Dental Diagnostic Surgical Equipment Market

Market Size in USD Billion

CAGR :

%

USD

13.39 Billion

USD

21.57 Billion

2024

2032

USD

13.39 Billion

USD

21.57 Billion

2024

2032

| 2025 –2032 | |

| USD 13.39 Billion | |

| USD 21.57 Billion | |

|

|

|

|

Dental Diagnostic and Surgical Equipment Market Size

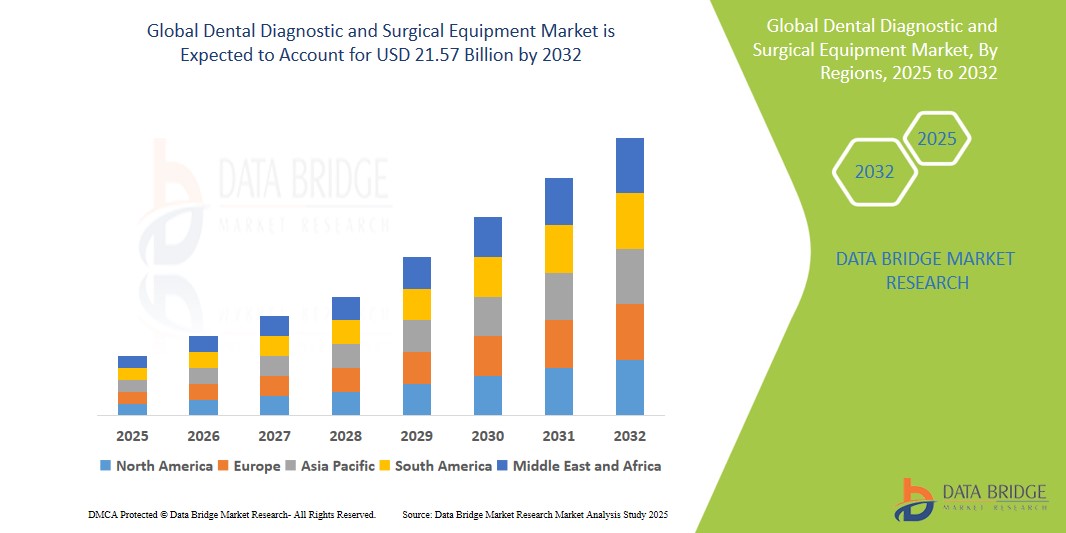

- The global dental diagnostic and surgical equipment market size was valued at USD 13.39 billion in 2024 and is expected to reach USD 21.57 billion by 2032, at a CAGR of 6.14% during the forecast period

- This growth is driven by rising prevalence of oral health issues

Dental Diagnostic and Surgical Equipment Market Analysis

- Dental diagnostic and surgical equipment refers to a wide range of medical devices used for examining, diagnosing, and performing surgical procedures in dental care

- The demand for dental diagnostic and surgical equipment is being fueled by the growing global prevalence of dental disorders, increasing geriatric population, rising patient awareness regarding oral health, and ongoing technological advancements such as digital imaging, CAD/CAM systems, and AI-assisted diagnostic tools

- North America is expected to dominate the dental diagnostic and surgical equipment market with the largest market share of 39.89%, driven by its well-established dental infrastructure, high dental expenditure per capita, favorable reimbursement scenarios, and robust presence of key industry players such as Dentsply Sirona, BIOLASE, and Henry Schein

- Asia-Pacific is expected to witness the highest growth rate in the dental diagnostic and surgical equipment market during the forecast period, due to rapid urbanization, increasing disposable income, expanding dental tourism in countries such as India and Thailand, and rising public-private investments in oral healthcare infrastructure

- The dental surgical equipment segment is anticipated to capture the largest market share of 52.11%, due to the rising number of dental procedures, increasing adoption of advanced surgical tools for enhanced precision and efficiency, and growing awareness about oral health and aesthetic dentistry, leading to higher demand for surgical interventions

Report Scope and Dental Diagnostic and Surgical Equipment Market Segmentation

|

Attributes |

Dental Diagnostic and Surgical Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dental Diagnostic and Surgical Equipment Market Trends

“Integration of Artificial Intelligence in Dental Imaging and Diagnostics”

- A key trend shaping the dental diagnostic and surgical equipment market is the rapid integration of artificial intelligence (AI) into dental imaging systems, enhancing diagnostic speed, accuracy, and decision-making capabilities for dental professionals.

- AI-powered software can automatically detect anomalies in dental X-rays and 3D scans, improving early detection of caries, bone loss, and other oral pathologies that may otherwise be overlooked

- AI tools are also being used for workflow optimization and treatment planning, helping reduce chair time and increase efficiency across dental clinics and hospitals

- For instance, in August 2023, Israeli tech firm Dentylec introduced an AI-based diagnostic platform to provide detailed oral health insights, aimed at revolutionizing early diagnosis and personalized dental care

- The growing reliance on AI-driven diagnostics is expected to reshape clinical workflows and provide more accurate, predictive, and preventive dental care across the globe

Dental Diagnostic and Surgical Equipment Market Dynamics

Driver

“Rising Demand for Cosmetic and Aesthetic Dentistry Procedures”

- A major driver of growth in the dental diagnostic and surgical equipment market is the increasing demand for cosmetic dental procedures, driven by heightened aesthetic consciousness and increasing disposable income among consumers

- Procedures such as teeth whitening, veneers, and dental implants require precise diagnostics and surgical tools, thus accelerating the uptake of advanced imaging systems and surgical instruments

- The influence of social media and digital platforms has significantly raised awareness around smile aesthetics, prompting more individuals to seek professional dental treatments

- For instance, a 2023 report from the American Academy of Cosmetic Dentistry highlighted a 22% increase in cosmetic dental procedures in the U.S. compared to 2021

- The rise of cosmetic dentistry is fueling technological innovation and equipment upgrades in dental diagnostics and surgery, strengthening overall market expansion

Opportunity

“Expanding Dental Tourism in Emerging Economies”

- An emerging opportunity in the dental diagnostic and surgical equipment market is the rise of dental tourism, particularly in countries such as India, Mexico, Thailand, and Hungary, where quality dental care is available at significantly lower costs

- These countries are investing heavily in modern dental infrastructure and acquiring advanced diagnostic and surgical tools to attract international patients

- As global patients seek affordable treatments without compromising quality, there is growing demand for digital imaging systems, intraoral scanners, and minimally invasive surgical devices in these markets

- For instance, in 2024, the Indian government launched a medical tourism initiative with tax benefits for dental hospitals upgrading to globally recognized diagnostic technologies

- Dental tourism offers strong market potential, especially for equipment manufacturers seeking to expand in cost-sensitive, high-volume markets

Restraint/Challenge

“High Cost of Advanced Dental Diagnostic Equipment”

- One of the major challenges restraining the growth of the dental diagnostic and surgical equipment market is the high capital investment required to purchase and maintain advanced imaging systems such as CBCT, digital X-ray machines, and intraoral scanners

- Small- and medium-sized dental clinics, particularly in developing regions, face budgetary constraints that prevent them from adopting these technologies despite their clinical benefits

- In addition, recurring costs associated with software licensing, training, and system upgrades create further financial burdens for end users

- For instance, in 2023, a survey by the Dental Economics Association found that over 40% of solo dental practices in Southeast Asia delayed equipment upgrades due to cost concerns

- The high cost barrier continues to limit market penetration and poses a challenge for widespread adoption of state-of-the-art dental diagnostic and surgical tools

Dental Diagnostic and Surgical Equipment Market Scope

The market is segmented on the basis of type and end user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By End User |

|

In 2025, the dental surgical equipment is projected to dominate the market with a largest share in type segment

The dental surgical equipment segment is expected to dominate the dental diagnostic and surgical equipment market with the largest market share of 52.11% in 2025 due to the rising number of dental procedures, increasing adoption of advanced surgical tools for enhanced precision and efficiency, and growing awareness about oral health and aesthetic dentistry, leading to higher demand for surgical interventions.

Dental Diagnostic and Surgical Equipment Market Regional Analysis

“North America Holds the Largest Share in the Dental Diagnostic and Surgical Equipment Market”

- North America is expected to dominate the dental diagnostic and surgical equipment market with the largest market share of 39.89%, driven by the strong presence of established dental equipment manufacturers, a highly developed healthcare infrastructure, and early adoption of technologically advanced diagnostic and surgical tools such as CBCT systems, CAD/CAM technology, and laser surgery devices

- The U.S. holds the leading share within the region due to the rising demand for cosmetic dentistry, growing awareness of preventive dental care, and increased investments in dental clinics and specialty centers equipped with advanced tools for accurate diagnostics and precision surgeries

- Strong reimbursement policies for dental procedures, increased number of practicing dentists, and continual advancements in digital dentistry are expected to further solidify North America’s leadership in the global dental diagnostic and surgical equipment market

“Asia-Pacific is Projected to Register the Highest CAGR in the Dental Diagnostic and Surgical Equipment Market”

- Asia-Pacific is expected to witness the highest CAGR in the dental diagnostic and surgical equipment market, driven by growing awareness of oral health, a rapidly aging population, increasing disposable incomes, and the rise in demand for minimally invasive dental procedures

- Countries such as China, India, and Japan are key growth engines in the region due to favorable government initiatives supporting dental infrastructure, an increase in dental tourism, and the expansion of private dental clinics with modern imaging and surgical capabilities

- China and India are seeing rapid demand growth through public-private healthcare investments, reforms in dental education, and improved access to oral care in urban and semi-urban regions

Dental Diagnostic and Surgical Equipment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- 3M (U.S.)

- A-dec Inc. (U.S.)

- BIOLASE, Inc. (U.S.)

- Carestream Health (U.S.)

- Danaher (U.S.)

- Dentsply Sirona (U.S.)

- GC International AG (Japan)

- Henry Schein, Inc. (U.S.)

- Hu-Friedy Mfg. Co., LLC (U.S.)

- Midmark Corporation (U.S.)

- NAKANISHI INC. (Japan)

- Patterson Companies, Inc. (U.S.)

- PLANMECA OY (Finland)

- KaVo Dental (U.S.)

- Ultradent Products Inc. (U.S.)

- Young Innovations, Inc. (U.S.)

- TEi Technovations LLP (India)

- J. MORITA CORP. (Japan)

- ASAHIROENTGEN IND.CO.,LTD. (Japan)

Latest Developments in Global Dental Diagnostic and Surgical Equipment Market

- In September 2024, RPA Dental launched a new web shop, allowing dental professionals to conveniently purchase spare parts, accessories, and other essential equipment online. This digital initiative is expected to enhance accessibility and streamline the procurement process for dental clinics

- In November 2023, DEXIS, a prominent dental imaging technology company, showcased its latest innovations—DEXIS OP 3D LX and DEXassist Solution. These advancements are anticipated to significantly contribute to the growth and efficiency of the dental diagnostic market

- In August 2023, Israeli tech firm Dentylec introduced groundbreaking dental diagnostic solutions powered by artificial intelligence to deliver clearer, more comprehensive insights into patients' oral health. The integration of AI is expected to revolutionize diagnostics and positively impact treatment outcomes in the dental sector

- In September 2022, BIOLASE Inc., a leading manufacturer of dental laser systems, revealed a strategic initiative to collaborate with postgraduate dental specialty programs across North America. This move aims to familiarize new dental professionals with the advantages of Waterlase laser technology, fostering wider adoption in clinical practice

- In September 2022, Columbia Dentoform, a brand under DENTAL-EZ, introduced 'Surgio,' a highly realistic surgical manikin designed for dental training and continuing education. The launch is expected to enhance hands-on learning experiences without the need for traditional cadaver-based training

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.