Global Molybdenum Market

Market Size in USD Billion

CAGR :

%

USD

5.04 Billion

USD

6.14 Billion

2024

2032

USD

5.04 Billion

USD

6.14 Billion

2024

2032

| 2025 –2032 | |

| USD 5.04 Billion | |

| USD 6.14 Billion | |

|

|

|

|

Molybdenum Market Size

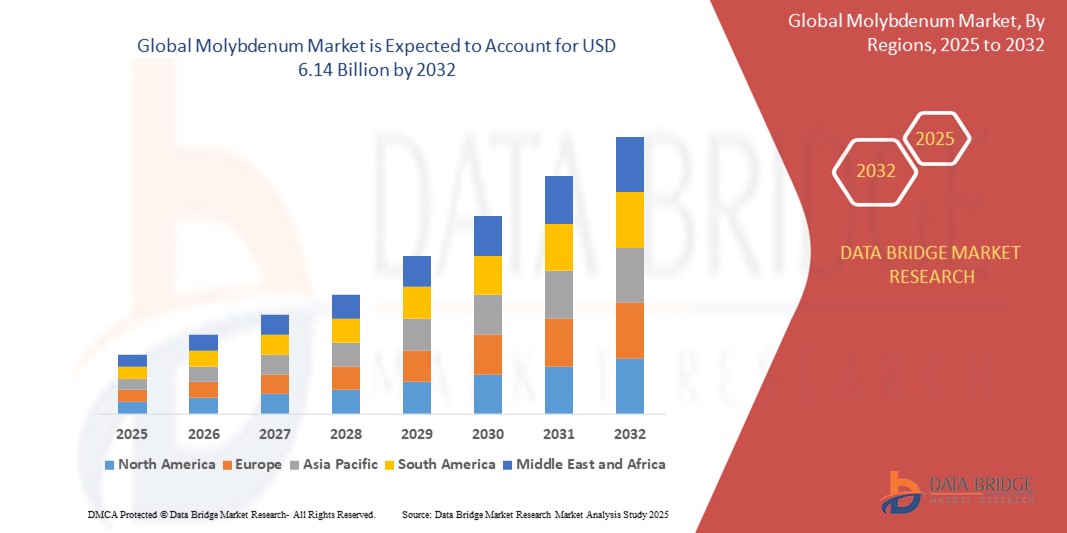

- The global molybdenum market size was valued at USD 5.04 billion in 2024 and is expected to reach USD 6.14 billion by 2032, at a CAGR of 2.50% during the forecast period

- This growth is driven by factors such as the increasing demand for molybdenum in the steel and industrial sectors, especially for high-strength and corrosion-resistant alloys.

Molybdenum Market Analysis

- The molybdenum market is seeing steady demand due to its crucial role in producing high-strength steel and various alloys used in industries such as construction, automotive, and aerospace

- There is growing interest in molybdenum's use in energy-efficient technologies, including solar panels and batteries, which is expected to drive further market expansion

- Asia-Pacific is expected to dominate the molybdenum market due to its high consumption in steel production, large reserves, and significant demand from key industrial sectors such as electronics, automotive, and construction

- North America is expected to be the fastest-growing region in the molybdenum market during the forecast period due to increasing demand from aerospace, defence, and energy sectors, alongside investments in infrastructure and clean energy technologies

- The steel segment is expected to dominate the molybdenum market with the largest share of 67.8% in 2025 due to its extensive use in construction, energy, and automotive industries where molybdenum enhances strength, heat resistance, and corrosion protection in steel alloys

Report Scope and Molybdenum Market Segmentation

|

Attributes |

Molybdenum Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Molybdenum Market Trends

“Increasing Demand for Molybdenum in Renewable Energy Applications”

- Molybdenum is increasingly utilized in renewable energy technologies, enhancing the efficiency and durability of components such as wind turbines and solar panels

- Its high thermal conductivity and resistance to corrosion make it ideal for use in harsh environmental conditions

- The growing adoption of renewable energy sources globally is driving the demand for molybdenum in these applications

- For instance, molybdenum is used in the production of thin-film solar cells, which are gaining popularity due to their cost-effectiveness and efficiency

- In addition, molybdenum's role in strengthening steel alloys contributes to the construction of robust wind turbine structures, further supporting the expansion of renewable energy infrastructure

Molybdenum Market Dynamics

Driver

“Rising Demand from the Steel Industry”

- Molybdenum is widely used as an alloying element in the steel manufacturing sector to improve strength, hardness, corrosion resistance, and weldability

- It plays a critical role in producing stainless steel and high-performance alloys used across construction, automotive, oil and gas, and aerospace industries

- As infrastructure projects expand globally, the demand for molybdenum-enhanced steel grows due to its durability in high-pressure and high-temperature environments

- For instance, molybdenum-containing steel is extensively used in oil pipelines and refinery equipment to withstand corrosive conditions

- In addition, with the rise in production of low-emission and electric vehicles, molybdenum alloys are used to meet lightweight and efficiency standards, as seen in automotive components such as turbochargers and engine parts for better fuel performance and longevity

Opportunity

“Growing Use in Renewable Energy Technologies”

- Molybdenum is increasingly being used in solar technologies, especially in thin-film photovoltaic cells, where it acts as a durable and conductive back contact material

- Its strength and heat resistance make it ideal for wind turbines and geothermal systems that operate under extreme environmental conditions

- The global push toward carbon neutrality and cleaner energy sources is accelerating demand for renewable infrastructure where molybdenum plays a vital role

- For instance, molybdenum is part of solar panel systems used in large-scale solar farms supported by the European Green Deal initiative

- Similarly, China’s aggressive investment in wind energy as part of its carbon neutrality target is increasing the use of molybdenum in turbine components for enhanced performance and durability

Restraint/Challenge

“Environmental and Regulatory Concerns”

- Molybdenum extraction is energy-intensive and may cause soil and water contamination if environmental safeguards are not strictly followed

- Increasing global focus on sustainability has led to stricter regulations on mining, including mandates on waste disposal, water use, and emissions control

- These regulations raise production costs and create hurdles for new market entrants or expansion projects, especially in regions with strong community resistance

- For instance, in South America, several mining operations have faced delays or opposition due to concerns over environmental degradation and water use

- In addition, the molybdenum market faces volatility from geopolitical events and supply chain disruptions, making consistent production and pricing more challenging for industry players

Molybdenum Market Scope

The market is segmented on the basis of product type, application, end-use.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Application |

|

|

By End-Use |

|

In 2025, the steel is projected to dominate the market with a largest share in product type segment

The steel segment is expected to dominate the molybdenum market with the largest share of 67.8% in 2025 due to its extensive use in construction, energy, and automotive industries where molybdenum enhances strength, heat resistance, and corrosion protection in steel alloys.

The stainless steel is expected to account for the largest share during the forecast period in application market

In 2025, the stainless-steel segment is expected to dominate the market with the largest market share of 41.5% due to its critical role in manufacturing durable, corrosion-resistant products used in chemical processing, food equipment, and infrastructure projects globally.

Molybdenum Market Regional Analysis

“Asia Pacific Holds the Largest Share in the Molybdenum Market”

- Asia Pacific is the dominating region in the global molybdenum market

- Asia Pacific held over 61.9% of the global molybdenum market share, driven by China's significant production and consumption

- China alone accounted for approximately 45.5% of global molybdenum production, highlighting its pivotal role in the market

- The region's industrial sectors, including steel, automotive, and electronics, are major consumers of molybdenum, supporting its market dominance

- Asia Pacific's rapid industrialization and infrastructure development continue to drive the increasing demand for molybdenum

“Asia-Pacific is Projected to Register the Highest CAGR in the Molybdenum Market”

- North America is the fastest-growing region in the global molybdenum market

- The U.S. molybdenum market is projected to grow, driven by increasing demand in aerospace, defence, and energy sectors

- Molybdenum's role in light weighting automotive manufacturing is crucial, as it enhances strength and fuel efficiency in vehicles

- The U.S. is a leading producer of molybdenum, with significant mining operations in Colorado, Utah, and Arizona, ensuring a stable supply for various industries

- Government policies, such as the Inflation Reduction Act, are encouraging investment in clean energy technologies, boosting molybdenum demand in renewable energy applications

Molybdenum Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Freeport-McMoRan (U.S.)

- China Molybdenum Co., Ltd. (China)

- BHP (U.K.)

- Compania Minera Dona Ines De Collahuasi S.C.M. (Chile)

- Antamina (Peru)

- Centerra Gold Inc (Canada)

- Antofagasta plc (U.K.)

- American CuMo Mining (U.S.)

- Grupo México, S.A.B. de C.V. (Mexico)

- Shaanxi Non-ferrous Metals Holding Group Co., Ltd. (China)

- Moly Metal L.L.P (Luxembourg)

- ENF Ltd. (U.K.)

- Jinduicheng Molybdenum Co., Ltd. (China)

- CODELCO (Chile)

- Southern Copper Corporation (U.S.)

Latest Developments in Global Molybdenum Market

- In February 2025, Greenland Resources signed a ten-year offtake agreement with Outokumpu to supply molybdenum from its Malmbjerg project in East Greenland. The deal will deliver around 8 million pounds of molybdenum annually, covering nearly half of Outokumpu’s needs. This agreement helps Greenland Resources secure financing and boosts Outokumpu’s raw material security. It also supports emission reduction goals and strengthens Europe’s molybdenum supply chain

- In June 2022, Rio Tinto inaugurated Gudai-Darri, its most technologically advanced iron ore mine in the Pilbara region of Western Australia. The $3.1 billion project features autonomous trucks, trains, drills, and the world’s first autonomous water trucks, along with a robotic ore sampling laboratory and a digital twin of the processing plant. A 34 MW solar farm powers about one-third of the mine’s electricity needs, reducing CO₂ emissions by approximately 90,000 tonnes annually. At full capacity, Gudai-Darri aims to produce 43 million tonnes of Pilbara Blend iron ore per year, supporting Rio Tinto’s long-term production and sustainability goals

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Molybdenum Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Molybdenum Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Molybdenum Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.