharmacists can manage dispensing, inventory, patient records, and billing, creating a unified and efficient workflow

- This trend towards more intelligent, data-driven, and interconnected pharmacy systems is fundamentally reshaping operational standards and patient care. Consequently, companies in Brazil are developing automation solutions with features such as AI-powered dispensing verification and integration with national EHR systems

- The demand for pharmacy automation that offers seamless data integration and intelligent features is growing rapidly across both hospital and retail pharmacies in Brazil, as healthcare providers increasingly prioritize efficiency, accuracy, and enhanced patient safety

Brazil Pharmacy Automation Market Dynamics

Driver

“Growing Need Due to Focus on Medication Safety and Operational Efficiency”

- The increasing emphasis on reducing medication errors and improving operational efficiency within Brazilian pharmacies, coupled with the growing adoption of technology in healthcare settings, is a significant driver for the heightened demand for pharmacy automation

- For instance, in March 2025, several major hospital chains in Brazil announced investments in automated dispensing systems to minimize dispensing errors and streamline medication management processes. Such initiatives are expected to drive the pharmacy automation industry growth in the forecast period

- As healthcare providers become more focused on patient safety and seek to optimize pharmacy workflows, automation systems offer advanced features such as barcode scanning, robotic dispensing, and inventory management, providing a compelling upgrade over manual processes

- Furthermore, the increasing integration of technology in hospitals and retail pharmacies, driven by government initiatives and the need for better data management, is making pharmacy automation an integral component of modern healthcare infrastructure

- The benefits of reduced dispensing errors, faster prescription fulfillment, improved inventory accuracy, and the ability to track medication usage through digital systems are key factors propelling the adoption of pharmacy automation in both inpatient and outpatient settings across Brazil. The trend towards digital transformation in healthcare and the increasing availability of user-friendly automation solutions further contribute to market growth

Restraint/Challenge

“Concerns Regarding Integration Complexity and High Initial Investment”

- Concerns surrounding the complexity of integrating new automation systems with existing pharmacy management software and the high initial costs associated with implementation pose a significant challenge to broader market adoption in Brazil. As pharmacy automation relies on seamless data exchange and specialized hardware, integration issues and upfront capital expenditure can deter potential adopters

- For instance, reports from smaller pharmacies in Brazil indicate hesitation in adopting advanced automation due to the perceived difficulty of integrating these systems with their current software and the significant upfront investment required

- Addressing these integration concerns through standardized protocols, user-friendly interfaces, and comprehensive technical support is crucial for building confidence among pharmacy owners. In addition, the relatively high initial cost of some sophisticated automation systems compared to manual processes can be a barrier, particularly for independent pharmacies or those with limited budgets. While more basic automation solutions are becoming available, comprehensive systems with advanced robotics often come with a substantial price tag

- While the long-term benefits of automation, such as reduced errors and increased efficiency, can offset the initial costs, the upfront financial commitment remains a significant hurdle for many pharmacies in Brazil

- Overcoming these challenges through the development of more modular and easily integrable systems, offering flexible financing options, and demonstrating a clear return on investment will be vital for sustained market growth

Brazil Pharmacy Automation Market Scope

The market is segmented on the basis of product and end user.

- By Product

On the basis of product, the Brazil pharmacy automation market is segmented into automated medication dispensing systems, automated packaging and labeling systems, automated table-top counters, automated storage and retrieval systems, and other pharmacy automation systems. The automated medication dispensing systems segment is expected to hold the largest market share of 34.1%. This dominance is driven by the critical need to reduce medication errors and improve dispensing accuracy in both hospital and retail pharmacies. These systems streamline the dispensing process, ensuring patients receive the correct medication and dosage, thereby enhancing patient safety and operational efficiency

The automated packaging and labeling systems segment is anticipated to witness significant growth in market. This growth is fueled by the increasing focus on medication traceability and patient-specific labeling requirements. These systems improve the accuracy and speed of packaging and labeling medications, reducing the risk of errors and ensuring compliance with regulatory standards

- By End User

On the basis of end user, the pharmacy automation market is segmented into inpatient pharmacies, outpatient pharmacies, pharmacy benefit management organizations and mail order pharmacies, and retail pharmacies. The retail pharmacies segment is expected to account for the largest market share in Brazil. This is driven by the high volume of prescriptions dispensed in retail settings and the increasing need for automation to manage inventory, improve dispensing speed, and enhance customer service. Automation helps retail pharmacies handle a large number of prescriptions efficiently and accurately

The outpatient pharmacies segment is anticipated to experience a significant growth rate in Brazil. This growth is driven by the increasing number of outpatient clinics and the need for efficient medication dispensing for patients leaving hospitals or clinics. Automation in outpatient pharmacies helps streamline the discharge process and ensures patients receive their medications promptly and accurately

Brazil Pharmacy Automation Market Share

The Brazil pharmacy automation industry is primarily led by well-established companies, including:

- BD (U.S.)

- Omnicell, Inc. (U.S.)

- KUKA AG (Germany)

- Baxter (U.S.)

- Capsa Healthcare (U.S.)

- Oracle ((U.S.)

- Yuyama Co., Ltd. (Japan)

- ARxIUM (Canada)

- ScriptPro (U.S.)

- Deenova S.r.l. (Italy)

- GPI Spa (Italy)

- NOVUS Automation Inc. (Brazil)

- Stäubli International AG (Switzerland)

- Opuspac (Brazil)

Latest Developments in Brazil Pharmacy Automation Market

- In May 2025, Brazil's government reportedly accelerated its efforts to digitize the national healthcare system, with a significant focus on integrating pharmacies into a unified digital network. This initiative aims to improve patient data management, streamline prescription processes, and enhance overall healthcare delivery

- In May 2025, A major global pharmaceutical distributor, with operations in Brazil, announced the opening of a new, highly automated logistics and distribution center in the state of São Paulo. The facility utilizes advanced robotics and warehouse management systems to improve the efficiency and speed of pharmaceutical delivery across the country

- In June 2022, Becton Dickinson (BD) and Frazier Healthcare Partners completed their USD 1.525 billion purchase of Parata Systems, a company known for its advanced pharmacy automation that helps pharmacies improve efficiency, cut costs, increase patient safety, and enhance the patient experience through technology

- In May 2022, Deenova introduced its novel Pay-Per-Dose unit dose pharmacy automation service to the United Kingdom, with an initial rollout planned for the Greater London area in late 2022. This service is designed for both NHS and private hospitals to optimize medication management, ensure accurate dosage, and improve efficiency and patient care

SKU-

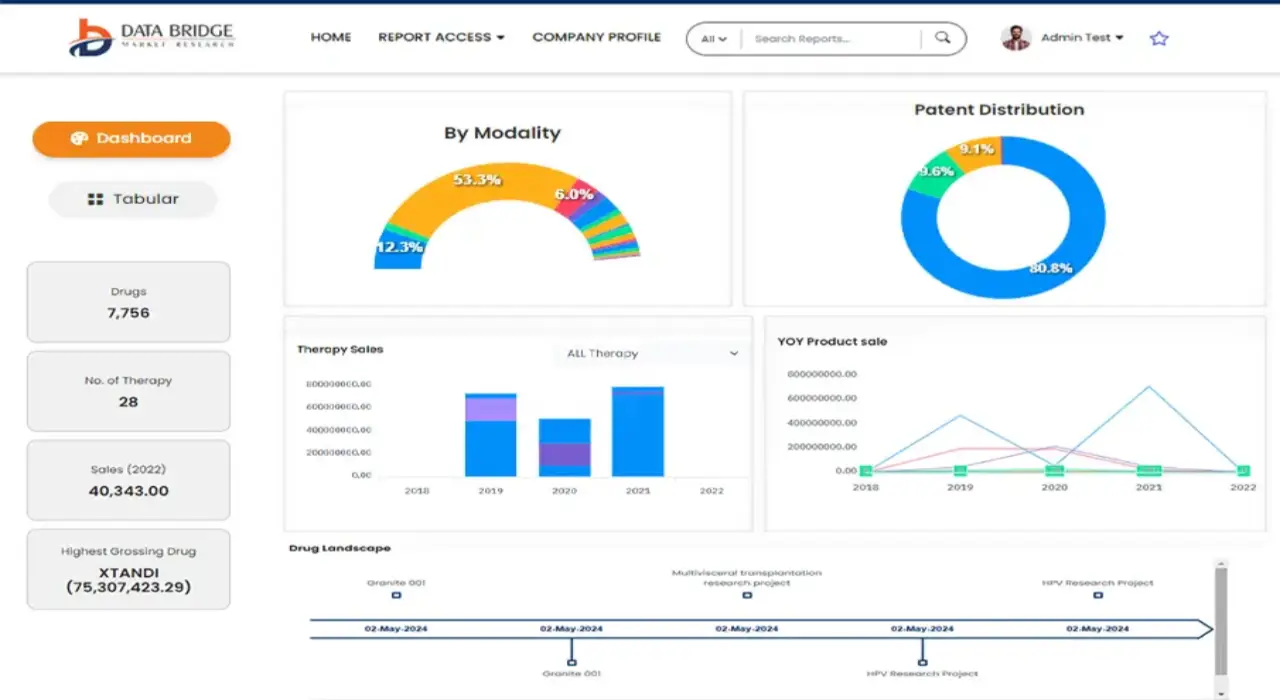

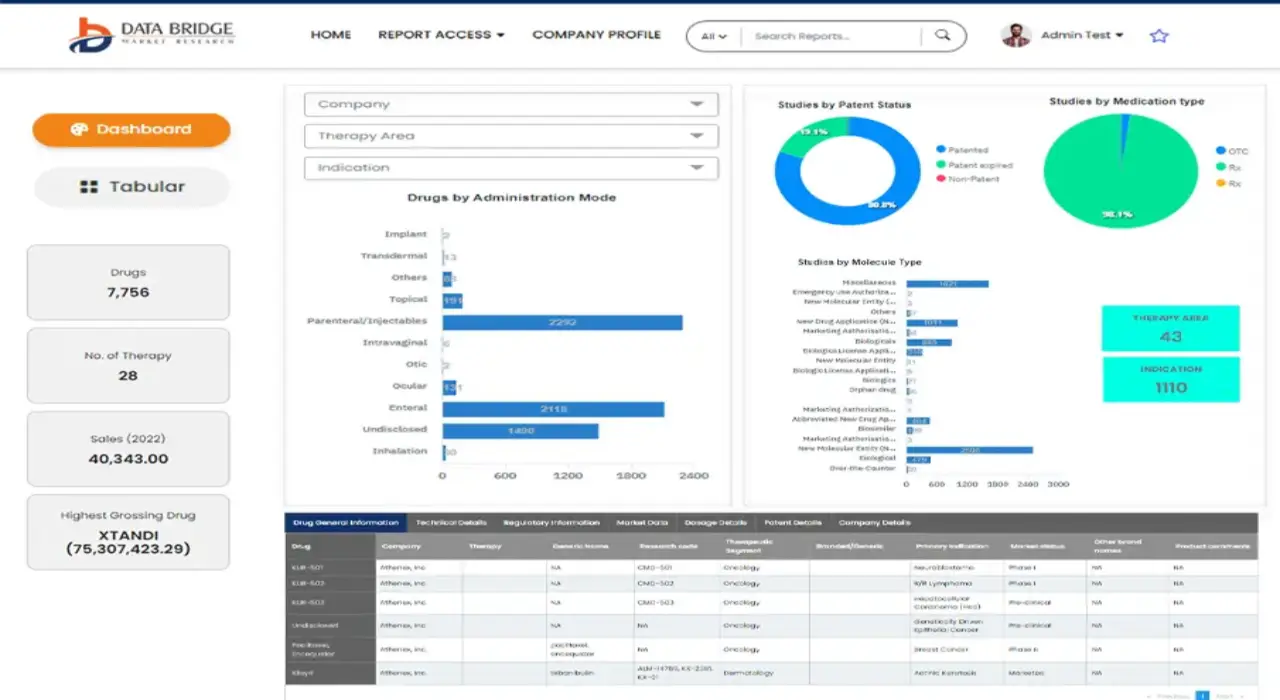

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.