Global Orthopedic Prosthetics Market

Market Size in USD Billion

CAGR :

%

USD

2.38 Billion

USD

4.30 Billion

2024

2032

USD

2.38 Billion

USD

4.30 Billion

2024

2032

| 2025 –2032 | |

| USD 2.38 Billion | |

| USD 4.30 Billion | |

|

|

|

|

Orthopedic Prosthetics Market Size

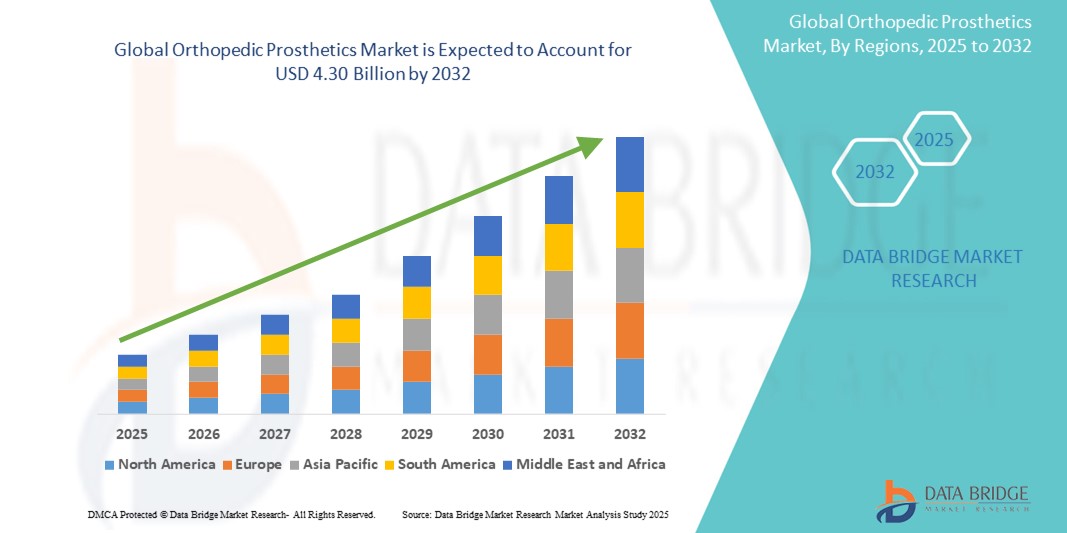

- The global orthopedic prosthetics market size was valued at USD 2.38 billion in 2024 and is expected to reach USD 4.30 billion by 2032, at a CAGR of 7.70% during the forecast period

- This growth is driven by factors such as the rising prevalence of orthopedic disorders, increasing geriatric population, advancements in prosthetic technology, growing incidence of trauma and sports-related injuries, and greater access to healthcare services across emerging economies

Orthopedic Prosthetics Market Analysis

- The orthopedic prosthetics market is experiencing a shift towards personalized devices that cater to individual anatomical needs, enhancing comfort and functionality. Customization is becoming essential as more patients seek prosthetics tailored to their lifestyles, utilizing advanced materials such as carbon fiber and silicone for better durability and performance

- Manufacturers are increasingly integrating smart technologies into prosthetics, such as microprocessor-controlled joints and myoelectric components, which offer more responsive and intuitive movement

- North America is expected to dominate the orthopedic prostheticss market with share 40.05% due to advanced healthcare infrastructure and a high adoption rate of innovative technologies

- Asia-pacific is expected to be the fastest growing region in the orthopedic prosthetics market during the forecast period with 23.05 % share due to increasing healthcare access and rising economic development

- The prosthetics segment is expected to dominate the orthopedic prosthetics market with the largest share of 63.06% in 2025 due to the increasing demand for advanced prosthetic devices that offer enhanced functionality, comfort, and mobility. Technological advancements, such as microprocessor-controlled joints, myoelectric components, and 3d printing, have led to better customization and performance, further driving the adoption of prosthetics.

Report Scope and Orthopedic Prosthetics Market Segmentation

|

Attributes |

Orthopedic Prosthetics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Orthopedic Prosthetics Market Trends

"Advancements in Prosthetic Technology Enhancing User Experience"

- Smart technologies such as microprocessor-controlled joints and myoelectric components are enhancing the functionality of prosthetics, offering more natural movement and better adaptability to user motions

- Advanced sensors and control systems are making prosthetics more intuitive, improving comfort and closely mimicking natural limb functions

- Prosthetic devices are becoming lighter and more user-friendly, allowing greater accessibility and making daily use more comfortable for users

- Materials such as carbon fiber and titanium are being used to create durable, lightweight prosthetics, ensuring comfort and long-term reliability

- For instance, recent upper-limb prosthetics offer customizable grips and adjustable sockets, enhancing dexterity and reducing discomfort during use

- In conclusion, the orthopedic prosthetics market is evolving with smart technologies and advanced materials, improving both functionality and comfort for users

Orthopedic Prosthetics Market Dynamics

Driver

“Growing Demand for Customized Prosthetics”

- The demand for customized orthopedic prosthetics is increasing due to their ability to provide better comfort, improved mobility, and an enhanced quality of life for individuals with limb loss or deficiency

- Unsuch as generic prosthetics, customized devices are tailored to the individual’s anatomical structure, specific needs, and lifestyle, offering a better fit and reducing discomfort through advanced technology

- Advances in 3D printing technology and the availability of lightweight composites and flexible polymers have made precise customization more accessible, allowing for better-fitting prosthetics that meet individual needs

- The trend towards customization extends beyond just the fit; it includes aesthetic choices, allowing users to select the appearance and design of their prosthetic devices, which helps improve psychological well-being

- Customized prosthetics are particularly beneficial for users engaging in specific activities, such as sports or heavy physical work, as they are designed to better suit their movements and daily tasks, improving overall functionality and comfort

- In conclusion, the growing demand for customized prosthetics, driven by technological advancements, is expected to continue to fuel market growth, offering individuals a better and more personalized experience

Opportunity

“Rapid Expansion in Emerging Economies”

- The expansion into emerging markets presents a significant opportunity in the orthopedic prosthetics market, driven by the growing healthcare infrastructure in countries such as India, China, and Brazil

- As these economies develop, there is a surge in demand for medical devices, including prosthetics, due to increased healthcare access, better awareness, and rising incidences of injuries and accidents, which drive the need for prosthetic solutions

- Prosthetics in emerging markets are often more affordable than in developed regions, making them accessible to a larger portion of the population and fueling the market's growth

- Manufacturers are seizing this opportunity by establishing production facilities and forming partnerships with local distributors, ensuring quicker access and a more efficient supply chain for prosthetic devices

- Governments in these regions are investing in healthcare programs, which may include prosthetic devices as part of public health initiatives, providing additional support for increasing demand

- In conclusion, the development of affordable, high-quality prosthetics for emerging markets offers a valuable opportunity for manufacturers and healthcare providers to meet the growing demand for these devices in these regions

Restraint/Challenge

“High Cost of Advanced Prosthetic Devices”

- The high cost of advanced orthopedic prosthetics remains a major challenge, as technological innovations such as microprocessor-controlled joints, myoelectric components, and advanced sensors significantly increase production costs

- These sophisticated prosthetics are often out of reach for individuals in low-income or underdeveloped regions, limiting access to improved functionality and comfort offered by these devices

- The cost of prosthetics can be a barrier for patients who require frequent replacements, particularly for growing children or individuals with rapidly changing needs, as insurance coverage is often limited

- Customization, whether through 3D printing or individualized design, further adds to the cost, making it difficult for many potential users to afford personalized solutions

- Research into cost-effective production methods and potential government subsidies or insurance reforms are essential to address these financial barriers and make advanced prosthetics more accessible globally

- In conclusion, the high cost of advanced prosthetics poses a significant challenge to market growth, and addressing affordability through innovation and support policies is crucial for wider access

Orthopedic Prosthetics Market Scope

The market is segmented on the basis of product type, technology type, and end user type.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Technology Type |

|

|

By End User Type |

|

In 2025, the prosthetics segment is projected to dominate the market with a largest share in product type segment

The prosthetics segment is expected to dominate the Orthopedic Prosthetics market with the largest share of 63.06% in 2025 due to the increasing demand for advanced prosthetic devices that offer enhanced functionality, comfort, and mobility. Technological advancements, such as microprocessor-controlled joints, myoelectric components, and 3D printing, have led to better customization and performance, further driving the adoption of prosthetics. Additionally, a growing aging population, rising incidence of limb amputations due to diabetes and trauma, and the increasing awareness of prosthetic solutions are contributing to the segment's growth.

The Electric Powered segment is expected to account for the largest share during the forecast period in technology type segment

In 2025, the Electric Powered segment is expected to dominate the market with the largest market share due to the increasing demand for efficient, sustainable, and cost-effective solutions. Electric-powered systems provide enhanced performance with lower energy consumption compared to traditional mechanical systems. They offer greater precision, faster response times, and reduced maintenance requirements, making them ideal for a wide range of industries, including healthcare, manufacturing, and automotive.

Orthopedic Prosthetics Market Regional Analysis

“North America Holds the Largest Share in the Orthopedic Prosthetics Market”

- North America leads the global orthopedic prosthetics market with a significant share with 40.05%

- The U.S. is the primary contributor, with 5.13% share and benefiting from advanced healthcare infrastructure and a high adoption rate of innovative technologies

- Canada also plays a vital role, experiencing steady growth in the market

- The region is supported by strong research and development investments, as well as the presence of leading prosthetics manufacturers

- Favorable reimbursement policies and access to cutting-edge prosthetic solutions further enhance market growth

“Asia-Pacific is Projected to Register the Highest CAGR in the Orthopedic Prosthetics Market”

- The Asia-Pacific region is experiencing the highest growth rate in the orthopedic prosthetics market with 23.05 % share

- Countries such as China, India, and Japan are driving the demand due to increasing healthcare access and rising economic development

- A large patient base, improving healthcare infrastructure, and increased investments by key market players are contributing to the growth

- Government initiatives and advancements in medical technology are further accelerating the market expansion

- The prevalence of conditions such as diabetes and vascular diseases is fueling the demand for orthopedic prosthetics in this region

Orthopedic Prosthetics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Blatchford Group (U.K.)

- The Ohio Willow Wood Co. (U.S.)

- Össur (Iceland)

- Fillauer LLC. (U.S.)

- Advanced Arm Dynamics, Inc. (U.S.)

- Stryker (U.S.)

- Exactech, Inc. (U.S.)

- Globus Medical Inc (U.S.)

- Touch Bionics Inc. (U.K.)

- RTI Surgical Inc. (U.S.)

- Wright Medical Group N.V. (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Arthrex Inc. (U.S.)

- AlloSource (U.S.)

- Braun Melsungen AG (Germany)

- Smith & Nephew plc (Germany)

- Zimmer Biomet (U.S.)

- Hanger Inc. (U.S.)

- Otto Bock Healthcare GmBH (Germany)

Latest Developments in Global Orthopedic Prosthetics Market

- In January 2025, Group FH ORTHO launched JARVIS, a new round baseplate for reverse shoulder prostheses in the U.S. Designed for reverse glenoid indications, JARVIS offers flexibility with angles of 10°, 20°, and 30°, and features options for compression and locking screws. Its adaptive glenosphere provides various lateralization and distalization options, ensuring optimal fixation. The system is compatible with Arrow Prime and Short Stem for the humeral side and is constructed from durable materials such as UHMWPE, Ti6Al4V, and Cobalt Chromium. FDA-cleared in November 2024, JARVIS aims to enhance shoulder joint replacement solutions for American patients

- In February 2025, Össur introduced the Pro-Flex Terra, a cutting-edge prosthetic foot designed to enhance mobility and comfort for users. This innovative foot integrates pre-tensioned carbon technology, a pre-compressed foam layer, and a gliding contact pad to deliver natural ankle motion, explosive push-off, and superior control. A standout feature is its user-removable wedge, produced using Carbon's Digital Light Synthesis technology, allowing for customizable heel stiffness and improved performance across varied terrains

- In March 2025, Zimmer Biomet showcased its diverse portfolio of orthopedic and musculoskeletal innovations at the American Academy of Orthopaedic Surgeons (AAOS) 2025 Annual Meeting. The company highlighted advancements in joint reconstruction, robotics, and digital health technologies, emphasizing its commitment to enhancing patient outcomes and surgical precision. Zimmer Biomet's participation underscored its leadership in integrating cutting-edge solutions to address the evolving needs of the orthopedic community

- In November 2024, Auxein launched a comprehensive suite of advanced orthopedic and arthroscopy products at MEDICA 2024 in Düsseldorf, Germany. The showcased innovations included AV-Wiselock Plates, Osteochondral Transfer Systems, bioabsorbable interference screws, and reusable suture passers, among others. These products are designed to enhance surgical precision and support minimally invasive procedures, aligning with the growing demand for efficient recovery solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.