Global Computed Tomography Devices Market

Market Size in USD Billion

CAGR :

%

USD

7.36 Billion

USD

12.41 Billion

2024

2032

USD

7.36 Billion

USD

12.41 Billion

2024

2032

| 2025 –2032 | |

| USD 7.36 Billion | |

| USD 12.41 Billion | |

|

|

|

|

Computed Tomography Devices Market Size

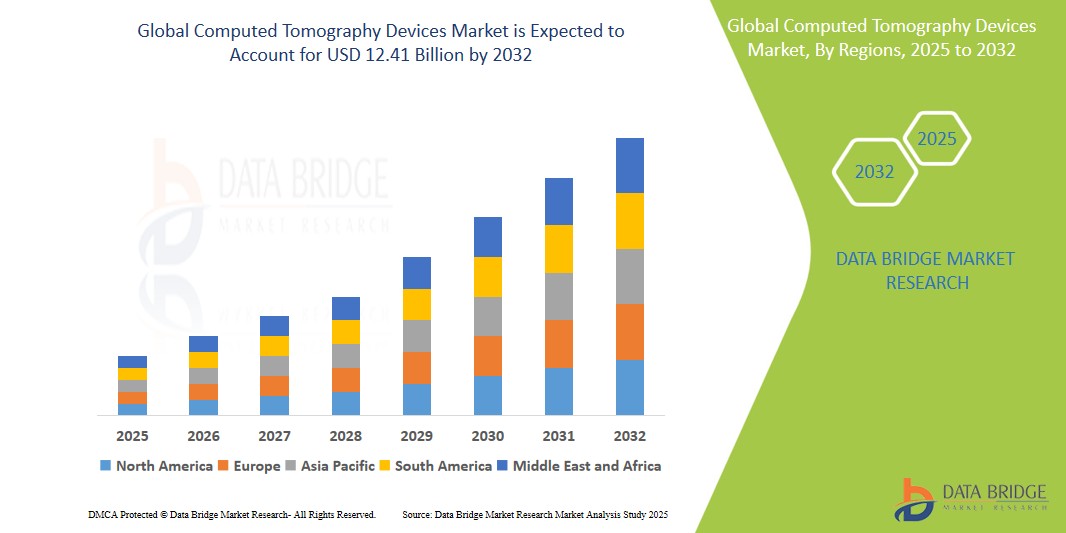

- The global computed tomography devices market size was valued at USD 7.36 billion in 2024 and is expected to reach USD 12.41 billion by 2032, at a CAGR of 6.76% during the forecast period

- This growth is driven by advancements in software and data management

Computed Tomography Devices Market Analysis

- Computed Tomography Devices are essential diagnostic tools that use specialized X-ray technology to generate detailed cross-sectional images of internal organs and tissues.

- The demand for computed tomography devices is driven by the increasing prevalence of chronic diseases, advancements in CT technology, and growing healthcare investments aimed at improving diagnostic capabilities and patient outcomes.

- North America is expected to dominate the computed tomography devices market with a largest market share of 35.41%, driven by the region's advanced healthcare infrastructure, the high adoption rate of cutting-edge diagnostic technologies, and the presence of major players offering state-of-the-art CT solutions

- Asia-Pacific is projected to register the highest growth rate in the computed tomography devices market during the forecast period, owing to expanding healthcare systems, increased awareness about early detection of diseases, and rising demand for advanced diagnostic tools in emerging economies such as China and India

- The high-end slice CT segment is anticipated to dominate the market with a largest market share of 36.61%, fueled by 80% less radiation exposure than mid-end slice technology (64 slices) with a 16 cm imaging area helping in accurate technique

Report Scope and Computed Tomography Devices Market Segmentation

|

Attributes |

Computed Tomography Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Computed Tomography Devices Market Trends

“Rise in Adoption of AI-Driven Imaging Solutions”

- A prominent trend in the computed tomography devices market is the growing adoption of artificial intelligence (AI)-driven imaging solutions, which enhance diagnostic accuracy and efficiency by automating image analysis and interpretation

- AI technologies integrated with CT scanners are being used to detect early signs of diseases such as cancer, cardiovascular conditions, and neurological disorders, significantly reducing the workload on radiologists

- For instance, AI algorithms can now help identify abnormal growths in scans, allowing for faster and more accurate diagnoses, thereby improving patient outcomes

- The increasing use of AI in imaging is expected to accelerate the growth of the market, as healthcare providers seek to improve diagnostic accuracy and reduce human error

Computed Tomography Devices Market Dynamics

Driver

“Growing Demand for Non-Invasive Diagnostics”

- A key driver in the computed tomography devices market is the rising demand for non-invasive diagnostic technologies, which provide detailed internal body images without the need for invasive procedures

- With the increasing focus on patient comfort and reducing hospital stays, CT scans offer a safer, faster alternative to traditional invasive methods, driving their adoption in various healthcare settings

- For instance, the demand for cardiac CT scans has risen sharply due to the non-invasive nature of the procedure, providing an effective way to assess coronary artery diseases

- This trend is contributing significantly to the overall growth of the CT market, as patients and healthcare providers seek less invasive alternatives for accurate diagnosis

Opportunity

“Development of Portable and Compact CT Scanners”

- An emerging opportunity in the computed tomography devices market is the development of portable and compact CT scanners, which are being designed to bring imaging capabilities to resource-limited and remote locations

- These smaller, more affordable units enable healthcare facilities in rural and underserved areas to perform critical diagnostic tests, improving accessibility and care in these regions

- For instance, in 2024, GE HealthCare introduced its portable CT scanner for use in emergency and mobile healthcare environments, enhancing the ability to diagnose patients in diverse settings

- The expansion of portable CT scanners is expected to open new growth opportunities, particularly in emerging markets and rural areas, making medical imaging more accessible to a broader population

Restraint/Challenge

“High Capital Investment and Operational Costs”

- A significant challenge in the computed tomography devices market is the high capital investment required to acquire and maintain advanced CT scanning equipment, which can be a financial burden for smaller healthcare facilities and hospitals in developing regions

- The operational costs, including maintenance, training, and upgrades, also add to the financial strain on healthcare systems, limiting the widespread adoption of advanced CT technologies

- For instance, a report by the World Health Organization (WHO) highlighted that the high upfront and operational costs of CT scanners hinder their adoption in low- and middle-income countries, where healthcare budgets are often constrained

- These financial challenges are creating disparities in access to advanced diagnostic services, posing a significant barrier to the growth of the market, especially in emerging economies

Computed Tomography Devices Market Scope

The market is segmented on the basis of product type, application, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Application |

|

|

By End User |

|

In 2025, the high-end slice CT is projected to dominate the market with a largest share in product type segment

The high-end slice CT segment is expected to dominate the computed tomography devices market with the largest share of 36.11% in 2025, due to 80% less radiation exposure than mid-end slice technology (64 slices) with a 16 cm imaging area helping in accurate technique.

The Oncology is expected to account for the largest share during the forecast period in end user segment

In 2025, the oncology segment is expected to dominate the market with the largest market share of 43.25% due to rising number of cancer cases, advancements in imaging technology, and increased use of CT scans in cancer diagnosis and monitoring.

Computed Tomography Devices Market Regional Analysis

“North America Holds the Largest Share in the Computed Tomography Devices Market”

- North America is expected to dominate the computed tomography (CT) devices market with a largest market share of 35.41%, driven by the presence of leading CT device manufacturers, advanced healthcare infrastructure, widespread adoption of diagnostic imaging, and high healthcare spending

- The U.S. dominates the region due to significant advancements in CT technology, high adoption rates of multi-slice CT scanners, and extensive research in diagnostic imaging. Strong government funding for healthcare and reimbursement policies are key growth drivers

- The continuous development of CT-based imaging techniques, especially for cancer detection and cardiac applications, is expected to reinforce North America's market leadership in the global CT devices market

“Asia-Pacific is Projected to Register the Highest CAGR in the Computed Tomography Devices Market”

- Asia-Pacific is expected to witness the highest growth rate in the computed tomography (CT) devices market, driven by improving healthcare infrastructure, rising healthcare expenditure, and increasing adoption of advanced diagnostic technologies in emerging markets

- Countries such as China, India, and Japan are key contributors to regional growth, supported by government health initiatives, rapid urbanization, and expanding healthcare access, which fuels demand for diagnostic imaging solutions

- Japan, known for its healthcare innovations, is seeing an increasing adoption of high-end CT scanners, while China and India, with their large and growing populations, are witnessing a significant rise in CT device installations, supported by public-private healthcare partnerships and investments in medical technology

Computed Tomography Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- GE HealthCare (U.S.)

- Siemens (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Hitachi, Ltd. (Japan)

- Neusoft Corporation (China)

- Medtronic (Ireland)

- Shenzhen Anke High-tech Co., Ltd. (China)

- Accuray Incorporated (U.S.)

- PLANMED OY (Finland)

- Koning Health (U.S.)

- Carestream Health (U.S.)

- PointNix Co., Ltd (South Korea)

- Fujifilm Corporation (Japan)

- Hologic, Inc. (U.S.)

- Shimadzu Corporation (Japan)

Latest Developments in Global Computed Tomography Devices Market

- In February 2024, Koning Health received regulatory approval from the Federal Authority for Nuclear Regulation (FANR) in the United Arab Emirates (UAE), marking a pivotal moment in the company's expansion. This clearance establishes Koning as the first provider of breast CT technology in the UAE, setting a new benchmark for breast imaging and care in the region. This approval opens the door for advanced breast imaging technology across the UAE

- In January 2024, GE HealthCare announced its acquisition of MIM Software, a leading provider of AI-driven solutions for medical imaging analysis. MIM Software specializes in radiation oncology, molecular radiotherapy, diagnostic imaging, and urology, providing cutting-edge solutions in healthcare settings worldwide. This acquisition will enable GE HealthCare to enhance its imaging analytics and digital workflows, further improving patient care globally

- In January 2023, GE HealthCare entered into an agreement to acquire IMACTIS, a France-based company specializing in Computed Tomography (CT) interventional guidance. IMACTIS is known for its innovations in the growing field of CT-guided interventional procedures, and this acquisition will strengthen GE HealthCare’s capabilities in offering advanced imaging solutions for healthcare providers globally

- In November 2023, Canon Medical Systems Corp. introduced major updates to its CT portfolio at the Radiological Society of North America Congress (RSNA), including the new flagship system, Aquilion ONE / INSIGHT Edition, and the high-throughput system, Aquilion Serve SP. These new systems offer cutting-edge imaging capabilities and enhanced efficiency, further solidifying Canon’s leadership in the CT devices market

- In June 2022, Trivitron Healthcare announced its plans to launch made-in-India CT-Scan and MRI systems during the 2022-23 fiscal year. These systems, designed for both the Indian and international markets, are intended to provide better diagnostic capabilities in remote areas, thanks to their smart features, cost-effectiveness, and portability. This launch will expand access to high-quality diagnostic technology in underserved regions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.