Global Ink Additives Market 2

Market Size in USD Billion

CAGR :

%

USD

3.12 Billion

USD

3.65 Billion

2024

2032

USD

3.12 Billion

USD

3.65 Billion

2024

2032

| 2025 –2032 | |

| USD 3.12 Billion | |

| USD 3.65 Billion | |

|

|

|

|

Ink Additives Market Size

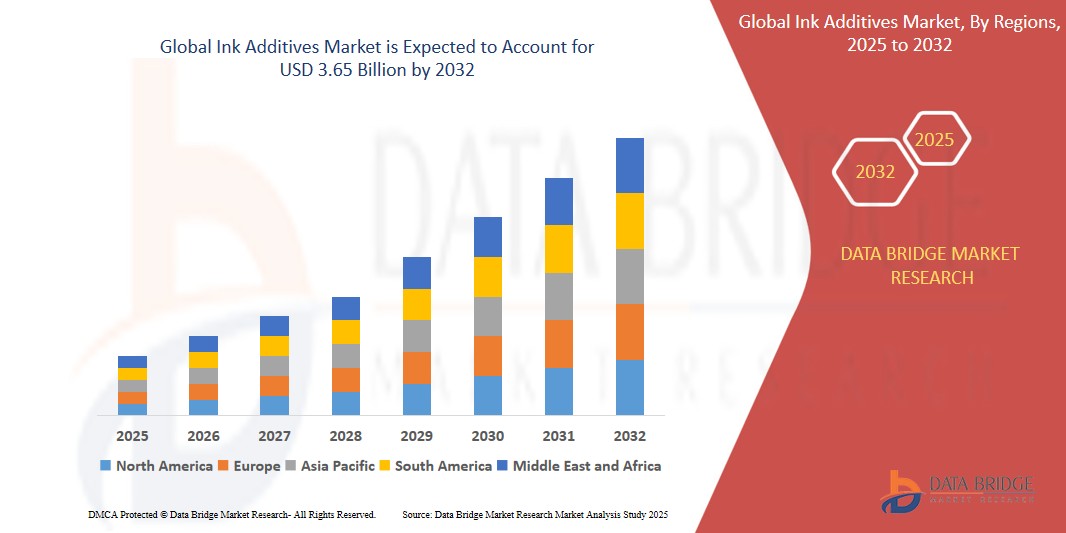

- The global Ink Additives market was valued at USD 3.12 billion in 2024 and is expected to reach USD 3.65 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 5.50%, primarily driven by the factor such as growing demand for environmentally friendly and sustainable products.

- This growth is driven by factors such as the stricter government regulations regarding the use of solvents, VOC emissions, and toxic chemicals in printing processes which are pushing the ink manufacturers to develop safer, more eco-friendly ink additives.

Ink Additives Market Analysis

- The global ink additives market is expanding steadily, driven by increasing demand from industries such as packaging, commercial printing, and publishing. As print quality, substrate compatibility, and drying speed become critical factors, manufacturers are turning to functional additives to enhance ink performance and production efficiency.

- Growing environmental concerns and regulatory pressure are pushing the development of low-VOC, bio-based, and sustainable ink additives. These innovations aim to reduce ecological impact while maintaining high-quality printing standards across water-based, solvent-based, and UV-curable ink systems.

- Rapid growth in digital printing and inkjet technologies is reshaping ink formulation strategies, with a rising focus on additives that offer improved flowability, pigment dispersion, and adhesion to diverse surfaces including plastics, paper, and metals.

- For instance, in March 2025, Evonik Industries launched TEGO® Foamex 8420, a high-performance defoamer designed for waterborne overprint varnishes and inks. This siloxane-based defoamer addresses challenging foaming issues in ink formulations, offering superior defoaming performance, excellent long-term effectiveness, and broad food contact compliance

Report Scope and Ink Additives Market Segmentation

|

Attributes |

Ink Additives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ink Additives Market Trends

“Innovations in Sugar Substitutes & Functional Ingredients for Blood Sugar Management”

- A major trend in the ink additives market is the growing demand for environmentally friendly and sustainable products. This is being driven by stricter environmental regulations and the increasing preference for green alternatives in the packaging and printing industries.

- Ink manufacturers are investing in bio-based additives that reduce the ecological impact of printing inks while maintaining high-quality performance. These include additives that help reduce volatile organic compound (VOC) emissions, improve biodegradability, and enhance recyclability.

- Innovations like water-based additives and UV-curable systems are gaining traction, offering high-performance alternatives with fewer environmental risks compared to traditional solvent-based ink additives.

Ink Additives Market Dynamics

Driver

“Regulatory Pressure and Environmental Concerns Driving Innovation”

- Stricter government regulations regarding the use of solvents, VOC emissions, and toxic chemicals in printing processes are pushing ink manufacturers to develop safer, more eco-friendly ink additives. As sustainability and health concerns rise, ink companies are innovating with water-based, low-VOC, and non-toxic additives.

- The increasing pressure to adopt eco-friendly solutions in the packaging industry is leading to the development of biodegradable, recyclable, and renewable additive formulations that meet environmental standards without compromising on performance.

- With governments tightening regulations on solvent-based inks due to their harmful effects on the environment and human health, there has been a significant rise in the adoption of water-based and low-VOC (Volatile Organic Compound) inks. These inks help reduce harmful emissions during the printing process, aligning with both environmental and regulatory standards.

For instance,

- Sun Chemical launched a range of sustainable ink additives made from renewable resources, designed to meet both environmental regulations and high performance in printing. These additives aim to reduce the carbon footprint of ink manufacturing.

- In response to regulatory pressures and environmental concerns, the ink additives market is witnessing significant innovation, with manufacturers focusing on creating greener, more sustainable additives that not only meet regulations but also cater to the growing consumer preference for environmentally responsible products. This trend is expected to continue, fostering long-term growth and sustainability in the market.

Opportunity

“Growth in Eco-Friendly Packaging Solutions”

- The increasing demand for sustainable and recyclable packaging is driving the need for eco-friendly ink additives that align with environmental regulations without compromising print quality

- Manufacturers are developing additives compatible with water-based and biodegradable inks, catering to industries like food & beverage and cosmetics, where sustainable packaging is a growing priority.

- This trend supports global sustainability commitments and circular economy initiatives, presenting new markets for ink additive producers focused on green innovation.

For instance,

- Siegwerk has established a new business unit dedicated to functional coatings effective April 1, 2024, aiming to realize sustainable packaging innovations within the circular economy. This initiative underscores the company's commitment to developing eco-friendly solutions that meet the evolving demands of the packaging industry

- As consumers and brands increasingly prioritize environmentally responsible packaging, this shift offers long-term growth potential for ink additive manufacturers committed to sustainable research and development.

Restraint/Challenge

“Volatility in Raw Material Prices Impacting Profit Margins”

- The production of diabetic-friendly food products often involves the use of specialized ingredients such as natural sugar substitutes, high-fiber additives, and low-glycemic formulations, which significantly increase manufacturing costs.

- These premium ingredients, along with strict regulatory requirements for health claims and food safety, make diabetic-friendly products more expensive than conventional alternatives, limiting their affordability for a large segment of consumers.

- Higher production costs also pose a challenge for small and mid-sized food manufacturers, as they struggle to compete with larger players who have more resources for research, development, and bulk ingredient sourcing.

For instance,

- In October 2023, according to a report by Ink World Magazine, while the costs and availability of key ingredients have generally improved during the past year, most prices have not rebounded to pre-pandemic levels. The supply chain has stabilized, although certain pigments like carbon black remain tight.

- The high production costs of raw materials remain a major barrier to market expansion, limiting affordability and accessibility, especially in price-sensitive regions

Ink Additives Market Scope

The market is segmented on the basis product type, technology, magnification type, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Technology |

|

|

By Process |

|

|

By Application |

|

Ink Additives Market Regional Analysis

“Asia Pacific is the Dominant Region in the Ink Additives market”

- Asia-Pacific leads the ink additives market due to rapid industrialization, expansion of the packaging and printing sectors, and increased demand for eco-friendly and sustainable printing solutions across major economies such as China, India, and Japan.

- China dominates the regional market, being a global hub for packaging, textiles, and publishing, where ink additives are essential for print performance and durability.

- Japan is a leader in developing high-performance ink formulations, particularly in the electronics and label printing segments, supported by significant R&D capabilities.

- India is witnessing robust growth due to rising demand for packaged food, e-commerce, and increased government focus on sustainable printing practices.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The region is expected to maintain its high growth momentum driven by regulatory support for low-VOC and bio-based additives, combined with increased awareness among consumers and businesses about sustainable printing.

- The booming e-commerce and flexible packaging industries in Southeast Asia, along with digital printing expansion, are key contributors to future growth.

- Government initiatives such as China’s “dual carbon” goals and India’s environmental packaging mandates are accelerating innovation in ink formulations.

- Rising demand from sectors such as food & beverage, cosmetics, and textile printing is creating lucrative opportunities for ink additive manufacturers.

Ink Additives Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Munzing Chemie GmbH (Germany)

- Lubrizol (U.S.)

- Harima Chemicals Group (Japan)

- ALTANA AG (Germany)

- Shamrock Technologies (U.S.)

- Evonik Industries (Germany)

- BASF (Germany)

- Dow Corning (U.S.)

- Elementis PLC (U.K.)

- Solvay S.A (Belgium)

Latest Developments in Global Ink Additives market

- In June 2024, Cabot Corporation announced it has attained Operation Clean Sweep (OCS) Europe certification at its two masterbatch and compounding facilities in Pepinster and Loncin, Belgium. As one of the first black masterbatch manufacturers in Europe to earn this third-party certification, Cabot underscores its commitment to responsible plastic management practices, aiming to reduce plastic waste in the environment

- In June 2024, Evonik commissioned a new plant for AEROSIL Easy-to-Disperse silicas at its Rheinfelden site. This innovative dispersion technology simplifies and accelerates the incorporation of fumed silica into paint and coating formulations, enhancing the efficiency and sustainability of the manufacturing process. The expansion at Rheinfelden strengthens the global availability of high-quality silica and marks a significant step towards providing eco-friendly solutions for the paint and coatings sector

- In March 2024, Dow was honoured with the 2024 CIO 100 Award for its Integrated Data Hub. This esteemed award, granted by Foundry, recognizes global organizations that exhibit outstanding strategic and operational excellence in IT. This is the third consecutive year that Dow has received this recognition Ink Additives

- In October 2023, ALTANA significantly extended its Cubic Ink 3D printing material family for high-performance resins. This expansion positions ALTANA as a supplier of manufacturer-independent, system-open materials suitable for various 3D printing applications, including inks for material jetting.

- In June 2023, Evonik introduced TEGO R Rad 2550, a slip and defoamer additive designed for radiation-curing inks and coatings. This innovation enhances print quality and durability, addressing the industry's need for high-performance printing solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Ink Additives Market 2, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Ink Additives Market 2 research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Ink Additives Market 2 consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.