Global Ophthalmic Surgical Instruments Market

Market Size in USD Billion

CAGR :

%

USD

11.00 Billion

USD

23.75 Billion

2024

2032

USD

11.00 Billion

USD

23.75 Billion

2024

2032

| 2025 –2032 | |

| USD 11.00 Billion | |

| USD 23.75 Billion | |

|

|

|

|

Ophthalmic Surgical Instruments Market Size

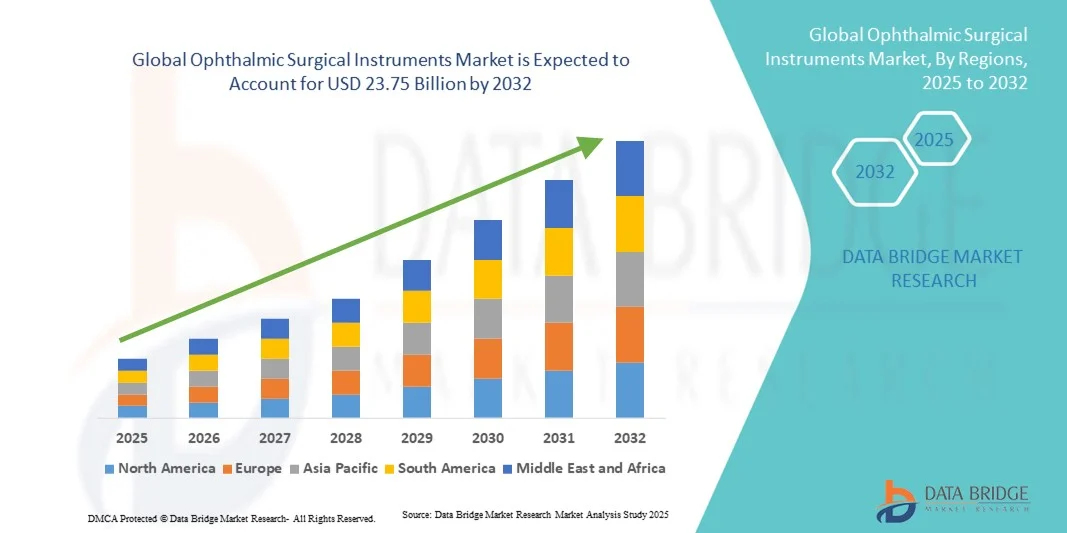

- The global ophthalmic surgical instruments market size was valued at USD 11.00 billion in 2024 and is expected to reach USD 23.75 billion by 2032, at a CAGR of 10.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of eye-related disorders, rising geriatric population, and growing demand for advanced surgical interventions

- Furthermore, technological advancements in minimally invasive ophthalmic procedures and the rising adoption of automated and precision surgical instruments are accelerating the uptake of ophthalmic surgical instruments solutions, thereby significantly boosting the industry's growth

Ophthalmic Surgical Instruments Market Analysis

- Ophthalmic surgical instruments, encompassing devices and tools for eye surgeries, are increasingly vital in both hospital and specialty clinic settings due to their precision, efficiency, and ability to improve patient outcomes

- The growing demand is primarily fueled by rising prevalence of eye disorders, increased awareness of advanced surgical procedures, and adoption of minimally invasive ophthalmic technologies

- North America dominated the ophthalmic surgical instruments market with the largest revenue share of 41.5% in 2024, driven by advanced healthcare infrastructure, high adoption of cutting-edge ophthalmic surgical devices, and a strong presence of leading medical device manufacturers. U.S. hospitals and specialty eye clinics are increasingly investing in modern surgical instruments to enhance precision and patient outcomes. Government initiatives supporting digital health, technological innovation, and healthcare modernization further bolster market growth

- Asia-Pacific is expected to be the fastest growing region in the ophthalmic surgical instruments market during the forecast period, with a projected CAGR from 2025 to 2032, fueled by increasing urbanization, rising healthcare expenditure, expansion of eye care facilities in India and China, and growing awareness of advanced ophthalmic surgical procedures

- The cataract surgery application segment dominated the largest market revenue share of 39.5% in 2024, driven by the high prevalence of cataract, increasing awareness of early surgical intervention, and rising geriatric population. Advanced phacoemulsification techniques and premium lens implants improve patient outcomes and accelerate adoption

Report Scope and Ophthalmic Surgical Instruments Market Segmentation

|

Attributes |

Ophthalmic Surgical Instruments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ophthalmic Surgical Instruments Market Trends

Advancements Driving Precision and Efficiency in Ophthalmic Surgery

- A significant and accelerating trend in the global ophthalmic surgical instruments market is the deepening integration of advanced technologies such as artificial intelligence (AI) and smart imaging systems. This fusion of technologies is significantly enhancing procedural efficiency, surgical precision, and clinical outcomes

- For instance, several AI-enabled phacoemulsification and vitrectomy systems now assist surgeons in real-time by providing predictive analytics, automated adjustments, and enhanced visualization during ophthalmic procedures. Similarly, advanced imaging-integrated surgical microscopes offer high-definition visualization and precise guidance, enabling more effective and safer interventions

- AI integration in ophthalmic surgical instruments enables features such as automated measurement of ocular parameters, real-time feedback on instrument positioning, and intelligent guidance during microsurgery. Furthermore, the incorporation of smart monitoring and imaging capabilities allows clinicians to detect complications earlier, adjust techniques dynamically, and improve patient recovery times

- The seamless integration of surgical instruments with hospital IT and imaging systems facilitates centralized management of data and procedural workflows. Through a single interface, surgeons can access patient imaging, preoperative planning data, and instrument telemetry, creating a more efficient and coordinated surgical environment

- This trend towards more intelligent, precise, and interconnected ophthalmic surgical systems is fundamentally reshaping user expectations for clinical outcomes. Consequently, companies are developing AI-enabled instruments with enhanced imaging, automated control, and real-time analytics to support surgeons in achieving optimal results

- The demand for technologically advanced ophthalmic surgical instruments is growing rapidly across both hospital and specialty clinic sectors, as healthcare providers increasingly prioritize procedural accuracy, patient safety, and comprehensive ophthalmic care functionality

Ophthalmic Surgical Instruments Market Dynamics

Driver

Growing Need Due to Increasing Prevalence of Eye Disorders and Technological Advancements

- The rising prevalence of ocular disorders such as cataracts, glaucoma, and retinal diseases, coupled with the accelerating adoption of advanced surgical technologies, is a significant driver for the heightened demand for ophthalmic surgical instruments

- For instance, in April 2024, major companies announced the launch of AI-assisted ophthalmic surgical platforms with integrated imaging, enhancing precision in delicate microsurgeries. Such strategies by key players are expected to drive the ophthalmic surgical instruments industry growth in the forecast period

- As healthcare providers become more aware of potential surgical challenges and seek enhanced patient outcomes, advanced instruments offer features such as automated adjustments, real-time imaging, and analytics, providing a compelling upgrade over conventional surgical tools

- Furthermore, the growing emphasis on minimally invasive procedures and the desire for integrated operating room workflows are making advanced ophthalmic instruments an integral component of modern eye care, offering seamless integration with diagnostic and imaging systems

- The convenience of automated controls, improved accuracy, and enhanced monitoring capabilities are key factors propelling the adoption of technologically advanced ophthalmic surgical instruments in both hospitals and specialty clinics. The trend towards data-driven surgery and the increasing availability of AI-assisted ophthalmic instruments further contribute to market growth

Restraint/Challenge

Concerns Regarding High Costs and Technological Adaptation

- The relatively high initial cost of advanced ophthalmic surgical instruments compared to traditional tools can be a barrier to adoption for price-sensitive hospitals and clinics, particularly in developing regions or for smaller specialty centers. While some basic automated instruments have become more accessible, premium features such as AI-assisted imaging, real-time analytics, and integrated microsurgical guidance often come with a higher price tag

- While costs are gradually decreasing, the perceived premium for cutting-edge technology can still hinder widespread adoption, especially for institutions that do not see an immediate need for enhanced features

- The complexity of advanced ophthalmic surgical instruments can pose challenges for surgical staff who require extensive training to operate these systems efficiently. Limited access to specialized training programs in certain regions may slow adoption and reduce operational efficiency

- Integration challenges with existing hospital IT infrastructure and imaging systems may also restrict seamless use, requiring additional investment in software compatibility and system upgrades

- Potential concerns regarding maintenance, calibration, and technical support for high-end instruments can deter healthcare providers, especially in regions with limited service networks

- Budget constraints and competing priorities in hospital procurement decisions may lead to slower adoption rates, as administrators weigh the costs versus perceived clinical benefits

- Overcoming these challenges through cost-effective product development, training programs for surgical staff, and demonstration of improved patient outcomes will be vital for sustained market growth. Robust support services and maintenance programs also play a key role in facilitating the adoption of technologically advanced ophthalmic surgical instruments

Ophthalmic Surgical Instruments Market Scope

The market is segmented on the basis of product, application, and end user.

- By Product

On the basis of product, the Ophthalmic Surgical Instruments market is segmented into cataract surgery devices, refractive surgery devices, glaucoma surgery devices, vitreoretinal surgery devices, ophthalmic microscopes, and ophthalmic surgical accessories. The cataract surgery devices segment dominated the largest market revenue share of 38.9% in 2024, driven by the high prevalence of cataract cases globally, increasing geriatric population, and rising adoption of advanced phacoemulsification and femtosecond laser-assisted cataract surgeries. Hospitals and specialty eye clinics are investing in premium cataract surgery devices to improve precision, reduce recovery times, and enhance surgical outcomes. Technological advancements in foldable intraocular lenses and automated phaco systems further reinforce demand. Reimbursement policies in developed countries, along with training programs for ophthalmic surgeons, support widespread adoption. The availability of cost-effective devices in emerging regions also contributes to its leading market position. Clinical studies demonstrating improved visual outcomes and reduced complications boost confidence among surgeons. The integration of digital imaging and smart device connectivity enhances surgical planning and intraoperative guidance. Collaborative initiatives with global medical device companies promote innovation.

The glaucoma surgery devices segment is expected to witness the fastest CAGR of 9.1% from 2025 to 2032, fueled by the increasing incidence of glaucoma, technological advancements in minimally invasive glaucoma surgery (MIGS), and growing awareness of early diagnosis. The adoption of micro-stent implants, trabecular meshwork devices, and ab-interno procedures is rising across hospitals and specialty clinics. Expansion of glaucoma screening programs, coupled with rising patient awareness, supports faster growth. Surgeons increasingly prefer devices that provide precise intraocular pressure control with reduced complications. Integration with imaging guidance systems enhances adoption. Government initiatives to prevent vision loss due to glaucoma further propel market growth. Strategic collaborations between device manufacturers and healthcare institutions drive innovation. Rising investments in ophthalmic R&D and product approvals contribute to growth momentum. Emerging markets are witnessing increasing adoption due to expanding healthcare infrastructure. Insurance coverage and reimbursement policies for glaucoma surgeries incentivize the use of advanced devices.

- By Application

On the basis of application, the Ophthalmic Surgical Instruments market is segmented into cataract, refractive, glaucoma, vitreoretinal, diabetic retinopathy, and others. The cataract surgery application segment dominated the largest market revenue share of 39.5% in 2024, driven by the high prevalence of cataract, increasing awareness of early surgical intervention, and rising geriatric population. Advanced phacoemulsification techniques and premium lens implants improve patient outcomes and accelerate adoption. Hospitals and ambulatory surgery centers prioritize efficiency and precision, encouraging investment in cutting-edge cataract devices. Government initiatives promoting vision care, insurance coverage for cataract surgeries, and rapid adoption in emerging regions further support dominance. Clinical evidence demonstrating superior visual outcomes and minimal complications drives surgeon preference. Awareness campaigns and patient education programs increase procedure uptake. Technological integration with imaging systems enhances intraoperative guidance. Cost-effective devices in developing countries expand market reach. Ongoing R&D in lens materials and surgical automation promotes innovation.

The refractive surgery application segment is expected to witness the fastest CAGR of 8.7% from 2025 to 2032, fueled by rising demand for vision correction procedures such as LASIK, SMILE, and PRK. Increasing patient preference for minimally invasive and laser-based procedures drives adoption. The growth is supported by technological advancements in excimer and femtosecond lasers, improved safety profiles, and reduced recovery times. Rising disposable incomes, increasing awareness of refractive options, and expanding specialty eye clinics accelerate growth. Strategic partnerships and collaborations between laser device manufacturers and hospitals support market expansion. Enhanced precision, patient satisfaction, and efficiency contribute to higher adoption rates. Insurance coverage and promotional campaigns further encourage uptake. Urbanization and growing ophthalmology-focused infrastructure in emerging markets also propel growth.

- By End User

On the basis of end user, the Ophthalmic Surgical Instruments market is segmented into hospitals, specialty clinics, and ambulatory surgery centers. The hospitals segment dominated the largest market revenue share of 44.2% in 2024, driven by the presence of advanced surgical infrastructure, availability of skilled ophthalmic surgeons, and adoption of premium surgical devices. Hospitals provide comprehensive ophthalmic care, integrating multiple surgical applications such as cataract, glaucoma, and vitreoretinal surgeries. Government-funded hospitals and private hospitals are increasing investments in state-of-the-art instruments to improve patient outcomes. The high patient throughput and multidisciplinary care environment support dominance. Strategic collaborations with global device manufacturers facilitate access to the latest technologies. Hospitals also benefit from economies of scale, training programs, and access to advanced imaging and intraoperative guidance systems. Regulatory approvals, reimbursement policies, and clinical validation studies further strengthen adoption. Ongoing upgrades and hospital modernization projects boost market share.

The specialty clinics segment is expected to witness the fastest CAGR of 9.3% from 2025 to 2032, fueled by the increasing number of ophthalmic specialty centers, growing demand for outpatient eye surgeries, and rising patient preference for personalized care. Clinics adopt minimally invasive surgical devices and laser-based equipment to provide efficient and precise procedures. Expansion of private ophthalmology practices, technological upgrades, and growing awareness of vision correction treatments drive adoption. Cost-effective and portable devices allow clinics in emerging regions to expand services. Enhanced training programs and collaborations with device manufacturers further accelerate growth. Increasing patient footfall, insurance coverage, and promotional campaigns boost clinic-based surgeries. High demand for cataract, refractive, and glaucoma surgeries in specialized outpatient settings supports rapid market growth

Ophthalmic Surgical Instruments Market Regional Analysis

- North America dominated the ophthalmic surgical instruments market with the largest revenue share of 41.5% in 2024, characterized by advanced healthcare infrastructure, high adoption of ophthalmic procedures, and the strong presence of key industry players

- The U.S. shows substantial growth in cataract surgeries, retinal interventions, and corneal treatments, driven by innovations from both established medical device companies and emerging startups focusing on minimally invasive and precision ophthalmic instruments

- High demand from hospitals, specialty eye care centers, and ambulatory surgical facilities continues to drive market expansion in the region

U.S. Ophthalmic Surgical Instruments Market Insight

The U.S. the ophthalmic surgical instruments market captured the largest revenue share in 2024 within North America, fueled by rapid adoption of advanced ophthalmic procedures, increasing prevalence of vision-related disorders, and ongoing initiatives to enhance procedural efficiency and patient outcomes. Investments in technologically advanced instruments, training programs for surgeons, and the expansion of specialty eye care centers are further propelling market growth.

Europe Ophthalmic Surgical Instruments Market Insight

The Europe the ophthalmic surgical instruments market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by increasing prevalence of age-related eye disorders, technological advancements in surgical instruments, and rising healthcare expenditure. The growth is further supported by government initiatives promoting eye care awareness and the incorporation of advanced instruments in both public and private healthcare facilities.

U.K. Ophthalmic Surgical Instruments Market Insight

The U.K. Ophthalmic Surgical Instruments mar the ophthalmic surgical instruments market ket is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising adoption of modern ophthalmic procedures and the demand for improved surgical outcomes. Increasing geriatric population, higher prevalence of cataract and retinal diseases, and expansion of specialty eye care centers are contributing to market growth.

Germany Ophthalmic Surgical Instruments Market Insight

The Germany the ophthalmic surgical instruments market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of vision care, adoption of technologically advanced surgical instruments, and government-supported healthcare programs. Germany’s well-developed healthcare infrastructure, focus on innovation, and presence of major ophthalmic device manufacturers facilitate strong market growth, particularly in hospitals and specialty clinics.

Asia-Pacific Ophthalmic Surgical Instruments Market Insight

The Asia-Pacific the ophthalmic surgical instruments market is poised to grow at the fastest CAGR during the forecast period of 2025 to 2032, driven by increasing urbanization, rising disposable incomes, and growing prevalence of vision disorders in countries such as China, Japan, and India. Expansion of tertiary care hospitals, rising ophthalmic surgeries, and adoption of advanced instruments are key factors supporting growth. Government initiatives promoting healthcare access and investments in eye care infrastructure further propel market adoption across the region.

Japan Ophthalmic Surgical Instruments Market Insight

The Japan Ophthalmic Surgical Instruments ma the ophthalmic surgical instruments market rket is gaining momentum due to the country’s high-tech healthcare environment, rapid urbanization, and rising demand for advanced ophthalmic procedures. Growth is driven by an aging population, increasing prevalence of cataract and glaucoma, and integration of advanced surgical instruments in hospitals and specialty clinics.

China Ophthalmic Surgical Instruments Market Insight

The China the ophthalmic surgical instruments market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to expanding healthcare infrastructure, growing prevalence of eye disorders, and strong adoption of advanced ophthalmic surgical instruments. China’s large patient population, government health initiatives, and rising investments in specialty eye care facilities are key factors propelling the market.

Ophthalmic Surgical Instruments Market Share

The Ophthalmic Surgical Instruments industry is primarily led by well-established companies, including:

• Alcon Inc. (U.S.)

• Bausch + Lomb Incorporated (U.S.)

• Johnson & Johnson and its affiliates (U.S.)

• Carl Zeiss Meditec AG (Germany)

• Hoya Corporation (Japan)

• NIDEK Co., Ltd. (Japan)

• Topcon Corporation (Japan)

• Ellex Medical Lasers Ltd. (Australia)

• STAAR Surgical Company (U.S.)

• Ophtec BV (Netherlands)

• DORC International (Netherlands)

• Lumenis Ltd. (Israel)

• Medicel AG (Switzerland)

• Volk Optical Inc. (U.S.)

• Asico LLC (U.S.)

Latest Developments in Global Ophthalmic Surgical Instruments Market

- In October 2024, Beyeonics launched the Beyeonics One ophthalmic microscope, the first fully digital microscope with infrared night-vision technology. This innovation aims to enhance surgical precision and visualization during ophthalmic procedures

- In July 2024, Oertli Instruments received FDA 510(k) clearance for its Faros anterior cataract surgery system. This milestone underscores the company's commitment to providing advanced, reliable surgical equipment worldwide

- In October 2024, ZEISS introduced ZEISS VisioGen, an AI-driven solution designed to enhance refractive patient communication and streamline clinic operations. This innovation aims to improve patient engagement and clinic efficiency

- In September 2025, BVI Medical unveiled the Virtuoso phaco-vitrectomy system, a dual-function surgical platform designed for both cataract and vitreoretinal procedures. The European debut is planned for the 2025 Global Ophthalmic Congresses in Europe

- In February 2025, Alcon announced the full U.S. commercial availability of the Voyager direct selective laser trabeculoplasty (DSLT) device. This device is the first and only DSLT device, providing a streamlined workflow to deliver 120 laser pulses without a gonio lens or manual aiming

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.