Global Medical Equipment Maintenance Market

Market Size in USD Billion

CAGR :

%

USD

28.31 Billion

USD

58.09 Billion

2024

2032

USD

28.31 Billion

USD

58.09 Billion

2024

2032

| 2025 –2032 | |

| USD 28.31 Billion | |

| USD 58.09 Billion | |

|

|

|

|

Medical Equipment Maintenance Market Size

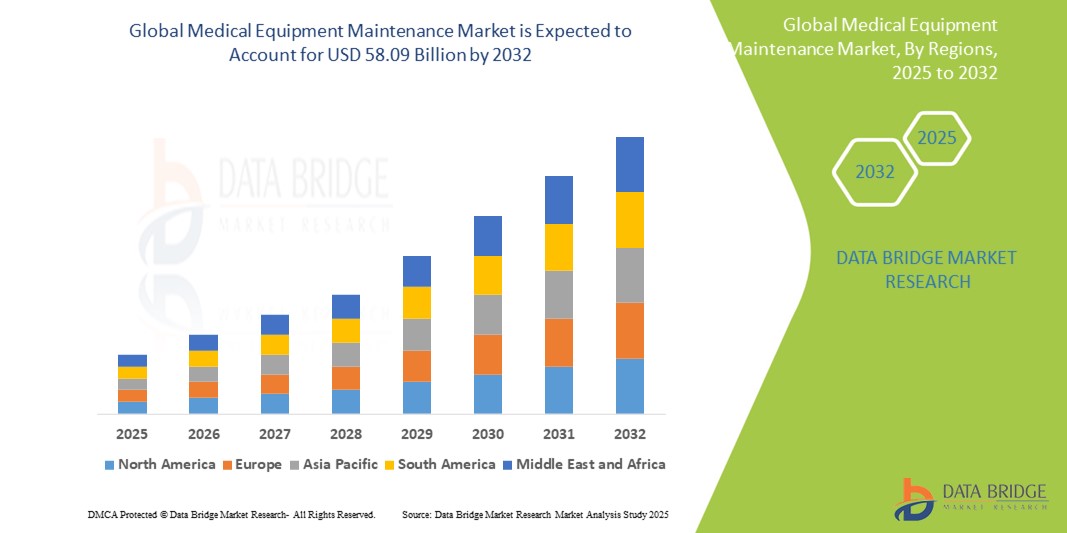

- The global Medical Equipment Maintenance market was valued at USD 28.31 billion in 2024 and is expected to reach USD 58.09 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.40%, primarily driven by the increasing demand for advanced medical devices and the rising focus on preventive maintenance to ensure equipment efficiency and patient safety

- This growth is driven by factors such as the rising prevalence of chronic diseases, expanding healthcare infrastructure, and the growing adoption of multi-vendor maintenance services to reduce downtime and operational costs

Medical Equipment Maintenance Market Analysis

- Medical equipment maintenance is essential for ensuring the functionality, safety, and longevity of healthcare devices, encompassing preventive, corrective, and operational maintenance across a wide range of medical technologies. It is crucial for minimizing equipment downtime and enhancing patient care quality

- The demand for medical equipment maintenance is significantly driven by the increasing complexity of medical devices, stringent regulatory compliance, and the rising need for cost-effective healthcare operations. Hospitals and clinics are prioritizing scheduled maintenance to reduce unexpected failures and improve operational efficiency

- The North America region stands out as one of the dominant regions for the medical equipment maintenance market, supported by a well-established healthcare system, high volume of medical equipment, and early adoption of advanced service models, including multi-vendor maintenance and digital health solutions

- For instance, the U.S. healthcare facilities are increasingly outsourcing maintenance services to specialized providers, helping reduce costs and enhance equipment uptime across large health systems and outpatient centers

- Globally, medical equipment maintenance services are regarded as one of the most critical components of healthcare infrastructure management, ensuring uninterrupted medical service delivery and supporting the effective use of high-value diagnostic and therapeutic devices

Report Scope and Medical Equipment Maintenance Market Segmentation

|

Attributes |

Medical Equipment Maintenance Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Medical Equipment Maintenance Market Trends

“Integration of Predictive Maintenance and IoT Technologies”

- One prominent trend in the global medical equipment maintenance market is the increasing integration of predictive maintenance solutions powered by IoT and data analytics

- These technologies enable real-time monitoring of medical devices, allowing healthcare providers to anticipate potential failures before they occur and schedule maintenance proactively

- For instance, IoT-enabled sensors embedded in imaging and diagnostic equipment can detect performance anomalies and trigger alerts for early intervention, reducing unplanned downtime and maintenance costs

- Predictive maintenance not only extends equipment lifespan but also enhances patient safety by ensuring consistent device performance and compliance with regulatory standards

- This trend is transforming maintenance strategies from reactive to proactive, driving operational efficiency, lowering costs, and fueling demand for smart, tech-driven maintenance services across healthcare facilities

Medical Equipment Maintenance Market Dynamics

Driver

“Rising Demand Due to Increasing Healthcare Equipment Utilization”

- The growing utilization of complex and high-value medical equipment across healthcare facilities is significantly driving the demand for reliable and timely maintenance services

- With the expansion of healthcare infrastructure and increased patient volumes, medical devices—from diagnostic imaging systems to surgical tools—are being used more intensively, requiring frequent upkeep to ensure performance and compliance

- Equipment failure or downtime in critical care environments can lead to delayed diagnoses, compromised patient safety, and financial losses, emphasizing the need for preventive and corrective maintenance services

- The emphasis on quality care, along with regulatory pressures to maintain equipment standards, is pushing healthcare providers to invest in comprehensive maintenance strategies and service contracts

For instance,

- In March 2023, a report by the World Health Organization highlighted that nearly 50% of medical equipment in low- and middle-income countries is not functioning properly due to a lack of proper maintenance, underlining the global need for structured service models

- In 2022, the U.S. FDA emphasized the importance of equipment performance management in its medical device safety guidelines, encouraging healthcare systems to adopt predictive maintenance models

- As healthcare systems increasingly rely on technologically advanced equipment, the need for consistent, efficient, and smart maintenance services is accelerating, making it a critical driver for the medical equipment maintenance market

Opportunity

“Transforming Maintenance with Artificial Intelligence and Predictive Analytics”

- The integration of artificial intelligence (AI) and predictive analytics into medical equipment maintenance is creating significant opportunities to enhance service efficiency, reduce equipment downtime, and optimize operational costs

- AI-driven maintenance systems can analyze real-time equipment data, detect patterns, and forecast potential failures before they occur, allowing for proactive interventions and minimizing service disruptions

- In addition, these smart maintenance platforms also support automated scheduling, parts replacement predictions, and performance benchmarking, which streamline workflow management for healthcare providers

For instance,

- In October 2024, a report by Frost & Sullivan highlighted how AI-based predictive maintenance reduced unscheduled downtime by over 30% in large hospital networks, significantly improving resource utilization and patient care delivery intervention, which can significantly delay or even reverse the progression of the disease

- In April 2023, according to the National Institutes of Health, AI-enhanced maintenance tools showed promising results in managing high-demand devices such as MRI and CT scanners, where uninterrupted operation is critical for diagnostics and treatment planning

- By leveraging AI and predictive analytics, healthcare facilities can move from reactive to condition-based maintenance models, ensuring equipment reliability, extending device lifecycles, and ultimately improving clinical outcomes and operational efficiency

Restraint/Challenge

“High Cost of Advanced Maintenance Technologies and Services”

- The high cost associated with advanced medical equipment maintenance services and technologies poses a significant challenge to widespread market adoption, particularly in low- and middle-income regions

- Predictive maintenance tools, remote diagnostics, and AI-driven platforms often require substantial upfront investment, as well as skilled personnel and ongoing service contracts, which may exceed the budgets of smaller healthcare facilities

- For institutions with limited financial and technical resources, maintaining high-end medical devices can become burdensome, leading to delayed maintenance, increased equipment downtime, and compromised patient care

For instance,

- In June 2024, a study published by the Biomedical Engineering Society noted that many rural hospitals in developing regions report service interruptions due to a lack of access to cost-effective maintenance solutions and trained technicians

- In February 2023, according to the International Federation of Medical and Biological Engineering, over 40% of healthcare facilities in low-income countries rely on outdated or improperly maintained equipment due to prohibitive costs of modern maintenance technologies

- Consequently, these cost-related barriers limit the reach of advanced maintenance services and widen the gap in healthcare quality between urban and rural or resource-constrained regions, ultimately restraining the growth potential of the medical equipment maintenance market

Medical Equipment Maintenance Market Scope

The market is segmented on the basis of service type, service providers, device type, level of maintenance, technology and end user.

|

Segmentation |

Sub-Segmentation |

|

By Service Type |

|

|

By Service Providers |

|

|

By Device Type |

|

|

By Level of Maintenance

|

|

|

By Technology |

|

|

By End User |

|

Medical Equipment Maintenance Market Regional Analysis

“North America is the Dominant Region in the Medical Equipment Maintenance Market”

- North America dominates the medical equipment maintenance market, supported by a robust healthcare infrastructure, widespread adoption of advanced medical technologies, and the presence of leading maintenance service providers

- U.S. leads the region due to high equipment density in hospitals and diagnostic centers, increasing reliance on third-party and multi-vendor service models, and strong regulatory compliance requirements that emphasize equipment performance and safety

- The favorable reimbursement structures, rising investment in digital health technologies, and early adoption of AI-driven predictive maintenance tools further drive market growth in the region

- In addition, the growing focus on reducing healthcare costs and improving operational efficiency continues to push demand for comprehensive maintenance solutions across healthcare systems in North America

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness the highest growth rate in the medical equipment maintenance market, fueled by rapid expansion in healthcare infrastructure and increasing investments in hospital modernization across developing nations

- Countries such as China, India, and South Korea are emerging as key growth markets due to their growing healthcare needs, rising patient volumes, and increasing government focus on strengthening medical device safety and reliability

- Japan continues to play a pivotal role with its highly advanced medical technology landscape and commitment to maintaining international standards for equipment safety and functionality

- Moreover, the rising number of healthcare facilities, growing demand for quality patient care, and the influx of international service providers offering scalable maintenance solutions are accelerating market expansion in the region

Medical Equipment Maintenance Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Medtronic (U.S.)

- Stryker (U. S.)

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- Koninklijke Philips N.V. (The Netherlands)

- Canon Medical Systems Corporation (Japan)

- Hitachi High-Tech Corporation (Japan)

- Fujifilm Holdings Corporation (Japan)

- Shimadzu Corporation (Japan)

- Agfa-Gevaert N.V. (Belgium)

- Drägerwerk AG & Co. KGaA (Germany)

- Carestream Health (U.S.)

- Aramark (U.S.)

- Crothall Healthcare (U.S.)

- Alpha Source Group (U.S.)

- Alliance Medical Limited (U.K.)

- Althea Group Holdings Limited (Austraila)

- Pantheon Healthcare (U.K.)

- TOSHIBA CORPORATION (Japan)

- Esaote SPA (Italy)

Latest Developments in Global Medical Equipment Maintenance Market

- In November 2024, Medline Industries, a leading medical supply firm, confidentially filed for an initial public offering (IPO) in the United States, aiming to raise over USD 5 billion. The IPO, expected as early as the second quarter of 2025, could value the company at approximately USD 50 billion, marking a significant move for its private equity owners

- In August 2024, Swedish medical-equipment maker Getinge acquired U.S.-based organ transport company Paragonix Technologies for approximately USD 477 million. This strategic move aims to enhance Getinge's offerings in the organ transplant sector by integrating Paragonix's advanced organ preservation solutions

- In July 2024, Owens & Minor, a medical supplies distributor, announced its agreement to acquire Rotech Healthcare, a provider of home medical equipment, for USD 1.36 billion in cash. This strategic move aims to expand Owens & Minor's presence in the home-based care sector, enhancing its portfolio with Rotech's offerings, including devices for sleep apnea and diabetes treatments

- In April 2024, Ecolab announced the sale of its global surgical solutions business to Medline for USD 950 million in cash. This unit, which generated over USD 400 million in sales the previous year, provides sterile drape solutions for surgical settings. The divestiture is part of Ecolab's strategy to focus on its core healthcare offerings

- In January 2024, Siemens Healthineers announced the expansion of its digital solutions for medical equipment maintenance. The new service integrates artificial intelligence (AI) and predictive analytics to minimize downtime and enhance the operational efficiency of medical equipment in hospitals, aiming to improve customer experience and optimize preventive maintenance scheduling

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.