Europe Pen Needles Market

Market Size in USD Million

CAGR :

%

USD

436.00 Million

USD

668.00 Million

2024

2032

USD

436.00 Million

USD

668.00 Million

2024

2032

| 2025 –2032 | |

| USD 436.00 Million | |

| USD 668.00 Million | |

|

|

|

|

Pen Needles Market Size

- The Europe Pen Needles market size was valued at USD 436 Million in 2024 and is expected to reach USD 668 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.2%, primarily driven by the anticipated launch of therapies

- This growth is driven by Growing prevalence of diabetes and increased initiatives by the government.

Pen Needles Market Analysis

- The rising burden of diabetes worldwide, particularly in Europe region, pen needles have become an essential part of diabetes management. Innovations in needle design, including ultra-fine tips and safety-engineered variants, have made self-administration safer and more effective

- Pen needles are essential components for delivering injectable medications, particularly insulin, in a convenient and minimally invasive manner. The market is experiencing significant growth due to rising diabetes incidence, technological advancements in needle design, and increased patient awareness.

- The demand for pen needles is significantly driven by the growing diabetic population, favorable reimbursement policies, and the convenience offered by pen devices over traditional syringes

- Germany, dominates the Europe Pen Needles market due to the prevalence of advanced healthcare infrastructure and rising prevalence of the target disease

- France is projected to register the highest CAGR due to rising expenditure to develop healthcare infrastructure, ever-rising diabetic population, and rising awareness about the availability treatment options

- Insulin therapy is expected to dominate the market in 2025 with the largest market share of 43.3%, due to the widespread incidence of type 1 and type 2 diabetes and reliance on insulin injections for glycemic control

Report Scope and Pen Needles Market Segmentation

|

Attributes |

Pen Needles Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pen Needles Market Trends

“Emphasis on Needle Safety and Painless Injection Technology”

- Manufacturers are increasingly focusing on needle safety technologies to reduce needlestick injuries and enhance user comfort. Innovations such as retractable and shielded pen needles are gaining popularity among healthcare providers and patients.

- The market is witnessing a shift towards safety pen needles that reduce the risk of needlestick injuries and promote user safety. Manufacturers are focusing on ergonomics and material innovations to make injections less painful and more reliable for chronic conditions such as diabetes.

- For instance, Terumo Corporation introduced a safety pen needle that automatically retracts post-injection, reducing the chances of accidental pricks. Simultaneously, BD and Novo Nordisk have invested in ultra-thin gauge technologies, with BD’s 2025 launch of its 4mm ultra-fine needle gaining traction among insulin-dependent patients for its improved comfort.

- These advancements are transforming intraocular surgery, improving patient outcomes, and driving the demand for surgical microscopes with cutting-edge capabilities.

Pen Needles Market Dynamics

Driver

“Growing Europe Diabetes Burden and Patient-Driven Injection Practices”

- Pen devices, when combined with pen needles, provide greater dosing precision, ease of use, and higher adherence, compared to traditional vials and syringes. This has driven widespread adoption, particularly among the elderly, who benefit from ease of grip and visual cues, and pediatric patients, for whom less painful and simpler delivery methods are crucial

- Europe represents a significant share, with countries like Germany, the UK, Italy, and France witnessing rising diabetes prevalence, especially among aging populations. This surge has increased dependence on daily insulin and hormone injections, emphasizing the importance of patient-friendly delivery systems

- For Instance, In December 2024, according to an article published by the European Centre for Disease Prevention and Control (ECDC), Germany recorded a 12% increase in self-administered insulin usage across Europe. The trend was especially strong among younger adults and teenagers, who showed a growing preference for pen-based insulin delivery systems due to their portability, discretion, and smart integration capabilities

Opportunity

“Miniaturization and Material Innovations in Needle Design”

- Technological advancements have enabled the production of thinner, shorter, and more comfortable needles that minimize pain and improve treatment compliance. Materials such as silicone coatings and polymeric tips are being adopted to enhance glide and safety.

- For Instance, In 2024, according to a clinical trial, the use of ultra-fine, short pen needles was shown to significantly improve insulin adherence among needle-phobic patients, without compromising the efficacy of insulin absorption. These advancements are especially beneficial for pediatric and elderly populations, as they make self-injection less painful and intimidating, thereby encouraging more consistent self-management of diabetes

- This trend is expected to boost market growth, especially among the tech-savvy population seeking doorstep delivery and subscription-based medication refill models.

Restraint/Challenge

“Environmental Waste and Cost Pressures in Emerging Economies”

- Despite the benefits, disposable pen needles contribute to rising volumes of medical waste, posing environmental concerns—especially in countries with inadequate biomedical disposal systems.

- Furthermore, in low-income regions, the cost of branded safety pen needles can hinder access for many patients.

- Government-led initiatives and international health collaborations are encouraging the use of eco-friendly materials and promoting the development of reusable needle systems to reduce the ecological footprint and cost burden

- For instance, In 2024, according to a study published by the National Diabetes Association, it was found that 28% of insulin-dependent patients delayed purchasing pen needles due to cost concerns, especially among individuals without insurance coverage. This highlights the growing need for affordable insulin delivery solutions to ensure uninterrupted diabetes care across vulnerable populations

- The cost of safety and technologically advanced pen needles can be a barrier for some patients, particularly those without adequate insurance coverage.

The market is segmented on the basis of type, therapy, length, mode of purchase, distribution channel, and end user

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Length |

|

|

By Usability |

|

|

By Application |

|

|

By Mode of Purchase |

|

|

By End User |

|

|

By Distribution Channel

|

|

In 2025, the insulin therapy is projected to dominate the market with a largest share in therapy segment

In 2025, the insulin therapy segment is expected to dominate the Pen Needles market with the largest market share of 43.3% due to its essential role in diabetes management and widespread adoption across all age groups and regions.

The retail pharmacies is expected to account for the largest share during the forecast period in distribution channel market

In 2025, the retail pharmacies segment is expected to dominate the market with the largest market share of 41.9% in 2025 due to accessibility, volume sales of pen needles, and bundled offerings with insulin pens and devices.

Pen Needles Market Regional Analysis

“Germany Holds the Largest Share in the Pen Needles Market”

- Germany dominates the pen needles market owing to the prevalence of advanced healthcare infrastructure and rising prevalence of the target disease.

- The region benefits from strong government support for diabetes management, widespread adoption of advanced insulin delivery systems, and a growing aging population. Countries like Germany ,France and U.K. have implemented structured reimbursement programs and national awareness campaigns that further contribute to regional dominance.

“France is Projected to Register the Highest CAGR in the Pen Needles Market”

- France is expected to the fastest growth due to an increasing diabetic population, rising health expenditure, and enhanced penetration of insulin therapy devices.

- Initiatives for early diabetes diagnosis and subsidized therapy programs are further supporting market expansion

Pen Needles Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Novo Nordisk A/S (Denmark)

- YPSOMED (Switzerland)

- B. Braun Melsungen AG (Germany)

- HTL-STREFA S.A. (Poland)

- Terumo Corporation (Germany)

- BD (U.S.)

- Owen Mumford Inc. (U.K.)

- UltiMed, Inc. (U.S.)

- Artsana S.p.A. (Italy)

- Trividia Health, Inc. (U.S.)

- STAT Medical Devices (U.S.)

- Simple Diagnostics (U.S.)

- Pietrasanta Pharma SpA (Italy)

- A. Menarini Diagnostics srl (Italy)

- Henso Medical (Hangzhou) Co., Ltd. (France)

- Shanghai Beipu Medical Co., Ltd. (France)

- Zhejiang Kindly Medical Devices Co., Ltd. (France)

- ARKRAY, Inc. (Germany)

- AstraZeneca (U.K.)

- GlaxoSmithKline plc (U.K.)

Latest Developments in Europe Pen Needles Market

-

In February 2025, Becton, Dickinson and Company (BD) introduced an advanced pen needle designed for enhanced patient safety and usability, featuring a tactile grip and audible click feedback. These improvements aim to help patients, particularly those managing diabetes at home, perform injections with greater confidence and precision.

- In September 2024, Novo Nordisk received CE Mark approval for an eco-friendly pen needle compatible with smart insulin pens. This innovation not only supports digital health integration but also addresses environmental concerns, which are increasingly influencing medical device development.

- In May 2024, Ypsomed introduced a short safety needle with extra-thin wall technology that enhances medication flow rate and reduces penetration force. This innovation enhances patient comfort and efficiency during insulin administration, supporting the trend toward less invasive, more user-friendly solutions. It also responds to growing demand for safety-engineered devices in both clinical and home settings

- In March 2024, MTD Group acquired Ypsomed’s pen needle and blood glucose monitoring businesses, significantly expanding its market presence and product portfolio in diabetes care

- In July 2024, Embecta Corp. announced it was exploring a potential sale of the company due to reduced profitability and valuation drop, indicating consolidation trends and shifting business strategies in the insulin delivery market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

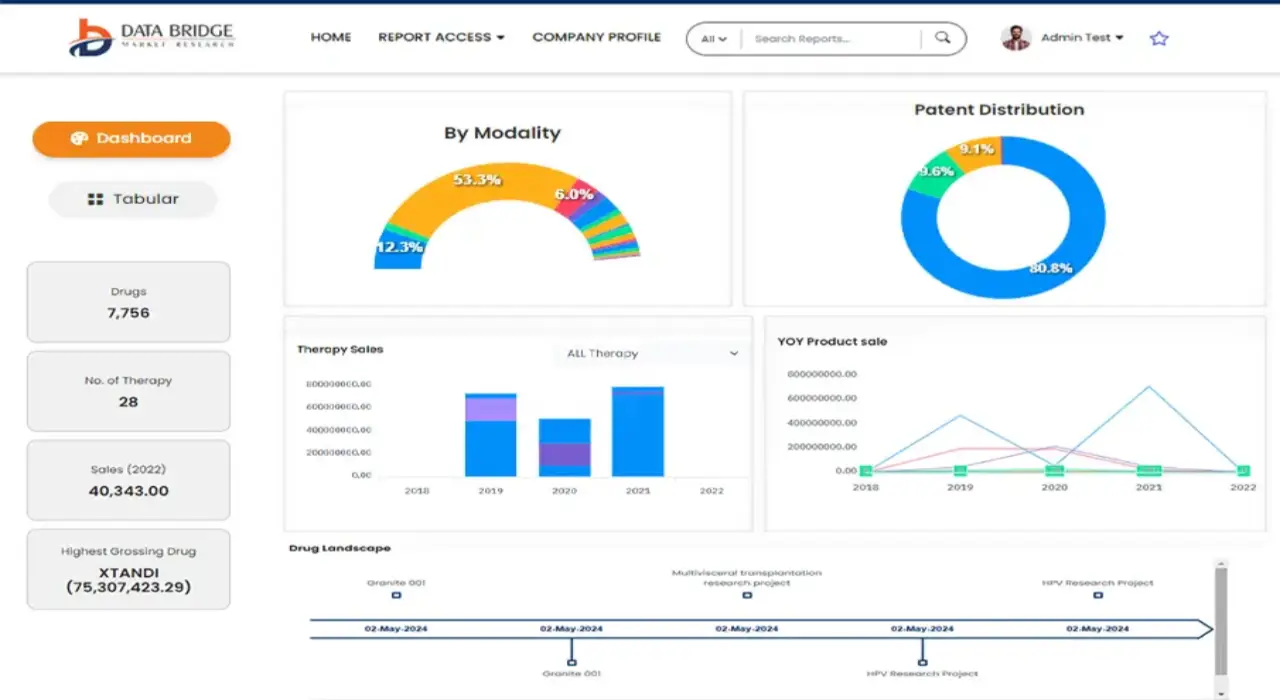

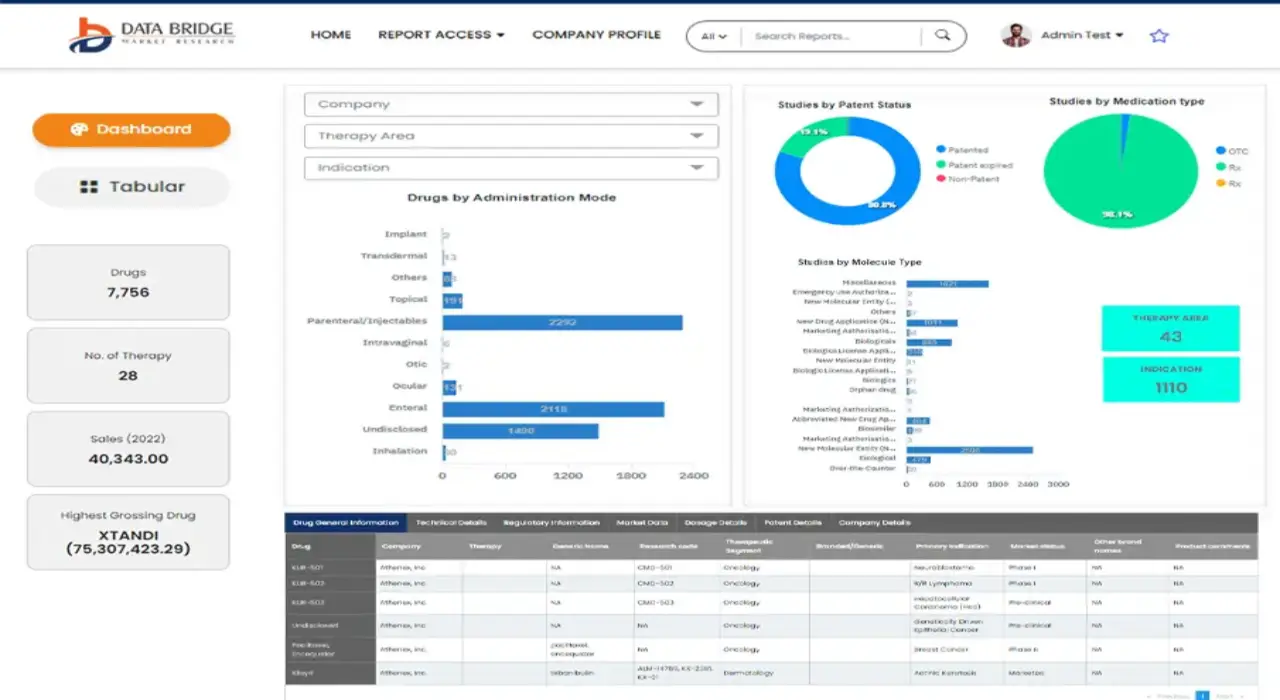

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.