Global Chromatography Solvents Market

Market Size in USD million

CAGR :

%

USD

6.88 million

USD

12.64 million

2024

2032

USD

6.88 million

USD

12.64 million

2024

2032

| 2025 –2032 | |

| USD 6.88 million | |

| USD 12.64 million | |

|

|

|

|

Chromatography Solvents Market Size

- The global chromatography solvents market size was valued at USD 6.88 Million in 2024 and is expected to reach USD 12.64 Million by 2032, at a CAGR of 7.90% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress in advanced analytical techniques, particularly in pharmaceutical, biotechnology, food & beverage, and environmental testing sectors. These advancements are driving higher demand for high-purity chromatography solvents to ensure accuracy and reliability of analytical results

- Furthermore, rising consumer and regulatory emphasis on quality assurance, drug safety, and food testing is establishing chromatography solvents as an indispensable component across industries. These converging factors are accelerating the uptake of chromatography solvents solutions, thereby significantly boosting the industry’s growth

Chromatography Solvents Market Analysis

- Chromatography solvents, which include HPLC-grade and GC-grade solvents such as methanol, acetonitrile, hexane, and ethanol, are essential components in separation techniques widely used in pharmaceuticals, biotechnology, food & beverage testing, petrochemicals, and environmental analysis. Their role in enhancing accuracy, reproducibility, and sensitivity makes them a critical part of analytical testing processes across multiple industries.

- The growing demand for chromatography solvents is primarily fueled by the rapid expansion of pharmaceutical R&D, rising adoption of chromatography techniques in clinical diagnostics, increasing focus on food safety testing, and stringent regulations mandating quality analysis in drug development and environmental monitoring

- North America dominated the chromatography solvents market with the largest revenue share of 39.5% in 2024, driven by the strong presence of pharmaceutical companies, extensive use of chromatography in biopharmaceutical research, and advanced healthcare infrastructure. The U.S. led the regional market, supported by FDA regulations emphasizing high-purity solvents in drug testing and the increasing prevalence of contract research organizations (CROs) that heavily rely on HPLC solvents for regulatory-compliant analysis

- Asia-Pacific is expected to be the fastest growing region in the chromatography solvents market during the forecast period, projected to expand at a CAGR of 7.8% from 2025 to 2032. Factors driving this growth include rapid urbanization, expansion of pharmaceutical manufacturing hubs in India and China, growing investment in biotechnology research, and rising demand for food and environmental safety testing. In addition, supportive government initiatives and growing outsourcing of drug development activities to Asia are fueling significant regional demand

- The polar solvents segment dominated the chromatography solvents market with a revenue share of 68% in 2024, primarily due to their wide application in reverse-phase liquid chromatography and HPLC techniques, which dominate global chromatography practices. Polar solvents such as methanol, acetonitrile, and water are critical for achieving high-resolution separations of polar and semi-polar compounds

Report Scope and Chromatography Solvents Market Segmentation

|

Attributes |

Chromatography Solvents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Chromatography Solvents Market Trends

Enhanced Convenience Through AI and Automation in Chromatography Solvents

- A significant and accelerating trend in the global chromatography solvents market is the deepening integration with artificial intelligence (AI), advanced automation, and digital laboratory ecosystems. This fusion of technologies is significantly enhancing laboratory efficiency, precision, and data reproducibility in chromatography applications

- For instance, automated chromatography systems now utilize AI-driven solvent selection algorithms to optimize solvent usage, reduce waste, and improve separation accuracy. In 2024, nearly 42.6% of chromatography laboratories globally reported adopting AI-assisted solvent management systems, a number expected to surpass 68.3% by 2032

- AI integration in chromatography solvents enables features such as predictive solvent optimization, pattern recognition in analyte separation, and real-time adjustments in solvent flow rates. For instance, next-generation HPLC and UHPLC systems are increasingly embedded with AI-based modules that can reduce analysis time by up to 30% while enhancing sensitivity for complex biomolecules and pharmaceutical compounds

- Furthermore, automation technologies are driving hands-free solvent preparation and blending, reducing manual errors, and allowing researchers to remotely monitor solvent consumption and system performance. This trend is particularly valuable in large-scale pharmaceutical R&D centers and food safety laboratories, where high throughput and error-free workflows are critical

- The seamless integration of chromatography solvents with cloud-based digital platforms and laboratory information management systems (LIMS) facilitates centralized control of experimental workflows. Through a single interface, researchers can manage solvent usage, analytical runs, and compliance documentation, creating a unified, data-driven laboratory environment

- This trend toward more intelligent, automated, and interconnected chromatography workflows is fundamentally reshaping user expectations for laboratory solvents. Consequently, companies such as Thermo Fisher Scientific, Merck KGaA, and Avantor are investing in AI-enabled solvent delivery systems and digitally integrated chromatography solutions

- The demand for automation- and AI-driven chromatography solvents is growing rapidly across pharmaceutical, biotechnology, and environmental testing sectors. By 2032, it is projected that over 60% of chromatography workflows will incorporate AI-based solvent optimization, reflecting a strong market shift toward efficiency, reproducibility, and sustainability

Chromatography Solvents Market Dynamics

Driver

Growing Demand from Pharmaceutical, Biotechnology, and Food Testing Applications

- The Chromatography Solvents market is witnessing significant growth due to the increasing reliance on chromatography techniques in pharmaceutical R&D, clinical diagnostics, biotechnology, and quality testing across industries. High-performance liquid chromatography (HPLC) and gas chromatography (GC) require ultra-pure solvents such as methanol, acetonitrile, ethanol, and hexane, making solvents a critical consumable in analytical laboratories

- For instance, in March 2024, Merck KGaA expanded its chromatography solvents portfolio with new high-purity grades designed to meet the growing requirements of regulatory-compliant pharmaceutical testing. Such product advancements by leading players are fueling industry expansion and helping laboratories meet stringent quality standards

- The rising prevalence of chronic diseases and the growing need for accurate drug discovery and development are driving demand for chromatography solvents in pharmaceutical and biopharmaceutical industries. Similarly, stricter government regulations regarding food safety, water testing, and environmental monitoring have increased the adoption of chromatography-based testing methods globally

- Additionally, technological advancements in chromatography instruments, coupled with the growth of contract research organizations (CROs) and contract manufacturing organizations (CMOs), are further propelling the demand for high-quality solvents. Their use ensures precision, reproducibility, and compliance with international quality standards

Restraint/Challenge

High Cost of High-Purity Solvents and Environmental Concerns

- Despite strong growth prospects, the Chromatography Solvents market faces challenges due to the high cost of producing ultra-pure solvents, which are essential for analytical accuracy. Manufacturing these solvents requires advanced purification technologies and quality-control processes, resulting in higher costs compared to standard solvents. This makes adoption difficult for small-scale laboratories and price-sensitive markets, especially in developing economies

- In addition, environmental and health concerns related to solvent disposal pose a significant challenge. Many chromatography solvents, such as acetonitrile and methanol, are hazardous and require strict handling, storage, and disposal measures. Increasing regulatory restrictions regarding the safe use and disposal of organic solvents add operational complexity for laboratories and increase overall costs

- For instance, several global regulatory agencies, including the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), have imposed stricter guidelines for the management of solvent waste, pushing companies to invest in greener alternatives and recycling technologies

- Another challenge is the limited availability and fluctuating prices of key raw materials, which can affect solvent supply and pricing stability. Shortages of acetonitrile in the past, due to production constraints, have highlighted the market’s vulnerability to supply chain disruptions

- Overcoming these challenges will require increased investment in sustainable solvent production, greater adoption of solvent recycling systems, and the development of cost-effective high-purity alternatives. Market players that can address these concerns while maintaining quality will be better positioned to capture growth opportunities

Chromatography Solvents Market Scope

The market is segmented on the basis of application, type, technology, and end user.

- By Application

On the basis of application, the chromatography solvents market is segmented into analytical chromatography and preparative chromatography. The analytical chromatography segment dominated the market with the largest revenue share of 62% in 2024, driven by its widespread use in drug development, clinical diagnostics, environmental monitoring, and food safety testing. The ability of analytical chromatography to provide highly accurate, reproducible, and sensitive separation of complex mixtures makes it indispensable across pharmaceutical and biotechnology industries. Analytical chromatography is further supported by the rising regulatory emphasis on quality control and the growing need for precise quantification in research applications. The increasing use of HPLC and UHPLC systems for small molecule and biomolecule characterization also enhances demand for solvents in this segment.

On the other hand, the preparative chromatography segment is projected to witness the fastest CAGR of 8.5% from 2025 to 2032, fueled by the rising adoption of chromatography in large-scale biomolecule purification, biopharmaceutical production, and natural product isolation. The ability to purify proteins, peptides, and active pharmaceutical ingredients (APIs) in bulk quantities is driving significant investment in preparative chromatography systems, making solvents in this segment increasingly critical.

- By Type

On the basis of type, the chromatography solvents market is segmented into polar solvents and non-polar solvents. The polar solvents segment accounted for the largest revenue share of 68% in 2024, primarily due to their wide application in reverse-phase liquid chromatography and HPLC techniques, which dominate global chromatography practices. Polar solvents such as methanol, acetonitrile, and water are critical for achieving high-resolution separations of polar and semi-polar compounds. Their solubility characteristics, compatibility with detectors, and widespread availability further contribute to their dominance. Pharmaceutical and biotech industries particularly favor polar solvents because they provide consistent results for drug quality testing and biomolecule characterization.

Conversely, the non-polar solvents segment is projected to register the fastest CAGR of 9.2% during the forecast period, as they are increasingly being utilized in normal-phase chromatography and gas chromatography applications, particularly for separating hydrophobic compounds and lipophilic biomolecules. The expansion of natural product research and lipidomics is fueling adoption, alongside their growing use in the cosmetic and food industries, where non-polar analytes are critical.

- By Technology

On the basis of technology, the chromatography solvents market is segmented into liquid chromatography, high-pressure liquid chromatography (HPLC), ultra high-performance liquid chromatography (UHPLC), gas chromatography, and others. The high-pressure liquid chromatography (HPLC) segment dominated the market in 2024, capturing the largest revenue share of 45%, due to its widespread application in pharmaceutical quality assurance, clinical diagnostics, and food testing laboratories. HPLC remains the gold standard for routine analysis because of its reliability, accuracy, and ability to handle a wide range of analytes. The rising demand for drug validation, stability testing, and regulatory compliance ensures strong adoption across industries.

In contrast, the ultra high-performance liquid chromatography (UHPLC) segment is projected to grow at the fastest CAGR of 10.1% from 2025 to 2032. The growth is attributed to its ability to deliver faster run times, higher resolution, and reduced solvent consumption, making it cost-effective for high-throughput labs. The increasing use of UHPLC in biopharmaceuticals, proteomics, and advanced drug discovery is accelerating adoption, as researchers seek more efficient techniques to manage large, complex datasets with greater sensitivity.

- By End-User

On the basis of end-user, the chromatography solvents market is segmented into pharmaceutical industry, biotechnology industry, academics and research, environmental, cosmetic industry, and food and beverage. The pharmaceutical industry segment held the largest revenue share of 48% in 2024, driven by the expanding global drug development pipeline, stringent quality assurance requirements, and increasing investments in clinical trials. Chromatography solvents are extensively used in drug discovery, formulation, and stability testing, making them vital in meeting FDA and EMA compliance standards. The pharmaceutical sector’s growing reliance on chromatography for precise quantification of APIs and impurities cements its leading role.

Meanwhile, the biotechnology industry is expected to register the fastest CAGR of 11.3% from 2025 to 2032. This growth is propelled by the rapid rise of biologics, biosimilars, gene therapies, and personalized medicines, all of which require advanced chromatography techniques for large biomolecule purification and analysis. The biotechnology sector’s expanding research activities in proteomics and metabolomics further enhance demand for chromatography solvents, making it the most dynamic growth driver in the forecast period.

Chromatography Solvents Market Regional Analysis

- North America dominated the chromatography solvents market with the largest revenue share of 39.5% in 2024, driven by the strong presence of pharmaceutical and biotechnology companies, the extensive use of chromatography in biopharmaceutical research, and advanced healthcare infrastructure

- The region benefits from stringent quality regulations that require high-purity solvents for analytical and preparative chromatography applications. In particular, the adoption of HPLC and UHPLC techniques in drug discovery, quality control, and clinical diagnostics is contributing to market growth

- The rising prevalence of chronic diseases and the demand for personalized medicines are further boosting the consumption of chromatography solvents

U.S. Chromatography Solvents Market Insight

The U.S. chromatography solvents market accounted for the largest share of 65% within North America in 2024. Growth is underpinned by FDA regulations emphasizing the use of high-quality solvents in pharmaceutical testing, along with an increasing number of contract research organizations (CROs) that rely heavily on chromatography for regulatory-compliant analysis. Additionally, the U.S. pharmaceutical pipeline and high investment in R&D are driving the steady demand for solvents in drug discovery and development workflows. The presence of key industry players and their continuous innovation in producing environmentally sustainable, high-performance solvents further support market expansion.

Europe Chromatography Solvents Market Insight

The Europe chromatography solvents market is projected to expand at a significant CAGR during the forecast period, fueled by stringent regulatory standards for pharmaceutical and food safety testing, as well as the region’s strong academic and research base. Increasing emphasis on drug safety and environmental monitoring is encouraging wider adoption of chromatography solvents across industries. In addition, Europe’s growing biologics sector and the rising demand for biosimilars are supporting solvent consumption for protein purification and large-scale analysis.

U.K. Chromatography Solvents Market Insight

The U.K. chromatography solvents market is expected to grow at a robust pace, driven by ongoing investments in biotechnology research, the presence of major pharmaceutical companies, and increasing applications of chromatography in food safety testing. Growing concerns over contamination and regulatory pressure to ensure high-quality standards in food and beverages are further boosting demand. Moreover, the country’s expanding biopharmaceutical R&D landscape is likely to accelerate solvent consumption.

Germany Chromatography Solvents Market Insight

The Germany chromatography solvents market is anticipated to witness considerable growth, supported by its advanced pharmaceutical manufacturing base and high R&D investments in life sciences. The country’s strong emphasis on innovation, sustainability, and digitalization in laboratories is shaping demand for high-purity solvents. Furthermore, the increasing adoption of chromatography in environmental testing and academic research is driving solvent usage, especially in HPLC and GC applications.

Asia-Pacific Chromatography Solvents Market Insight

The Asia-Pacific chromatography solvents market is expected to be the fastest-growing region in the Chromatography Solvents market, projected to expand at a CAGR of 7.8% from 2025 to 2032. This growth is primarily driven by rapid urbanization, the expansion of pharmaceutical manufacturing hubs in India and China, and growing investment in biotechnology research. The rising demand for food and environmental safety testing, along with supportive government initiatives promoting quality control and regulatory compliance, is further accelerating regional demand. Outsourcing of drug development and clinical trials to Asia-Pacific is also contributing significantly to the market expansion.

Japan Chromatography Solvents Market Insight

The Japan chromatography solvents market is witnessing growing adoption of chromatography solvents due to its strong focus on precision medicine, biopharmaceutical development, and advanced healthcare systems. The country’s high-tech infrastructure, combined with continuous innovation in analytical instruments, supports steady demand for solvents in R&D and quality control. Increasing emphasis on food safety standards and environmental monitoring further boosts growth.

China Chromatography Solvents Market Insight

The China chromatography solvents market captured the largest share of the Asia-Pacific market in 2024, supported by its rapidly expanding pharmaceutical industry, rising drug approvals, and the presence of a large number of generic drug manufacturers. Growing investment in biopharmaceutical research and government initiatives encouraging local drug innovation are significantly increasing the use of chromatography solvents. Additionally, China’s role as a major global supplier of raw materials and APIs makes chromatography a critical tool, thereby fueling high solvent demand across multiple industries.

Chromatography Solvents Market Share

The Chromatography Solvents industry is primarily led by well-established companies, including:

- Merck KGaA (Germany)

- Avantor, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Columbus Chemicals (U.S.)

- Elite Advanced Materials Sdn Bhd (Malaysia)

- Biosolve Chimie (France)

- GFS Chemicals, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Orochem Technologies Inc. (U.S.)

- Qualikems Lifesciences Pvt Ltd (India)

- Regis Technologies, Inc. (U.S.)

- Romil Ltd. (U.K.)

- Santa Cruz Biotechnology, Inc. (U.S.)

- Spectrum Chemical (Canada)

- Scharlab, S.L (Philippines)

- Tokyo Chemical Industry (India) Pvt. Ltd.

- Tedia Company Inc. (U.S.)

- VWR International, LLC (U.S.)

Latest Developments in Global Chromatography Solvents Market

- In April 2024, INEOS Nitriles announced the first sales of INVIREO bio-based acetonitrile, a key solvent widely used in HPLC/LC-MS workflows, citing up to a 90% carbon-footprint reduction versus fossil routes. This marks a notable sustainability milestone for chromatographic solvent supply

- In March 2024, Thermo Fisher Scientific unveiled the Dionex Integrion XT Ion Chromatography system to increase throughput and robustness in IC workflows—an advance expected to lift consumption of high-purity eluents and suppressor-compatible solvents in analytical labs

SKU-

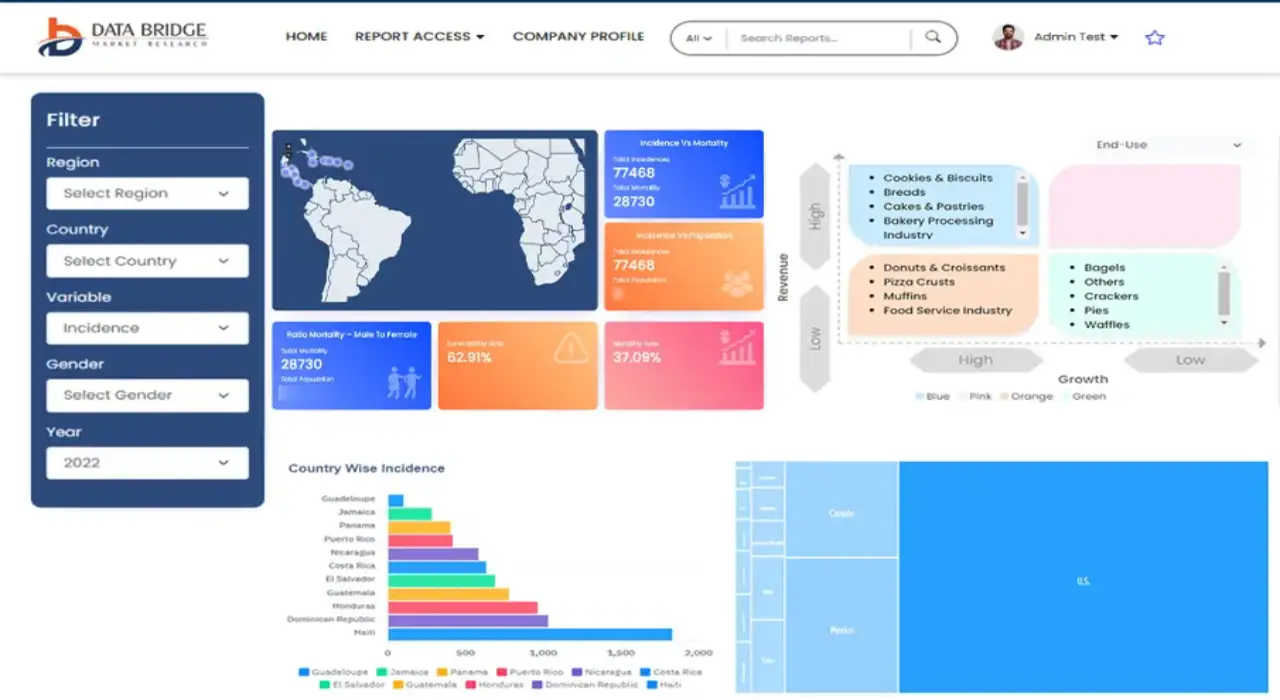

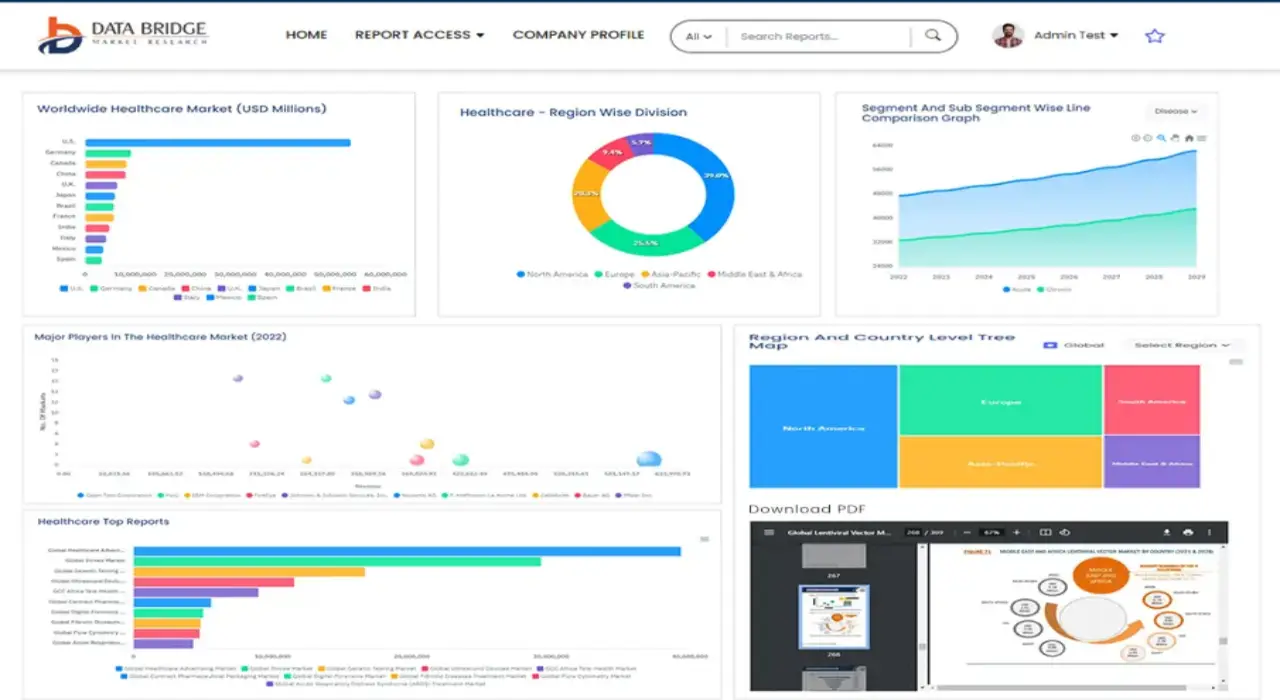

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.