Global Transplant Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

7.29 Billion

USD

12.35 Billion

2024

2032

USD

7.29 Billion

USD

12.35 Billion

2024

2032

| 2025 –2032 | |

| USD 7.29 Billion | |

| USD 12.35 Billion | |

|

|

|

|

Transplant Diagnostics Market Size

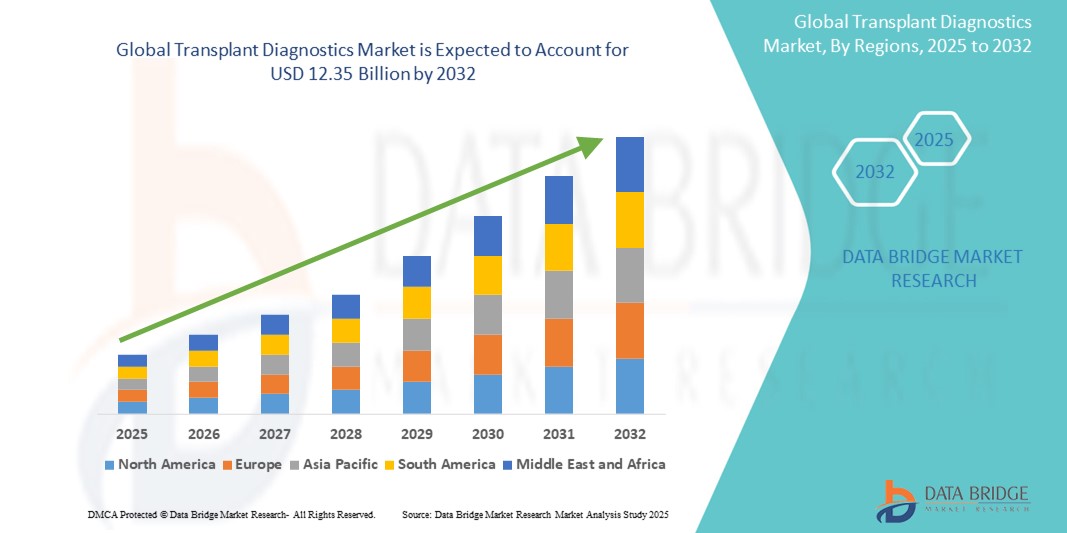

- The global transplant diagnostics market size was valued at USD 7.29 billion in 2024 and is expected to reach USD 12.35 billion by 2032, at a CAGR of 6.80% during the forecast period

- This growth is driven by factors such as the increasing number of organ transplant procedures, rising prevalence of chronic diseases requiring transplants, advancements in molecular diagnostics, and growing awareness about transplant immunology

Transplant Diagnostics Market Analysis

- Transplant diagnostics are critical for ensuring the success of organ transplants by assessing organ compatibility, monitoring rejection, and evaluating the immune response. They are essential for procedures such as kidney, liver, heart, and lung transplants

- The demand for transplant diagnostics is significantly driven by the increasing number of organ transplant surgeries, rising prevalence of chronic diseases, and advancements in diagnostic technologies such as molecular testing and genetic profiling

- North America is expected to dominate the transplant diagnostics market with a largest market share of 33.1%, due to the high volume of transplant procedures, advanced healthcare infrastructure, and strong presence of key players in the diagnostics sector

- Asia-Pacific is expected to be the fastest growing region in the transplant diagnostics market during the forecast period due to advancements in healthcare infrastructure, increasing healthcare expenditure and rising disposable income. Also, there has been significant increase in prevalence of chronic disease in middle age and geriatric population especially in countries such as China, Japan and India

- Diagnostic applications segment is expected to dominate the market with a largest market share of 71.2% due to the increasing demand for accurate and reliable testing methods to ensure organ compatibility and prevent transplant rejection. Diagnostic applications, including molecular testing, genetic profiling, and serological assays, are essential in determining the suitability of donor organs and monitoring the recipient's immune response

Report Scope and Transplant Diagnostics Market Segmentation

|

Attributes |

Transplant Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Transplant Diagnostics Market Trends

“Advancements in Molecular Diagnostics and Genetic Testing for Transplantation”

- One prominent trend in the evolution of transplant diagnostics is the increasing integration of molecular diagnostics and genetic testing technologies

- These innovations enable more precise matching of organ donors and recipients by analyzing genetic markers and immune system compatibility, improving transplant success rates and reducing the risk of organ rejection

- For instance, next-generation sequencing (NGS) and genomic profiling are being increasingly used to assess genetic compatibility and predict immune responses, ensuring better outcomes for patients

- These advancements are revolutionizing transplant diagnostics, enhancing the accuracy of transplant procedures, and driving the demand for more sophisticated diagnostic tools that aid in better organ transplant planning and management

Transplant Diagnostics Market Dynamics

Driver

“Growing Need Due to Increasing Organ Transplants”

- The rising number of organ transplant procedures worldwide is significantly contributing to the increased demand for transplant diagnostic solutions

- As the prevalence of chronic diseases such as kidney failure, heart disease, and liver disorders rises, more patients are requiring organ transplants, further driving the need for accurate diagnostic tools

- The demand for diagnostic solutions in transplant procedures ensures better matching of donors and recipients, reducing the risk of transplant rejection and improving patient outcomes

For instance,

- In June 2023, according to a report by the World Health Organization (WHO), the global number of organ transplants continues to increase, with over 150,000 transplants performed annually worldwide. This growing need highlights the importance of effective transplant diagnostic tools

- As the demand for organ transplants rises due to increasing chronic diseases and aging populations, the need for advanced diagnostic technologies to ensure better compatibility and reduce rejection rates also increases

Opportunity

“Advancing Transplant Diagnostics with Artificial Intelligence Integration”

- AI-powered transplant diagnostic solutions can enhance accuracy, streamline data analysis, and optimize donor-recipient matching, enabling medical professionals to make more informed decisions during the transplant process

- AI algorithms can analyze complex medical data in real-time, such as genetic compatibility and organ health, providing instant feedback to assist in transplant decisions and reduce the risk of organ rejection

- Additionally, AI can assist in predictive analytics, enabling the identification of potential complications post-transplant and guiding personalized treatment plans

For instance,

- In February 2025, according to a study published in the Journal of Transplantation, AI algorithms based on machine learning can accurately predict transplant rejection by analyzing histopathological data and genomic profiles. These tools can process large amounts of data quickly and provide critical insights that improve long-term transplant outcomes

- The integration of AI in transplant diagnostics can lead to improved patient survival rates, faster recovery times, and enhanced overall transplant success by providing more precise diagnostic and predictive capabilities

Restraint/Challenge

“High Costs and Limited Accessibility Hindering Market Expansion”

- The high cost of transplant diagnostic systems remains a significant challenge for the market, particularly limiting access in developing regions and for smaller healthcare facilities with constrained budgets

- Advanced transplant diagnostic equipment, including genetic testing systems and histopathology tools, can be very expensive, often ranging from tens of thousands to several hundred thousand dollars

- This financial barrier deters many smaller hospitals, clinics, and healthcare providers from investing in the latest technologies, resulting in continued reliance on outdated diagnostic methods and slower adoption of advanced systems

For instance,

- In March 2024, according to an article published by the Journal of Transplantation, one of the key obstacles in the broader adoption of advanced transplant diagnostic technologies is the high cost, which disproportionately affects healthcare systems in lower-income regions. The inability to afford modern diagnostic tools may compromise the accuracy of donor-recipient matching and increase the risk of transplant rejection

- As a result, these cost challenges limit the accessibility and quality of transplant diagnostics in some regions, hindering the overall growth and development of the global transplant diagnostics market

Transplant Diagnostics Market Scope

The market is segmented on the basis of product type, technology, transplant type, application, end user, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Technology |

|

|

By Transplant Type |

|

|

By Application |

|

|

By End User |

|

|

By Distribution Channel

|

|

In 2025, the diagnostic applications is projected to dominate the market with a largest share in application segment

The diagnostic applications segment is expected to dominate the transplant diagnostics market with the largest share of 71.2% due to the increasing demand for accurate and reliable testing methods to ensure organ compatibility and prevent transplant rejection. Diagnostic applications, including molecular testing, genetic profiling, and serological assays, are essential in determining the suitability of donor organs and monitoring the recipient's immune response

The solid organ transplantation is expected to account for the largest share during the forecast period in transplant type segment

In 2025, the solid organ transplantation segment is expected to dominate the market with the largest market share of 45.6% due to the increasing prevalence of organ failure, particularly in the kidney, liver, and heart, which drives the demand for solid organ transplants. Additionally, advancements in diagnostic technologies that improve organ matching and reduce rejection rates are further fueling the growth in this segment

Transplant Diagnostics Market Regional Analysis

“North America Holds the Largest Share in the Transplant Diagnostics Market”

- North America dominates the transplant diagnostics market with a largest market share of 33.1%, driven by advanced healthcare infrastructure, high adoption of cutting-edge diagnostic technologies, and the strong presence of key market players

- The U.S. holds a significant share of 45.5%, due to the increasing prevalence of chronic diseases requiring organ transplantation, high demand for precision diagnostics to improve transplant success, and continued advancements in molecular diagnostics

- The region benefits from well-established reimbursement policies and robust investments in research and development by leading medical device companies, further strengthening its market dominance

- Additionally, the increasing number of organ transplant procedures, along with advancements in transplant diagnostic technologies, is fueling market growth across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Transplant Diagnostics Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the transplant diagnostics market, driven by rapid expansion in healthcare infrastructure, growing awareness of organ donation, and rising transplant volumes

- Countries such as China, India, and Japan are emerging as key markets due to their large population sizes, rising incidence of chronic diseases, and increased demand for transplantation services and diagnostics

- Japan remains a major market with advanced healthcare systems, and high adoption of transplant diagnostics technologies aimed at improving transplant outcomes and reducing organ rejection

- China and India, with increasing government and private sector investments in healthcare infrastructure, are expected to experience significant market growth as access to advanced transplant diagnostics improves and organ transplantation services expand

Transplant Diagnostics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Thermo Fisher Scientific Inc. (U.S.)

- Abbott (U.S.)

- QIAGEN N.V. (Germany)

- Bio-Rad Laboratories, Inc. (U.S.)

- Merck Group (Germany)

- Becton, Dickinson and Company (U.S.)

- Hoffmann-La Roche AG (Switzerland)

- Illumina, Inc. (U.S.)

- HLA Typing Ltd. (U.K.)

- Sartorius AG (Germany)

- GenDx (Netherlands)

- LABORATORY CORPORATION OF AMERICA HOLDINGS (U.S.)

- Pall Corporation (U.S.)

- Luminex Corporation (U.S.)

- Grifols (Spain)

- Eurofins Scientific (Luxembourg)

- CareDx, Inc. (U.S.)

- Asuragen, Inc. (U.S.)

- Roche Diagnostics (Switzerland)

- Ortho Clinical Diagnostics (U.S.)

Latest Developments in Global Transplant Diagnostics Market

- In August 2022, QIAGEN announced the publication of a validation study for its clinical decision support software, QIAGEN Clinical Insight Interpret One (QCI Interpret One), in the Journal of Molecular Pathology. The study, independently conducted by Genomics Quality Assessment (GenQA) and commissioned by QIAGEN, demonstrated that QCI Interpret One exhibited superior concordance with expert panels in variant classification for oncology patient samples when compared to human reviewers. Its contribution in global transplant diagnostics market by facilitating precise and efficient decision support tools which are crucial for optimizing patient care and enhancing diagnostic accuracy

- In March 2022, Immucor, Inc. expanded its transplant diagnostics portfolio with the introduction of two new offerings, further reinforcing its commitment to advancing histocompatibility in transfusion and transplantation diagnostics. This strategic expansion holds significant relevance to the global Transplant Diagnostics Market, where the need for advanced diagnostic tools is critical to improving transplant success rates and patient outcomes

- In March 2022, Biocartis and Ophiomics announced a strategic collaboration to commercialize HepatoPredict, a prognostic gene expression signature test developed to identify liver transplant recipients most likely to benefit from the procedure. This partnership leverages Biocartis' expertise in commercialization alongside Ophiomics' pioneering research in liver disease diagnostics, with the goal of enhancing patient outcomes and optimizing decision-making in liver transplantation. This collaboration holds significant relevance to the global Transplant Diagnostics Market, where the demand for precise diagnostic tools is growing. HepatoPredict represents a key advancement in personalized medicine, offering clinicians a valuable tool to improve transplant success rates and better tailor treatments to individual patients

- In January 2022, Hoffmann-La Roche Ltd. introduced Cobas Infinity Edge, a cloud-based point-of-care platform designed for global accessibility. This innovative solution equips healthcare practitioners with advanced technology to effectively manage patient data, streamline clinical workflows, and facilitate seamless connectivity across healthcare systems worldwide. The introduction of Cobas Infinity Edge provide real-time access to patient data and enhanced connectivity are crucial for improving transplant outcomes

- In May 2024, Thermo Fisher introduced the CXCL10 testing service, specifically designed for kidney transplant patients. This advanced service enables faster detection of the CXCL10 chemokine compared to existing testing methods, offering enhanced diagnostic efficiency. The launch of the CXCL10 testing service is highly relevant for timely and accurate monitoring of transplant rejection and critical for improving patient outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.