Middle East And Africa Wearable Devices In Sports Market

Market Size in USD Million

CAGR :

%

USD

528.63 Million

USD

1,124.95 Million

2025

2033

USD

528.63 Million

USD

1,124.95 Million

2025

2033

| 2026 –2033 | |

| USD 528.63 Million | |

| USD 1,124.95 Million | |

|

|

|

|

Middle East and Africa Wearable Devices in Sports Market Size

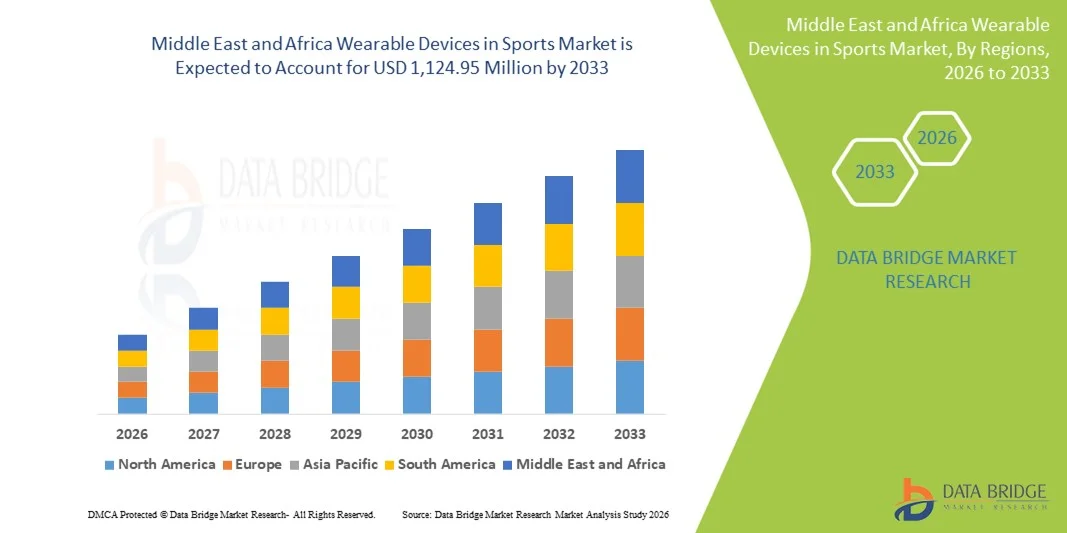

- The Middle East and Africa wearable devices in sports market size was valued at USD 528.63 million in 2025 and is expected to reach USD 1,124.95 million by 2033, at a CAGR of 9.9% during the forecast period

- The market growth is largely fueled by rising adoption of advanced wearable technologies for sports performance tracking, heart rate and activity monitoring, and integration of IoT and Bluetooth technologies in sports wearables across both individual consumers and sports centers, reflecting increasing digitalization of fitness and athletic activities in the region

- Furthermore, growing health and fitness awareness, expanding sports activities, and heightened demand for data‑driven insight solutions for training and performance optimization are establishing wearable devices as essential tools for athletes, coaches, and fitness enthusiasts accelerating uptake of smart sports wearables and significantly boosting industry growth in Middle East and Africa.

Middle East and Africa Wearable Devices in Sports Market Analysis

- Wearable devices in sports, including smartwatches, fitness trackers, and sensor-enabled apparel, are increasingly vital tools for monitoring performance, tracking health metrics, and enhancing training efficiency for athletes, coaches, and fitness enthusiasts across both professional and recreational settings due to their convenience, real-time data collection, and integration with mobile and cloud-based platforms

- The escalating demand for wearable sports devices is primarily fueled by rising health and fitness awareness, growing popularity of sports and outdoor activities, and a rising preference for personalized, data-driven insights to optimize athletic performance and overall wellness.

- United Arab Emirates dominated the Middle East and Africa wearable devices in sports market in 2025 with a market share of 22.3%, characterized by high disposable incomes, rapid adoption of smart fitness technologies, and a strong presence of tech-savvy consumers

- Egypt is expected to be the fastest-growing market during the forecast period due to increasing urbanization, rising disposable incomes, and expanding awareness of connected fitness solutions

- The Fitness & Heart Rate Monitors segment dominated the market with a share of 41.5% in 2025, driven by its essential functionality in tracking health metrics, optimizing training performance, and growing consumer preference for accurate, real-time wearable devices

Report Scope and Middle East and Africa Wearable Devices in Sports Market Segmentation

|

Attributes |

Middle East and Africa Wearable Devices in Sports Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Wearable Devices in Sports Market Trends

Advanced Fitness Tracking Through AI and Sensor Integration

- A significant and accelerating trend in the Middle East and Africa wearable devices in sports market is the integration of artificial intelligence (AI) and advanced sensor technologies in fitness and heart rate monitors, enabling more precise activity tracking, health monitoring, and personalized training recommendations

- For instance, the Garmin Forerunner series integrates AI-based analytics and multi-sensor tracking to provide real-time heart rate, calorie burn, and running efficiency metrics for professional and amateur athletes

- AI integration in wearable devices enables features such as learning user exercise patterns to suggest optimized workouts and providing intelligent alerts for irregular heart rates or recovery needs. For instance, the Fitbit Sense uses AI algorithms to detect anomalies in heart rate and stress levels

- The seamless integration of wearables with mobile apps and cloud platforms facilitates centralized monitoring of various fitness metrics, allowing users to track sleep, hydration, and performance data alongside exercise routines in one interface

- This trend toward intelligent, interconnected, and data-driven wearable devices is reshaping user expectations for sports and fitness monitoring. Consequently, companies such as Polar and Huawei are developing AI-enabled wearables with real-time feedback, automated workout suggestions, and multi-sport compatibility

- The demand for wearable devices offering AI and sensor-enabled functionality is growing rapidly across both individual consumers and sports facilities, as users increasingly prioritize precise performance insights and holistic fitness management

- Wearables are increasingly incorporating multi-sport modes and environmental sensors such as GPS, temperature, and altitude tracking, enhancing their versatility for outdoor activities and professional sports. For instance, Suunto watches combine GPS, heart rate, and barometric sensors to provide comprehensive activity insights

Middle East and Africa Wearable Devices in Sports Market Dynamics

Driver

Rising Health Awareness and Sports Participation

- The increasing health and fitness consciousness among consumers, coupled with expanding participation in organized sports and recreational activities, is a key driver of the heightened demand for wearable sports devices

- For instance, in March 2025, Garmin Middle East launched an AI-powered sports tracking campaign targeting runners and fitness enthusiasts across UAE and Saudi Arabia to enhance personalized training

- As consumers seek to optimize performance and monitor health metrics such as heart rate, calories burned, and sleep quality, wearables offer compelling advantages over traditional monitoring methods

- Furthermore, growing adoption of connected fitness ecosystems, including gyms, sports academies, and digital coaching platforms, is making wearable devices an essential tool for performance tracking and injury prevention

- The convenience of real-time feedback, activity tracking, and integration with mobile applications, alongside increasing affordability of entry-level devices, are key factors propelling adoption across both professional athletes and casual fitness enthusiasts

- Government initiatives promoting health and sports participation in countries like UAE and Saudi Arabia are boosting market growth by creating structured fitness programs and incentives for wearable adoption. For instance, the Saudi Sports for All Federation encourages using smart wearables in community fitness programs

- Rising corporate wellness programs are also contributing to adoption, as companies provide employees with wearable devices to track physical activity, reduce health risks, and enhance productivity. For instance, multinational companies in Dubai and Johannesburg have integrated wearable monitoring into their employee wellness schemes

Restraint/Challenge

High Costs and Sensor Accuracy Concerns

- The relatively high cost of advanced wearable sports devices compared to basic fitness gadgets, particularly those with AI or multi-sensor capabilities, can limit adoption among price-sensitive consumers in the region

- For instance, some premium devices from Polar or Garmin may cost significantly more than standard fitness trackers, which can be a barrier for casual users or emerging markets like Kenya and Nigeria

- Concerns regarding sensor accuracy and data reliability, especially for heart rate monitoring during high-intensity exercises, can also hinder consumer confidence and reduce repeat purchases

- While mid-range devices such as Xiaomi Mi Band offer affordable options, they may lack advanced features or precise data, limiting their appeal for serious athletes and fitness-focused consumers

- Overcoming these challenges through affordable yet accurate devices, consumer education on data interpretation, and increased awareness of the benefits of sensor-enabled wearables will be critical for sustained market growth across Middle East and Africa

- Limited local support, after-sales services, and warranty coverage in some countries may affect consumer confidence in adopting high-end wearable devices. For instance, customers in smaller markets like Kenya or Egypt may experience delays in device servicing or software updates

- Privacy concerns regarding sensitive health and biometric data collected by wearables can also restrain adoption, as consumers remain cautious about how their data is stored and used. For instance, some users hesitate to share heart rate and activity data with cloud-based apps due to perceived security risks

Middle East and Africa Wearable Devices in Sports Market Scope

The market is segmented on the basis of component, product type, site, application, end user, and distribution channel.

- By Component

On the basis of component, the market is segmented into hardware and software. The Hardware segment dominated the market with the largest share in 2025, driven by the critical role of sensors, processors, and battery systems in ensuring accurate fitness tracking and reliable device performance. Consumers in UAE, Saudi Arabia, and South Africa prioritize high-quality hardware for durability and precise data collection, particularly in heart rate monitoring and multi-sport applications. The segment also benefits from technological advancements in lightweight, ergonomic designs and waterproof materials, which enhance user comfort and device versatility. Strong brand reputation and integration with global sports monitoring standards further reinforce hardware dominance. Hardware-driven innovations, including GPS, accelerometers, and optical sensors, make wearables suitable for professional and casual athletes alike. Furthermore, the growing adoption of wearables in sports centers and fitness academies ensures sustained demand for hardware-intensive devices.

The Software segment is expected to witness the fastest growth from 2026 to 2033 due to rising adoption of AI analytics, cloud-based fitness tracking, and mobile app integration. Software enables personalized insights, virtual coaching, and performance trend analysis, which are increasingly valued by both individual users and sports organizations. Apps that sync with hardware devices for heart rate, calorie tracking, and sleep monitoring drive continuous engagement and recurring revenue through subscriptions. Software updates also enhance device functionality over time, making older hardware compatible with new features. Gamification and community-based fitness challenges facilitated by software are increasingly popular in countries like Egypt and Kenya. The software segment growth is further supported by expansion of online fitness platforms and virtual training services across the region.

- By Product Type

On the basis of product type, the market is segmented into pedometers, fitness & heart rate monitors, smart fabrics, smart camera, shot trackers, and others. The Fitness & Heart Rate Monitors segment dominated the market with the largest revenue share of 41.5% in 2025, owing to its core functionality in tracking vital health metrics such as heart rate, calories burned, and workout intensity. Users across UAE, Saudi Arabia, and South Africa rely on these devices for real-time monitoring during professional and recreational activities. The segment benefits from continuous innovations like multi-sport tracking modes, AI-based analytics, and smartphone connectivity. Rising health awareness and increased sports participation amplify demand for accurate monitoring devices. The segment also enjoys strong brand loyalty, with consumers willing to invest in trusted devices like Garmin, Polar, and Fitbit. Corporate wellness programs and fitness center integrations further reinforce its dominance.

The Smart Fabrics segment is expected to witness the fastest growth from 2026 to 2033, fueled by the adoption of sensor-embedded apparel that provides continuous biometric monitoring without the need for handheld devices. Athletes and fitness enthusiasts increasingly prefer smart clothing for real-time heart rate tracking, posture analysis, and motion detection. The growth is supported by advances in conductive fibers, washable sensors, and AI-powered analytics embedded in fabrics. Smart fabrics also integrate seamlessly with apps to provide insights on performance, recovery, and training optimization. Market expansion in professional sports academies and premium gyms is driving adoption in UAE and South Africa. Consumer interest in wearable fashion-tech blends, especially among younger demographics, accelerates this segment’s growth.

- By Site

On the basis of site, the market is segmented into headband, handheld, arm & wrist, clip, shoe sensor, and others. The Arm & Wrist segment dominated the market in 2025 due to the widespread popularity of wrist-worn fitness trackers and smartwatches. Devices placed on the arm or wrist offer convenience, continuous heart rate monitoring, and easy integration with mobile apps. Fitness centers and home users across UAE, Saudi Arabia, and South Africa prefer wrist-based wearables for tracking step counts, heart rate, sleep, and multi-sport activity. Ergonomic designs, lightweight materials, and durable battery life make them suitable for prolonged daily use. Brand campaigns emphasizing wrist-worn convenience further drive consumer preference. Additionally, compatibility with both iOS and Android platforms reinforces the dominance of arm & wrist devices.

The Shoe Sensor segment is expected to witness the fastest growth from 2026 to 2033 due to its specialized application in performance tracking for running, football, and other sports requiring detailed footwork analytics. Shoe sensors provide accurate metrics on stride length, ground contact time, and motion patterns. Rising adoption in professional sports academies and advanced training facilities in UAE and South Africa is fueling demand. Integration with apps for real-time coaching and injury prevention enhances appeal. The segment is also attracting fitness enthusiasts seeking highly precise metrics beyond basic heart rate and step counts.

- By Application

On the basis of application, the market is segmented into step counts, calorie burnt, heart rate monitoring, sleep tracking, and others. The Heart Rate Monitoring segment dominated the market in 2025 as users increasingly prioritize cardiovascular health, workout intensity management, and real-time performance feedback. Fitness enthusiasts, athletes, and home users across UAE, Saudi Arabia, and South Africa rely on heart rate monitoring for safe and effective exercise. The segment benefits from accurate optical and sensor-based measurement technologies, integration with mobile apps, and AI-driven performance suggestions. Corporate wellness initiatives and gym memberships also promote the adoption of heart rate monitoring devices. The availability of multi-sport modes further enhances device utility. Continuous innovations in wearable accuracy and battery life reinforce dominance.

The Sleep Tracking segment is expected to witness the fastest growth from 2026 to 2033, driven by rising awareness of the importance of sleep for recovery and overall health. Wearables capable of monitoring sleep patterns, duration, and quality are gaining popularity in UAE, Saudi Arabia, and South Africa. Integration with apps that suggest lifestyle or activity modifications enhances user engagement. Sleep tracking devices also appeal to fitness enthusiasts and professional athletes for optimizing recovery. Partnerships with wellness programs and hospitals further boost market penetration. Technological advances in sensor sensitivity and comfort contribute to accelerated adoption.

- By End User

On the basis of end user, the market is segmented into sports centers, fitness centers, homecare settings, and others. The Fitness Centers segment dominated the market in 2025, driven by the need to provide members with personalized training insights, performance tracking, and engagement analytics. Fitness centers in UAE, Saudi Arabia, and South Africa integrate wearable devices into structured training programs for both casual and professional clients. Wearables help trainers monitor heart rate, calories, and activity intensity, enhancing service quality. Corporate gyms also adopt devices to incentivize member performance. Partnerships with wearable brands further reinforce dominance. Multi-user compatibility and device robustness make fitness center adoption practical and profitable.

The Homecare Settings segment is expected to witness the fastest growth from 2026 to 2033 due to rising adoption of wearables for self-monitoring of health, fitness, and recovery at home. Consumers in UAE, Egypt, and Nigeria increasingly use devices for personalized coaching, health tracking, and integration with virtual fitness platforms. The COVID-19 pandemic accelerated adoption of at-home fitness solutions. AI-driven insights and remote monitoring features further encourage usage. Growing disposable income and awareness of wellness technologies boost growth. The segment also benefits from increasing availability of affordable wearables for home users.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into independent retail store, hypermarket/supermarket, brand store, and online sale channel. The Online Sale Channel segment dominated the market in 2025, driven by the convenience of direct-to-consumer purchasing, extensive product selection, and availability of detailed specifications and reviews. Consumers in UAE, Saudi Arabia, and South Africa prefer online platforms for price comparison, availability of the latest models, and home delivery. E-commerce promotions, subscription bundles, and app-linked services further encourage adoption. Online channels also provide access to niche products such as smart fabrics or advanced multi-sensor wearables. Partnerships between manufacturers and e-commerce platforms reinforce the dominance of online sales. Growing smartphone penetration and digital literacy strengthen this channel.

The Brand Store segment is expected to witness the fastest growth from 2026 to 2033 due to enhanced brand visibility, experiential demos, and dedicated support for premium wearables. Flagship stores in UAE and South Africa allow consumers to interact with products, try on smart fabrics, and receive personalized consultations. Brand stores also drive customer trust for high-value items and provide warranty and servicing facilities. Marketing campaigns, loyalty programs, and bundled offers further accelerate adoption. Rising disposable income and premiumization trends contribute to growth. Brand-exclusive stores also help educate customers on device functionalities and app integration.

Middle East and Africa Wearable Devices in Sports Market Regional Analysis

- United Arab Emirates dominated the Middle East and Africa wearable devices in sports market in 2025 with a market share of 22.3%, characterized by high disposable incomes, rapid adoption of smart fitness technologies, and a strong presence of tech-savvy consumers

- Consumers in the UAE highly value convenience, accurate heart rate and calorie tracking, AI-based workout recommendations, and seamless integration of wearable devices with mobile apps and cloud platforms, enhancing both home and professional fitness experiences

- This widespread adoption is further supported by high disposable incomes, well-established fitness infrastructure, and the presence of premium gyms and sports academies, making wearable devices a preferred solution for both individual users and organized fitness programs

The UAE Wearable Devices in Sports Market Insight

The UAE wearable devices in sports market captured the largest revenue share of 22.3% in 2025, fueled by rapid adoption of smart fitness devices and a tech-savvy population embracing digital health solutions. Consumers increasingly prioritize performance tracking, heart rate monitoring, and AI-based workout analytics. The growing trend of home gyms, professional fitness centers, and corporate wellness programs is further propelling market growth. Integration with mobile apps, cloud platforms, and wearable ecosystems enhances convenience and engagement. Premium gyms and sports academies provide exposure to advanced wearables, boosting adoption. Additionally, rising disposable incomes and government initiatives promoting health and fitness contribute to sustained market expansion.

Saudi Arabia Wearable Devices in Sports Market Insight

The Saudi Arabia wearable devices in sports market accounted for 18.7% of the regional revenue in 2025, driven by government-led programs encouraging sports participation and wellness awareness. Consumers are increasingly investing in smart wearables for heart rate monitoring, step tracking, and AI-assisted fitness analytics. The popularity of fitness centers, sports academies, and recreational facilities supports adoption across both professional and casual users. Integration with mobile applications, real-time coaching, and multi-sport tracking enhances the appeal of wearable devices. Rising urbanization, disposable income growth, and technological literacy further support market expansion. Both individual and institutional buyers are contributing to steady revenue growth.

South Africa Wearable Devices in Sports Market Insight

South Africa held a 16.4% revenue share in 2025, propelled by growing awareness of connected fitness solutions and rising health consciousness. Consumers increasingly use wearables to monitor heart rate, calories, sleep patterns, and activity intensity. Corporate wellness programs, fitness centers, and at-home exercise adoption are driving demand. Advanced features like GPS tracking, AI coaching, and smartphone integration enhance user engagement. Increasing penetration of online sales channels and retail availability further supports growth. The presence of professional sports academies and urban fitness hubs reinforces market expansion.

Egypt Wearable Devices in Sports Market Insight

Egypt is the fastest-growing market in Middle East & Africa in 2025 and accelerated growth projected from 2026 onward. Urban population growth, rising health awareness, and expanding adoption of wearable devices in home fitness and recreational sports are fueling demand. Consumers increasingly rely on wearables for heart rate monitoring, calorie tracking, and AI-driven workout recommendations. Integration with mobile apps and cloud platforms facilitates personalized insights, virtual coaching, and gamified fitness experiences. The affordability of entry-level devices and growing e-commerce availability support wider adoption. Fitness center partnerships and community wellness programs are further driving market expansion

Middle East and Africa Wearable Devices in Sports Market Share

The Middle East and Africa Wearable Devices in Sports industry is primarily led by well-established companies, including:

- WHOOP, Inc. (U.S.)

- Oura Health Oy (Finland)

- Garmin Ltd. (U.S.)

- Fitbit, Inc. (U.S.)

- Coros Wearables (U.S.)

- Apple Inc. (U.S.)

- Polar Electro Oy (Finland)

- Suunto Oy (Finland)

- Samsung Electronics Co., Ltd. (South Korea)

- Fitbit International Ltd. (Ireland)

- Under Armour, Inc. (U.S.)

- Nike, Inc. (U.S.)

- Adidas AG (Germany)

- Xiaomi Corporation (China)

- Google LLC (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Oppo (China)

- Sony Corporation (Japan)

- Xsensio AG (Switzerland)

What are the Recent Developments in Middle East and Africa Wearable Devices in Sports Market?

- In November 2025, Huawei launched a new wearable device in Kenya targeting health and fitness enthusiasts. The event in Nairobi unveiled the Huawei Watch GT6, designed with advanced features tailored for high‑intensity sports such as swimming, cycling, and running, including heartbeat analysis and emotional well‑being indicators. The launch highlights the rising demand for smart wearables across East Africa as consumers adopt technology to support active, health‑conscious lifestyles

- In February 2025, wearable technology brand Black announced a strategic partnership with the Stanbic Black Pirates Rugby Club in Uganda to incorporate advanced wearable devices into team training and fan engagement. This collaboration leverages Black’s tech products to provide real‑time performance tracking and aims to enhance both player analytics and fan experiences through interactive initiatives

- In January 2025, Arab Health, the Middle East’s largest healthcare event, announced it would showcase wearable health and fitness device technologies at its annual congress in Dubai. This event highlighted rising wearable adoption for sports, health, and wellness tracking, noting expanding demand across the Middle East & Africa region for devices that collect vital and physical activity data in real time

- In October 2023, Huawei launched a new range of smart wearables (including health‑focused watches and audio devices) in the UAE and broader Middle East & Africa market. The launch emphasized fitness and health‑centric features aimed at elevating consumer engagement with sports and wellness monitoring, reflecting broader industry momentum for connected fitness technology in the region

- In May 2023, Egyptian tech startup CardoO launched its first IoT‑enabled smartwatch, marking a major local entry into wearable sports and fitness devices in the Middle East & Africa region. The stylish smartwatch combines health and activity tracking with smart connectivity and is designed to meet diverse consumer needs, representing a significant step for regional consumer tech in wearables

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.