Global Adhesion Barriers Market

Market Size in USD Million

CAGR :

%

USD

730.42 Million

USD

1,392.53 Million

2024

2032

USD

730.42 Million

USD

1,392.53 Million

2024

2032

| 2025 –2032 | |

| USD 730.42 Million | |

| USD 1,392.53 Million | |

|

|

|

|

Adhesion Barriers Market Size

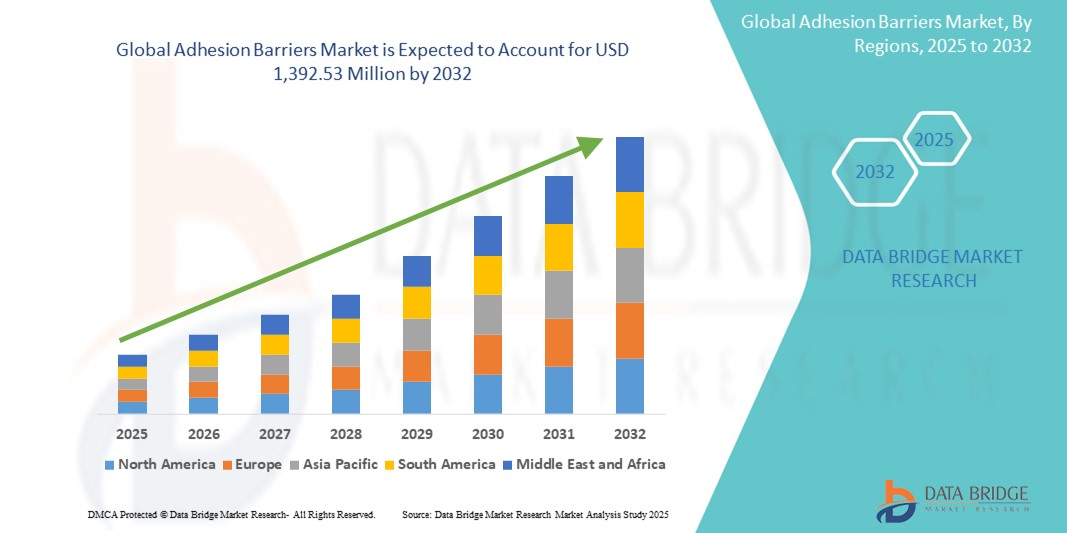

- The global adhesion barriers market size was valued at USD 730.42 million in 2024 and is expected to reach USD 1,392.53 million by 2032, at a CAGR of 8.40% during the forecast period

- The market growth is primarily driven by the alarming rise in the risk of post-surgical adhesions, with a high percentage of patients developing adhesions after abdominal operations

- Furthermore, increasing awareness among healthcare professionals about the complications associated with adhesions, coupled with advancements in surgical techniques and the development of innovative adhesion barrier products, are significantly contributing to the industry's expansion

Adhesion Barriers Market Analysis

- Adhesion barriers are vital medical devices, available in liquid, gel, or film forms, used to prevent the formation of abnormal fibrous tissue connections between internal organs and tissues after surgical procedures, thereby minimizing complications and improving patient outcomes

- The increasing demand for adhesion barriers is primarily driven by the rising global volume of surgical procedures across various specialties, including gynecological, abdominal, cardiovascular, orthopedic, and neurological surgeries, coupled with growing awareness among healthcare professionals about the severe implications of post-operative adhesions

- North America dominates the adhesion barriers market with the largest revenue share of 38.7% in 2025, characterized by its advanced healthcare infrastructure, high adoption rates of innovative medical technologies, and a significant number of surgical procedures performed annually

- Asia-Pacific is expected to be the fastest growing region in the adhesion barriers market during the forecast period due to improving healthcare infrastructure, increasing surgical volumes, and rising awareness about adhesion prevention in developing economies

- Synthetic adhesion barriers segment is expected to dominate the adhesion barriers market with a market share of 57.5% in 2025, driven by its engineered design for controlled tissue separation, biocompatibility, cost-effectiveness, and the wide availability of advanced products such as hyaluronic acid and regenerated cellulose-based barriers

Report Scope and Adhesion Barriers Market Segmentation

|

Attributes |

Adhesion Barriers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Adhesion Barriers Market Trends

“Advancements in Material Science and Formulations”

- A significant and accelerating trend in the global adhesion barriers market is the continuous innovation in material science and the development of novel formulations, including films, gels, liquids, and sprays. This focus on advanced materials aims to enhance the efficacy, biocompatibility, and ease of application of adhesion barriers, addressing the diverse needs of various surgical specialties

- For instance, synthetic barriers, such as those based on hyaluronic acid, regenerated cellulose, and polyethylene glycol (PEG), are gaining traction due to their controlled degradation, reduced immune response, and ability to form a physical separation between tissues. Natural adhesion barriers, derived from materials such as fibrin and collagen, are also evolving with improved formulations for better performance

- The development of smart adhesion barriers capable of targeted drug delivery is a key area of innovation. Some new products are designed to release anti-inflammatory agents or other therapeutic compounds directly at the surgical site, further reducing adhesion formation and promoting healing

- Formulation advancements also include the creation of more versatile and user-friendly products, such as sprayable solutions and ready-to-use devices, which simplify application during both open and minimally invasive surgeries. These innovations improve surgical workflow and reduce operative time

- This trend towards more advanced, multi-functional, and easy-to-apply adhesion barriers is fundamentally reshaping surgical practice and improving patient outcomes. Consequently, companies are investing heavily in R&D to bring next-generation products to market that offer superior anti-adhesion properties and broader surgical applicability

- The demand for adhesion barriers with improved material properties and convenient formulations is growing rapidly across all surgical sectors, as surgeons increasingly prioritize effective and safe solutions for adhesion prevention

Adhesion Barriers Market Dynamics

Driver

“Increasing Volume of Surgical Procedures and Growing Awareness of Adhesion-Related Complications”

- The increasing number of surgical procedures performed globally across various specialties, such as gynecological, general/abdominal, cardiovascular, orthopedic, and neurological surgeries, is a primary driver for the sustained growth of the adhesion barriers market

- For instance, the rising prevalence of chronic diseases, an aging population, and advancements in surgical techniques contribute to the higher volume of operations. As more surgeries are performed, the inherent risk of post-operative adhesion formation significantly increases, thereby boosting the demand for preventive solutions

- Furthermore, there is a growing awareness among healthcare professionals and patients alike about the severe complications associated with adhesions, including chronic pain, bowel obstruction, infertility, and the need for costly re-operations. This increased recognition of adhesion-related morbidity is driving the adoption of adhesion barriers as a standard of care to improve patient outcomes

- Regulatory bodies and clinical guidelines are also increasingly emphasizing the importance of minimizing post-operative complications, which further encourages the use of adhesion barriers. The desire to enhance patient quality of life and reduce healthcare burdens stemming from adhesion-related issues is a key factor propelling the market forward

- The continuous investment in research and development by manufacturers to create more effective, biocompatible, and user-friendly adhesion barrier products, such as advanced synthetic and natural formulations, further supports this trend, providing surgeons with reliable tools to mitigate adhesion risks

Restraint/Challenge

“Limitations in Efficacy and High Product Costs”

- A significant challenge to the widespread adoption of adhesion barriers is their perceived limitations in consistently preventing all types of post-surgical adhesions across all patient populations and surgical procedures. While some barriers show efficacy in reducing adhesion incidence, complete prevention remains a challenge, and clinical outcomes such as reduction in re-operations for adhesion-related complications are not always consistently demonstrated across all studies

- For instance, even with the proven benefits of certain hyaluronic acid-based barriers in reducing gynecological adhesions, their routine use can be debated due to varying reported efficacy rates in other surgical contexts. The effectiveness can also be influenced by surgeon technique and patient-specific factors

- Furthermore, the relatively high cost of advanced adhesion barrier products can be a significant barrier to their routine use, especially in healthcare systems with budget constraints or in developing countries. Hospitals often face pressure to manage costs, and the premium price of some synthetic barriers can deter their widespread adoption

- While the long-term cost savings from preventing adhesion-related re-operations are often highlighted, the upfront investment can be a hurdle for many healthcare providers. This is particularly true for single-use products that add directly to the procedural cost

- Overcoming these challenges will require further robust clinical trials to demonstrate more definitive and consistent efficacy across a wider range of surgical scenarios and patient demographics. In addition, manufacturers must focus on developing more cost-effective solutions and providing stronger economic justifications to healthcare providers and policymakers to drive broader acceptance and integration into standard surgical protocols

Adhesion Barriers Market Scope

The market is segmented on the basis of product, formulation, and application

- By Product

On the basis of product, the adhesion barriers market is segmented into synthetic adhesion barriers, natural adhesion barriers, and other synthetic adhesion barriers. The synthetic adhesion barriers segment holds the largest market share of 57.5%, driven by their established efficacy, biocompatibility, and cost-effectiveness. This category includes widely used materials such as Hyaluronic Acid (HA)-based, Regenerated Cellulose, and Polyethylene Glycol (PEG)-based barriers, which offer controlled degradation and effective tissue separation

The natural adhesion barriers segment is anticipated to witness significant growth, fueled by increasing demand for naturally derived materials and their excellent biocompatibility. Natural barriers, such as those derived from collagen and fibrin, are gaining traction for their potential to integrate well with the body's natural healing processes and reduce foreign body reactions.

- By Formulation

On the basis of formulation, the adhesion barriers market is segmented into film formulations, gel formulations, and liquid formulations. The film formulations segment currently holds the largest market revenue share, driven by their versatility, ease of application, and strong clinical evidence supporting their safety and efficacy, particularly in general/abdominal and gynecological surgeries

The gel formulations segment is expected to witness the fastest growth rate, fueled by their conformability to irregular tissue surfaces and improved bioavailability. Their increasing preference over film-based barriers in certain procedures highlights a trend towards more adaptable and easily applied solutions

- By Application

On the basis of application, the adhesion barriers market is segmented into gynecological surgeries, general/abdominal surgeries, orthopedic surgeries, cardiovascular surgeries, neurological surgeries, urological surgeries, reconstructive surgeries, and others. The general/abdominal surgeries segment holds the largest market revenue share, driven by the high incidence of adhesion formation associated with these procedures, including laparotomies and various gastrointestinal surgeries. The extensive tissue manipulation in these surgeries drives a strong demand for adhesion prevention

The gynecological surgeries segment is anticipated to witness significant growth, fueled by the high rates of adhesion formation following gynecological procedures, such as C-sections, hysterectomies, and endometriosis surgeries. Adhesion barriers are crucial in this segment for preventing complications such as chronic pelvic pain and infertility

Adhesion Barriers Market Regional Analysis

- North America dominates the adhesion barriers market with the largest revenue share of 38.7% in 2024, driven by its advanced healthcare infrastructure, high adoption rates of innovative medical technologies, and a significant number of surgical procedures performed annually

- Consumers in the region value the advanced medical technologies and comprehensive patient care, leading to higher adoption rates of adhesion barriers

- This widespread adoption is further supported by significant healthcare expenditure, a technologically advanced medical community, and the growing emphasis on reducing post-operative complications, establishing adhesion barriers as a critical component of surgical care

U.S. Adhesion Barriers Market Insight

The U.S. adhesion barriers market captured largest revenue share of 56.4% in 2024 within North America, fueled by its highly developed healthcare infrastructure, a large volume of surgical procedures, and high awareness among medical professionals regarding post-operative adhesion complications. Consumers and healthcare providers in the region prioritize advanced solutions that improve patient outcomes and reduce the burden of secondary surgeries. The growing adoption of innovative surgical techniques and the robust presence of key market players further propel the adhesion barrier industry in the U.S.

Europe Adhesion Barriers Market Insight

The European adhesion barriers market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by its aging population, increasing prevalence of chronic diseases necessitating surgery, and stringent regulatory frameworks emphasizing patient safety. The rising awareness of post-operative adhesion complications among surgeons and the widespread adoption of advanced surgical techniques are fostering the demand for adhesion barriers. European healthcare systems also prioritize solutions that reduce hospital stays and re-admission rates, further contributing to market growth across various surgical applications

U.K. Adhesion Barriers Market Insight

The U.K. adhesion barriers market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing number of surgical procedures, a strong emphasis on patient safety, and growing awareness of adhesion-related morbidity. In addition, the National Health Service (NHS) initiatives focused on improving surgical outcomes and reducing healthcare costs associated with adhesion complications are encouraging the adoption of adhesion barriers. The U.K.'s commitment to advanced medical technologies and its robust healthcare infrastructure are expected to continue to stimulate market growth

Germany Adhesion Barriers Market Insight

The German adhesion barriers market is expected to expand at a considerable CAGR during the forecast period, fueled by its highly advanced healthcare system, strong focus on medical research and development, and increasing awareness of the benefits of adhesion prevention. Germany’s well-developed infrastructure, combined with its emphasis on precision medicine and patient-centric care, promotes the adoption of high-quality adhesion barriers, particularly in its well-established hospitals and surgical centers. The integration of adhesion barriers into standard surgical protocols is also becoming increasingly prevalent, aligning with local medical standards and patient expectations

Asia-Pacific Adhesion Barriers Market Insight

The Asia-Pacific adhesion barriers market is poised to grow at the fastest CAGR of 11.6%, driven by increasing urbanization, rising disposable incomes, and rapid advancements in healthcare infrastructure in countries such as China, Japan, and India. The region's growing surgical volumes, fueled by a large and aging population and increasing prevalence of chronic diseases, are significantly boosting the adoption of adhesion barriers. Furthermore, as APAC emerges as a manufacturing hub for medical devices, the increasing affordability and accessibility of adhesion barriers are expanding their reach to a wider patient base

Japan Adhesion Barriers Market Insight

The Japan adhesion barriers market is gaining momentum due to the country’s advanced medical technology, rapidly aging population, and stringent quality standards in healthcare. The Japanese market places a significant emphasis on reducing post-operative complications, and the adoption of adhesion barriers is driven by the increasing number of surgeries and a strong focus on improving patient outcomes. The integration of adhesion barriers into standard surgical practices, particularly in complex procedures, is fueling growth. Moreover, Japan's commitment to innovation is likely to spur demand for next-generation, highly effective adhesion solutions

India Adhesion Barriers Market Insight

The India adhesion barriers market is accounted for a significant market revenue share in Asia Pacific, attributed to the country's expanding middle class, rapid urbanization, and increasing access to advanced medical treatments. India's growing volume of surgical procedures across various specialties, coupled with rising awareness among surgeons about adhesion prevention, is driving the adoption of adhesion barriers. The push towards improving healthcare infrastructure and the availability of both established and local manufacturers offering a range of adhesion barrier options are key factors propelling the market in India

Adhesion Barriers Market Share

The Adhesion Barriers industry is primarily led by well-established companies, including:

- Baxter (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Medtronic (Ireland)

- BD (U.S.)

- Integra LifeSciences Corporation (U.S.)

- Anika Therapeutics, Inc. (U.S.)

- Terumo Corporation (Japan)

- FzioMed, Inc. (U.S.)

- GUNZE LIMITED (Japan)

- CGBIO (South Korea)

- Getinge (U.S.)

- MAST Biosurgery AG (Switzerland)

- EMCM B.V.(Netherlands)

- PlantTec Medical GmbH (Germany)

- SEIKAGAKU Corporation (Japan)

- Hangzhou Singclean Medical Products Co., Ltd. (China)

- AlloSource (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- B. Braun SE (Germany)

- Ferring B.V. (Switzerland)

Latest Developments in Global Adhesion Barriers Market

- In March 2025, Fziomed, Inc. a recognized global leader in postsurgical adhesion prevention, today announced it will showcase its Dynavisc Adhesion Barrier Gel, the only synthetic dual-polymer technology on the market, designed to reduce adhesion formation following tendon and peripheral nerve surgery

- In January 2024, Gunze Limited announced a significant investment of 3.5 billion JPY into the construction of a third medical plant and the expansion of its R&D laboratory in Ayabe, Kyoto, Japan. This strategic investment, with an anticipated completion in February 2025, is primarily aimed at increasing the production capacity of TENALEAF, their absorbable adhesion barrier sheet, to meet growing demand and enhance production efficiency for their medical business

- In June 2022, CGBIO, a Korean bio-regenerative medicine company, launched Mediclore, an anti-adhesion agent in Indonesia. Mediclore inhibits adhesion by changing from sol to gel form by body temperature when applied to the body, offering a novel solution for various surgical operations. This expansion highlights the increasing reach of advanced adhesion barrier solutions in emerging markets

- In June 2022, Toray Industries, Inc. and ASKA Pharmaceutical Co., Ltd. formalized a joint development agreement for an adhesion barrier product, targeting marketing approval in Japan. Under the terms of the agreement, Toray will handle the manufacturing, while ASKA Pharmaceutical will be responsible for the exclusive marketing of the product in the Japanese market upon its approval. This collaboration highlights ongoing strategic efforts in research, development, and market expansion for advanced adhesion barrier solutions

- In February 2022, Gunze Limited, a Japanese company, achieved a significant milestone by receiving medical device approval to commence manufacturing and sales of TENALEAF. This pioneering product stands out as the first sheet-type absorbable adhesion barrier to be produced in Japan, offering a new domestic solution aimed at preventing adhesion formation and supporting post-operative healing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.