Global Gas Chromatography Market

Market Size in USD Billion

CAGR :

%

USD

4.14 Billion

USD

7.92 Billion

2024

2032

USD

4.14 Billion

USD

7.92 Billion

2024

2032

| 2025 –2032 | |

| USD 4.14 Billion | |

| USD 7.92 Billion | |

|

|

|

|

Global Gas Chromatography Market Analysis

The global gas chromatography market is witnessing robust growth, driven by increasing demand from various sectors such as pharmaceuticals, biotechnology, food and beverage, and environmental testing. Gas chromatography is an analytical technique used to separate and analyze volatile compounds in complex mixtures. It plays a crucial role in ensuring the purity, potency, and stability of pharmaceutical products, as well as in toxicological studies to identify and quantify harmful substances. The market is also benefiting from technological advancements, such as the integration of artificial intelligence (AI) to streamline and optimize the gas chromatography process. AI algorithms help analyse and interpret the vast amount of data generated by gas chromatography instruments with incredible speed and accuracy. Additionally, the growing focus on personalized medicine and biologics is driving the demand for sophisticated analytical techniques such as gas chromatography. The COVID-19 pandemic further accelerated the adoption of gas chromatography in the healthcare sector for diagnostic testing, drug development, and vaccine research. As industries continue to expand and place a heightened emphasis on quality control and regulatory standards, the gas chromatography market is poised for significant growth in the coming years.

Global Gas Chromatography Market Size

The global gas chromatography market size was valued at USD 4.14 billion in 2024 and is projected to reach USD 7.92 billion by 2032, with a CAGR of 8.45% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Global Gas Chromatography Market Trends

“Shaping the Global Gas Chromatography Market”

The global gas chromatography market is experiencing significant growth, driven by increasing demand for analytical testing across various industries. The market is expected to register a compound annual growth rate (CAGR) of 5.6% during the forecast period, with the Asia-Pacific region projected to witness the highest growth rate. Key factors contributing to this growth include rising food safety concerns, the growing use of chromatography tests in the drug approval process, and the adoption of gas chromatography systems in industrial research and manufacturing processes. Additionally, the COVID-19 pandemic has highlighted the importance of reliable diagnostic technologies, further boosting the demand for gas chromatography and gas chromatography-mass spectrometry (GC-MS) systems. The market is also benefiting from ongoing technological innovations, such as high-resolution columns and integrated mass spectrometry, which enhance accuracy and efficiency. As a result, the gas chromatography market is poised for continued expansion, driven by the increasing need for precise analytical testing in pharmaceuticals, environmental monitoring, forensic science, food safety, and biotechnology.

Report Scope and Gas Chromatography Market Segmentation

|

Attributes |

Global Gas Chromatography Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Agilent Technologies Inc. (U.S.), Thermo Fisher Scientific (U.S.), Merck KGaA (Germany), Restek Corporation (U.S.), Shimadzu Analytical (India) Pvt. Ltd. (India), LECO Corporation (U.S.), PerkinElmer Inc. (U.S.), Danaher (U.S.), Edinburgh Instruments (U.K.), Falcon.ioApS (Denmark), Chromatotec Inc. (U.S.), General Electric Company (U.S.), W. R. Grace & Co.-Conn. (U.S.), Bio-Rad Laboratories, Inc. (U.S.), Yokogawa India Ltd. (India), Siemens (Germany), Regis Technologies, Inc. (U.S.), Illumina, Inc. (U.S.), O.I. Corporation / Xylem Inc. (U.S.), Virtusa Corp (U.S.), Phenomenex (U.S.), GL Sciences Inc. (Japan), SRI Instruments (U.S.), and Trajan Scientific and Medical (Australia) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Global Gas Chromatography Market Definition

Gas chromatography is an analytical technique used to separate and analyze compounds that can be vaporized without decomposition. It is commonly employed to analyze volatile and semi-volatile organic compounds in various fields such as pharmaceuticals, environmental monitoring, food and beverage testing, and petrochemicals. The process involves injecting a sample into a chromatograph, where it is vaporized and carried by an inert gas (such as helium or nitrogen) through a column packed with a stationary phase. As the sample travels through the column, its components interact with the stationary phase at different rates, causing them to separate. The separated compounds are then detected by a detector, such as a flame ionization detector (FID) or a mass spectrometer (MS), and the resulting data is used to identify and quantify the compounds.

Global Gas Chromatography Market Dynamics

Drivers

- Increasing Demand in Pharmaceuticals and Biotechnology

The pharmaceutical and biotechnology industries are witnessing rapid evolution, marked by significant advancements in drug development, stringent quality control measures, and strict regulatory compliance. These developments are driven by the need to ensure the highest standards of safety and efficacy in pharmaceutical products. Gas chromatography has emerged as a pivotal technique in this context, playing a crucial role in guaranteeing the purity, potency, and stability of pharmaceutical compounds. By enabling precise and accurate separation, identification, and quantification of chemical components, gas chromatography ensures that drugs meet the required specifications and regulatory standards. This analytical method is essential for detecting impurities, verifying the consistency of active pharmaceutical ingredients, and monitoring the stability of formulations over time. Furthermore, the biotechnology sector relies on gas chromatography to analyze complex biological samples, facilitate the development of biopharmaceuticals, and support cutting-edge research in genomics and proteomics. As the demand for innovative and high-quality pharmaceutical products continues to rise, the role of gas chromatography in maintaining rigorous quality control and compliance will only become more critical, driving its widespread adoption and growth in these industries.

- Technological Advancements in Gas Chromatography

Technological advancements have significantly transformed gas chromatography, enhancing its accuracy, efficiency, and overall performance. High-resolution columns now enable better separation of complex mixtures, providing clearer and more detailed results. These columns offer increased sensitivity and faster analysis times, making gas chromatography more effective for a wide range of applications. Integrated mass spectrometry has further elevated the capabilities of gas chromatography systems, allowing for precise identification and quantification of compounds. This integration enables comprehensive analysis by combining the separation power of gas chromatography with the molecular identification capabilities of mass spectrometry. Additionally, improved data analysis software has revolutionized the processing and interpretation of chromatographic data. Advanced algorithms and user-friendly interfaces streamline data analysis, reducing the such aslihood of human error and increasing the reliability of results. This software also facilitates automation, enabling high-throughput analysis and enhancing laboratory productivity. Collectively, these innovations have made gas chromatography a more robust and versatile analytical technique, driving its widespread adoption in various industries, including pharmaceuticals, biotechnology, environmental monitoring, and food safety. As technological progress continues, gas chromatography systems will only become more sophisticated and indispensable in scientific research and industrial applications.

Opportunities

- Expansion in Emerging Markets

Emerging markets in Asia-Pacific, Latin America, and Africa are witnessing rapid growth in the gas chromatography market, driven by industrialization and stringent regulatory requirements. The expanding industrial base in these regions, encompassing sectors such as pharmaceuticals, biotechnology, food and beverages, and environmental monitoring, has created a substantial demand for gas chromatography systems. These industries rely on gas chromatography to ensure product quality, adhere to safety standards, and comply with regulatory guidelines. As governments in these regions implement stricter environmental and safety regulations, companies are increasingly adopting advanced analytical techniques, including gas chromatography, to meet compliance standards. Furthermore, the increasing focus on research and development activities, coupled with the rising awareness of the benefits of gas chromatography, is propelling market growth. The availability of cost-effective gas chromatography instruments and the presence of a skilled workforce are also contributing to the market's expansion. As a result, emerging markets are becoming lucrative opportunities for gas chromatography manufacturers and suppliers, driving innovation and fostering the development of more efficient and accessible analytical solutions. This rapid growth in emerging markets is set to significantly impact the global gas chromatography landscape, reinforcing its importance in various industries.

- Automation and Miniaturization in Gas Chromatography

The trend towards automation and miniaturization in gas chromatography technology is revolutionizing the field, creating exciting new opportunities. With advancements in automated systems, gas chromatography has become more efficient, allowing for high-throughput analysis and reducing the chances of human error. These automated systems streamline workflows, increase productivity, and enable more consistent and reliable results. Simultaneously, the miniaturization of gas chromatography instruments has led to the development of portable and comparatively inexpensive devices, making the technology more accessible to a wider range of users. These compact instruments are ideal for on-site analysis in various industries, including environmental monitoring, food safety, and field research. The combination of automation and miniaturization is particularly beneficial for small laboratories, startups, and educational institutions with limited budgets, as it lowers the barriers to entry and enhances their analytical capabilities. Additionally, these advancements are driving innovation in the development of new applications and methodologies, further expanding the scope and utility of gas chromatography. As technology continues to evolve, the trend towards automation and miniaturization will undoubtedly play a pivotal role in shaping the future of gas chromatography, making it more versatile, accessible, and indispensable across diverse fields.

Restraints/Challenges

- High Cost of Instruments and Maintenance

Gas chromatography systems, while powerful and versatile, come with significant costs. The initial investment in high-quality instruments can be substantial, and ongoing maintenance further adds to the financial burden. This high cost can be particularly challenging for small and medium-sized enterprises (SMEs) and academic institutions, which often operate with limited budgets. As a result, many of these organizations may find it difficult to justify or afford the expenditure on gas chromatography technology. In emerging markets, where financial resources and infrastructure may be less developed, the adoption of gas chromatography can be even more constrained. The expense of purchasing, installing, and maintaining these systems can hinder their widespread use, despite the clear benefits they offer in terms of analytical precision and reliability. Addressing these cost-related challenges will be crucial for ensuring broader accessibility and adoption of gas chromatography technology in various sectors and regions. Efforts to develop more cost-effective solutions, along with financial support and incentives, could help mitigate these barriers and promote the wider use of gas chromatography.

- Competition from Alternative Technologies

Competition from alternative analytical techniques, such as liquid chromatography and spectroscopy, poses a significant challenge to the growth of the gas chromatography market. Liquid chromatography, for example, offers similar separation capabilities but can be more versatile in handling a wider range of sample types, including those that are thermally unstable or non-volatile. Additionally, advancements in liquid chromatography, such as high-performance liquid chromatography (HPLC), provide high resolution and sensitivity, making it an attractive alternative. Spectroscopy techniques, such as mass spectrometry and infrared spectroscopy, also offer powerful analytical capabilities and are often easier to use and maintain. These technologies can provide rapid, non-destructive analysis, which is appealing for many applications. The relative ease of use, lower maintenance costs, and broader applicability of these alternative techniques can make them more cost-effective options for some laboratories. As a result, the availability and continued development of these alternative technologies can limit the adoption and growth of gas chromatography systems. To remain competitive, the gas chromatography market must continue to innovate and demonstrate the unique advantages of gas chromatography in specific applications where it excels, such as the separation of complex mixtures and the detection of trace impurities.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Global Gas Chromatography Market Scope

The market is segmented on the basis by instrument, accessories and consumables and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Instrument

- Systems

- Detectors

- Autosamplers

- Fraction Collectors

Accessories and Consumables

- Columns

- Column Accessories

- Pressure Regulators

- Gas Generators

- Other Accessories

End User

- Oil and Gas Industry

- Environmental Agencies

- Pharma and Biotech

Global Gas Chromatography Market Analysis

The market is analysed and market size insights and trends are provided by country, by traditional solution, by emerging solution and by deployment type as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

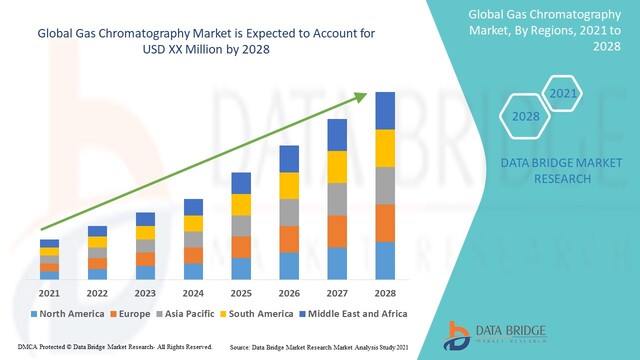

North America is expected to be the dominant region in the global gas chromatography market imaging during the forecast period, primarily due to its well-established industrial landscape, which includes significant sectors such as pharmaceuticals, petrochemicals, and environmental testing that heavily rely on gas chromatography for quality control and research. The region's robust research and development infrastructure drives the demand for advanced gas chromatography systems, with numerous key manufacturers and institutions pushing the boundaries of innovation. North America's stringent regulatory requirements necessitate the use of precise and reliable analytical techniques, further bolstering the market's growth.

Asia Pacific is expected to be the fastest-growing region for gas chromatography market imaging during the forecast period. This growth is driven by rapid industrialization, increasing investments in research and development, and the expansion of the pharmaceutical and biotechnology sectors. Countries such as China, India, and Japan are witnessing a surge in demand for gas chromatography systems due to their growing focus on environmental monitoring and food safety. Government initiatives to promote scientific research and technological advancements further contribute to the region's market growth. The presence of a large and skilled workforce, combined with the rising awareness of the benefits of gas chromatography, is propelling the adoption of this technology.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Global Gas Chromatography Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Global Gas Chromatography Operating in the Market Are:

- Agilent Technologies Inc. (U.S.)

- Thermo Fisher Scientific (U.S.)

- Merck KGaA (Germany)

- Restek Corporation (U.S.)

- Shimadzu Analytical (India) Pvt. Ltd. (India)

- LECO Corporation (U.S.)

- PerkinElmer Inc. (U.S.)

- Danaher (U.S.)

- Edinburgh Instruments (U.K.)

- Falcon.io ApS (Denmark)

- Chromatotec Inc. (U.S.)

- General Electric Company (U.S.)

- W. R. Grace & Co.-Conn. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Yokogawa India Ltd. (India)

- Siemens (Germany)

- Regis Technologies, Inc. (U.S.)

- Illumina, Inc. (U.S.)

- O.I. Corporation / Xylem Inc. (U.S.)

- Virtusa Corp (U.S.)

- Phenomenex (U.S.)

- GL Sciences Inc. (Japan)

- SRI Instruments (U.S.)

- Trajan Scientific and Medical (Australia)

Latest Developments in Global Gas Chromatography Market

- In December 2024, Agilent Technologies introduced an advanced gas chromatography system equipped with integrated AI-based data analysis tools. This innovative product aims to enhance the accuracy and efficiency of chemical analysis, making it particularly valuable for industries such as pharmaceuticals, food safety, and environmental testing. The integration of AI-based tools allows for more precise data interpretation, reducing the likelihood of human error and increasing the reliability of results. This new system is designed to streamline workflows, improve productivity, and provide more consistent and accurate analytical outcomes, addressing the growing demand for high-quality and efficient analytical solutions in these critical industries

- In November 2024, Thermo Fisher Scientific announced a partnership with a global chemical company to co-develop a next-generation gas chromatography solution. This collaboration aims to enhance the sensitivity and speed of detecting volatile compounds in industrial applications. By combining their expertise and resources, the two companies seek to create an advanced analytical tool that will improve the efficiency and accuracy of chemical analysis, catering to the needs of various industries

- In October 2024, Waters Corporation acquired a leading provider of gas chromatography accessories and consumables. This strategic acquisition strengthens Waters' position in the gas chromatography market by expanding its portfolio of products designed to enhance laboratory productivity and reduce operational costs. By integrating these accessories and consumables into their offerings, Waters aims to provide comprehensive solutions that cater to the diverse needs of laboratories, ensuring more efficient and cost-effective operations. This move underscores Waters' commitment to innovation and excellence in the field of analytical instrumentation, further solidifying its market leadership

- In September 2024, PerkinElmer introduced a breakthrough gas chromatography column optimized for petrochemical and environmental testing applications. This innovative column allows for faster and more accurate separation of complex samples, addressing the growing market demand for high-performance analytical tools

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.