Global Industrial Wlan Market

Marktgröße in Milliarden USD

CAGR :

%

USD

4.72 Billion

USD

9.22 Billion

2025

2033

USD

4.72 Billion

USD

9.22 Billion

2025

2033

| 2026 –2033 | |

| USD 4.72 Billion | |

| USD 9.22 Billion | |

|

|

|

|

Global Industrial WLAN Market Segmentation, By Component (Hardware, Software, and Services), Technology Standard (802.11a/b/g, 802.11n, 802.11ac (Wi-Fi 5), 802.11ax (Wi-Fi 6/6E), and 802.11be (Wi-Fi 7)), Deployment Type (On-premise, Cloud-based, and Hybrid), Application (Machine-to-Machine Communication, Inventory & Asset Tracking, Worker Mobility & Communication, Automation & Control Systems, and Others), End User Industry (Automotive, General Manufacturing, Oil & Gas, Energy & Utilities, and Others) - Industry Trends and Forecast to 2033

Industrial WLAN Market Size

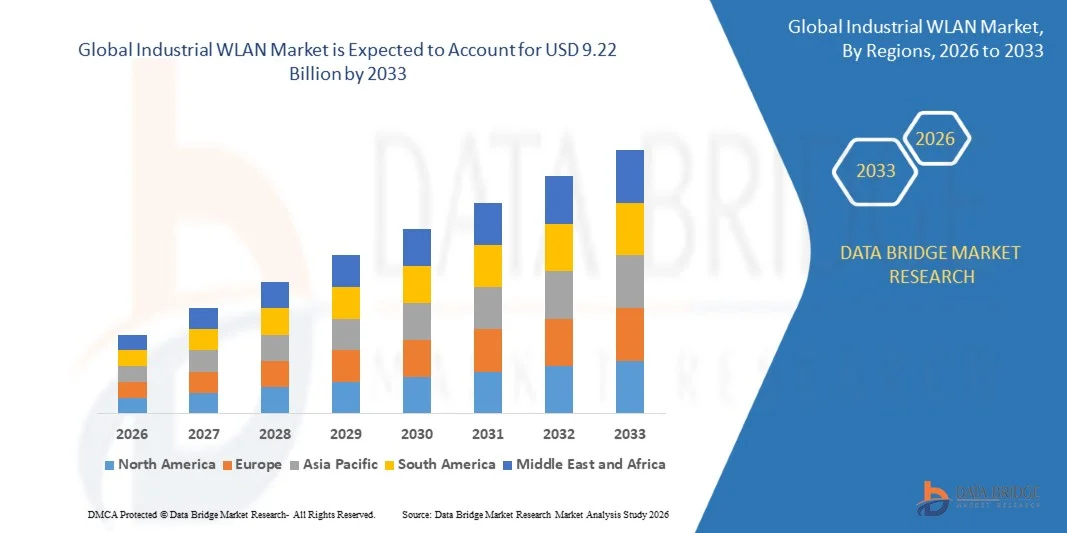

- The global industrial WLAN market size was valued at USD 4.72 billion in 2025 and is expected to reach USD 9.22 billion by 2033, at a CAGR of 8.71% during the forecast period

- The market growth is largely driven by the accelerating adoption of industrial automation, Industrial IoT, and Industry 4.0 initiatives, which are increasing the need for reliable, low-latency, and high-capacity wireless connectivity across manufacturing plants, warehouses, and process industries

- Furthermore, rising demand for real-time data access, seamless machine connectivity, and flexible network infrastructure to support smart factories and digital operations is strengthening the adoption of Industrial WLAN solutions, thereby significantly boosting overall market growth

Industrial WLAN Market Analysis

- Industrial WLAN solutions, enabling secure and high-performance wireless communication in harsh and mission-critical environments, have become essential for supporting automation, asset tracking, worker mobility, and machine-to-machine communication across industrial facilities

- The growing reliance on wireless networks is primarily fueled by increasing deployment of smart manufacturing systems, heightened focus on operational efficiency and safety, and the need for scalable, secure connectivity to support advanced industrial applications

- Asia-Pacific dominated the industrial WLAN market with a share of 32.4% in 2025, due to rapid industrial automation, expanding manufacturing facilities, and large-scale adoption of Industry 4.0 practices across emerging economies

- North America is expected to be the fastest growing region in the industrial WLAN market during the forecast period due to rapid adoption of advanced automation, strong presence of industrial IoT deployments, and increasing reliance on wireless connectivity for mission-critical operations

- Hardware segment dominated the market with a market share of 67% in 2025, due to high demand for industrial-grade access points, ruggedized routers, controllers, and antennas across manufacturing plants and process industries. Industrial environments require durable, high-performance networking equipment capable of operating under extreme temperatures, vibration, and electromagnetic interference. Continuous expansion of smart factories and brownfield automation projects further supported strong hardware adoption

Report Scope and Industrial WLAN Market Segmentation

|

Attributes |

Industrial WLAN Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Industrial WLAN Market Trends

“Rising Adoption of Wi-Fi 6 and Wi-Fi 7 in Industrial Environments”

- A major trend shaping the industrial WLAN market is the accelerated adoption of Wi-Fi 6 and Wi-Fi 7 technologies to support high-density, latency-sensitive industrial operations. These next-generation standards enable improved throughput, deterministic performance, and better device handling, which are critical for smart factories, automated warehouses, and mission-critical industrial networks

- For instance, Siemens has been actively integrating Wi-Fi 6 capabilities into its industrial networking portfolio to support connected manufacturing systems and real-time industrial communication. These deployments enhance reliability and ensure consistent performance for automation, robotics, and data-intensive industrial applications

- The transition toward Wi-Fi 6 and Wi-Fi 7 is enabling industries to handle a growing number of connected devices, including sensors, AGVs, and industrial robots, without compromising network stability. This is particularly important in environments where wired connectivity limits operational flexibility

- Industrial operators are increasingly prioritizing advanced WLAN standards to reduce latency and improve synchronization across machines and control systems. These improvements directly support precision manufacturing and real-time process optimization

- High-density industrial settings are benefiting from features such as OFDMA and multi-user connectivity, which improve spectrum efficiency and minimize interference. This is strengthening WLAN performance in complex industrial layouts

- Overall, the rising deployment of Wi-Fi 6 and Wi-Fi 7 is reinforcing the shift toward fully wireless, scalable, and future-ready industrial networking architectures across global manufacturing and process industries

Industrial WLAN Market Dynamics

Driver

“Growing Implementation of Industry 4.0 and Industrial IoT Initiatives”

- The expanding implementation of Industry 4.0 and Industrial IoT initiatives is a key driver of the industrial WLAN market, as industries increasingly rely on wireless networks for real-time data exchange and intelligent automation. Industrial WLAN enables seamless connectivity between machines, sensors, and control systems, supporting data-driven decision-making and predictive operations

- For instance, Bosch has deployed industrial WLAN solutions across its smart factories to support connected production lines, machine monitoring, and digital twins. These wireless networks play a central role in enabling end-to-end visibility and operational efficiency

- The demand for flexible manufacturing systems is pushing industries to adopt WLAN solutions that allow rapid reconfiguration of production layouts without extensive cabling. This flexibility is essential for mass customization and agile manufacturing models

- Manufacturers are increasingly investing in wireless infrastructure to support integration of advanced analytics, AI-driven systems, and cloud-based industrial platforms. This reliance on connected ecosystems is reinforcing the importance of robust industrial WLAN solutions

- The growing emphasis on operational efficiency, reduced downtime, and real-time intelligence continues to drive sustained demand for industrial WLAN as a foundational component of Industry 4.0 environments

Restraint/Challenge

“Network Security and Interference Issues in Harsh Industrial Settings”

- The industrial WLAN market faces challenges related to network security risks and wireless interference in complex and harsh industrial environments. Industrial facilities often contain heavy machinery, metal structures, and electromagnetic interference, which can disrupt wireless signal quality and reliability

- For instance, industrial operators deploying WLAN networks in oil & gas facilities must address strict security requirements to protect critical infrastructure from cyber threats. Companies such as Fortinet focus on integrating industrial-grade security features to mitigate these risks, highlighting the complexity involved in securing wireless networks

- Wireless interference from overlapping networks, machinery, and external signals can impact data transmission consistency, especially in large-scale industrial plants. This creates challenges in maintaining deterministic performance for time-sensitive applications

- Industrial environments also demand high network availability, where any disruption can lead to operational downtime and financial losses. Balancing security, performance, and reliability remains a critical challenge

- Collectively, concerns related to cybersecurity threats, interference management, and network resilience continue to restrain adoption in certain industrial settings, requiring advanced solutions and expertise to overcome these limitations

Industrial WLAN Market Scope

The market is segmented on the basis of component, technology standard, deployment type, application, and end user industry.

• By Component

On the basis of component, the Industrial WLAN market is segmented into hardware, software, and services. The hardware segment dominated the market with the largest revenue share of 67% in 2025, driven by high demand for industrial-grade access points, ruggedized routers, controllers, and antennas across manufacturing plants and process industries. Industrial environments require durable, high-performance networking equipment capable of operating under extreme temperatures, vibration, and electromagnetic interference. Continuous expansion of smart factories and brownfield automation projects further supported strong hardware adoption.

The software segment is anticipated to witness the fastest growth from 2026 to 2033, supported by rising adoption of centralized network management, security monitoring, and analytics platforms. Enterprises are increasingly investing in WLAN software to enable real-time visibility, predictive maintenance, and policy-based access control across large industrial campuses. Growing cybersecurity concerns and the need for scalable network orchestration further accelerate software demand.

• By Technology Standard

On the basis of technology standard, the market is segmented into 802.11a/b/g, 802.11n, 802.11ac (Wi-Fi 5), 802.11ax (Wi-Fi 6/6E), and 802.11be (Wi-Fi 7). The 802.11ac (Wi-Fi 5) segment accounted for the largest revenue share in 2025 due to its balanced performance, stable throughput, and widespread installed base across industrial facilities. Many enterprises continue to rely on Wi-Fi 5 for mission-critical operations because of proven reliability and cost efficiency.

The 802.11ax (Wi-Fi 6/6E) segment is expected to grow at the fastest rate during the forecast period, driven by its ability to support high device density, low latency, and deterministic performance. Industrial applications such as robotics, AGVs, and real-time control systems increasingly require Wi-Fi 6 capabilities to ensure seamless connectivity and minimal packet loss.

• By Deployment Type

On the basis of deployment type, the Industrial WLAN market is segmented into on-premise, cloud-based, and hybrid. The on-premise segment dominated the market in 2025, as industries prioritize data security, low latency, and full control over network infrastructure. Critical manufacturing and energy operations often prefer on-premise WLAN deployments to meet strict regulatory, safety, and uptime requirements.

The cloud-based segment is projected to register the fastest growth from 2026 to 2033, supported by increasing adoption of cloud-managed WLAN platforms. Cloud deployment enables remote monitoring, centralized configuration, faster troubleshooting, and reduced operational complexity across geographically dispersed industrial sites. Growing acceptance of industrial IoT and edge computing further strengthens cloud-based WLAN adoption.

• By Application

On the basis of application, the market is segmented into machine-to-machine communication, inventory & asset tracking, worker mobility & communication, automation & control systems, and others. Automation & control systems represented the largest revenue share in 2025, driven by rising use of wireless networks for PLC communication, robotics coordination, and real-time process monitoring. Industrial WLAN plays a critical role in enabling flexible, scalable automation architectures within modern factories.

Machine-to-machine communication is expected to witness the fastest growth over the forecast period, supported by expanding adoption of connected machines, sensors, and autonomous systems. Increasing focus on predictive maintenance, real-time data exchange, and digital twins accelerates the need for reliable low-latency WLAN solutions in M2M applications.

• By End User Industry

On the basis of end user industry, the Industrial WLAN market is segmented into automotive, general manufacturing, oil & gas, energy & utilities, and others. General manufacturing dominated the market in 2025 due to extensive deployment of wireless networks across assembly lines, warehouses, and quality inspection processes. The shift toward Industry 4.0 and smart production environments continues to drive strong WLAN demand in this sector.

The energy & utilities segment is anticipated to grow at the fastest rate from 2026 to 2033, supported by rising investments in smart grids, substations, and renewable energy infrastructure. Industrial WLAN enables real-time monitoring, remote asset management, and secure communication across geographically distributed energy assets, supporting operational efficiency and grid reliability.

Industrial WLAN Market Regional Analysis

- Asia-Pacific dominated the industrial WLAN market with the largest revenue share of 32.4% in 2025, driven by rapid industrial automation, expanding manufacturing facilities, and large-scale adoption of Industry 4.0 practices across emerging economies

- Strong growth in smart factories, rising deployment of industrial IoT solutions, and increasing investments in wireless infrastructure are accelerating the adoption of Industrial WLAN across production plants and warehouses

- Availability of cost-efficient manufacturing ecosystems, skilled technical workforce, and supportive government initiatives promoting digitalization and smart manufacturing are contributing significantly to regional market expansion

China Industrial WLAN Market Insight

China held the largest share in the Asia-Pacific Industrial WLAN market in 2025, supported by its dominance in large-scale manufacturing, automotive production, and electronics assembly. The country’s aggressive push toward smart factories, combined with substantial investments in industrial automation and 5G-integrated wireless networks, is driving strong demand for reliable WLAN solutions. Government-backed initiatives focused on industrial digital transformation further strengthen market growth.

India Industrial WLAN Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by expanding manufacturing capacity, rising adoption of smart industrial infrastructure, and increasing foreign direct investment in automation technologies. Government programs promoting domestic manufacturing and digital industrial ecosystems are accelerating WLAN deployment across factories and logistics hubs. Growing demand from automotive, general manufacturing, and energy sectors is further supporting market expansion.

Europe Industrial WLAN Market Insight

The Europe Industrial WLAN market is expanding steadily, supported by strong emphasis on industrial automation, data security, and advanced manufacturing standards. The region’s focus on smart production systems, predictive maintenance, and real-time operational monitoring is increasing reliance on robust wireless networking solutions. Strict regulatory compliance and high adoption of advanced industrial technologies continue to drive stable market growth.

Germany Industrial WLAN Market Insight

Germany’s Industrial WLAN market is driven by its leadership in Industry 4.0 implementation, strong automotive manufacturing base, and advanced engineering capabilities. The country’s focus on connected factories, robotics, and real-time production monitoring is boosting demand for high-performance industrial WLAN systems. Strong collaboration between technology providers and manufacturing enterprises supports continuous innovation and deployment.

U.K. Industrial WLAN Market Insight

The U.K. market benefits from growing investments in smart manufacturing, logistics automation, and digital infrastructure modernization. Increasing adoption of wireless connectivity across industrial facilities, combined with rising focus on operational efficiency and cybersecurity, is driving WLAN demand. Government initiatives supporting digital transformation across industries further contribute to steady market development.

North America Industrial WLAN Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by rapid adoption of advanced automation, strong presence of industrial IoT deployments, and increasing reliance on wireless connectivity for mission-critical operations. The region’s focus on smart factories, real-time data analytics, and resilient network infrastructure is accelerating market growth. Rising investments in industrial digitalization across manufacturing and energy sectors further support expansion.

U.S. Industrial WLAN Market Insight

The U.S. accounted for the largest share in the North America market in 2025, supported by widespread adoption of smart manufacturing, strong industrial automation spending, and advanced IT infrastructure. The presence of major technology providers, coupled with high demand from automotive, energy, and general manufacturing industries, continues to drive WLAN deployment. Ongoing investments in industrial cybersecurity and next-generation wireless technologies reinforce the country’s leading position.

Industrial WLAN Market Share

The industrial WLAN industry is primarily led by well-established companies, including:

- Cisco Systems, Inc. (U.S.)

- CommScope Inc. (U.S.)

- D-Link Limited (Taiwan)

- Extreme Networks (U.S.)

- Fortinet, Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Huawei Technologies Co., Ltd. (China)

- Juniper Networks, Inc. (U.S.)

- Ruckus Wireless (U.S.)

- Siemens (Germany)

- Zebra Technologies Corporation (U.S.)

- Belden Inc. (U.S.)

- Moxa Inc. (Taiwan)

- Advantech Co., Ltd. (Taiwan)

- Allied Telesis, Inc. (Japan)

Latest Developments in Global Industrial WLAN Market

- In November 2025, Zyxel Networks launched its first industrial-grade wireless access point, the BE5000 4-Stream WiFi 7 Dual-Radio NebulaFlex Pro IAP500BE, significantly strengthening the Industrial WLAN market by addressing connectivity challenges in harsh indoor environments. The launch supports growing demand for rugged, high-throughput Wi-Fi 7 solutions in warehouses, maintenance facilities, and industrial plants. This development highlights the market shift toward AI-powered, cloud-managed, and high-performance WLAN infrastructure to support industrial digital transformation

- In June 2025, Huawei, in collaboration with the World WLAN Application Alliance and industry partners, released the “Smart Campus Wi-Fi CSI Sensing Development and Use Cases White Paper,” expanding the scope of Industrial WLAN from connectivity to intelligent sensing. By enabling applications such as industrial intrusion detection and smart healthcare monitoring through Wi-Fi CSI sensing, this initiative enhances the value proposition of WLAN networks. The development is expected to accelerate adoption of advanced WLAN technologies across industrial campuses and mission-critical environments

- In February 2025, Juniper Networks introduced new additions to its wired access portfolio with the launch of the EX4000 Series Switches, designed to support Wi-Fi 7 performance and Zero Trust security. This development strengthens the Industrial WLAN ecosystem by ensuring high availability, scalability, and secure wired backhaul for dense industrial wireless deployments. It reflects increasing enterprise focus on resilient and secure network infrastructure to support next-generation industrial WLAN applications

- In August 2024, Cervoz announced the launch of its MEC-WIFI-2142B-30 Wi-Fi 6E module, supporting growing industrial demand for high-speed, low-latency wireless connectivity. The module addresses requirements of IoT-driven manufacturing and smart factory environments by enabling reliable performance across extended spectrum bands. This launch contributes to wider adoption of Wi-Fi 6E in industrial devices and embedded systems

- In November 2022, Westermo expanded its Ibex range with the introduction of the Ibex-1310 and Ibex-1510 Wi-Fi 6 access points, targeting transportation, industrial vehicles, and outdoor applications. By supporting high device density and enhanced performance, these access points strengthened industrial WLAN adoption in mobility-centric and harsh environments. This development underscored early momentum toward Wi-Fi 6 in mission-critical industrial networking use cases

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.