Global Digital Health Monitoring Devices Market

Market Size in USD Billion

CAGR :

%

USD

5.19 Billion

USD

20.70 Billion

2024

2032

USD

5.19 Billion

USD

20.70 Billion

2024

2032

| 2025 –2032 | |

| USD 5.19 Billion | |

| USD 20.70 Billion | |

|

|

|

|

Digital Health Monitoring Devices Market Size

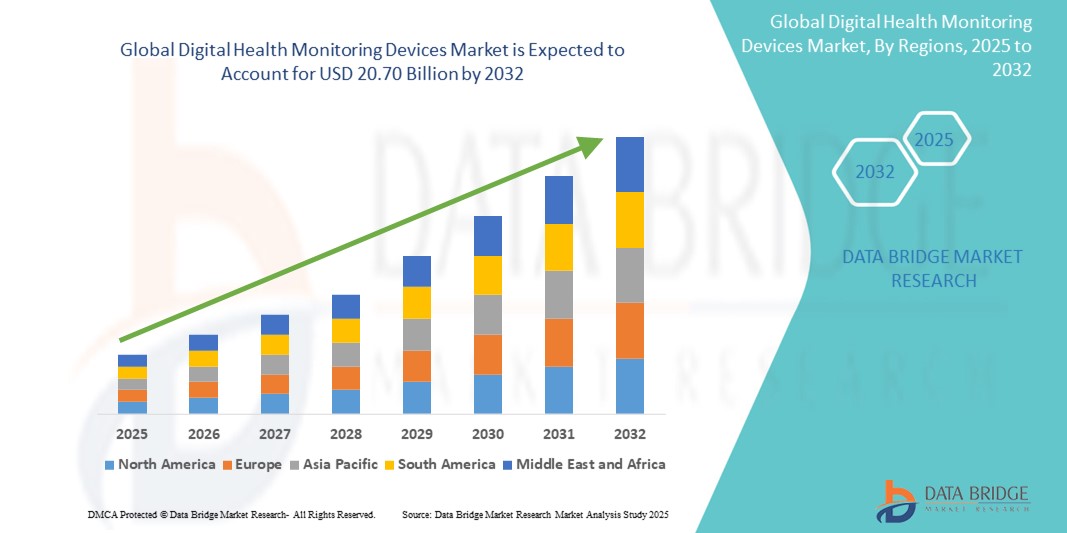

- The global digital health monitoring devices market size was valued at USD 5.19 billion in 2024 and is expected to reach USD 20.70 billion by 2032, at a CAGR of 18.87% during the forecast period

- This growth is driven by factors such as the aging population, rise in chronic diseases, and technological advancements

Digital Health Monitoring Devices Market Analysis

- Digital health monitoring devices are advanced tools used to track and manage various health parameters in real-time, such as heart rate, blood pressure, glucose levels, and oxygen saturation. These devices are integral in providing continuous health data for individuals, enabling proactive management of chronic conditions such as diabetes, hypertension, and cardiovascular diseases

- The demand for these devices is significantly driven by the increasing adoption of telemedicine, a rise in chronic diseases, and the growing consumer preference for self-care and preventive health monitoring. In addition, technological advancements in sensors, connectivity (IoT), and data analytics further enhance the effectiveness and accessibility of these devices

- North America holds approximately 40.6% of the global digital health monitoring devices market, with the U.S. contributing significantly to this share due to its advanced healthcare system and high demand for innovative health solutions

- Asia-Pacific is expected to grow at a significant pace, contributing 30.3% of the global market by 2025, with India projected to have the highest share in this region

- Device’s segment is expected to dominate the digital health monitoring devices market with a market share of 60.74% in 2025 due to its wide range of products, including wearable health trackers, continuous glucose monitors, blood pressure monitors, and other diagnostic tools. These devices are integral for real-time health monitoring, enabling individuals to manage chronic conditions effectively and proactively

Report Scope and Digital Health Monitoring Devices Market Segmentation

|

Attributes |

Digital Health Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Digital Health Monitoring Devices Market Trends

“Advancements in Digital Health Monitoring Devices & AI Integration for Personalized Healthcare”

- One prominent trend in the evolution of digital health monitoring devices is the increasing integration of artificial intelligence (AI) and advanced sensors, which enable more accurate and personalized health tracking

- These innovations improve the efficiency and effectiveness of health monitoring by providing real-time data analysis, predictive insights, and early detection of health issues, empowering individuals and healthcare providers to make proactive, informed decisions

- For instance, AI-powered algorithms in wearable devices can analyze heart rate variability, detect irregularities such as arrhythmias, and alert users or healthcare professionals, enabling timely intervention. In addition, glucose monitoring devices for diabetics offer personalized insights based on daily trends and behaviors, improving disease management

- These advancements are revolutionizing healthcare, enhancing preventive care, reducing healthcare costs, and driving the demand for next-generation digital health monitoring devices with enhanced AI and data analytics capabilities

Digital Health Monitoring Devices Market Dynamics

Driver

“Growing Adoption of Digital Health Monitoring Devices Due to Rising Chronic Diseases”

- The increasing prevalence of chronic diseases such as diabetes, hypertension, and cardiovascular disorders is significantly driving the demand for digital health monitoring devices. As the global population ages and the incidence of these diseases rises, individuals are seeking continuous and real-time health monitoring to manage their conditions more effectively

- The demand for these devices is further fueled by the increasing focus on preventive healthcare, where early detection and management of chronic conditions can lead to better health outcomes and reduced healthcare costs

- With advancements in sensor technologies, wearables, and mobile health apps, individuals can now monitor vital parameters such as blood sugar levels, blood pressure, heart rate, and oxygen saturation, helping to manage chronic diseases remotely and proactively

For instance,

- In 2023, the Centers for Disease Control and Prevention (CDC) reported that nearly 1 in 10 Americans have diabetes, leading to increased demand for continuous glucose monitoring devices. This surge is further supported by the growing preference for self-management tools that empower individuals to track their health and take preventive measures

- As a result, the rising prevalence of chronic conditions is accelerating the need for digital health monitoring devices, making them integral to improving health outcomes and reducing the burden on healthcare systems worldwide

Opportunity

“Expansion of Wearable Health Monitoring Devices”

- The growing demand for wearable health monitoring devices is driven by the increasing consumer preference for self-health management and preventive care. These devices, such as fitness trackers, smartwatches, and biosensors, enable users to monitor key health metrics such as heart rate, blood pressure, and glucose levels in real time

- As individuals become more health-conscious and seek to manage chronic conditions at home, wearable devices are becoming essential tools for tracking health status and preventing disease progression

For instance,

- In 2023, a study published by the American Heart Association highlighted the growing popularity of wearable devices for managing cardiovascular health, demonstrating that users can track heart rate variability and detect early signs of irregularities, improving overall health management and reducing emergency incidents

- This demand for accessible, real-time health data is driving innovations in wearable devices, leading to more affordable and efficient monitoring solutions, particularly for chronic disease management and preventive healthcare

Restraint/Challenge

“Data Privacy and Security Concerns”

- The widespread use of digital health monitoring devices raises concerns around the privacy and security of the vast amount of personal health data being collected. These devices often store sensitive health information, which could be vulnerable to cyberattacks or data breaches, potentially compromising patient privacy

- Regulatory challenges related to data protection laws, such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. or the General Data Protection Regulation (GDPR) in Europe, further complicate the adoption of these devices. Healthcare providers and device manufacturers must ensure compliance with strict data security standards to build trust with consumers and healthcare systems

For instance,

- In March 2024, a report by the European Commission on the security of medical devices noted that growing concerns over cybersecurity are leading to the implementation of more stringent security protocols in health devices, highlighting the need for robust data protection measures in the digital health sector

- As a result, while the adoption of digital health devices continues to grow, privacy and security concerns present significant challenges that need to be addressed for the continued expansion and acceptance of these technologies

Digital Health Monitoring Devices Market Scope

The market is segmented on the basis of product, type and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By End User |

|

In 2025, the devices are projected to dominate the market with a largest share in product segment

The devices segment is expected to dominate the digital health monitoring devices market with the largest share of 60.74% in 2025 as devices encompass a wide range of products, including wearable health trackers, continuous glucose monitors, blood pressure monitors, and other diagnostic tools. These devices are integral for real-time health monitoring, enabling individuals to manage chronic conditions effectively and proactively.

The wireless healthare expected to account for the largest share during the forecast period in type market

In 2025, the wireless healthare segment is expected to dominate the market with the largest market share of 33.31%, driven by continuous advancements and investments in wireless connectivity solutions essential for remote patient monitoring. The capability to monitor patients without the need for physical presence has been a key driver behind the growth of wireless health technologies.

Digital Health Monitoring Devices Market Regional Analysis

“North America Holds the Largest Share in the Digital Health Monitoring Devices Market”

- North America holds approximately 40.6% of the global digital health monitoring devices market, with the U.S. contributing significantly to this share due to its advanced healthcare system and high demand for innovative health solutions, hence U.S. would hold approximately 29.32% of the global digital health monitoring devices market

- North America dominates the digital health monitoring devices market, driven by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and the strong presence of key market players

- U.S. holds a significant share due to increased demand for high-precision health monitoring devices, rising prevalence of chronic diseases such as diabetes and hypertension, and continuous advancements in wearable and diagnostic technologies

- The availability of well-established reimbursement policies and growing investments in research & development by leading medical device companies further strengthens the market

- In addition, the increasing focus on preventive healthcare and a growing consumer preference for self-monitoring health devices is fuelling market expansion across the region

“Asia-Pacific is Projected to Register the Highest CAGR in the Digital Health Monitoring Devices Market”

- Asia-Pacific is expected to witness the highest growth rate in the digital health monitoring devices market, driven by rapid expansion in healthcare infrastructure, increasing awareness about health monitoring, and rising health-consciousness among the growing middle class

- Countries such as China, India, and Japan are emerging as key markets due to the growing aging population, which is more susceptible to chronic conditions such as diabetes, hypertension, and cardiovascular diseases

- Japan, with its advanced medical technology and increasing number of healthcare professionals, remains a crucial market for digital health monitoring devices, leading the region in the adoption of high-tech wearable and diagnostic devices

- India is projected to register the highest CAGR in the Digital Health Monitoring Devices market, driven by expanding healthcare infrastructure, increasing awareness about health management, and the rising prevalence of chronic diseases

- Asia-Pacific is expected to grow at a significant pace, contributing 30.3% of the global market by 2025, with India is expected to account for approximately 8.7% of the Asia-Pacific market share by 2025, driven by factors such as the rapid adoption of digital health technologies, expanding internet and smartphone penetration, rising healthcare awareness, and increasing government initiatives promoting telehealth and remote patient monitoring solutions

Digital Health Monitoring Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- NEVRO CORP (U.S.)

- Inspire Medical Systems, Inc. (U.S.)

- SPR (U.S.)

- ALEVA NEUROTHERAPEUTICS (Switzerland)

- LivaNova PLC (U.K.)

- NeuroPace, Inc. (U.S.)

- Synapse Biomedical Inc. (U.S.)

- Soterix Medical Inc. (U.S.)

- Accellent Technologies, Inc. (U.S.)

- Abbott (U.S.)

- Apple Inc. (U.S.)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Empatica Inc. (U.S.)

- Hill-Rom Holdings, Inc. (U.S.)

Latest Developments in Global Digital Health Monitoring Devices Market

- In January 2025, Dexcom received FDA clearance for its G7 15-Day Continuous Glucose Monitoring (CGM) System. The new system offers up to 15.5 days of continuous wear before replacement, providing improved convenience for diabetes management. This advancement enhances the accuracy of glucose readings and allows users to better manage their diabetes with real-time data and alerts

- In March 2025, Oura launched the Oura Ring 4, the latest iteration of its smart health tracker. This version features enhanced sensors for tracking heart rate, blood oxygen levels, and body temperature, offering more precision for daily health monitoring. The ring has gained significant attention for its minimalist design and the growing trend of wearables that provide actionable health insights

- In December 2024, Apple introduced a new ECG app with the latest version of the Apple Watch Series 9, enabling users to take an electrocardiogram directly from their wrist. The app enhances heart health monitoring and has been approved by health authorities for its diagnostic accuracy, expanding the watch’s functionality for preventive healthcare

- In February 2025, Fitbit unveiled its Sense 3 smartwatch, which integrates advanced health features such as skin temperature tracking and stress management tools. The device is designed to provide a comprehensive look at users' well-being, with AI-powered insights to help users manage chronic conditions, track fitness levels, and improve overall health

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.