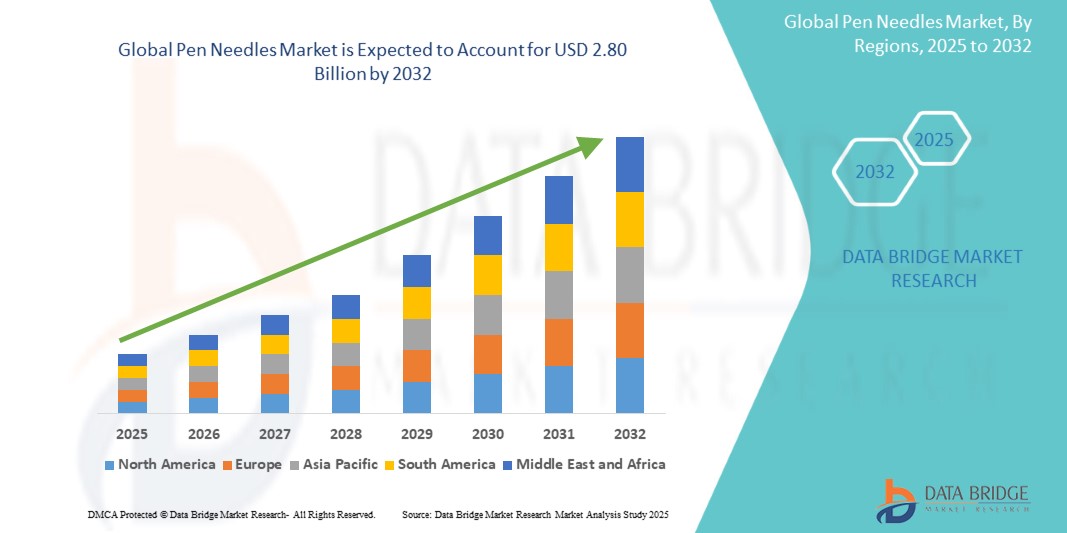

Global Pen Needles Market

Market Size in USD Billion

CAGR :

%

USD

1.44 Billion

USD

2.80 Billion

2024

2032

USD

1.44 Billion

USD

2.80 Billion

2024

2032

| 2025 –2032 | |

| USD 1.44 Billion | |

| USD 2.80 Billion | |

|

|

|

|

Pen Needles Market Size

- The global Pen Needles market size was valued at USD 1.44 billion in 2024 and is expected to reach USD 2.80 billion by 2032, at a CAGR of 8.7% during the forecast period

- This growth is driven by Growing prevalence of diabetes and increased initiatives by the government.

Pen Needles Market Analysis

- the rising burden of diabetes worldwide, particularly in Asia-Pacific and North America, pen needles have become an essential part of diabetes management. Innovations in needle design, including ultra-fine tips and safety-engineered variants, have made self-administration safer and more effective

- Europe dominates the global Pen Needles market due to the prevalence of advanced healthcare infrastructure and rising prevalence of the target diseas

- Asia-Pacific is projected to register the highest CAGR due to rising expenditure to develop healthcare infrastructure, ever-rising diabetic population, and rising awareness about the availability treatment options

- Insulin therapy is expected to dominate the market in 2025 with the largest market share of 64.3%, due to the widespread incidence of type 1 and type 2 diabetes and reliance on insulin injections for glycemic control

Report Scope and Pen Needles Market Segmentation

|

Attributes |

Pen Needles Key Market Insights |

|

Segments Covered |

By Type: Standard Pen Needles and Safety Pen Needles By Length: 4mm,5mm, 6mm, 8mm, 10mm and 12mm By Usability: Reusable Pen Needles Disposable Pen Needles By Application: Diabetes Growth Hormone Deficiency Others By Therapy: Insulin Therapy, GLP-1 Therapy Growth Hormone Therapy Others By Mode of Purchase Retail and Non-Retail By Distribution Channel: Hospital Pharmacies, Retail Pharmacies and Online Pharmacies By End User: Hospitals, Clinics, Home Healthcare and Others |

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pen Needles Market Trends

“Emphasis on Needle Safety and Painless Injection Technology”

- Manufacturers are increasingly focusing on needle safety technologies to reduce needlestick injuries and enhance user comfort. Innovations such as retractable and shielded pen needles are gaining popularity among healthcare providers and patients

- In October 2024, a U.S.-based company launched a silicone-coated micro-pen needle aimed at pediatric and elderly diabetic patients to reduce injection anxiety and improve adherence

Pen Needles Market Dynamics

Driver

“Growing Global Diabetes Burden and Patient-Driven Injection Practices”

With over 537 million people living with diabetes globally (as per IDF Diabetes Atlas 2023), the reliance on regular insulin and hormone injections has grown significantly. Pen devices, when paired with pen needles, offer greater accuracy, convenience, and compliance compared to traditional syringes. This has led to widespread adoption of pen needles, particularly among the elderly and pediatric populations.

For Instance, In 2024, the CDC reported a 12% increase in self-administered insulin usage across the U.S., with younger demographics preferring pen-based delivery systems

Opportunity

“Miniaturization and Material Innovations in Needle Design”

Technological advancements have enabled the production of thinner, shorter, and more comfortable needles that minimize pain and improve treatment compliance. Materials such as silicone coatings and polymeric tips are being adopted to enhance glide and safety. A 2024 clinical trial in Germany demonstrated that ultra-fine, short pen needles significantly improved insulin adherence in needle-phobic patients without compromising absorption efficacy. These innovations are particularly beneficial for pediatric and elderly populations, making self-injection less intimidating

Restraint/Challenge

“Environmental Waste and Cost Pressures in Emerging Economies”

Despite their benefits, disposable pen needles contribute to rising volumes of medical waste, posing environmental concerns—especially in countries with inadequate biomedical disposal systems. Furthermore, in low-income regions, the cost of branded safety pen needles can hinder access for many patients. Government-led initiatives and international health collaborations are encouraging the use of eco-friendly materials and promoting the development of reusable needle systems to reduce the ecological footprint and cost burden

The market is segmented on the basis of type, therapy, length, mode of purchase, distribution channel, and end user

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Length |

|

|

By Usability |

|

|

By Application |

|

|

By Mode of Purchase |

|

|

By End User |

|

|

By Distribution Channel

|

|

In 2025, the insulin therapy is projected to dominate the market with a largest share in therapy segment

In 2025, the insulin therapy segment is expected to dominate the Pen Needles market with the largest market share of 64.3% due to its essential role in diabetes management and widespread adoption across all age groups and regions.

The retail pharmacies is expected to account for the largest share during the forecast period in distribution channel market

In 2025, the retail pharmacies segment is expected to dominate the market with the largest market share of 48.9% in 2025 due to accessibility, volume sales of pen needles, and bundled offerings with insulin pens and devices.

Pen Needles Market Regional Analysis

“Europe Holds the Largest Share in the Pen Needles Market”

- Europe dominates the pen needles market owing to the prevalence of advanced healthcare infrastructure and rising prevalence of the target disease.

- The region benefits from strong government support for diabetes management, widespread adoption of advanced insulin delivery systems, and a growing aging population. Countries like Germany, the U.K., and France have implemented structured reimbursement programs and national awareness campaigns that further contribute to regional dominance.

“Asia-Pacific is Projected to Register the Highest CAGR in the Pen Needles Market”

- Asia-Pacific is projected to witness the fastest growth due to an increasing diabetic population, rising health expenditure, and enhanced penetration of insulin therapy devices.

- Initiatives for early diabetes diagnosis and subsidized therapy programs are further supporting market expansion

Pen Needles Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Novo Nordisk A/S (Denmark)

- YPSOMED (Switzerland)

- B. Braun Melsungen AG (Germany)

- HTL-STREFA S.A. (Poland)

- Terumo Corporation (Japan)

- BD (U.S.)

- Owen Mumford Inc. (U.K.)

- UltiMed, Inc. (U.S.)

- Artsana S.p.A. (Italy)

- Trividia Health, Inc. (U.S.)

- STAT Medical Devices (U.S.)

- Simple Diagnostics (U.S.)

- Pietrasanta Pharma SpA (Italy)

- A. Menarini Diagnostics srl (Italy)

- Henso Medical (Hangzhou) Co., Ltd. (China)

- Shanghai Beipu Medical Co., Ltd. (China)

- Zhejiang Kindly Medical Devices Co., Ltd. (China)

- ARKRAY, Inc. (Japan)

- AstraZeneca (U.K.)

- GlaxoSmithKline plc (U.K.)

Latest Developments in Global Pen Needles Market

- In February 2025, BD launched a next-generation pen needle with tactile grip and audible click feedback for safer home injections

- In September 2024, Novo Nordisk received CE Mark approval for an eco-friendly pen needle compatible with smart insulin pens in Europe

- In May 2024, Ypsomed introduced a short safety needle with extra-thin wall technology that enhances medication flow rate and reduces penetration force

- In March 2024, MTD Group acquired Ypsomed’s pen needle and blood glucose monitoring businesses, significantly expanding its market presence and product portfolio in diabetes care

- In July 2024, Embecta Corp. announced it was exploring a potential sale of the company due to reduced profitability and valuation drop, indicating consolidation trends and shifting business strategies in the insulin delivery market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.