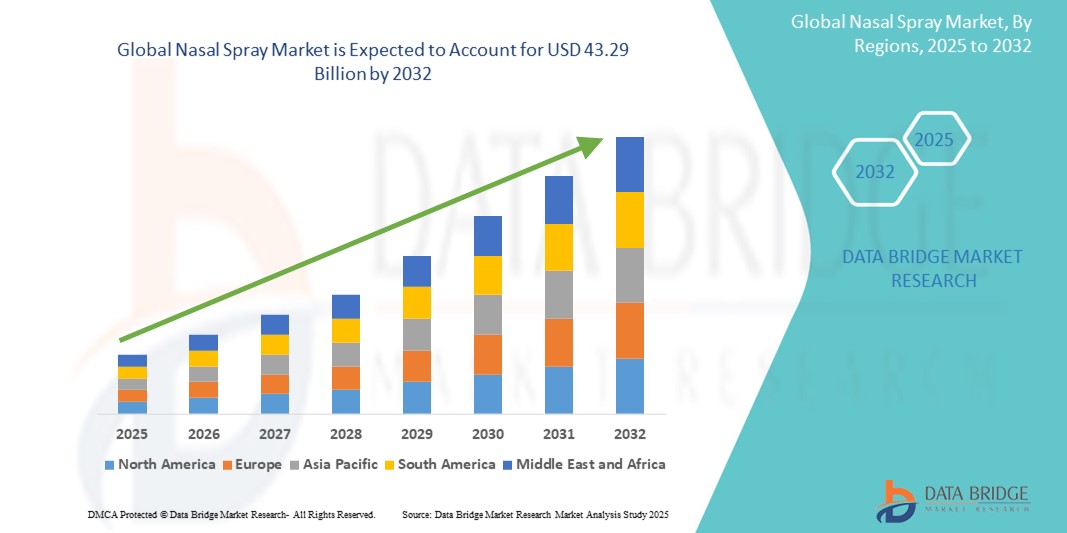

Global Nasal Spray Market

Market Size in USD Billion

CAGR :

%

USD

25.76 Billion

USD

43.29 Billion

2024

2032

USD

25.76 Billion

USD

43.29 Billion

2024

2032

| 2025 –2032 | |

| USD 25.76 Billion | |

| USD 43.29 Billion | |

|

|

|

|

Nasal Spray Market Size

- The global Nasal Spray market was valued at USD 25.76 billion in 2024 and is expected to reach USD 43.29 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.70%, primarily driven by the rising prevalence of respiratory disorders

- This growth is driven by factors such as the increased demand for effective and convenient treatments for conditions such as allergies, sinusitis, and nasal congestion

Nasal Spray Market Analysis

- The growing incidence of conditions such as allergies, sinusitis, and nasal congestion is driving the demand for nasal sprays as a preferred form of medication due to their quick and targeted action

- Companies are continually innovating to improve nasal spray formulations, such as introducing faster-acting sprays and those with additional therapeutic benefits, expanding the range of available products in the market

- The increasing preference for over-the-counter products, where consumers can purchase nasal sprays without a prescription, is contributing to the market’s growth, offering convenience and accessibility to a broader consumer base

- The development of advanced spray mechanisms for better dosage control and enhanced efficacy is a key trend in the market, attracting both manufacturers and consumers interested in efficient solutions for nasal care

- As more individuals become aware of the availability and benefits of nasal sprays, particularly in managing seasonal allergies, there has been an uptick in consumer adoption. For instance, brands such as Flonase have gained significant market share due to their well-known effectiveness in treating nasal symptoms associated with allergies

Report Scope and Nasal Spray Market Segmentation

|

Attributes |

Nasal Spray Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Nasal Spray Market Trends

“Development of Advanced Nasal Sprays”

- The development of advanced nasal sprays has seen significant innovations aimed at enhancing efficacy, user comfort, and broadening therapeutic applications

- Haleon introduced Otrivin Nasal Mist, utilizing microdroplet technology to deliver a gentle mist that evenly covers nasal passages, minimizing dripping and enhancing user comfort

- Addressing patient concerns over preservatives, manufacturers such as Aptar Pharma have developed preservative-free intranasal spray systems, incorporating filter membranes to prevent microbial contamination without the need for preservatives

- The FDA approved FluMist for at-home use, allowing individuals up to age 49 to self-administer the influenza vaccine, thereby increasing accessibility and convenience

- Researchers have developed nasal sprays such as SPL7013, demonstrating potent antiviral activity against SARS-CoV-2, offering potential protection against COVID-19

- Innovations include nasal sprays formulated with natural ingredients, such as Zingiber officinalis extract, providing green and natural treatment options for rhinitis and rhinosinusitis

Nasal Spray Market Dynamics

Driver

“Increasing Cases of Allergic Rhinitis and Respiratory Infections”

- The global rise in allergic rhinitis cases is significantly boosting the demand for nasal sprays. Factors such as urbanization, increased pollution, and changing lifestyles contribute to this surge

- Frequent respiratory infections, especially in developing countries, lead to higher usage of nasal sprays for relief from nasal congestion and other symptoms

- Nasal sprays offer a convenient self-medication option, aligning with the growing consumer trend towards over-the-counter products for managing mild symptoms

- Nasal sprays provide quick relief, making them a preferred choice among consumers seeking immediate symptom alleviation

- For Instance, the approval of Spravato (esketamine) nasal spray by the FDA in March 2019 for treatment-resistant depression highlights the expanding therapeutic applications of nasal sprays

Opportunity

“Integration of Smart Devices”

- Modern nasal spray devices are increasingly equipped with smart sensors that monitor usage patterns and provide real-time feedback to usersThese devices can track dosage, timing, and frequency, ensuring patients adhere to prescribed regimens

- For instance, Aptar Pharma's HeroTracker Sense transforms a standard metered-dose inhaler into a smart connected healthcare device, offering digital tracking and reminders

- Smart nasal spray devices can transmit usage data to healthcare providers, facilitating remote monitoring of patient conditions.This integration supports personalized treatment plans and timely interventions

- Smart nasal spray devices can transmit usage data to healthcare providers, facilitating remote monitoring of patient conditions

- This integration supports personalized treatment plans and timely interventions

Restraint/Challenge

“Regulatory Hurdles and Potential Adverse Effects”

- Navigating stringent regulatory frameworks for nasal spray approval can delay product launches and increase development costs, posing challenges for manufacturers

- Potential side effects such as nosebleeds, dryness, or rebound congestion from overuse can limit the long-term use of nasal sprays, affecting consumer trust and market growth

- The availability of alternative treatments, including oral medications and inhalers, presents competition, challenging the market share of nasal sprays

- Overuse of nasal sprays can lead to dependency and other health issues, necessitating consumer education and potentially affecting market dynamics

- For Instance, the approval process for new nasal spray formulations can be lengthy and costly, as seen with the development timelines of products such as Spravato, highlighting the impact of regulatory challenges on market offerings

Nasal Spray Market Scope

The market is segmented on the basis product type, container design, dosage form, therapeutic class, application, prescription/availability, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Container Design |

|

|

By Dosage Form |

|

|

By Therapeutic Class |

|

|

By Application |

|

|

By Prescription/Availability |

|

|

By End-User |

|

Nasal Spray Market Regional Analysis

“North America is the Dominant Region in the Nasal Spray Market”

- The region's advanced healthcare systems facilitate widespread availability and adoption of nasal sprays

- North America hosts key pharmaceutical companies, ensuring a steady supply of diverse nasal spray products

- High levels of health awareness among consumers contribute to the prevalent use of nasal sprays for various conditions

- Favorable regulations and reimbursement policies enhance market accessibility, solidifying North America's leading position

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is projected to experience the highest compound annual growth rate (CAGR) in the nasal spray market during the forecast period

- Rising cases of respiratory infections and allergic conditions are driving the demand for effective nasal treatments in countries such as China, India, and Japan

- Rapid urbanization and changing lifestyles are contributing to a higher incidence of conditions treated with nasal sprays, such as allergic rhinitis and sinusitis

- Improvements in healthcare infrastructure and increased healthcare spending are enhancing the availability and accessibility of nasal spray products across the region

- Growing awareness and acceptance of nasal sprays as a convenient and effective treatment option are fueling market growth in the Asia-Pacific region

Nasal Spray Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- EMERGENT (U.S.)

- Cipla Inc. (India)

- Sandoz International GmbH (A Part of Novartis) (Switzerland)

- Aytu Health (A subsidiary of Aytu BioPharma, Inc.) (U.S.)

- Bayer AG (Germany)

- GlaxoSmithKline plc. (U.K.)

- Assertio Therapeutics, Inc. (U.S.)

- Aurena Laboratories (Sweden)

- J Pharmaceuticals (U.S.)

- St. Renatus (U.S.)

- Ultratech India Limited (India)

- Catalent, Inc. (U.S.)

- Teva Pharmaceuticals USA, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Viatris Inc. (U.S.)

- LEEFORD HEALTHCARE LTD (India)

- Aishwarya Group (India)

Latest Developments in Global Nasal Spray Market

- In August 2024, ARS Pharmaceuticals launched Neffy, an epinephrine nasal spray approved by the FDA for the treatment of anaphylaxis. Neffy offers a needle-free alternative for individuals at risk of severe allergic reactions, enhancing the accessibility and ease of emergency care

- In October 2023, Otrivin Nasal Mist was introduced using microdroplet technology to provide effective relief for nasal congestion. This product offers a gentle mist for better coverage in the nasal passages, improving patient comfort and ease of use

- In August 2023, Padagis LLC, a leading provider of specialty pharmaceuticals, introduced the first over-the-counter (OTC) Naloxone HCl Nasal Spray in the U.S. This groundbreaking product is designed to quickly reverse the life-threatening effects of opioid overdoses, making it more accessible to the public

- In March 2023, Teva Pharmaceuticals, the U.S. affiliate of Teva Pharmaceutical Industries Ltd, launched additional strengths of the generic version of Revlimid® (lenalidomide capsules) in 2.5 mg and 20 mg doses in the U.S., aimed at expanding the company’s product portfolio

- In January 2023, Viatris Inc. a global healthcare company, announced the completion of its acquisitions of Oyster Point Pharma and Famy Life Sciences, marking the creation of its new Viatris Eye Care Division. This acquisition is expected to support the company's business expansion efforts

- In November 2021, Amcyte Pharma, a Seattle-based innovative pharmaceutical company, announced the U.S. launch of Nasitrol nasal spray, specifically formulated for sinus irrigation. This product aims to provide relief for sinus congestion and improve nasal health through routine use

- In October 2021, Cipla, Inc. launched Naselin, an antiviral nasal spray designed to protect against respiratory tract infections caused by coronaviruses. This product was developed to offer an additional layer of defense against viral infections, particularly during the COVID-19 pandemic

SKU-

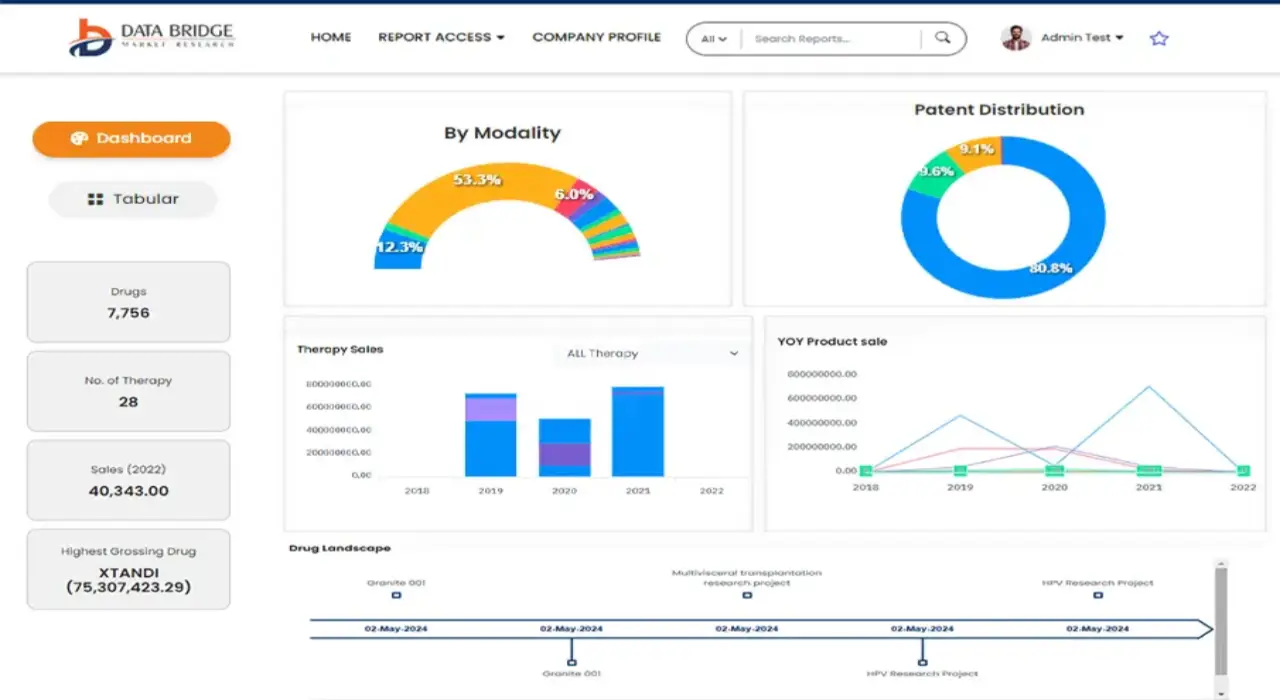

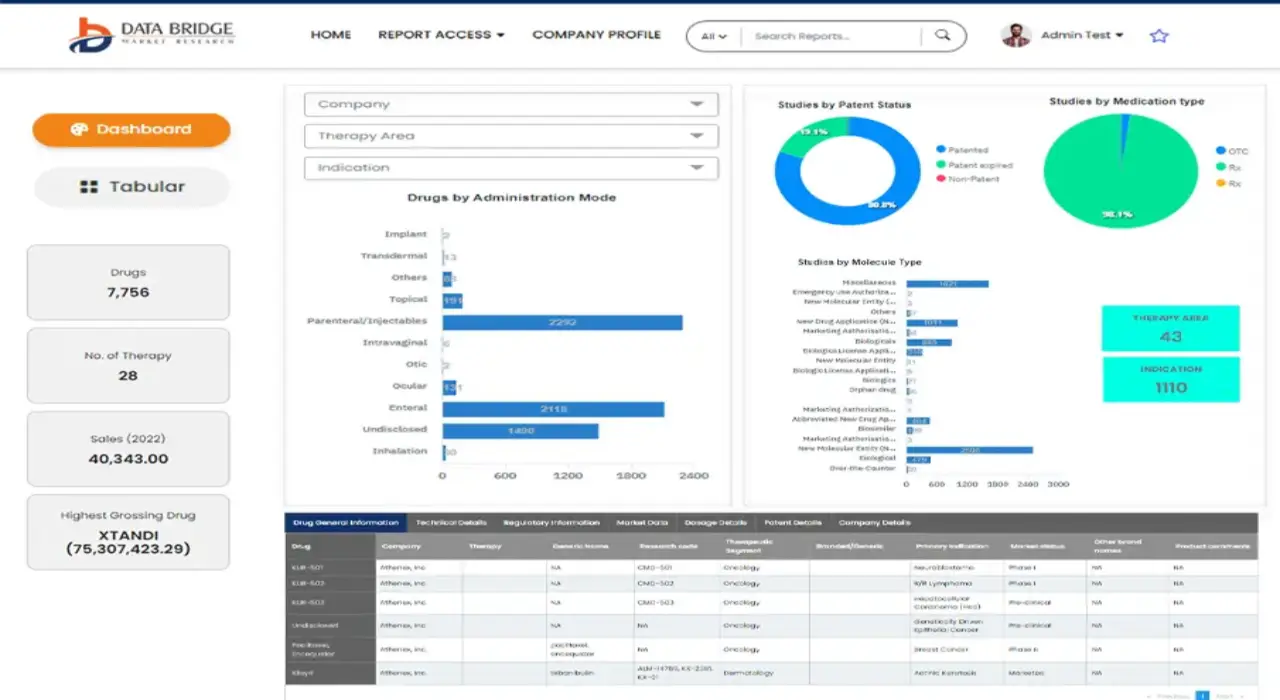

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.