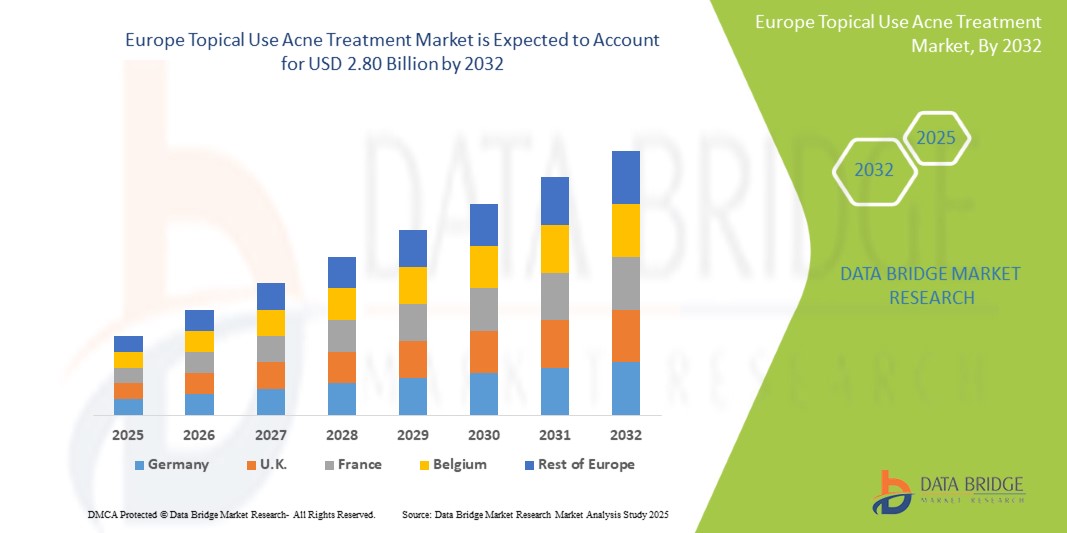

Europe Topical Use Acne Treatment Market

Market Size in USD Billion

CAGR :

%

USD

1.44 Billion

USD

2.80 Billion

2024

2032

USD

1.44 Billion

USD

2.80 Billion

2024

2032

| 2025 –2032 | |

| USD 1.44 Billion | |

| USD 2.80 Billion | |

|

|

|

|

Topical Use Acne Treatment Market Size

- The Europe Topical Use Acne Treatmentmarket size was valued at USD 1.44 billion in 2024 and is expected to reach USD 2.80 billion by 2032, at a CAGR of 8.7% during the forecast period

- This growth is driven by rising acne incidence due to unhealthy diets, hormonal imbalances, and changing lifestyles

Topical Use Acne Treatment Market Analysis

- The Europe topical use acne treatment market refers to pharmaceutical and cosmetic dermatology products formulated specifically for topical application to treat acne. These include creams, gels, foams, lotions, and serums that contain active pharmaceutical ingredients (APIs) like benzoyl peroxide, salicylic acid, antibiotics, retinoids, and anti-inflammatories. Topical treatments work by reducing inflammation, unclogging pores, and controlling bacterial growth on the skin. They are typically used as first-line therapies and are widely available as both prescription and over-the-counter (OTC) solutions. This market caters to varying acne types, including mild, moderate, and severe forms, and is shaped by treatment efficacy, consumer awareness, and regulatory standards across European healthcare systems.

- The demand for topical acne treatments is significantly driven by the growing adolescent population, increased product accessibility through pharmacies and online platforms, and evolving cosmetic dermatology preferences in Europe.

- Germany dominates the Europe Topical Use Acne Treatment market due to the presence of robust healthcare infrastructure, high awareness of dermatological conditions, and early adoption of topical regimens.

- U.K. is projected to register the highest CAGR due to cosmetic dermatology adoption, growing awareness of non-prescription acne care, and digital pharmacy infrastructure that supports wide access to topical treatments.

- Insulin therapy is expected to dominate the market in 2025 with the largest market share of 64.3%, due to the widespread incidence of type 1 and type 2 diabetes and reliance on insulin injections for glycemic control

Report Scope and Topical Use Acne Treatment Market Segmentation

|

Attributes |

Topical Use Acne Treatment Key Market Insights |

|

Segments Covered |

By Type: Comedonal Acne, Inflammatory Acne, Cystic Acne, and Post-Surgical/Wound Acne By Medication Type: Prescription, and Over-The-Counter (OTC) By Product: Antibiotics (Erythromycin, Clindamycin) Retinoids (Adapalene, Tazarotene, Tretinoin, Isotretinoin) Anti-Inflammatory Drugs, Combination Medications, Hormonal Agents , and Others (Azelaic Acid, Resorcinol) By Device: Laser, and Others By Route of Administration: Topical, and Oral By End User: Hospitals, Clinics, Home Healthcare, and Others |

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Topical Use Acne TreatmentMarket Trends

“Rise of Dermacosmetics and OTC Acne Treatment Options”

Increased consumer demand for cosmetic dermatology has propelled the use of dermacosmetic brands offering acne treatments.

Popular OTC formulations with proven active ingredients such as benzoyl peroxide, niacinamide, and adapalene are dominating e-commerce and pharmacy shelves.

Topical Use Acne TreatmentMarket Dynamics

Driver

“Increasing Acne Prevalence and Early Skincare Adoption”

- Studies indicate acne affects 80% of the adolescent population in Europe. Increased dermatology access and routine skincare awareness in schools and digital media have normalized early acne management, particularly with topical therapies. For example, a 2023 survey by the European Academy of Dermatology and Venereology (EADV) found that over 65% of teenagers aged 12–18 in France and Germany had used a topical acne product in the past six months.

- Studies indicate acne affects 80% of the adolescent population in Europe. Increased dermatology access and routine skincare awareness in schools and digital media have normalized early acne management, particularly with topical therapies.

Opportunity

“Expansion of Biotech-Based Acne Formulations”

- Advancements in biotechnology and dermatological research are encouraging the development of biologically active and probiotic-based acne formulations. These innovations aim to rebalance skin microbiota, improve inflammation control, and reduce antibiotic resistance.

- For instance, in 2023, Germany-based biotech company S-Biomedic initiated a clinical study on live bacterial therapies targeting Cutibacterium acnes modulation in adult patients with moderate acne.

- Advancements in biotechnology and dermatological research are encouraging the development of biologically active and probiotic-based acne formulations. These innovations aim to rebalance skin microbiota, improve inflammation control, and reduce antibiotic resistance, presenting new therapeutic opportunities for both chronic and resistant acne types.Digital pharmacies and AI-driven skin analysis tools are becoming prominent across Europe. Platforms offering personalized acne regimens and doorstep delivery are driving OTC product demand. Startups like NIVEA’s DermaScan are expanding skin-tech accessibility.

Restraint/Challenge

“Regulatory Delays and Misuse of OTC Products”

- Despite product innovation, topical formulations must navigate complex EU cosmetic and medicinal regulations. In 2022, several new acne creams containing dual APIs faced delays in EMA approvals due to labeling and efficacy documentation requirements. Furthermore, excessive or incorrect use of OTC products without dermatologist supervision may lead to antibiotic resistance or irritation, challenging market trust. A 2023 U.K. dermatology audit reported a 15% increase in adverse reactions linked to unprescribed benzoyl peroxide overuse.

- Despite product innovation, topical formulations must navigate complex EU cosmetic and medicinal regulations. Furthermore, excessive or incorrect use of OTC products without dermatologist supervision may lead to antibiotic resistance or irritation, challenging market trust.

The market is segmented on the basis of type, medication type, product, device, route of administration, end user, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Medication Type |

|

|

By Usability |

|

|

By Route of Administration |

|

|

By End User |

|

|

By Distribution Channel

|

|

In 2025, the OTC retinoids segment is projected to dominate the market with a largest share in product segment

In 2025, the OTC retinoid segment is expected to dominate the Europe topical use acne treatment market with the largest market share of 52.8% due to their effectiveness, convenience, and dermatologist endorsement for mild to moderate acne cases

The topical route is expected to account for the largest share during the forecast period in administration mode

In 2025, the topical segment is expected to dominate the market with the largest market share of 61.3%, owing to user preference, lower side-effect profile, and direct action on affected areasTopical Use Acne Treatment Market Regional Analysis

Europe Topical Use Acne Treatment Market Country Analysis

“Germany Holds the Largest Share in the Europe Topical Use Acne Treatment Market”

- Germany dominates the Europe topical use acne treatment market owing to the country's strong dermatological infrastructure, large adolescent demographic, and expansive OTC pharmacy presence • The availability of reimbursable prescription therapies and public health campaigns targeting teen skincare awareness further strengthen its market leadership

“France is Projected to Register the Highest CAGR in the Europe Topical Use Acne Treatment Market”

- France is expected to witness the fastest growth in the regional acne treatment market, supported by increased cosmetic dermatology penetration and national campaigns on teen skin health • Government-driven subsidies and wide-scale insurance coverage for dermatological consultations enhance access and foster growth

Europe Topical Use Acne Treatment Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Merck Sharp & Dohme Corp. (U.S.)

- Abbott (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Pfizer Inc. (U.S.)

- Eli Lilly and Company (U.S.)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Novartis AG (Switzerland)

- Mylan N.V. (U.S.)

- Bayer AG (Germany)

- Allergan (U.S.)

- GlaxoSmithKline plc (U.K.)

- Zydus Cadila (India)

- Amgen Inc. (U.S.)

- Cipla Inc. (India)

- AstraZeneca (U.K.)

- Sun Pharmaceutical Industries Ltd. (India)

Latest Developments in Europe Topical Use Acne TreatmentMarket

- In March 2024, Bayer launched a new combination retinoid-antibiotic topical gel under its dermaceutical division across Germany and France.

- In September 2023, GlaxoSmithKline’s Stiefel division introduced a reformulated OTC adapalene cream for sensitive skin types in U.K. retail stores.

- In June 2023, Sun Pharma partnered with a chain of e-pharmacies in Europe to improve last-mile delivery of dermatology prescriptions and acne OTC kits.

SKU-

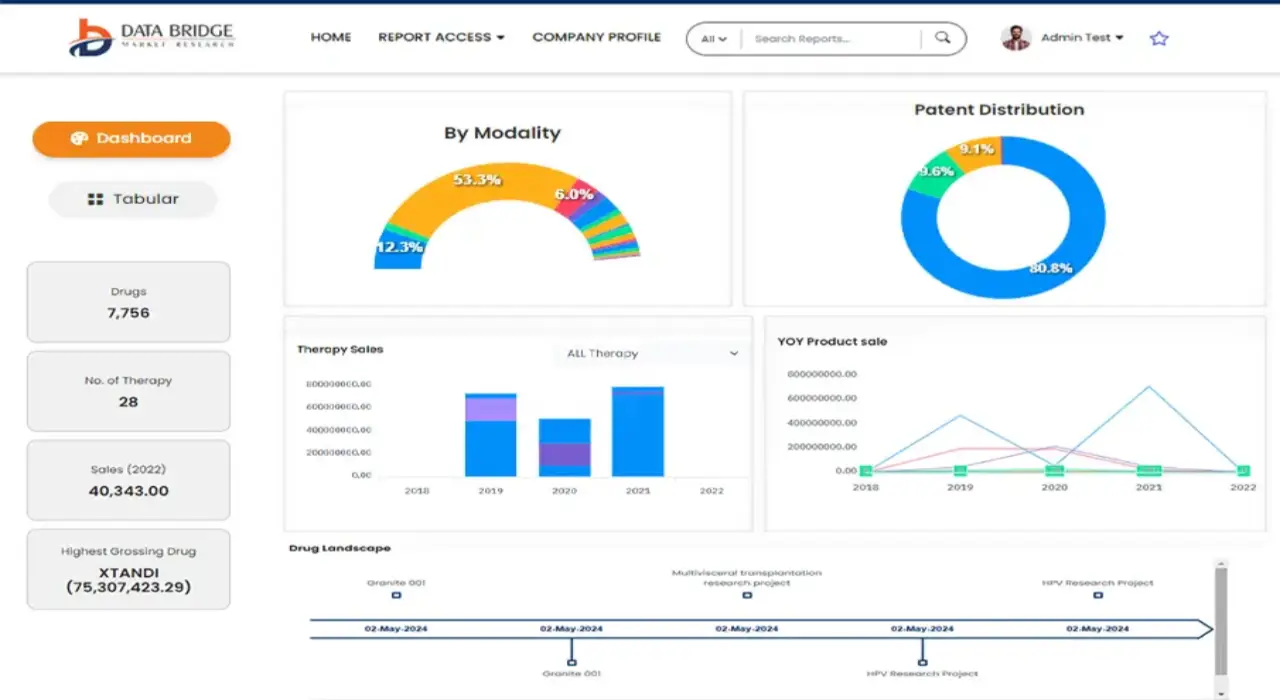

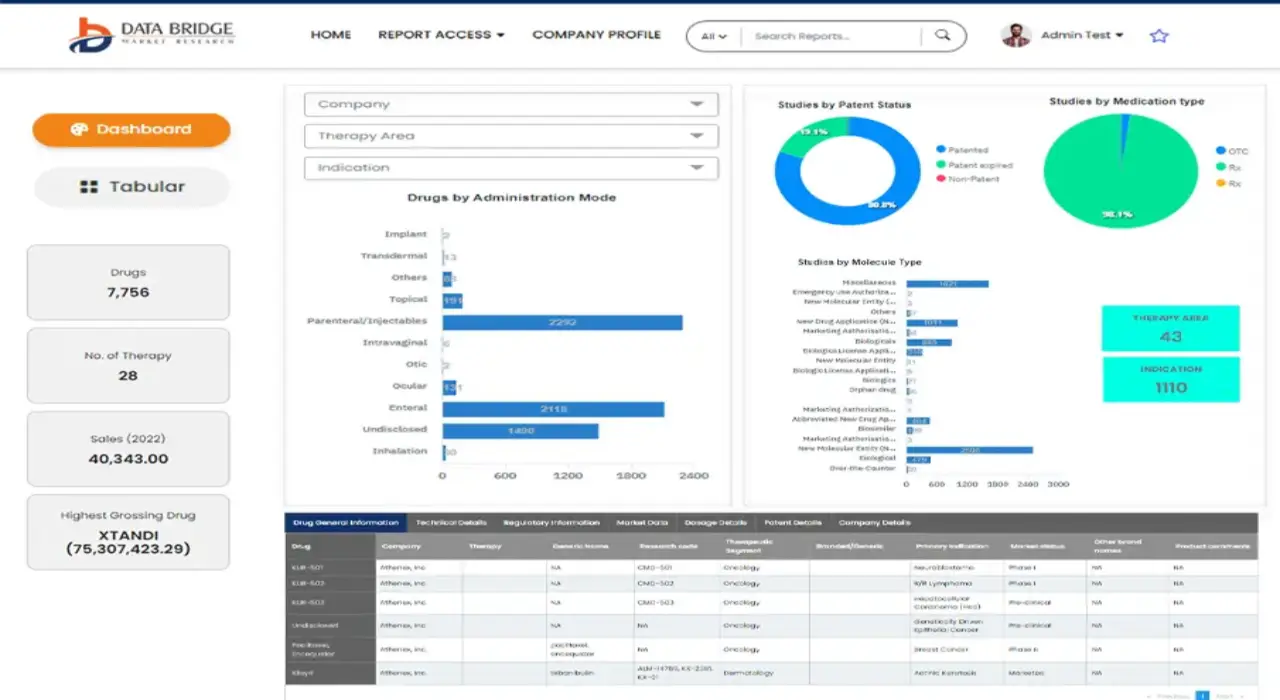

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.