North America Kyphoplasty Market

Market Size in USD Million

CAGR :

%

USD

354.30 Million

USD

474.70 Million

2024

2032

USD

354.30 Million

USD

474.70 Million

2024

2032

| 2025 –2032 | |

| USD 354.30 Million | |

| USD 474.70 Million | |

|

|

|

|

Kyphoplasty Market Size

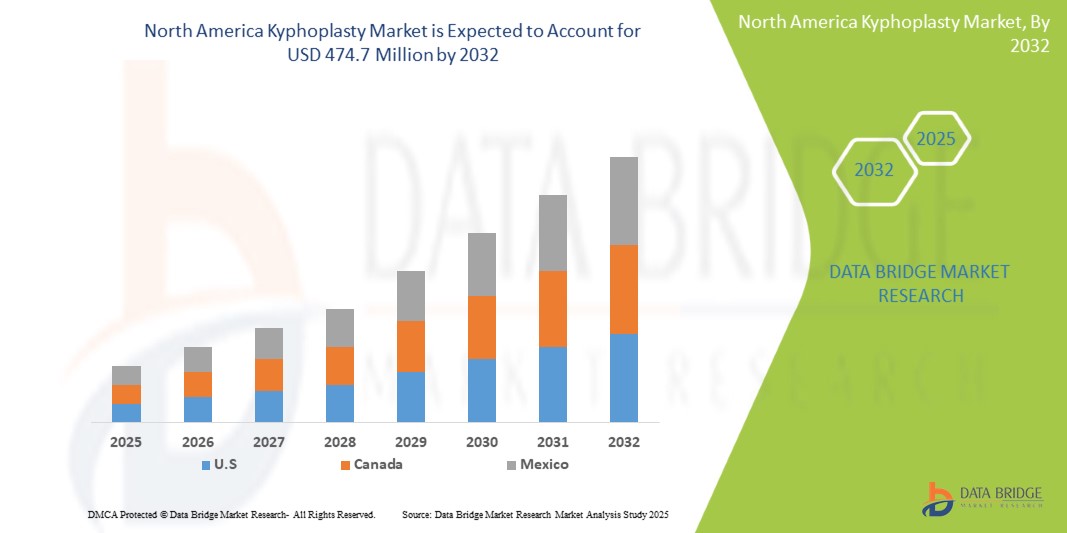

- The North America Kyphoplasty Market was valued at USD 354.3 Million in 2024 and is expected to reach USD by 474.7 million 2032, at a CAGR of 5.2% during the forecast period

- The rising prevalence of osteoporosis and vertebral compression fractures (VCFs) due to an aging population, which increases the demand for effective treatment options like kyphoplasty. Additionally, the growing preference for minimally invasive procedures and advancements in medical technologies that offer faster recovery times and reduced complications are contributing to the increased adoption of kyphoplasty across the region.

North America Kyphoplasty Market Analysis

- Kyphoplasty plays a critical role in the treatment of vertebral compression fractures (VCFs), which are commonly associated with osteoporosis and aging. This procedure provides pain relief, restores vertebral height, and improves mobility, significantly enhancing the quality of life for patients. Kyphoplasty is widely used in hospitals, outpatient clinics, and rehabilitation centers, and is increasingly available in home care settings for post-surgery recovery.

- The demand for Kyphoplasty in North America is primarily driven by the rising prevalence of osteoporosis and vertebral fractures, particularly among the elderly population. Additionally, the growing awareness of the benefits of minimally invasive procedures, along with advancements in medical technology that improve surgical outcomes and reduce recovery time, are contributing to market growth. Increasing adoption of outpatient procedures and home-based recovery solutions further supports the demand for kyphoplasty in the region.

- North America is a key region in the North America Kyphoplasty market, supported by a strong healthcare infrastructure, early adoption of advanced medical technologies, and favorable reimbursement policies. The United States holds a dominant share, driven by high healthcare spending, a significant aging population, and the widespread adoption of advanced surgical techniques that reduce hospital stays and improve patient outcomes.

Report Scope Kyphoplasty Market Segmentation

|

Attributes |

Kyphoplasty Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Kyphoplasty Market Trends

“Minimally Invasive Innovations and Outpatient Procedure Growth”

- A major trend shaping the Kyphoplasty market is the growing preference for minimally invasive surgical techniques, which offer reduced recovery times, less postoperative pain, and shorter hospital stays. Advances in image-guided procedures and specialized instruments are enabling more precise vertebral restoration, increasing surgeon confidence and patient satisfaction.

- Another key trend is the shift toward outpatient and ambulatory surgical settings, driven by cost-effectiveness and healthcare system efficiency. As kyphoplasty procedures become safer and faster, more patients are being treated in outpatient centers, supported by improved post-operative care protocols and follow-up technologies. This transition is expanding patient access and reducing the overall burden on hospitals.

- For instance, the growing awareness of osteoporosis and vertebral compression fractures (VCFs), especially in the aging population, is driving demand for kyphoplasty procedures. As patients seek minimally invasive treatments to manage fractures and reduce pain, the market for kyphoplasty devices is expanding.

- Additionally, there is a shift towards more advanced and comfortable kyphoplasty tools that enable faster recovery times and improved patient outcomes. The integration of smart technologies, such as real-time imaging and AI-guided systems, is enhancing procedural precision, making these treatments more accessible and effective for a broader patient demographic, including those with chronic conditions.

Kyphoplasty Market Dynamics

Driver

“Rising Prevalence of Osteoporotic Fractures and Increasing Geriatric Population”

- The North America Kyphoplasty Market is witnessing strong growth driven by the rising incidence of osteoporosis-related vertebral compression fractures (VCFs), particularly among the elderly population. As life expectancy increases, so does the number of age-related spinal conditions that require minimally invasive treatments like kyphoplasty.

- The growing awareness of minimally invasive procedures that offer quick pain relief, restore spinal stability, and reduce hospitalization time is accelerating the adoption of kyphoplasty across hospitals and outpatient settings.

- Healthcare systems in North America are increasingly focused on reducing long-term disability and improving mobility among older adults, making kyphoplasty a preferred solution due to its effectiveness in restoring vertebral height and function.

For instance,

- According to the National Osteoporosis Foundation, about 1.5 million vertebral fractures occur annually in the U.S., most of which are due to osteoporosis.

- In 2024, Medtronic launched a next-generation kyphoplasty balloon catheter with enhanced navigation and bone access capabilities, allowing safer and more effective treatment of spinal fractures.

Opportunity

“Technological Advancements and Expansion into Outpatient & Ambulatory Care Settings”

- A significant opportunity lies in the continued innovation in kyphoplasty tools and materials, including advanced balloon systems, real-time imaging integration, and cement delivery techniques that improve precision and safety.

- The expansion of kyphoplasty procedures into outpatient and ambulatory surgical centers (ASCs) is creating cost-effective options for patients and healthcare providers, reducing the overall burden on hospital resources.

- Increasing demand for value-based care models and shorter recovery times supports the integration of kyphoplasty into routine care for vertebral fractures, especially as reimbursement and clinical outcomes improve.

For instance,

- In early 2024, Stryker introduced a streamlined kyphoplasty system specifically designed for ambulatory surgery centers, offering faster setup and reduced procedure time.

- Partnerships between device manufacturers and outpatient care networks are facilitating training and expanding access to kyphoplasty beyond urban hospital systems.

Restraint/Challenge

“High Procedure Cost and Reimbursement Barriers”

- One of the key challenges facing the Kyphoplasty Market in North America is the high cost of the procedure, which includes specialized equipment, imaging support, and post-operative care. For many patients, especially those without comprehensive insurance, this can limit access to treatment.

- Inconsistent reimbursement policies across private and public insurance plans can create financial uncertainty for both providers and patients. These disparities often affect access to kyphoplasty in rural or underserved regions.

- Additionally, the complex regulatory landscape and rigorous clinical validation requirements for new kyphoplasty devices can slow market entry, increase development costs, and limit innovation in the short term.

For instance,

- A 2023 report by the U.S. Centers for Medicare & Medicaid Services noted that reimbursement rates for vertebral augmentation procedures remain variable, leading to gaps in accessibility across states.

- Smaller healthcare providers often lack the capital to invest in kyphoplasty systems, especially if patient volumes are low or reimbursement timelines are prolonged.

Kyphoplasty Market Scope

The market is segmented on the basis, three notable segments based on By Product Type, Application, End User.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Application

|

|

|

By end user |

|

In 2025, the Balloon is projected to dominate the market with a largest share in product type segment

The Balloon is expected to lead the North America Kyphoplasty Market in 2025 with the largest share of 66.12% in 2025 driven by its ability to restore vertebral height more effectively and reduce spinal deformity in patients with compression fractures. The technique provides better control during cement delivery, minimizing the risk of leakage and complications. Additionally, the growing adoption of minimally invasive procedures in outpatient and ambulatory settings supports its widespread use.

The Kyphosis is expected to account for the largest share during the forecast period in application market

In 2025, Kyphosis is projected to account for the largest share of the North America Kyphoplasty Market by application with the largest market share of 31.68%. This is attributed to the high prevalence of osteoporotic vertebral compression fractures leading to spinal curvature. The growing elderly population and demand for minimally invasive spinal correction procedures are further driving this trend.

Kyphoplasty Market Regional Analysis

“U.S. is the Dominant Country in the Kyphoplasty Market”

- The United States dominates the North America Kyphoplasty Market, holding the largest share due to its well-established healthcare infrastructure, widespread access to minimally invasive surgical technologies, and strong presence of leading medical device manufacturers.

- The high prevalence of osteoporosis-related vertebral compression fractures (VCFs), combined with a large aging population and increasing demand for outpatient spinal procedures, is significantly driving the adoption of kyphoplasty across hospitals and ambulatory centers.

- Major companies such as Medtronic, Stryker, and Globus Medical operate extensively in the U.S., offering innovative balloon kyphoplasty systems and cement delivery tools that meet regulatory standards and clinical needs.

- Favorable reimbursement policies, government focus on reducing long-term disability, and growing physician awareness of minimally invasive spinal treatments further reinforce the U.S.’s leadership in the North American Kyphoplasty Market.

“Canada is Projected to Register the Highest Growth Rate”

- Canada is expected to witness the fastest growth in the North America Kyphoplasty Market, driven by increased government spending on bone health initiatives and improving access to spinal care services, especially for the elderly population.

- The country’s publicly funded healthcare system, coupled with growing awareness of minimally invasive fracture management options, is accelerating the adoption of kyphoplasty procedures.

- Expansion of ambulatory surgical centers and rehabilitation clinics, particularly in urban and semi-urban regions, is creating demand for efficient and low-risk vertebral compression treatments.

- Collaborative programs between health ministries, orthopedic societies, and research institutions are encouraging clinical training, technology transfer, and localized innovation in kyphoplasty solutions.

Kyphoplasty Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Stryker Corporation (U.S.)

- DePuy Synthes (Johnson & Johnson) (U.S.)

- Globus Medical (U.S.)

- Merit Medical Systems (U.S.)

- Medical Products (U.S.)

- Joimax GmbH (Germany)

- Smith & Nephew (U.K.)

- CareFusion (BD) (U.S.)

- Joline GmbH & Co. KG (Germany)

Latest Developments in North America Kyphoplasty Market

- in October 2021, Stryker set up an R&D lab in Australia (Queensland), which builds on the existing partnerships with researchers, hospitals, universities, and local governments, to drive the transformation of research into practical, commercially accessible precision medical device technology. This innovative R&D Lab will also associate with the company’s CMF instruments and endoscopy, medical, joint replacement, spine, & trauma, and extremities divisions to focus on research that drives technology platforms that can be used across facility lines over the upcoming years.

- in September 2020, The SpineJack implantable fracture reduction system developed by Stryker received the new technology add-on payment from the U.S. Centers for Medicare & Medicaid Services (CMS) as a component of the 2021 inpatient prospective payment system.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.