Global Traction Transformer Onboard Market

Market Size in USD Billion

CAGR :

%

USD

1.33 Billion

USD

2.43 Billion

2024

2032

USD

1.33 Billion

USD

2.43 Billion

2024

2032

| 2025 –2032 | |

| USD 1.33 Billion | |

| USD 2.43 Billion | |

|

|

|

|

Traction Transformer (Onboard) Market Size

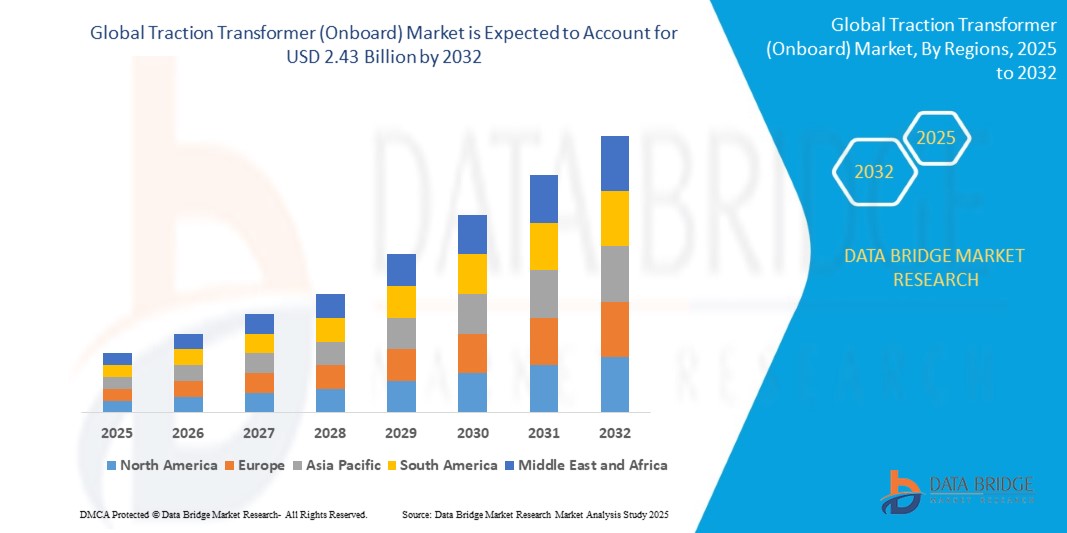

- The Global Traction Transformer (Onboard) Market size was valued at USD 1.33 billion in 2024 and is expected to reach USD 2.43 billion by 2032, at a CAGR of 7.84% during the forecast period

- This market growth is driven by factors such as rising government investments in rail electrification, increasing preference for low-emission transport, and advancements in lightweight, energy-efficient transformer technologies.

Traction Transformer (Onboard) Market Analysis

- Traction transformers (onboard) are essential components in electric railway systems, enabling efficient power conversion for propulsion and auxiliary functions. Their use in electric locomotives, metros, and high-speed trains ensures optimal performance, energy efficiency, and reduced environmental footprint in modern rail transport systems.

- Market growth is driven by increased investments in railway electrification, focus on low-emission public transport, and technological advancements in transformer designs such as compact sizing, lightweight materials, and improved thermal efficiency. Demand is also rising for transformers that can support higher power densities in limited onboard space.

- Asia-Pacific is expected to dominate and also fastest growing in the Global Traction Transformer (Onboard) Market throughout the forecast period. This leadership is supported by large-scale infrastructure development, urban metro expansion, and government-led green mobility initiatives across countries like China, India, and Japan. Rapid modernization of railway systems and electrification of intercity routes are further accelerating adoption.

- The AC segment in Traction Transformer (Onboard) market is anticipated to lead the market with a substantial share of 58.31%, driven by prevalence of AC-based electrification systems in major national rail networks and the ability of AC transformers to support longer transmission distances with lower power losses.

Report Scope and Traction Transformer (Onboard) Market Segmentation

|

Attributes |

Traction Transformer (Onboard) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Traction Transformer (Onboard) Market Trends

“Government-Led Investment in Railway Electrification and Infrastructure Modernization”

- One of the primary growth drivers for the traction transformer (onboard) market is the increasing investment by governments in upgrading rail infrastructure and promoting electric mobility to reduce carbon emissions.

- Electrification initiatives are accelerating the demand for onboard traction transformers, which are crucial for supplying power to electric rail vehicles.

- Additionally, liberalization of the rail transport network is encouraging private sector participation and modernization of rolling stock.

For instance:

- India's “Mission Electrification” aims to electrify 100% of broad-gauge railway routes, supported by multi-billion-dollar government funding. Such projects significantly increase the demand for onboard traction transformers in electric locomotives and metro rail systems.

Traction Transformer (Onboard) Market Dynamics

Driver

“Rising Shift Towards Public Transport and Urbanization”

- Rapid urbanization and increasing traffic congestion are pushing governments and consumers to adopt public rail transport systems over private vehicles.

- This shift is boosting demand for metro trains, high-speed rail, and suburban railways all of which rely on onboard traction transformers to manage power conversion and energy efficiency.

- Rising environmental awareness and fuel cost concerns are also encouraging consumers to opt for electric rail travel.

For instance:

- European cities such as Paris, Berlin, and Madrid are expanding their metro and suburban rail networks as part of sustainable mobility plans, incorporating energy-efficient electric trains supported by advanced onboard traction transformers.

Opportunity

“Expansion of Electrified Rail Networks in Emerging Markets”

- Developing nations across Asia-Pacific, Africa, and Latin America are rapidly expanding their railway infrastructure to support growing passenger and freight demand.

- These regions present untapped opportunities for traction transformer manufacturers due to the shift from diesel to electric locomotives and the development of high-speed and metro rail corridors.

- Additionally, international collaborations and public-private partnerships are helping to fund these infrastructure upgrades.

For instance:

- Vietnam and Indonesia have launched major metro rail projects in urban centers, including Hanoi Metro and Jakarta MRT, both of which are transitioning to electrified rail systems and adopting traction transformers for onboard power distribution.

Restraint/Challenge

“High Capital Investment and Complexity in Traction Transformer Design”

- One of the major challenges in the market is the high cost associated with railway electrification and the sophisticated engineering required for traction transformer design.

- These systems must meet strict technical standards, be lightweight, compact, and resilient under harsh conditions all of which increase R&D and manufacturing costs.

- Additionally, countries with established diesel-powered networks face logistical and economic hurdles in making a full transition to electric systems.

For instance:

- In regions like Sub-Saharan Africa and parts of Eastern Europe, the dominance of diesel locomotives and limited electrification infrastructure delay the adoption of onboard traction transformers, limiting market growth potential.

Traction Transformer (Onboard) Market Scope

The traction transformer (onboard) market is segmented on the basis of rolling stock, mounting position and overhead line voltage.

|

Segmentation |

Sub-Segmentation |

|

By Rolling Stock |

|

|

By Mounting Position |

|

|

By Overhead Line Voltage |

|

In 2025, the AC Segment is Projected to Lead the Overhead Line Voltage Segment

The AC (Alternating Current) segment is anticipated to dominate the overhead line voltage segment with a large market share in 2025. This growth is primarily due to the increasing adoption of AC-powered electric rail systems, especially in high-speed trains and metro systems. AC voltage offers better efficiency over long-distance travel, which is a critical factor for intercity and high-speed rail networks. Various AC voltage options, including 15 KV and 25 KV, provide the flexibility needed for different applications, contributing to the growth of this segment.

In 2025, the Underframe Segment is Expected to Account for the Largest Share in the Mounting Position Segment

The underframe segment is expected to hold the largest market share in the mounting position segment by 2025. This segment is projected to account for a substantial portion of the market due to its widespread use in rail transport systems, particularly in heavy-duty applications such as freight locomotives. The underframe mounting position allows for better space utilization and more efficient integration of traction transformers. This configuration is especially suitable for harsh environmental conditions and for optimizing performance in terms of power distribution.

Traction Transformer (Onboard) Market Regional Analysis

“Asia-Pacific Holds the Largest Share and Highest CAGR in the Traction Transformer (Onboard) Market”

- Asia-Pacific currently dominates the global traction transformer (onboard) market and is projected to continue leading through 2032, driven by rapid rail network electrification and government-backed infrastructure expansion across countries such as China, India, and Japan.

- China remains at the forefront due to its aggressive investments in high-speed rail projects and the government’s push for greener transportation solutions.

- India is undergoing major railway modernization programs under public-private partnerships, which are significantly increasing the demand for efficient onboard traction transformers.

- Japan contributes steadily due to its mature and technologically advanced railway ecosystem, with a strong focus on compact, lightweight, and energy-efficient transformer systems.

- Additionally, rising urbanization, increasing public transport demand, and favorable policies for low-emission transport systems further support regional growth.

Traction Transformer (Onboard) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ABB(Switzerland)

- Alstom (France)

- Mitsubishi Electric Corporation (Japan)

- Siemens(Germany)

- EMCO Limited (India)

- Hind Rectifiers Limited (India)

- International Electric Co., Ltd(South Korea)

- ORBCOM(United States)

- M&I Materials Ltd.(United Kingdom)

- Toshiba India Pvt. Ltd. (India)

- MORNSUN Guangzhou Science & Technology Co., Ltd. (China)

- Operation Technology, Inc.(United States)

- BTB Plaza Ltd(United Kingdom)

- JST Transformateurs S.A.(France)

- Setrans Holding(Switzerland)

- Wilson Transformer Company Pty(Australia)

- GENERAL ELECTRIC(United States)

- Gujarat Transformers Pvt. Ltd.(India)

Latest Developments in Global Traction Transformer (Onboard) Market

- In March 2025, Alstom unveiled a next-generation lightweight onboard traction transformer for high-speed rail applications, designed to reduce energy losses and optimize power conversion in compact underframe spaces. The new system, launched as part of its Avelia series, emphasizes sustainability and reduced lifecycle costs for operators across Europe and Asia.

- In January 2025, Siemens Mobility introduced its Sitras® TCD modular onboard traction transformer, engineered for metro and regional trains. The transformer supports multiple voltage ranges (AC and DC) and features enhanced cooling efficiency, making it suitable for varied climatic conditions and high-traffic urban networks.

- In October 2024, Mitsubishi Electric Corporation announced the development of a hybrid-insulated traction transformer system that significantly lowers weight and improves insulation performance. The innovation targets EMU (Electric Multiple Unit) rolling stock and aligns with Japan’s initiative for faster, lighter, and greener transit solutions.

- In September 2024, ABB completed successful trials of its EcoTraction™ onboard transformer system in India. Designed for 25 kV AC lines, the system incorporates biodegradable insulation fluid and high-efficiency magnetic cores to reduce energy loss and maintenance requirements, supporting Indian Railways' electrification goals.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Traction Transformer Onboard Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Traction Transformer Onboard Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Traction Transformer Onboard Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.