Global Sulfate Potash Market

Market Size in USD Billion

CAGR :

%

USD

56.12 Billion

USD

82.92 Billion

2024

2032

USD

56.12 Billion

USD

82.92 Billion

2024

2032

| 2025 –2032 | |

| USD 56.12 Billion | |

| USD 82.92 Billion | |

|

|

|

|

Sulfate of Potash Market Size

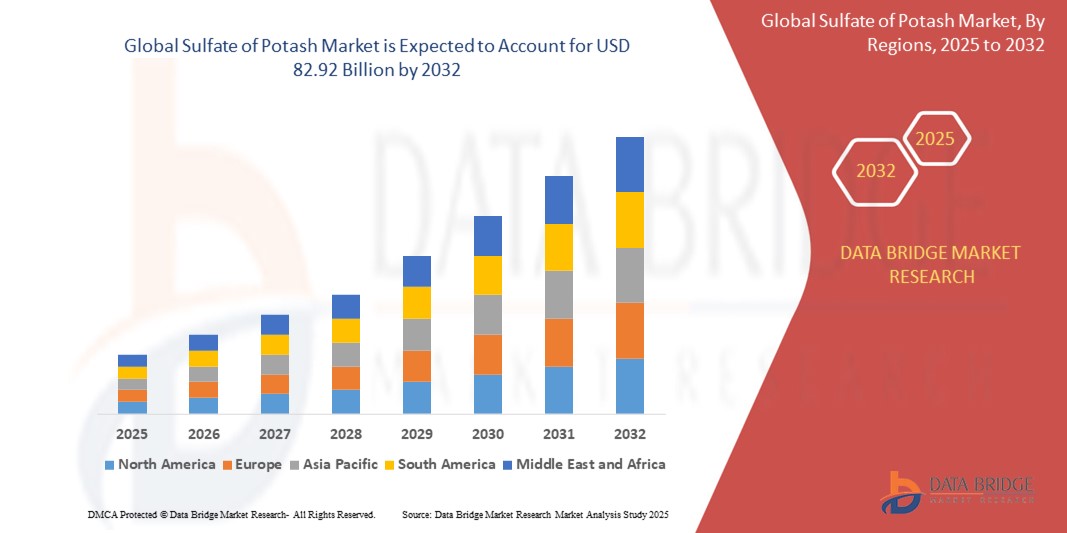

- The global sulfate of potash market size was valued at USD 56.12 billion in 2024 and is expected to reach USD 82.92 billion by 2032, at a CAGR of 5.00% during the forecast period

- This growth is driven by factors such as the increasing demand for high-quality fertilizers in agriculture, particularly in regions with potassium-deficient soils, as well as the growing focus on sustainable farming practices and crop yield improvement

Sulfate of Potash Market Analysis

- The global sulfate of potash market is witnessing steady growth, driven by the increasing demand for high-quality fertilizers in agriculture

- With growing awareness about sustainable farming practices, sulfate of potash is increasingly being preferred over other fertilizers for its minimal chloride content

- Asia-Pacific is expected to dominate the sulfate of Potash market due to share of 37.14% in the global market due to its large agricultural sector, increasing demand for high-value crops, and the widespread adoption of chloride-free fertilizers

- North America is expected to be the fastest growing region in the Sulfate of Potash market during the forecast period with share of 46.07% due to the widespread adoption of advanced agricultural practices, increasing focus on crop quality, and rising need for chloride-free fertilizers for specialty crop cultivation

- The agricultural segment is expected to dominate the sulfate of potash market with the largest share of 92.14% in 2025 due to its vital role in enhancing crop yield and quality, particularly for chloride-sensitive and high-value crops such as fruits, vegetables, and tobacco, as well as the growing global emphasis on sustainable and efficient fertilizer use

Report Scope and Sulfate of Potash Market Segmentation

|

Attributes |

Sulfate of Potash Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sulfate of Potash Market Trends

“Advancements in Operating Microscopes & 3D Visualization for Intraocular Surgery”

- The global sulfate of potash market is seeing increased demand due to the shift toward chloride-free fertilizers

- Farmers are opting for sulfate of potash for its ability to improve crop quality without causing salt damage to sensitive plants

- This trend is particularly noticeable in the cultivation of high-value crops such as fruits and vegetables, where quality is critical

- The growing interest in premium agricultural products has accelerated the adoption of sulfate of potash in various farming sectors

- In conclusion, as the demand for high-quality, specialty crops rises, sulfate of potash continues to be a preferred choice for growers aiming for optimal crop performance and quality

Sulfate of Potash Market Dynamics

Driver

“Growing Demand for High-Quality Crops”

- The growing demand for high-quality crops, especially in the fruit and vegetable sector, is a key driver for sulfate of potash use

- Specialty crops such as tomatoes and peppers require chloride-free fertilizers for optimal growth, making sulfate of potash the preferred choice

- Potassium enhances plant health, photosynthesis, and disease resistance, while sulfur improves the synthesis of amino acids and proteins, boosting crop quality

- As consumer demand for premium produce rises, farmers are turning to sulfate of potash to meet these quality expectations

- For instance, sulfate of potash is increasingly used in high-value crops such as tomatoes, where its benefits for flavor and yield are well-recognized

- In conclusion, the growing focus on crop quality and sustainability is expected to keep sulfate of potash in high demand across agriculture

Opportunity

“Expansion in Emerging Markets”

- Emerging markets in regions such as Asia-Pacific, Africa, and Latin America present significant growth opportunities for the sulfate of potash market

- As urbanization increases and farming practices modernize, there is a growing need for more efficient and sustainable fertilizers such as sulfate of potash

- The rising population in these regions intensifies the demand for improved food production systems, further driving the need for quality fertilizers

- For instance, in countries such as India, China, and Brazil, the shift to more advanced agricultural techniques is increasing the demand for chloride-free fertilizers in high-value crops

- The opportunity lies in building stronger distribution networks, introducing sulfate of potash products tailored to regional crop needs, and educating farmers on the benefits of sustainable fertilization

- In conclusion, with the growing awareness of sustainable farming practices, sulfate of potash is positioned to capture significant market share in emerging economies, promoting both food security and economic growth

Restraint/Challenge

“High Production Costs”

- A major challenge facing the sulfate of potash market is the high production cost associated with its complex manufacturing process

- The process of extracting potassium from mineral deposits and refining it is more costly compared to the simpler production of conventional potassium chloride fertilizers

- Factors such as higher raw material costs, energy consumption, and the need for sophisticated processing methods all contribute to the higher price of sulfate of potash

- For instance, regions far from production sites incur additional transportation and logistical costs, making the final product less affordable and competitive

- Smaller farmers, especially in developing regions, struggle to afford the higher price of sulfate of potash, limiting its widespread adoption

- In conclusion, addressing these cost challenges through technological innovation, efficient supply chains, and improved production methods will be essential for market growth and competitiveness

Sulfate of Potash Market Scope

The market is segmented on the basis of form, product, crop type, and application.

|

Segmentation |

Sub-Segmentation |

|

By Form |

|

|

By Product |

|

|

By Crop Type |

|

|

By Application

|

|

In 2025, the agricultural segment is projected to dominate the market with a largest share in application segment

The agricultural segment is expected to dominate the sulfate of potash market with the largest share of 92.14% in 2025 due to its vital role in enhancing crop yield and quality, particularly for chloride-sensitive and high-value crops such as fruits, vegetables, and tobacco, as well as the growing global emphasis on sustainable and efficient fertilizer use.

The liquid segment is expected to account for the largest share during the forecast period in form segment

In 2025, the liquid segment is expected to dominate the market with the largest market share of 63.10% due to its ease of application, better nutrient absorption by crops, and increasing preference for precision farming techniques that rely on efficient and uniform fertilizer distribution

Sulfate of Potash Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Sulfate of Potash Market”

- Asia Pacific holds a dominant position in the sulfate of potash market, accounting for a significant share of 37.14% in the global market due to its large agricultural sector, increasing demand for high-value crops, and the widespread adoption of chloride-free fertilizers

- Countries such as China and India are major contributors to this growth, driven by their large agricultural bases and increasing adoption of modern farming practices

- The rising demand for high-value crops and the expansion of precision agriculture further bolster the market in this region

- The dominance of Asia Pacific is attributed to its substantial agricultural output and the growing need for high-quality fertilizers to support crop production

- Increased awareness of sustainable farming practices and a shift towards premium crop production continue to strengthen the region's market presence

“North America is Projected to Register the Highest CAGR in the Sulfate of Potash Market”

- North America represents a substantial market for sulfate of potash, with a growing demand for high-quality fertilizers with share of 46.07% due to the widespread adoption of advanced agricultural practices, increasing focus on crop quality, and rising need for chloride-free fertilizers for specialty crop cultivation

- The U.S. and Canada are key markets within the region, with significant investments in agricultural research and development aimed at enhancing crop yield and quality

- The region's advanced agricultural industry, strong focus on sustainable farming practices, and high adoption of precision agriculture technologies contribute to this growth

- The growing emphasis on sustainable agriculture and the need for high-quality fertilizers drive the demand for sulfate of potash in North America

- North America's commitment to sustainable farming practices and technological advancements positions it as the fastest-growing market for sulfate of potash

Sulfate of Potash Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- SESODA CORPORATION (South Korea)

- Sinofert Holdings Limited (China)

- Compass Minerals (U.S.)

- Jiangsu Kolod Food Ingredients Co.,Ltd. (China)

- Tessenderlo Kerley International (U.S.)

- Yara (India)

- SDIC lnc. (China)

- Kemira (Finland)

- Intrepid Potash (U.S.)

- K+S AG (Germany)

- Israel Chemicals Ltd. (Israel)

- The Mosaic Company (U.S.)

- Sociedad Química y Minera de Chile (Chile)

- Haifa Group (Israel)

- Belaruskali (Belarus)

- Potash Corporation of Saskatchewan (Canada)

- Canpotex (Canada)

- OCI Nitrogen (Netherlands)

- EuroChem Group (Switzerland)

- Uralkali (Russia)

Latest Developments in Global Sulfate of Potash Market

- In September 2024, GreenSwitch Potassium Sulphate (SOP), the first water-soluble SOP fertilizer made using a highly circular method, was launched by Cinis Fertilizer and, due to its circular, sustainable production process that drastically lowers emissions, it establishes new benchmarks in the fertilizer sector

- In June 2022, American Lithium Corp. announced the successful precipitation of high purity, fertilizer-quality potassium sulfate (“SOP”-sulfate of potash) by-product from the Company’s Falchani Project. Testing confirms that in addition to producing high quality lithium compounds, SOP can be produced to potentially supply Peru with its domestic needs

- In May 2025, sulphate of potassium continues to be recognized as a premium-grade fertilizer ideal for chloride-sensitive crops. It contains essential nutrients such as potassium and sulfur that improve plant strength, yield, and resistance to diseases. The product is especially suited for high-value crops such as fruits, vegetables, and flowers, supporting balanced and sustainable nutrient management

- In May 2020, Uralkali, a leading potash producer, announced that its subsidiary, Uralkali Trading, had finalized a contract with Indian Potash Limited (IPL), a primary importer of fertilizers in India. The agreement entails the delivery of potash, vital for agricultural productivity. This strategic partnership underscores Uralkali's commitment to serving global agricultural needs while solidifying its presence in the Indian market, essential for sustaining agricultural growth and food security in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Sulfate Potash Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Sulfate Potash Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Sulfate Potash Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.