Global Marketing Attribution Software Market

Market Size in USD Billion

CAGR :

%

USD

4.06 Billion

USD

12.38 Billion

2024

2032

USD

4.06 Billion

USD

12.38 Billion

2024

2032

| 2025 –2032 | |

| USD 4.06 Billion | |

| USD 12.38 Billion | |

|

|

|

|

Marketing Attribution Software Market Size

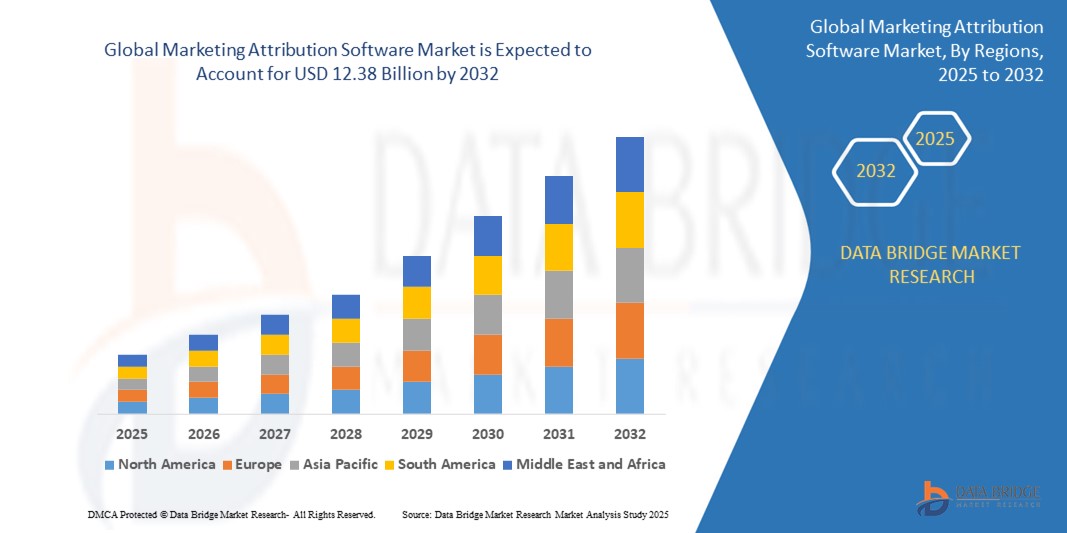

- The Global Marketing Attribution Software Market size was valued at USD 4.06 billion in 2024 and is expected to reach USD 12.38 billion by 2032, at a CAGR of 17.3% during the forecast period

- This growth is driven by factors such as the growing attention of enterprises on expanding their marketing expenditure

Marketing Attribution Software Market Analysis

- Marketing attribution software plays a vital role in modern digital marketing by enabling businesses to track, analyze, and optimize the performance of various marketing channels across the customer journey. These platforms help marketers allocate budgets more efficiently, understand consumer behavior, and improve campaign ROI through multi-touch and data-driven attribution models.

- Market growth is driven by the increasing complexity of customer journeys across digital platforms, the surge in omnichannel marketing, and rising demand for data-driven decision making. Additionally, the growing use of AI and machine learning in attribution modeling is enabling deeper insights into campaign performance.

- North America is expected to dominate the global Marketing Attribution Software Market, supported by the presence of major technology firms, high digital ad spending, and early adoption of advanced martech solutions by enterprises. Strong demand for real-time analytics and ROI-based marketing strategies is further accelerating market growth in the U.S. and Canada.

- The Asia-Pacific region is anticipated to witness the fastest growth, fueled by rapid digitization, increasing internet penetration, and the rise of e-commerce platforms. Countries like India, China, and Southeast Asian nations are experiencing a surge in demand for tools that can optimize marketing performance in a highly competitive digital space.

- The multi-source attribution segment holds the largest market share, accounting for approximately 58.20%, owing to its ability to provide a holistic view of customer interactions across various touchpoints. Organizations are shifting from traditional single-touch models to multi-touch approaches to better assess campaign contributions and optimize budget allocation.

Report Scope and Marketing Attribution Software Market Segmentation

|

Attributes |

Marketing Attribution Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Marketing Attribution Software Market Trends

“AI-Powered Predictive Attribution Models Reshaping Marketing Insights”

- A key trend transforming the global marketing attribution software market is the increasing integration of AI and machine learning to power predictive attribution models. These models enhance the precision of marketing performance analysis by forecasting customer behaviors and crediting touchpoints more accurately across complex omnichannel journeys.

- AI algorithms help marketers identify not just past conversion paths but also optimize future campaigns by learning from historical and real-time data patterns.

For Instance,

- In April 2025, Adobe introduced an upgraded version of its Attribution AI platform under Adobe Experience Cloud, which leverages deep learning to improve accuracy in multi-source attribution. The tool analyzes billions of customer touchpoints across campaigns and predicts optimal marketing investment splits across channels like search, email, and display. This shift is enabling smarter budget allocation and faster campaign adjustments.

- AI-driven attribution is becoming a cornerstone of performance marketing, enabling real-time decision making and enhancing ROI tracking across industries.

Marketing Attribution Software Market Dynamics

Driver

“Rising Demand for ROI-Driven Marketing and Customer Journey Optimization”

- The growing need to quantify marketing effectiveness and optimize customer acquisition costs is a major driver of the market.

- Companies are increasingly focused on understanding the impact of each digital channel email, social, search, and display on customer journeys to optimize conversion funnels and ad spending.

- This demand is particularly high in sectors such as e-commerce, retail, BFSI, and SaaS, where customer acquisition costs are significant, and performance tracking is crucial.

For instance,

- In February 2025, Unilever adopted a customized attribution platform to improve performance visibility across its global digital campaigns. The system provided data-driven insights that led to a 17% increase in conversion efficiency and a 12% drop in cost per acquisition. This reflects the increasing enterprise-level demand for actionable attribution data.

- As competition and digital ad spending rise, marketing attribution platforms are becoming indispensable for optimizing performance and justifying ROI.

Opportunity

“Expansion of Cloud-Based Attribution Solutions Among SMEs”

- The growing availability of scalable, cloud-based attribution tools is opening significant opportunities, especially among small and medium enterprises (SMEs) that previously lacked access to enterprise-grade analytics.

- These solutions offer easy integration with CRM, ad platforms, and marketing automation tools, reducing the cost and complexity barriers for smaller players.

- Moreover, pay-as-you-go pricing models and API-based integrations make it easier for SMEs to implement advanced attribution without large IT teams.

For Instance,

- In March 2025, Funnel.io, a marketing data hub company, launched a cloud-native multi-touch attribution module designed for small businesses. The product enables plug-and-play integration with platforms like Google Ads, Facebook, and HubSpot, allowing SMEs to access insights at a fraction of enterprise-level costs. This innovation is broadening the market base for attribution software.

- As digital adoption among SMEs accelerates globally, vendors offering flexible, cloud-native attribution models are poised for strong growth.

Restraint/Challenge

“Data Privacy Regulations and Cross-Platform Tracking Limitations”

- A major challenge facing the marketing attribution software market is navigating tightening data privacy regulations and restrictions on third-party cookie tracking across regions.

- Legislation such as GDPR in Europe, CCPA in California, and India's DPDP Act impose strict requirements on data consent, storage, and usage, directly affecting the ability of software tools to track user journeys comprehensively.

For instance,

- In January 2025, a European digital agency faced legal compliance issues when deploying a U.S. based attribution tool that relied on cross-platform cookies. The solution was temporarily suspended due to non-compliance with local consent policies under GDPR, delaying campaign measurement for over a month. These regulatory barriers create significant hurdles for global deployment.

- Additionally, the phasing out of third-party cookies by browsers like Chrome and Safari has reduced visibility across user touchpoints, prompting a shift toward first-party data reliance and server-side tracking, which requires more technical integration and strategy.

- These compliance and technical challenges increase implementation complexity and hinder the ability to deliver a seamless omnichannel attribution experience.

Marketing Attribution Software Market Scope

The market is segmented on the basis of Component, Attribution Type, Organization Size, Deployment Type, Vertical

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Attribution Type

|

|

|

By Organization Size

|

|

|

By Deployment Type

|

|

|

By Vertical |

|

In 2025, Multi-Source is projected to dominate the market with a largest share in Attribution Type segment

The multi-source segment is expected to dominate the global marketing attribution software market with 58.20%, in 2025, due to its ability to allocate credit across multiple customer touchpoints instead of a single source. This method provides marketers with a more holistic understanding of how various channels contribute to conversions. With the rise of omnichannel marketing, businesses are embracing multi-touch attribution models to make smarter budgeting decisions and improve campaign effectiveness.

The solution is expected to account for the largest share during the forecast period in component segment

In 2025, the solution segment is expected to dominate the market with the largest market share of 54.52%. As enterprises prioritize data-driven marketing strategies, the demand for robust attribution platforms that offer real-time analytics, performance tracking, and campaign optimization has surged. Organizations are increasingly adopting end-to-end attribution solutions to gain granular insights into customer journeys and optimize marketing ROI across multiple touchpoints.

Marketing Attribution Software Market Regional Analysis

“North America Holds the Largest Share in the Marketing Attribution Software Market”

- North America dominates the global marketing attribution software market, supported by the region’s advanced digital marketing ecosystem, high adoption of martech solutions, and presence of major technology providers. Enterprises in the United States and Canada are increasingly prioritizing data-driven marketing strategies, which is fueling widespread adoption of attribution platforms for campaign optimization and ROI measurement.

- The US is the leading country in the region, driven by significant investments in performance marketing, omnichannel strategies, and customer analytics across sectors such as retail, BFSI, and media.

- Major companies like Adobe, Google, and Oracle, headquartered in North America, are continually innovating attribution models, accelerating regional market maturity.

“Asia-Pacific is Projected to Register the Highest CAGR in the Marketing Attribution Software Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the global marketing attribution software market, driven by rapid digital transformation, increasing internet penetration, and a growing e-commerce landscape in countries like China, India, Japan, and Southeast Asian nations.

- In particular, China and India are witnessing exponential growth in online retail, mobile advertising, and digital media consumption. This has led to a surge in demand for marketing attribution platforms that can provide deeper insights into consumer behavior and help optimize multi-channel campaigns in real time.

- The increasing presence of global and regional martech vendors, along with growing awareness of customer journey analytics, is further accelerating adoption. As marketing complexity increases across fast-growing APAC economies, businesses are seeking attribution tools to navigate data silos and make informed strategic decisions.

Marketing Attribution Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SAP (Germany)

- Visual IQ (U.S.)

- Oracle (U.S.)

- Rockerbox (U.S.)

- Neustar (U.S.)

- CaliberMind (U.S.)

- Engagio (U.S.)

- LeadsRx (U.S.)

- LeanData (U.S.)

- Singular (U.S.)

- Adobe (U.S.)

- Google (U.S.)

- Marketing Attribution (U.S.)

- Attribution (U.S.

- WIZALY (France)

- OptiMine (U.S.)

- Merkle (U.S.)

- Fospha (UK)

- IRI (U.S.)

- Analytic Partners (U.S.)

Latest Developments in Global Marketing Attribution Software Market

- In April 2025, Adobe unveiled its new AI agents, Agent Orchestrator and Brand Concierge, at the Adobe Summit. These agents are designed to optimize websites, manage content, refine target audiences, and deliver personalized customer experiences. By integrating these AI solutions into its marketing platform, Adobe aims to enhance customer engagement and streamline daily marketing functions through autonomous and collaborative AI agents.

- In January 2025, Mediaocean, a firm specializing in advertising software and services, announced its acquisition of ad tech company Innovid for USD 500 million. Innovid focuses on connected television (CTV) and went public in 2021. This acquisition is expected to enhance Mediaocean's capacity to offer brands more control over their data and advertising expenditure, particularly in the CTV space. The merger also aims to bolster Mediaocean's position in the ad verification sector, competing with firms like Integral Ad Science and DoubleVerify.

- In March 2025, French advertising company Publicis announced its acquisition of data and ID technology group Lotame. This acquisition is set to double Publicis' individual consumer profiles to 4 billion, allowing the company to engage with 91% of all internet-using adults. By integrating Lotame into its targeted marketing arm, Epsilon, Publicis aims to enhance its data-driven marketing capabilities and solidify its position as the largest advertising firm globally.

- In January 2025, HockeyStack successfully raised USD 20 million in a Series A funding round to enhance its marketing analytics and attribution platform. The funding addresses the growing need among marketers for robust tools to analyze vast volumes of customer data. HockeyStack specializes in tracking customer behavior, including ad impressions, conversions, spending, and churn. The company also plans to introduce an AI agent named Odin to automate account research processes.

- In February 2025, AppsFlyer announced a strategic partnership with Adobe to enhance cross-channel marketing attribution capabilities. The collaboration focuses on integrating AppsFlyer's mobile attribution data with Adobe Experience Cloud’s customer journey analytics. This joint effort enables marketers to gain a unified view of customer interactions across mobile apps, web, and offline channels. The integration aims to improve campaign optimization and customer experience through more accurate, real-time attribution insights.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.