Global Mammography Devices Market

Market Size in USD Billion

CAGR :

%

USD

2.58 Billion

USD

6.35 Billion

2024

2032

USD

2.58 Billion

USD

6.35 Billion

2024

2032

| 2025 –2032 | |

| USD 2.58 Billion | |

| USD 6.35 Billion | |

|

|

|

|

Mammography Devices Market Size

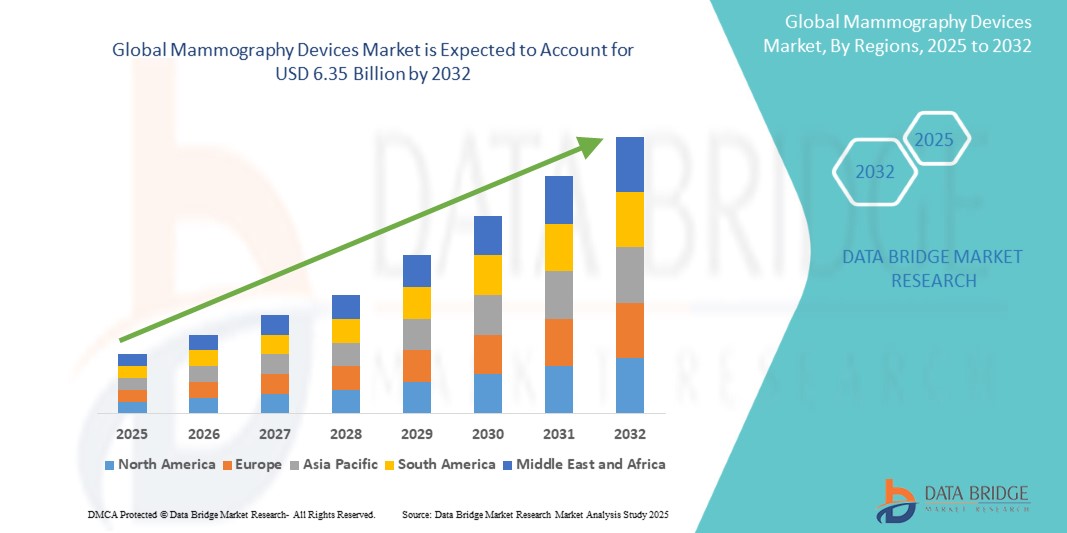

- The global mammography devices market size was valued at USD 2.58 billion in 2024 and is expected to reach USD 6.35 billion by 2032, at a CAGR of 11.90% during the forecast period

- This growth is driven by increasing incidence of breast cancer

Mammography Devices Market Analysis

- Mammography Devices are critical medical tools used for early detection of breast cancer, employing specialized X-ray technology to capture detailed images of breast tissue. These devices aid in diagnosing breast abnormalities, offering crucial insights for healthcare providers and improving patient outcomes

- The demand for mammography devices is primarily driven by the increasing global incidence of breast cancer, rising awareness about early detection, and advancements in imaging technologies that improve accuracy, comfort, and patient safety

- North America is expected to dominate the mammography devices market with a largest market share of 37.76%, owing to its well-established healthcare infrastructure, high adoption rate of advanced diagnostic technologies, and presence of leading market players in the region

- Asia-Pacific is projected to be the fastest-growing region in the mammography devices market during the forecast period, owing to rapidly improving healthcare infrastructure, growing awareness about breast cancer screening, and the increasing penetration of digital mammography systems in emerging economies

- The full field systems segment is expected to lead the market with a largest market share of 68.56%, due to due to government-led breast cancer screening initiatives and favorable reimbursement frameworks

Report Scope and Mammography Devices Market Segmentation

|

Attributes |

Mammography Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Mammography Devices Market Trends

“Increase in Demand for Digital Mammography Systems”

- A prominent trend in the mammography devices market is the rising demand for digital mammography systems, which offer improved image clarity, faster results, and lower radiation exposure compared to traditional film-based systems

- These systems allow for easier image storage, retrieval, and sharing, and are increasingly being integrated with advanced computer-aided detection (CAD) software to help radiologists identify potential abnormalities with greater accuracy

- For instance, digital systems enable immediate access to images for better diagnosis and treatment planning, thus improving the overall efficiency of healthcare providers

- The shift towards digital mammography is transforming breast cancer screening, increasing early detection rates, and improving patient outcomes, which is driving the growth of next-generation diagnostic tools in the market

Mammography Devices Market Dynamics

Driver

“Increasing Adoption of Screening Programs”

- One of the key drivers in the mammography devices market is the growing adoption of nationwide and regional breast cancer screening programs, which are expanding the need for mammography devices

- Governments and healthcare organizations are increasingly recommending regular mammography screenings, particularly for women over the age of 40, which is fueling the demand for advanced mammography technologies

- These programs are focused on early detection, which significantly improves survival rates and reduces the treatment costs for breast cancer

- For instance, the U.S. Preventive Services Task Force (USPSTF) recommends biennial mammograms for women aged 50 to 74, which has led to a substantial rise in demand for mammography services across the country

- The growing focus on early detection in breast cancer is contributing to the widespread adoption of mammography devices and driving their market growth globally

Opportunity

“Technological Advancements in 3D Mammography”

- A major opportunity in the mammography devices market lies in the continued development of 3D mammography, also known as tomosynthesis, which offers enhanced image quality and can better detect dense breast tissue compared to conventional 2D mammography

- 3D mammography allows for clearer and more accurate views of breast tissue, which reduces the likelihood of false positives and unnecessary biopsies, thus improving patient outcomes

- For instance, in 2024, Hologic launched its 3D mammography technology, MAMMOMAT Inspiration, combined with advanced software to enhance the detection of breast cancer in women with dense breasts

- The increasing adoption of 3D mammography is poised to create new growth avenues for the market, offering improved diagnostic accuracy and patient satisfaction

Restraint/Challenge

“High Costs of Advanced Mammography Devices”

- The high cost associated with advanced mammography devices, especially digital and 3D systems, is a significant challenge for their widespread adoption, particularly in developing regions with limited healthcare budgets

- While these devices offer superior imaging and faster results, their high purchase and maintenance costs create financial barriers for healthcare providers and patients, limiting their accessibility

- For instance, a report from the World Health Organization (WHO) highlighted that the cost of digital mammography systems is a key financial challenge for many low-resource countries

- The affordability issue restricts the adoption of the latest mammography technologies, particularly in low- and middle-income regions, hindering the overall growth of the market and creating disparities in access to breast cancer screening services

Mammography Devices Market Scope

The market is segmented on the basis of device type and end user.

|

Segmentation |

Sub-Segmentation |

|

By Device Type |

|

|

By End User |

|

In 2025, the full field systems is projected to dominate the market with a largest share in device type segment

The full field systems segment is expected to dominate the mammography devices market with the largest market share of 68.56% in 2025 due to government-led breast cancer screening initiatives and favorable reimbursement frameworks.

The hospitals is expected to account for the largest share during the forecast period in end user segment

In 2025, the hospitals segment is expected to dominate the market with the largest market share of 48.22% due to availability of mammography facilities within hospitals positively influences several key aspects, including reduced hospital stay durations, lower overall healthcare costs, improved quality of care, and enhanced access to emergency medical services.

Mammography Devices Market Regional Analysis

“North America Holds the Largest Share in the Mammography Devices Market”

- North America dominates the mammography devices market with a largest market share of 37.76%, driven by the presence of key manufacturers, advanced healthcare infrastructure, high awareness of breast cancer screening, and favorable reimbursement policies for mammography procedures

- The U.S. holds the largest share within the region due to the widespread adoption of digital breast tomosynthesis (DBT), strong screening programs supported by government initiatives, and continuous technological innovations in imaging systems

- Ongoing investments in early breast cancer detection technologies, coupled with rising awareness and supportive public health campaigns, are expected to further strengthen North America's position in the global market

“Asia-Pacific is Projected to Register the Highest CAGR in the Mammography Devices Market”

- Asia-Pacific is expected to witness the highest growth rate in the mammography devices market, driven by rapidly improving healthcare infrastructure, growing awareness about breast cancer screening, and the increasing penetration of digital mammography systems in emerging economies

- Countries such as China, India, and Japan are key contributors to regional growth, supported by government-led screening programs, growing healthcare expenditure, and rising demand for early cancer detection technologies

- Japan, recognized for its technological advancements and strong R&D culture, is embracing innovative mammography solutions, while public initiatives are driving widespread adoption across hospitals and diagnostic centers

- China and India, with their large population bases and expanding middle class, are seeing growing installations of mammography units, supported by national health missions, improved access to diagnostic services, and public-private partnerships in healthcare delivery

Mammography Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- FUJIFILM Corporation (Japan)

- Hologic, Inc. (U.S.)

- Siemens (Germany)

- PLANMED OY (Finland)

- Metaltronica S.p.A. (Italy)

- Aurora Health Care (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Analogic Corporation (U.S.)

- Carestream Health (U.S.)

- General Electric Company (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- CMR Naviscan (U.S.)

- Delphinus Medical Technologies, Inc. (U.S.)

- KUBTEC (U.S.)

- Micrima Limited (U.K.)

- SonoCiné (U.S.)

- Supersonic Imagine (France)

Latest Developments in Global Mammography Devices Market

- In October 2024, Family Medical Practice introduced 3D mammography technology (MAMMOMAT Inspiration) integrated with Transpara AI, an advanced tool that assists radiologists in enhancing the early detection and screening of breast cancer. This technological integration aims to significantly improve diagnostic accuracy and efficiency in breast cancer care

- In July 2024, LG Electronics (LG) announced its strategic push into the B2B medical device sector with the expansion of its diagnostic monitor lineup. The newly introduced 21HQ613D-B, a 21.3-inch 5-megapixel IPS display approved by the U.S. FDA, is designed for digital mammography and breast tomosynthesis, offering exceptional image clarity and consistent quality through integrated front calibration sensors. This move marks LG’s deeper commitment to medical imaging innovation

- In June 2024, FUJIFILM India Healthcare Division, in partnership with NM Medical Mumbai, launched its first skill lab dedicated to training radiologists and radiographers in full-field digital mammography (FFDM) technologies. The inaugural session included eight professionals, aiming to advance diagnostic proficiency. This initiative strengthens the talent pipeline for breast imaging expertise in India

- In June 2023, Siemens Healthineers expanded its medical device manufacturing presence in India by launching a new Computed Tomography (CT) Scanner production line at its Bengaluru facility. This expansion is part of a broader strategy to accelerate India’s role in the global medtech ecosystem. The move underscores Siemens' commitment to local manufacturing and healthcare innovation

- In May 2023, GE HealthCare unveiled three global innovations—Intelligent Radiation Therapy (IRT), Auto Segmentation, and an upgraded Magnetic Resonance Radiation Therapy Suite (AIR Open Coil Suite)—at a global event. These technologies highlight the company’s ongoing efforts to revolutionize the radiation oncology treatment landscape

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.