Europe Safety Systems Market

Marktgröße in Milliarden USD

CAGR :

%

USD

1.38 Billion

USD

2.25 Billion

2024

2032

USD

1.38 Billion

USD

2.25 Billion

2024

2032

| 2025 –2032 | |

| USD 1.38 Billion | |

| USD 2.25 Billion | |

|

|

|

|

Marktsegmentierung für Sicherheitssysteme in Europa nach Typ (Sicherheitssteuerungen und -relais, Sicherheits-Maschinensicht, Sicherheitssensoren und Sicherheitsschalter), Technologie (digitaler Sensor, intelligenter Sensor und analoger Sensor), Funktion (Maschinenschutz, Prozessüberwachung, Energiemanagement, Einparkhilfe, Kollisionsvermeidung, Vibrationsüberwachungssysteme, Not-Aus-Systeme und andere), Unternehmensgröße (große Unternehmen und kleine und mittlere Unternehmen), Endbenutzer (Automobilindustrie, Luft- und Raumfahrt und Verteidigung, Gesundheitswesen, Öl und Gas, Transport und Logistik, Unterhaltungselektronik, Lebensmittel und Getränke, Bauindustrie und andere), Vertriebskanal (Direktvertrieb und indirekter Vertrieb) – Branchentrends und Prognose bis 2032

Marktgröße für Sicherheitssysteme in Europa

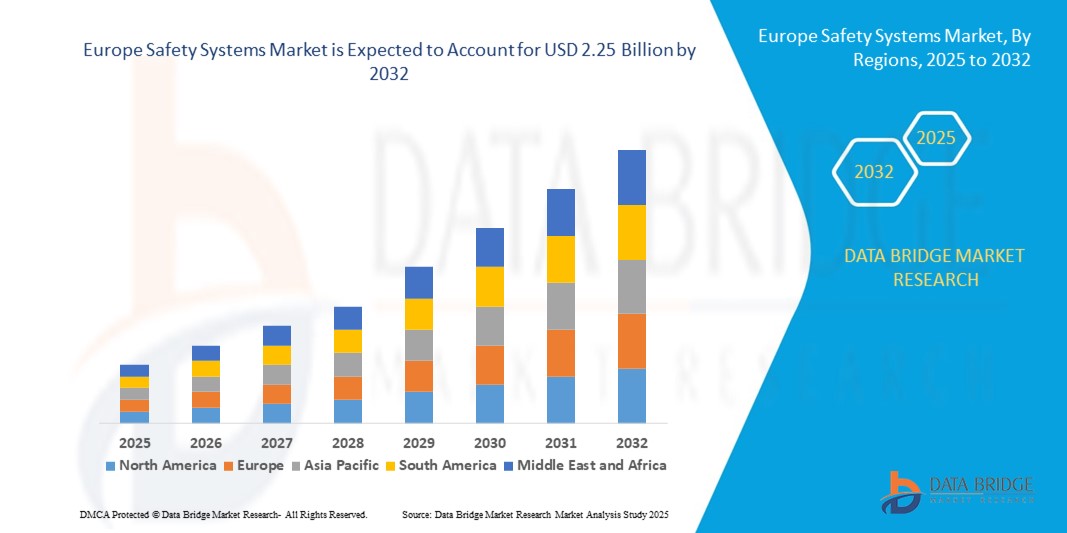

- Der europäische Markt für Sicherheitssysteme hatte im Jahr 2024 einen Wert von 1,38 Milliarden US-Dollar und dürfte bis 2032 einen Wert von 2,25 Milliarden US-Dollar erreichen , bei einer jährlichen Wachstumsrate von 6,3 % im Prognosezeitraum.

- Das Marktwachstum wird maßgeblich durch die zunehmende Automatisierung und strenge Arbeitsschutzvorschriften in allen Branchen vorangetrieben, was die Nachfrage nach fortschrittlichen Sicherheitssystemen zum Schutz von Maschinen, Arbeitern und Betrieben steigert.

- Darüber hinaus ermöglicht die zunehmende Nutzung intelligenter Sensoren, maschineller Bildverarbeitung und IoT-fähiger Überwachungslösungen ein Sicherheitsmanagement in Echtzeit, vorausschauende Wartung und Compliance, wodurch die Einführung von Sicherheitssystemen beschleunigt und die Marktexpansion deutlich vorangetrieben wird.

Marktanalyse für Sicherheitssysteme in Europa

- Sicherheitssysteme sind integrierte Lösungen, die Sensoren, Steuerungen, Relais und Überwachungsgeräte umfassen und zum Schutz von Geräten, Prozessen und menschlichen Bedienern vor gefährlichen Bedingungen in Branchen wie der Automobilindustrie, der Öl- und Gasindustrie, der Fertigung und dem Gesundheitswesen entwickelt wurden.

- Die steigende Nachfrage nach Sicherheitssystemen ist vor allem auf strengere gesetzliche Rahmenbedingungen, einen zunehmenden Fokus auf betriebliche Effizienz und die zunehmende Notwendigkeit zurückzuführen, Ausfallzeiten und Arbeitsunfälle durch automatisierte, intelligente Sicherheitstechnologien zu minimieren.

- Großbritannien dominierte im Jahr 2024 den Markt für Sicherheitssysteme aufgrund seiner starken industriellen Basis, seines fortschrittlichen Fertigungssektors und strenger Arbeitsschutzvorschriften in Branchen wie der Automobilindustrie, der Luft- und Raumfahrt sowie der Öl- und Gasindustrie.

- Deutschland wird im Prognosezeitraum voraussichtlich das am schnellsten wachsende Land im Markt für Sicherheitssysteme sein, aufgrund der schnellen Verbreitung von Industrie 4.0-Praktiken, der Einführung fortschrittlicher Robotik und der zunehmenden Abhängigkeit von automatisierten Maschinen in seinen Produktionszentren.

- Das Segment der intelligenten Sensoren dominierte den Markt mit einem Marktanteil von 42 % im Jahr 2024 aufgrund seiner Fähigkeit, präzise Daten zu liefern, Konnektivität mit IoT-Plattformen und Echtzeit-Überwachungsfunktionen zu bieten. Diese Sensoren werden häufig für die vorausschauende Wartung und die Steigerung der Betriebseffizienz in Branchen wie der Luft- und Raumfahrt, dem Gesundheitswesen und der Automobilindustrie eingesetzt. Ihre Anpassungsfähigkeit an fortschrittliche Automatisierungssysteme und die Integration mit Cloud-basierten Analysen gewährleisten zuverlässigen Schutz und optimierte Prozesse. Die steigende Nachfrage nach intelligenter Dateninterpretation und Selbstdiagnose in Sicherheitssystemen untermauert ihre Führungsrolle weiter.

Berichtsumfang und Marktsegmentierung für Sicherheitssysteme

|

Eigenschaften |

Wichtige Markteinblicke zu Sicherheitssystemen |

|

Abgedeckte Segmente |

|

|

Abgedeckte Länder |

Europa

|

|

Wichtige Marktteilnehmer |

|

|

Marktchancen |

|

|

Wertschöpfungsdaten-Infosets |

Zusätzlich zu den Einblicken in Marktszenarien wie Marktwert, Wachstumsrate, Segmentierung, geografische Abdeckung und wichtige Akteure enthalten die von Data Bridge Market Research kuratierten Marktberichte auch ausführliche Expertenanalysen, geografisch dargestellte Produktion und Kapazität nach Unternehmen, Netzwerklayouts von Distributoren und Partnern, detaillierte und aktuelle Preistrendanalysen und Defizitanalysen der Lieferkette und Nachfrage. |

Markttrends für Sicherheitssysteme in Europa

Steigende Akzeptanz von Smart Machines und Industrie 4.0

- Der Markt für Sicherheitssysteme verzeichnet mit der zunehmenden Verbreitung von Industrie 4.0 und intelligenten Maschinentechnologien ein deutliches Wachstum. Fortschrittliche Automatisierung und Digitalisierung erfordern integrierte Sicherheitsmechanismen, um einen reibungslosen Betrieb in zunehmend komplexen Industrieumgebungen zu gewährleisten.

- Rockwell Automation beispielsweise integriert intelligente Sicherheitstechnologien in seine industriellen Automatisierungslösungen. Die Systeme sind darauf ausgelegt, Sicherheit mit digitalen Abläufen zu verbinden und bieten prädiktive Analysen, die den Arbeitsschutz verbessern und Ausfallzeiten in Produktionsanlagen reduzieren.

- Die Kombination aus intelligenten Sensoren, IoT-Konnektivität und maschinellem Lernen verbessert Sicherheitssysteme, indem sie sie proaktiver macht. Diese Fortschritte ermöglichen Echtzeitüberwachung, vorausschauende Wartung und automatisierte Abschaltungen in gefährlichen Umgebungen, was die Sicherheit am Arbeitsplatz deutlich verbessert.

- Darüber hinaus erfordert die Nachfrage nach kollaborativer Robotik und autonomer Industrieausrüstung eine fortschrittliche Sicherheitsintegration. Sicherheitssysteme sind entscheidend, damit Maschinen und Menschen unfallfrei zusammenarbeiten können und so die Produktivität und die betriebliche Belastbarkeit gefördert werden.

- Die wachsende Bedeutung datenbasierter Entscheidungsfindung in Fabriken unterstreicht den Bedarf an Sicherheitssystemen, die mit zentralen Plattformen vernetzt sind. Diese Systeme liefern Echtzeit-Vorfallberichte und Compliance-Daten und stimmen die industrielle Sicherheit mit Strategien zur digitalen Transformation ab.

- Insgesamt rückt die Einführung von Industrie 4.0 Sicherheitssysteme in den Mittelpunkt moderner Fertigung und Betriebsabläufe. Ihre Integration mit intelligenter Technologie gewährleistet, dass industrieller Fortschritt mit einem stärkeren Schutz von Anlagen, Prozessen und Humankapital einhergeht.

Marktdynamik für Sicherheitssysteme in Europa

Treiber

Fortschritte in der Sicherheitssystemtechnologie

- Technologische Fortschritte bei Sicherheitssystemen treiben das Marktwachstum maßgeblich voran, da Hersteller innovative Lösungen integrieren, um den modernen industriellen Anforderungen gerecht zu werden. Verbesserte Effizienz, digitale Konnektivität und intelligente Automatisierung werden zu entscheidenden Merkmalen der Sicherheitslösungen der nächsten Generation.

- Siemens hat beispielsweise sicherheitsintegrierte Automatisierungssysteme entwickelt, die Produktivität mit fortschrittlichen Sicherheitsebenen kombinieren. Diese Plattformen ermöglichen es Unternehmen, strenge Standards einzuhalten und gleichzeitig die Flexibilität zu verbessern und die Markteinführungszeit für neue Produkte zu verkürzen.

- Neue Sicherheitssystemtechnologien wie programmierbare Sicherheitssteuerungen, fortschrittliche Bildverarbeitung und ausfallsichere Kommunikationsnetzwerke sorgen für schnellere Reaktionsfähigkeit und höhere Genauigkeit. Diese Innovationen minimieren Risiken und bieten maßgeschneiderte Sicherheit für verschiedene Industriebetriebe.

- Darüber hinaus verbessert die Integration mit IIoT-Plattformen die Datenanalysefunktionen und ermöglicht es Unternehmen, Risiken proaktiv zu erkennen. Sicherheitssysteme fungieren heute nicht mehr nur als reaktive Maßnahmen, sondern auch als prädiktive und präventive Instrumente und sind damit ein zentraler Bestandteil der operativen Exzellenz.

- Diese technologischen Fortschritte zeugen von der kontinuierlichen Innovationskraft der Branche. Durch die Verknüpfung von Sicherheit und digitaler Modernisierung sorgen Unternehmen für mehr Zuverlässigkeit, Compliance und Effizienz in industriellen Umgebungen und stärken so die Rolle von Sicherheitssystemen als langfristiger Wachstumstreiber.

Einschränkung/Herausforderung

Steigende regulatorische Anforderungen und Compliance-Standards

- Der Markt für Sicherheitssysteme steht vor Herausforderungen durch sich ständig weiterentwickelnde regulatorische Rahmenbedingungen und strenge Compliance-Anforderungen in allen Branchen. Unternehmen müssen ihre Systeme regelmäßig aktualisieren, um unterschiedliche regionale Standards zu erfüllen, was die Kosten und die betriebliche Komplexität erhöht.

- Beispielsweise stehen Unternehmen wie ABB und Honeywell unter ständigem Druck, ihre Sicherheitslösungen an verschiedene Sicherheitsrichtlinien wie ISO 13849 und OSHA-Vorschriften anzupassen. Die Einhaltung dieser internationalen und nationalen Normen erfordert oft erhebliche Investitionen in Systemdesign und Zertifizierung.

- Das Tempo der regulatorischen Entwicklung übersteigt die Anpassungsfähigkeit kleinerer Unternehmen, was zu Unterschieden bei der Branchenakzeptanz führt. Für viele Unternehmen behindern die Kosten für kontinuierliche Updates die flächendeckende Implementierung fortschrittlicher Sicherheitstechnologien.

- Darüber hinaus führen fragmentierte Sicherheitsvorschriften auf den globalen Märkten zu Komplikationen bei der Produktentwicklung und -einführung. Unternehmen müssen sich mit überlappenden Anforderungen auseinandersetzen, was die Produkteinführung verzögert und die Akzeptanz in bestimmten Regionen verlangsamt.

- Um diese Compliance-Herausforderungen zu bewältigen, sind eine engere Zusammenarbeit zwischen Unternehmen und Regulierungsbehörden sowie Investitionen in flexible und skalierbare Sicherheitslösungen erforderlich. Der Aufbau von Systemen, die sich an verschiedene regulatorische Bedingungen anpassen lassen, ist für ein nachhaltiges Wachstum im Markt für Sicherheitssysteme von entscheidender Bedeutung.

Marktumfang für Sicherheitssysteme in Europa

Der Markt ist nach Typ, Technologie, Funktion, Unternehmensgröße, Endbenutzer und Vertriebskanal segmentiert.

- Nach Typ

Der Markt für Sicherheitssysteme ist nach Typ in Sicherheitssteuerungen und -relais, Sicherheits-Maschinensicht, Sicherheitssensoren und Sicherheitsschalter unterteilt. Das Segment Sicherheitssteuerungen und -relais hatte 2024 den größten Marktanteil, was auf ihre zentrale Rolle bei der Verwaltung und Koordination von Sicherheitsabläufen in Industriemaschinen und Produktionslinien zurückzuführen ist. Diese Geräte gewährleisten die Einhaltung strenger internationaler Sicherheitsstandards, insbesondere in Branchen wie der Automobilherstellung und dem Schwermaschinenbau. Ihre einfache Integration in bestehende Automatisierungsinfrastrukturen und ihre bewährte Zuverlässigkeit bei der Minimierung von Gefahren am Arbeitsplatz untermauern ihre Dominanz. Die steigende Nachfrage nach Zertifizierungen für funktionale Sicherheit und der zunehmende Fokus auf den Schutz menschlicher Bediener treiben die Akzeptanz weiter voran.

Das Segment der Sicherheits-Bildverarbeitung wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, angetrieben durch die rasanten Fortschritte in der KI-gestützten Bilderkennung und Automatisierung. Bildverarbeitungssysteme werden zunehmend für Echtzeitüberwachung, Fehlererkennung und automatisierte Inspektion eingesetzt, um Anlagenausfälle und Unfälle zu verhindern. Die zunehmende Verbreitung von Industrie 4.0-Praktiken und intelligenten Fabriken verstärkt den Einsatz von Sicherheits-Bildverarbeitung für prädiktive Analysen und Prozessoptimierung. Darüber hinaus positioniert ihre Skalierbarkeit für verschiedene Anwendungen, darunter Pharmazeutika, Lebensmittelverarbeitung und Elektronikmontage, dieses Segment für beschleunigtes Wachstum.

- Nach Technologie

Der Markt für Sicherheitssysteme ist technologisch in digitale Sensoren, intelligente Sensoren und analoge Sensoren unterteilt. Das Segment der intelligenten Sensoren dominierte den Markt mit einem Anteil von 42 % im Jahr 2024 aufgrund seiner Fähigkeit, präzise Daten zu liefern, sich mit IoT-Plattformen zu verbinden und Echtzeit-Überwachungsfunktionen zu bieten. Diese Sensoren werden häufig für die vorausschauende Wartung und die Steigerung der Betriebseffizienz in Branchen wie der Luft- und Raumfahrt, dem Gesundheitswesen und der Automobilindustrie eingesetzt. Ihre Anpassungsfähigkeit an fortschrittliche Automatisierungssysteme und die Integration mit Cloud-basierten Analysen gewährleisten zuverlässigen Schutz und optimierte Prozesse. Die steigende Nachfrage nach intelligenter Dateninterpretation und Selbstdiagnose in Sicherheitssystemen untermauert ihre führende Position zusätzlich.

Das Segment der digitalen Sensoren wird voraussichtlich von 2025 bis 2032 die höchste durchschnittliche jährliche Wachstumsrate verzeichnen, was auf die Kosteneffizienz, das kompakte Design und den energieeffizienten Betrieb zurückzuführen ist. Digitale Sensoren werden zunehmend zur Überwachung von Temperatur, Vibration und Druck in industriellen Umgebungen eingesetzt, in denen schnelle Reaktionen entscheidend sind, um Ausfälle zu vermeiden. Ihre einfache Integration in automatisierte Steuerungssysteme und die Kompatibilität mit eingebetteten Technologien machen sie für KMU äußerst attraktiv. Die zunehmende Nutzung digitaler Zwillinge und Echtzeitsimulationen beschleunigt die Nachfrage nach digitalen Sensoren in modernen Sicherheitssystemen zusätzlich.

- Nach Funktion

Der Markt ist funktionsbezogen in Maschinenschutz, Prozessüberwachung, Energiemanagement, Einparkhilfe, Kollisionsvermeidung, Schwingungsüberwachungssysteme, Not-Aus-Systeme und weitere segmentiert. Das Segment Maschinenschutz dominierte den Markt im Jahr 2024, unterstützt durch seine entscheidende Rolle beim Schutz hochwertiger Industriemaschinen vor mechanischen Ausfällen und menschlichen Fehlern. Hersteller priorisieren Maschinenschutzsysteme, da sie Ausfallzeiten reduzieren, die Betriebseffizienz verbessern und die Lebensdauer der Geräte verlängern können. Die Akzeptanz ist in der Automobil-, Luft- und Raumfahrt- und Schwerindustrie stark, wo die Zuverlässigkeit der Geräte die Produktivität direkt beeinflusst. Die Durchsetzung internationaler Sicherheitsvorschriften und die steigenden Kosten von Arbeitsunfällen verstärken die Nachfrage zusätzlich.

Das Segment Kollisionsvermeidung wird voraussichtlich zwischen 2025 und 2032 am schnellsten wachsen, angetrieben durch den zunehmenden Einsatz in autonomen Fahrzeugen, Lagerrobotern und der Luftfahrt. Kollisionsvermeidungssysteme nutzen fortschrittliche Sensoren, LiDAR und KI-Algorithmen, um potenzielle Gefahren zu erkennen und Unfälle in Echtzeit zu verhindern. Die zunehmende Verbreitung von Fahrerassistenzsystemen in der Automobil- und Logistikbranche trägt maßgeblich zu deren Wachstum bei. Da Regierungen fortschrittliche Sicherheitsfunktionen in Fahrzeugen vorschreiben und die Industrie zunehmend automatisiert, werden Kollisionsvermeidungssysteme zu einem wesentlichen Bestandteil der Reduzierung operativer Risiken.

- Nach Unternehmensgröße

Der Markt wird anhand der Unternehmensgröße in kleine und mittelgroße Unternehmen sowie Großunternehmen segmentiert. Großunternehmen dominierten den Markt im Jahr 2024 aufgrund ihrer höheren Investitionskapazität, der umfassenden Automatisierung und der strikten Einhaltung von Sicherheitsstandards. Unternehmen in Branchen wie Öl und Gas, Automobilindustrie sowie Luft- und Raumfahrt legen Wert auf fortschrittliche Sicherheitssysteme, um Vermögenswerte und Mitarbeiter zu schützen und einen unterbrechungsfreien Betrieb zu gewährleisten. Der großflächige Einsatz von Robotern und vernetzten Maschinen erfordert anspruchsvolle, integrierte Sicherheitslösungen und stärkt so den Marktanteil dieses Segments.

Das Segment der kleinen und mittleren Unternehmen wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen. Dies ist auf das steigende Bewusstsein für Arbeitssicherheit, kostengünstige Lösungen und die Einhaltung gesetzlicher Vorschriften zurückzuführen. KMU setzen zunehmend auf modulare und skalierbare Sicherheitssysteme, die sich an ihr Budget anpassen und schrittweise Upgrades ermöglichen. Staatliche Anreize für den Einsatz von Sicherheitslösungen und die Verfügbarkeit kostengünstiger, einfach zu installierender Technologien fördern die Einführung zusätzlich. Dieser Wandel ist besonders in Schwellenländern sichtbar, wo KMU das Rückgrat der Industrie bilden.

- Nach Endbenutzer

Auf Basis der Endverbraucher ist der Markt in die Branchen Automobil, Luft- und Raumfahrt & Verteidigung, Gesundheitswesen, Öl & Gas, Transport & Logistik, Unterhaltungselektronik, Lebensmittel und Getränke, Bauindustrie und andere unterteilt. Das Automobilsegment dominierte den Markt im Jahr 2024 aufgrund der zunehmenden Bedeutung der Sicherheit von Fahrer und Passagieren sowie der zunehmenden Verbreitung fortschrittlicher Fahrerassistenzsysteme (ADAS). Automobilhersteller investieren massiv in die Integration von Sicherheitssensoren, maschinellem Sehen und Kollisionsvermeidungssystemen, um Sicherheitsvorschriften einzuhalten und die Fahrzeugzuverlässigkeit zu verbessern. Der wachsende Sektor der Elektrofahrzeuge steigert die Nachfrage nach fortschrittlichen Sicherheitssystemen zusätzlich.

Der Gesundheitssektor wird voraussichtlich zwischen 2025 und 2032 die höchste Wachstumsrate verzeichnen, getrieben durch den Bedarf an Präzision, Echtzeitüberwachung und Patientensicherheit in der Intensivpflege. Sicherheitssysteme im Gesundheitswesen sind unerlässlich, um eine präzise Diagnostik zu gewährleisten, den Zustand der Geräte zu überwachen und das medizinische Personal vor gefährlichen Belastungen zu schützen. Die rasante Digitalisierung von Krankenhäusern, die Einführung IoT-fähiger Überwachungssysteme und steigende Investitionen in intelligente Gesundheitsinfrastruktur verstärken das Wachstum. Die Nachfrage wird zusätzlich durch den regulatorischen Fokus auf die Sicherheit medizinischer Geräte und die Fehlervermeidung gefördert.

- Nach Vertriebskanal

Auf der Grundlage der Vertriebskanäle wird der Markt in Direktvertrieb und indirekten Vertrieb segmentiert. Der Direktvertrieb dominierte den Markt im Jahr 2024, unterstützt durch die Präferenz der Hersteller für eine direkte Kundenbindung, um maßgeschneiderte Lösungen, After-Sales-Services und langfristige Verträge anzubieten. Direktvertriebskanäle sind besonders in Branchen wie der Luft- und Raumfahrt, der Automobilindustrie sowie der Öl- und Gasindustrie verbreitet, wo hochwertige, maßgeschneiderte Sicherheitslösungen zum Einsatz kommen. Die Stärke dieses Kanals liegt im Aufbau enger Kundenbeziehungen und der Bereitstellung umfassender technischer Expertise.

Das Segment des indirekten Vertriebs wird voraussichtlich zwischen 2025 und 2032 das schnellste Wachstum verzeichnen, angetrieben durch die zunehmende Bedeutung von Distributoren, Systemintegratoren und E-Commerce-Plattformen. Indirekte Vertriebskanäle bieten eine größere Marktreichweite, insbesondere für KMU und Schwellenländer, in denen Kunden auf Drittanbieter angewiesen sind, um kostengünstige Lösungen zu erhalten. Die steigende Nachfrage nach modularen Plug-and-Play-Sicherheitsgeräten und der Ausbau digitaler Vertriebsplattformen erhöhen das Wachstumspotenzial des indirekten Vertriebskanals zusätzlich.

Regionale Analyse des europäischen Marktes für Sicherheitssysteme

- Großbritannien dominierte den Markt für Sicherheitssysteme mit dem größten Umsatzanteil im Jahr 2024, angetrieben durch seine starke industrielle Basis, seinen fortschrittlichen Fertigungssektor und strenge Arbeitsschutzvorschriften in Branchen wie der Automobil-, Luft- und Raumfahrt- sowie der Öl- und Gasindustrie.

- Die Führungsrolle des Landes wird durch die weit verbreitete Einführung von Automatisierung, die Integration intelligenter Sensoren und Bildverarbeitungstechnologien sowie kontinuierliche Investitionen in die Modernisierung der industriellen Sicherheitsinfrastruktur gestärkt.

- Der zunehmende Fokus auf die Einhaltung internationaler Sicherheitsstandards, gepaart mit der wachsenden Nachfrage nach Lösungen für vorausschauende Wartung und Arbeitnehmerschutz, stärkt die Position Großbritanniens weiter

Markteinblick in Sicherheitssysteme in Deutschland

Deutschland wird zwischen 2025 und 2032 voraussichtlich die höchste durchschnittliche jährliche Wachstumsrate (CAGR) in Europa verzeichnen. Grund hierfür sind die rasante Verbreitung von Industrie 4.0, die Einführung fortschrittlicher Robotik und die zunehmende Nutzung automatisierter Maschinen in den deutschen Produktionszentren. Unterstützt wird das Wachstum durch staatliche Initiativen zur Förderung der Arbeitssicherheit, hohe Investitionen in intelligente Fabriken und eine starke Nachfrage nach IoT-fähigen Überwachungssystemen. Die führende Rolle Deutschlands in den Bereichen Automobil, Maschinenbau und industrielle Automatisierung schafft erhebliche Chancen für Sicherheitstechnologien der nächsten Generation. Deutschlands Schwerpunkt auf der Integration von KI-gestützter Bildverarbeitung, Kollisionsvermeidungssystemen und digitalen Sensoren in industrielle Prozesse beschleunigt die Akzeptanz und treibt das robuste Marktwachstum voran.

Markteinblick in Sicherheitssysteme in Frankreich

Für Frankreich wird zwischen 2025 und 2032 ein stetiges Wachstum erwartet. Unterstützt wird dies durch den etablierten Industriesektor, die zunehmende Automatisierung im Bau- und Transportwesen sowie den zunehmenden Fokus auf die Einhaltung der Arbeitssicherheit. Die steigende Nachfrage nach Sicherheitssensoren, Not-Aus-Systemen und Maschinenschutztechnologien in der Lebensmittel- und Getränkeindustrie sowie der Unterhaltungselektronik treibt die Einführung voran. Die Zusammenarbeit zwischen inländischen Unternehmen und internationalen Herstellern von Sicherheitssystemen verbessert die Zugänglichkeit, Produktinnovation und Marktdurchdringung. Der Fokus des Landes auf nachhaltige Betriebsführung, regulatorische Anpassung und die Einführung digitaler Sicherheitstechnologien stärkt Frankreichs Marktaussichten weiter.

Marktanteil von Sicherheitssystemen in Europa

Die Sicherheitssystembranche wird hauptsächlich von etablierten Unternehmen angeführt, darunter:

- Siemens (Deutschland)

- Panasonic Corporation (Japan)

- ABB (Schweiz)

- Honeywell International Inc. (USA)

- Rockwell Automation (USA)

- Festo SE & Co. KG (Deutschland)

- Schneider Electric (Frankreich)

- SICK AG (Deutschland)

- KEYENCE CORPORATION (Japan)

- OMRON Corporation (Japan)

- Sensata Technologies, Inc. (USA)

- Pepperl+Fuchs SE (Deutschland)

- Balluff GmbH (Deutschland)

- TankScan (USA)

- Autonics Corporation (Südkorea)

- Hans Turck GmbH & Co. KG (Deutschland)

Neueste Entwicklungen auf dem europäischen Markt für Sicherheitssysteme

- Im August 2024 stellte Siemens Smart Infrastructure den SICAM Enhanced Grid Sensor (EGS) vor und treibt damit die Digitalisierung von Verteilnetzen deutlich voran. Durch kontinuierliche Überwachung und Überlastungsschutz ermöglicht diese Plug-and-Play-Lösung Netzbetreibern, die Nutzung bestehender Infrastruktur zu maximieren und gleichzeitig mehr Effizienz und Stabilität zu gewährleisten. Die Innovation unterstützt die Integration erneuerbarer Energiequellen in das Netz, eine zunehmende Notwendigkeit im Rahmen der globalen Energiewende. Mit dieser Markteinführung stärkt Siemens seine Führungsposition im Markt für intelligente Energielösungen und positioniert sich als bevorzugter Partner für Versorgungsunternehmen, die digitale Transformation und eine widerstandsfähige Infrastruktur anstreben.

- Im Dezember 2023 stellte die Panasonic Holdings Corporation einen 6-in-1-Trägheitssensor vor, der die Sicherheit und Leistung von Fahrzeugen steigern soll. Durch die Kombination mehrerer Sensorfunktionen in einer einzigen kompakten Einheit verbessert die Innovation die Fahrzeugstabilität und Fahrerassistenzsysteme und trägt so der steigenden Nachfrage nach fortschrittlichen Sicherheitstechnologien für Fahrzeuge Rechnung. Diese Entwicklung stärkt Panasonics Position auf dem Markt für Automobilsensoren und ermöglicht es dem Unternehmen, seinen Marktanteil auszubauen und die Zusammenarbeit mit Automobilherstellern zu intensivieren, die sich auf intelligente Mobilitätslösungen konzentrieren.

- Im Mai 2023 schloss ABB die Übernahme des Niederspannungs-NEMA-Motorengeschäfts von Siemens ab. Dieser strategische Schritt erweiterte das Industriemotorenportfolio von ABB. Mit dieser Akquisition stärkte ABB seine Fertigungskapazitäten und erweiterte sein Serviceangebot für globale Kunden in Branchen wie Automatisierung, Energie und Fertigung. Diese Entwicklung stärkte ABBs Führungsposition im Markt für Industriemotoren und ermöglichte es dem Unternehmen, die wachsende Nachfrage nach energieeffizienten und zuverlässigen Motorlösungen sowohl in Industrie- als auch in Schwellenländern zu bedienen.

- Im Januar 2023 vertiefte Honeywell International Inc. seine Partnerschaft mit Nexceris, um verbesserte Sicherheitslösungen für Elektrofahrzeuge anzubieten. Durch die Integration der Batteriesensortechnologie von Honeywell in das Gasdetektionssystem Li-Ion Tamer von Nexceris konzentrierte sich die Zusammenarbeit auf die Minderung des thermischen Durchgehens, das zu Bränden in Elektrofahrzeugbatterien führen kann. Dies stärkte Honeywells Marktposition im Bereich der Fahrzeugsicherheitslösungen, insbesondere im schnell wachsenden Elektrofahrzeugsektor, und unterstrich seine Fähigkeit, innovative, lebensrettende Technologien zu liefern, die den steigenden Sicherheitsanforderungen der Branche gerecht werden.

- Im August 2022 brachte Rockwell Automation seine Allen-Bradley 42EA RightSight S18 und 42JA VisiSight M20A Lichtschranken auf den Markt. Sie richten sich an Branchen, die kompakte, zuverlässige und vielseitige Sensorlösungen benötigen. Diese wirtschaftlichen Sensoren vereinfachen Installation und Wartung und bieten gleichzeitig hohe Leistung in beengten Umgebungen. Die Markteinführung stärkte Rockwells Position im Markt für industrielle Automatisierung und Sensoren, indem sie die Nachfrage nach kostengünstigen und dennoch fortschrittlichen Sensortechnologien adressierte und so seinen Kundenstamm in verschiedenen industriellen Anwendungen erweiterte.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.