Global Leather Luggage And Goods Market

Market Size in USD Billion

CAGR :

%

USD

310.10 Billion

USD

824.37 Billion

2024

2032

USD

310.10 Billion

USD

824.37 Billion

2024

2032

| 2025 –2032 | |

| USD 310.10 Billion | |

| USD 824.37 Billion | |

|

|

|

|

Leather Luggage and Goods Market Size

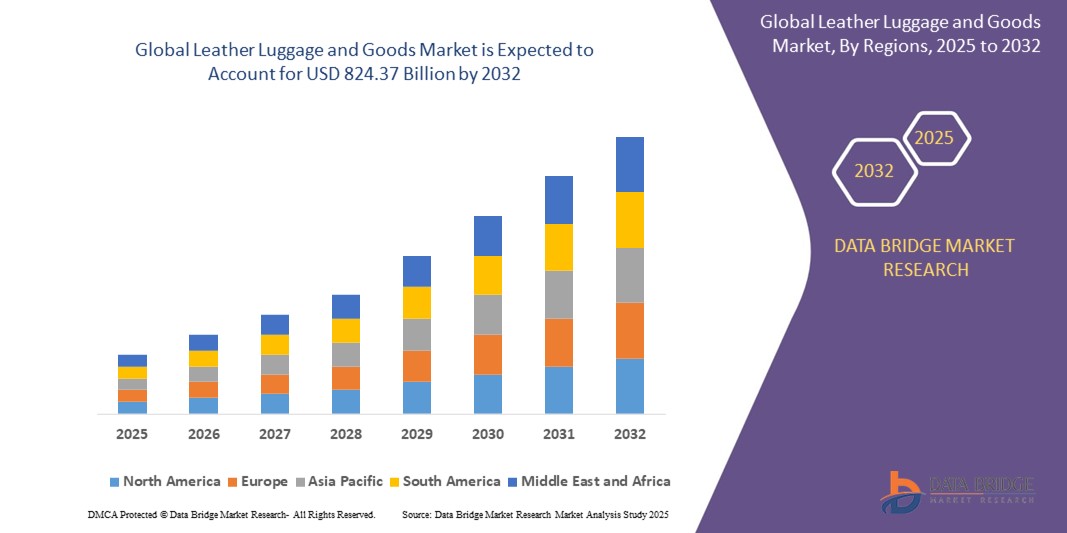

- The global leather luggage market size was valued at USD 310.10 billion in 2024 and is expected to reach USD 824.37 billion by 2032, at a CAGR of 13% during the forecast period

- This growth is driven by factors such as the increasing demand for luxury and durable accessories, advancements in leather processing techniques, and the rising popularity of sustainable and eco-friendly products

Leather Luggage and Goods Market Analysis

- Leather luggage and goods play a vital role in the global fashion and travel industry, offering premium quality, durability, and aesthetic appeal. These products include handbags, wallets, backpacks, and travel bags, widely used for both functional and lifestyle purposes

- The demand for leather goods is primarily driven by rising disposable incomes, changing fashion preferences, and the growing popularity of luxury and branded accessories, particularly in emerging economies

- Asia-Pacific is expected to dominate the leather luggage and goods market with a largest market share of 36.1% due to countries such as China and India. The region's growth is supported by the increasing demand for premium and luxury products, with Bangladesh and Pakistan serving as important sources of primary leather

- North America is expected to be the fastest growing region in the Leather Luggage and Goods market during the forecast period due to region's demand for leather goods is fueled by a strong consumer base, high purchasing power, and the presence of major luxury brands

- Footwear segment is expected to dominate the market with a largest market share of 39.4% due to increasing consumer demand for leather athletic footwear from brands Nike, Adidas, and Puma

Report Scope and Leather Luggage and Goods Market Segmentation

|

Attributes |

Leather Luggage and Goods Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Leather Luggage and Goods Market Trends

“Shift Towards Sustainable and Eco-Friendly Leather Goods”

- One prominent trend in the global leather luggage and goods market is the increasing demand for sustainable and eco-friendly products

- Consumers are becoming more conscious about the environmental impact of leather production, which is driving companies to innovate and offer products made from ethically sourced, recycled, or alternative materials like plant-based leather

- For instance, several brands are now using vegetable-tanned leather, which has a lower environmental footprint compared to traditional tanning processes, and offering products made from synthetic, eco-friendly leather alternatives

- This trend is not only improving the environmental impact of the leather goods industry but is also opening up new market opportunities, as more consumers seek products that align with their values of sustainability and ethical production

Leather Luggage and Goods Market Dynamics

Driver

“Rising Consumer Preference for Luxury and Premium Leather Goods”

- The growing demand for high-quality, luxury leather luggage and goods is significantly driving market growth. Consumers are increasingly seeking premium, durable, and stylish products, fueling the demand for top-tier leather items

- As disposable incomes rise, particularly in emerging markets, more consumers are willing to invest in luxury leather products, including luggage, handbags, wallets, and accessories, further boosting market expansion

- The shift towards personal luxury and high-end, crafted goods also reflects a broader trend towards quality and exclusivity in fashion and lifestyle products

- As a result, the growing demand for luxury and high-end leather goods is driving market growth, particularly in regions such as North America, Europe, and parts of Asia

Opportunity

“Growth of E-Commerce and Direct-to-Consumer Sales Channels”

- The rapid expansion of e-commerce platforms is creating significant growth opportunities for the global leather luggage and goods market. Online retail has become a key channel for consumers to purchase leather products, offering convenience and a wider selection of goods

- Direct-to-consumer (DTC) models are gaining traction, allowing brands to establish a direct relationship with consumers, offering personalized shopping experiences, and reducing reliance on traditional retail channels

- The increasing use of social media and digital marketing to showcase leather goods, coupled with the ability to cater to a global audience, is further driving online sales

For instance,

- In 2024, a report from eMarketer highlighted that global e-commerce sales are expected to reach new heights, with luxury goods, including leather luggage and accessories, being one of the fastest-growing categories online

- As a result, the growth of e-commerce and direct-to-consumer models presents a significant opportunity for leather goods brands to expand their market reach and enhance consumer engagement, driving overall market growth

Restraint/Challenge

“High Production Costs and Material Sourcing Challenges”

- The high production costs of leather luggage and goods, driven by the premium materials required and labor-intensive manufacturing processes, pose a significant challenge for the market

- Quality leather, which is essential for durable and aesthetically pleasing products, comes at a high cost. Additionally, sourcing sustainable, ethically produced leather further raises production expenses

- These high costs can hinder the ability of manufacturers to offer competitively priced products, limiting market access, especially in price-sensitive regions

For instance,

- In a 2024 report by Leather International, rising raw material costs due to limited supply and ethical sourcing standards are putting pressure on the margins of leather goods manufacturers, affecting their ability to scale and compete in global markets

- As a result, these challenges can lead to increased product prices, limiting the accessibility of leather luggage and goods to broader consumer segments, which in turn impacts overall market growth

Leather Luggage and Goods Market Scope

The market is segmented on the basis of type, distribution channel, product, and product outlook

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Distribution Channel |

|

|

By Product |

|

|

By Product Outlook |

|

In 2025, the footwear is projected to dominate the market with a largest share in product segment

The footwear segment is expected to dominate the leather luggage and goods market with the largest share of 39.4% in 2025 due to increasing consumer demand for leather athletic footwear from brands like Nike, Adidas, and Puma

The synthetic leather is expected to account for the largest share during the forecast period in product outlook segment

In 2025, the synthetic leather segment is expected to dominate the market with the largest market share of 53.6% due to reasons like synthetic leather goods are less expensive than genuine leather products and are equally attractive in terms of design, which is driving their demand among consumers. Synthetic leather is primarily derived from artificial sources, such as Polyurethane (PU) and Polyvinyl Chloride (PVC). PU leather is considered to be more eco-friendly as compared to its vinyl-based counterpart, as it does not emit dioxins

Leather Luggage and Goods Market Regional Analysis

“Asia Pacific Holds the Largest Share in the Leather Luggage and Goods Market”

- Asia-Pacific dominates the global leather luggage and goods market, with a largest market share of 36.1%, driven by the region’s large population, growing middle-class consumer base, and rising disposable incomes

- Countries such as China and India have witnessed a surge in consumer spending on lifestyle and travel accessories, contributing significantly to regional market growth

- The expansion of the retail and e-commerce sectors in the region has made luxury and premium leather goods more accessible to consumers, further fueling demand. In addition, the region benefits from a strong manufacturing base, particularly in countries like China, Vietnam, and Indonesia, which are key global suppliers of leather products

- Furthermore, the increasing influence of Western fashion trends, coupled with an evolving fashion consciousness among urban consumers, is supporting the market’s expansion across major Asia-Pacific economies

“North America is Projected to Register the Highest CAGR in the Leather Luggage and Goods Market”

- North America is expected to witness the highest compound annual growth rate in the leather luggage and goods market during the forecast period, propelled by increasing consumer preference for high-end lifestyle products and luxury fashion accessories

- The U.S., in particular, is a significant contributor to the regional market, supported by strong purchasing power, a robust fashion industry, and the presence of major luxury brands and premium retail outlets

- The growth of travel and tourism in the region is also driving the demand for stylish and durable leather luggage. Additionally, increased awareness about sustainable and ethically sourced leather products is leading to the emergence of innovative eco-friendly leather goods, opening up new growth opportunities

- The expansion of digital commerce platforms and the rising trend of customization and personalization in leather goods are further supporting the growth trajectory of the North American leather luggage and goods market

Leather Luggage and Goods Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Louis Vuitton (France)

- Gucci (Italy)

- Prada (Italy)

- Hermès (France)

- Rimowa (Germany)

- Tumi (U.S.)

- Samsonite (U.S.)

- Globe-Trotter (U.K.)

- Goyard (France)

- Bric’s (Italy)

- Montblanc (Germany)

- Coach (U.S.)

- Fendi (Italy)

- Mulberry (U.K.)

- Longchamp (France)

- Delvaux (Belgium)

- Barrow Hepburn & Gale (U.K.)

- Antler (U.K.)

- Horizn Studios (Germany)

- Paravel (U.S.)

Latest Developments in Global Leather Luggage and Goods Market

- In January 2021, as part of its broader sustainability initiative, Adidas AG announced the launch of a new line of trainers crafted from mushroom-based leather, also known as mycelium. This innovative material is part of the company’s commitment to reducing its environmental footprint and promoting the use of eco-friendly alternatives to traditional leather

- In August 2020, PUMA SE unveiled the first three models of its Xetic sneaker line in collaboration with Porsche Design, combining innovation, sustainability, and performance. The collection features materials such as 100% chrome-free leather, 30% algae-based lining, and 100% recycled mesh fabric, demonstrating the brand's commitment to sustainable manufacturing while maintaining high-performance standards suitable for both athletic and casual wear

- In October 2022, LVMH strengthened its foothold in Italy by inaugurating new production facilities for Fendi and Bulgari. Despite rising operational costs, LVMH continues to make substantial investments in enhancing its Italian production capabilities, underscoring the brand's commitment to maintaining high-quality craftsmanship and operational excellence.

- In October 2022, Prada, the renowned luxury fashion brand, inaugurated a new factory near Sibiu, Romania, dedicated to the production of leather goods components. The facility, operated by Hipic Prod Impex, now part of the Prada group, spans 31,000 square feet in the Sibiu West Industrial Zone. This expansion highlights Prada's strategic investment in enhancing its production capabilities for leather products, reinforcing its commitment to craftsmanship and quality in the global luxury goods market

- In April 2022: Tapestry, Inc., the New York-based luxury accessories and lifestyle brand house behind Coach, Kate Spade, and Stuart Weitzman, announced a partnership with the World Wildlife Fund (WWF) in conjunction with a USD 3 million philanthropic grant from the Tapestry Foundation, which focuses on promoting social and environmental justice. This partnership underscores Tapestry, Inc.'s commitment to sustainability and ethical sourcing in the global leather goods market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.