Global Nano Gps Global Positioning System Chip Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

88.09 Billion

USD

333.39 Billion

2025

2033

USD

88.09 Billion

USD

333.39 Billion

2025

2033

| 2026 –2033 | |

| USD 88.09 Billion | |

| USD 333.39 Billion | |

|

|

|

|

Global Nano GPS (Global Positioning System) Chip Market Segmentation, By Sensitivity (Below −165 dBm and 165 dBm and Above), Device (Smartphones, Wearables, UAVs, Asset Tracking, Personal Digital Assistants, Automotive, and Others), Type (Low Power and Sensitive), Application (Navigation, Mapping, Surveying, Location-Based Services, Telematics, Timing and Synchronization, and Others), Vertical (Consumer Electronics, Construction, Agriculture, Automotive, Military and Defence, Marine, and Transport) - Industry Trends and Forecast to 2033

What is the Global Nano GPS (Global Positioning System) Chip Market Size and Growth Rate?

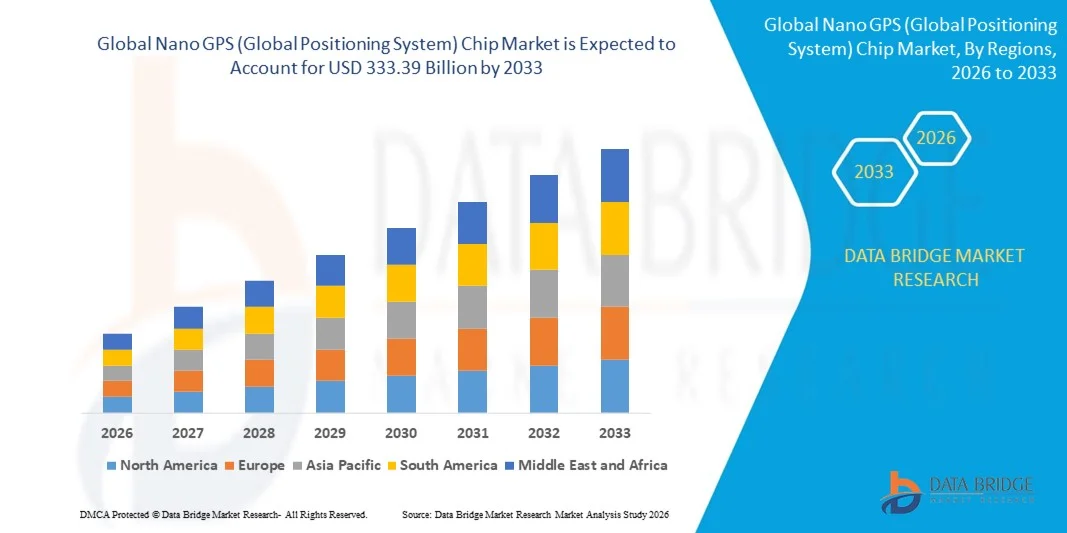

- The global Nano GPS (Global Positioning System) Chip market size was valued at USD 88.09 billion in 2025 and is expected to reach USD 333.39 billion by 2033, at a CAGR of18.10% during the forecast period

- Growing demand for digitization and nano GPS chip solutions in industrial applications, rising demand for commercial devices enabled with tracking features such as real-time clock, noise amplifiers, surface acoustic waves, a temperature-controlled crystal oscillator, a power management unit

What are the Major Takeaways of Nano GPS (Global Positioning System) Chip Market?

- Radio frequency shielding, increasing requirement for security systems, wearable products, and tracker devices are some of the major as well as vital factors which will such asly to augment the growth of the nano GPS (global positioning system) chip market

- Surging levels of investment in research and development activities along with growing number of technological advancements which will further contribute by generating massive opportunities that will lead to the growth of the nano GPS (global positioning system) chip market

- North America dominated the Nano GPS (Global Positioning System) Chip market with a 41.36% revenue share in 2025, driven by rapid growth in semiconductor design, embedded system development, electronics manufacturing, and extensive R&D initiatives across the U.S. and Canada

- Asia-Pacific is projected to register the fastest CAGR of 10.69% from 2026 to 2033, fueled by rapid semiconductor expansion, electronics manufacturing, and 5G-enabled IoT adoption across China, Japan, India, South Korea, and Southeast Asia

- The −165 dBm and Above segment dominated the market with a 42.1% share in 2025, owing to its superior signal acquisition capability in challenging environments, including dense urban areas, forests, and indoor applications

Report Scope and Nano GPS (Global Positioning System) Chip Market Segmentation

|

Attributes |

Nano GPS (Global Positioning System) Chip Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Nano GPS (Global Positioning System) Chip Market?

Increasing Shift Toward High-Speed, Compact, and PC-Based Nano GPS Chips

- The Nano GPS (Global Positioning System) Chip market is witnessing strong adoption of compact, energy-efficient, and high-performance GPS chipsets designed to support embedded systems, IoT devices, smart wearables, and automotive applications

- Manufacturers are introducing multi-frequency, high-sensitivity, and low-power chips that offer advanced positioning accuracy, rapid signal acquisition, and compatibility with modern GNSS platforms

- Growing demand for cost-efficient, lightweight, and portable GPS modules is driving usage across smartphones, drones, automotive navigation systems, industrial equipment, and consumer electronics

- For instance, companies such as u-blox, Broadcom, Qualcomm, and MediaTek have upgraded their chip portfolios with higher precision, multi-constellation support (GPS, GLONASS, Galileo, BeiDou), and integrated low-power designs

- Increasing need for real-time positioning, geofencing, and high-accuracy navigation is accelerating the shift toward compact, system-on-chip GPS solutions

- As devices become smaller and digitally complex, Nano GPS Chips remain vital for navigation, IoT integration, autonomous systems, and precise location tracking

What are the Key Drivers of Nano GPS (Global Positioning System) Chip Market?

- Rising demand for compact, highly accurate, and low-power GPS chips to support real-time navigation, tracking, and location-based services across consumer electronics, automotive, and industrial IoT

- For instance, in 2025, leading companies such as u-blox, MediaTek, and Qualcomm introduced next-generation GPS modules with multi-frequency support, low-power consumption, and improved signal acquisition capabilities

- Growing adoption of autonomous vehicles, drones, smart wearables, connected devices, and logistics solutions is boosting demand for high-performance Nano GPS chips across the U.S., Europe, and Asia-Pacific

- Advancements in multi-constellation support, miniature chip design, integrated AI-assisted positioning, and enhanced anti-jamming capabilities have strengthened performance, efficiency, and reliability

- Rising utilization of location-based services, geofencing applications, fleet management systems, and smart city initiatives is creating demand for compact and high-precision GPS chips

- Supported by continuous investments in semiconductor R&D, IoT development, and GNSS infrastructure, the Nano GPS Chip market is expected to witness strong long-term growth

Which Factor is Challenging the Growth of the Nano GPS (Global Positioning System) Chip Market?

- High costs associated with advanced, multi-frequency, and ultra-precise Nano GPS chips restrict adoption among low-cost consumer devices and small-scale manufacturers

- For instance, during 2024–2025, global component shortages, rising semiconductor prices, and extended lead times increased production costs for several GPS module vendors

- Complexity in integrating GPS chips into multi-sensor systems, supporting GNSS interoperability, and ensuring anti-jamming performance increases the need for specialized engineering expertise

- Limited awareness in emerging markets regarding multi-constellation GPS capabilities, low-power integration, and high-accuracy positioning slows adoption

- Competition from alternative location technologies, such as LiDAR-based localization, Wi-Fi positioning, and cellular triangulation, creates pricing and technology pressures

- To address these challenges, companies are focusing on cost-optimized chip design, system integration support, software-assisted GNSS solutions, and low-power high-accuracy modules to increase global adoption of Nano GPS Chips

How is the Nano GPS (Global Positioning System) Chip Market Segmented?

The market is segmented on the basis of sensitivity, device, type, application and vertical.

- By Sensitivity

On the basis of sensitivity, the Nano GPS (Global Positioning System) Chip market is segmented into Below −165 dBm and −165 dBm and above. The −165 dBm and Above segment dominated the market with a 42.1% share in 2025, owing to its superior signal acquisition capability in challenging environments, including dense urban areas, forests, and indoor applications. High-sensitivity chips allow reliable satellite tracking, rapid time-to-first-fix, and enhanced accuracy in multi-constellation GNSS systems. These chips are extensively adopted in smartphones, UAVs, automotive telematics, and wearable devices, where strong signal performance is critical.

The Below −165 dBm segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing demand for cost-effective, low-power devices in asset tracking, personal navigation devices, and consumer electronics. Technological advancements and integration with IoT-enabled systems are further boosting adoption across emerging markets.

- By Device

On the basis of device, the market is segmented into Smartphones, Wearables, UAVs, Asset Tracking, Personal Digital Assistants, Automotive, and Others. The Smartphones segment dominated the market with a 44.3% share in 2025, driven by the ubiquity of mobile devices and growing reliance on high-precision navigation, location-based services, and geotagging features. Smartphones require compact, energy-efficient Nano GPS Chips with multi-constellation support and fast acquisition.

The UAVs segment is projected to grow at the fastest CAGR from 2026 to 2033, owing to the surge in drone-based delivery, surveying, and industrial applications. Enhanced flight navigation, obstacle avoidance, and autonomous operation capabilities are fueling demand for high-accuracy, lightweight GPS chips in unmanned aerial vehicles across commercial and defense sectors.

- By Type

On the basis of type, the market is segmented into Low Power and Sensitive chips. The Sensitive segment dominated the market with a 41.5% share in 2025, driven by high-precision applications requiring superior signal reception in challenging environments, such as military operations, automotive telematics, and industrial navigation. Sensitive chips provide reliable satellite tracking under weak signal conditions and are critical for autonomous systems.

The Low Power segment is expected to grow at the fastest CAGR from 2026 to 2033, as demand rises for energy-efficient chips in wearable devices, smartphones, IoT modules, and battery-operated tracking devices. Increasing focus on sustainability, long battery life, and integration with portable electronics accelerates the adoption of low-power Nano GPS Chips globally.

- By Application

On the basis of application, the market is segmented into Navigation, Mapping, Surveying, Location-Based Services, Telematics, Timing and Synchronization, and Others. The Navigation segment dominated the market with a 39.8% share in 2025, driven by extensive use in automotive navigation, personal navigation devices, and UAV guidance systems. High-accuracy, multi-constellation GPS chips are essential for real-time route calculation, traffic management, and location awareness.

The Location-Based Services segment is projected to grow at the fastest CAGR from 2026 to 2033, fueled by the proliferation of mobile apps, smart city solutions, geo-marketing, asset tracking, and consumer engagement platforms. Integration of GPS with AI and IoT technologies further strengthens market demand for location-enabled applications.

- By Vertical

On the basis of vertical, the market is segmented into Consumer Electronics, Construction, Agriculture, Automotive, Military and Defence, Marine, and Transport. The Consumer Electronics segment dominated the market with a 38.7% share in 2025, driven by smartphones, wearables, tablets, and personal navigation devices that require compact, high-accuracy GPS chips. Rising consumer demand for real-time tracking, fitness applications, and geolocation features supports sustained growth.

The Automotive segment is expected to grow at the fastest CAGR from 2026 to 2033, propelled by the integration of advanced driver-assistance systems (ADAS), EV navigation, telematics, and autonomous driving solutions. Increasing vehicle electrification, connected car adoption, and government regulations on road safety accelerate Nano GPS chip deployment in the automotive sector.

Which Region Holds the Largest Share of the Nano GPS (Global Positioning System) Chip Market?

- North America dominated the Nano GPS (Global Positioning System) Chip market with a 41.36% revenue share in 2025, driven by rapid growth in semiconductor design, embedded system development, electronics manufacturing, and extensive R&D initiatives across the U.S. and Canada. High adoption of multi-constellation GPS receivers, low-power embedded systems, automotive telematics, and wearable devices continues to fuel demand across consumer electronics, UAVs, automotive, and industrial applications

- Leading North American companies are introducing high-performance, multi-frequency, and multi-constellation Nano GPS Chips with enhanced sensitivity, low power consumption, and integration capabilities. Continuous investment in AI, IoT, and autonomous systems strengthens the region’s technological advantage and supports long-term market expansion

- A dense concentration of skilled engineers, advanced semiconductor fabs, and robust innovation ecosystems further reinforce North America’s market leadership

U.S. Nano GPS (Global Positioning System) Chip Market Insight

The U.S. is the largest contributor in North America, backed by semiconductor innovation, embedded system development, and adoption of high-precision GPS technology in automotive, aerospace, defence, telecom, and industrial sectors. Rapid deployment of connected devices, autonomous systems, and smart infrastructure intensifies demand for Nano GPS Chips with superior sensitivity and multi-frequency support. Presence of major semiconductor manufacturers, technology startups, and test & validation centers further drives market growth.

Canada Nano GPS (Global Positioning System) Chip Market Insight

Canada significantly contributes to regional growth, driven by expanding electronics clusters, IoT adoption, and government-supported R&D in aerospace, automotive, and defence electronics. Engineering labs and universities increasingly utilize Nano GPS Chips for UAVs, asset tracking, and autonomous system prototyping. Skilled workforce availability and innovation programs strengthen market adoption.

Asia-Pacific Nano GPS (Global Positioning System) Chip Market

Asia-Pacific is projected to register the fastest CAGR of 10.69% from 2026 to 2033, fueled by rapid semiconductor expansion, electronics manufacturing, and 5G-enabled IoT adoption across China, Japan, India, South Korea, and Southeast Asia. High-volume production of smartphones, automotive telematics, drones, and wearable devices drives demand for highly sensitive, multi-constellation Nano GPS Chips. Growth in AI-enabled navigation, smart devices, industrial automation, and digital infrastructure accelerates market adoption across engineering and manufacturing applications.

China Nano GPS (Global Positioning System) Chip Market Insight

China leads Asia-Pacific adoption due to massive semiconductor investments, world-class manufacturing capacity, and government initiatives supporting digital innovation. Increasing demand for multi-frequency, low-power GPS Chips in consumer electronics, EVs, and UAVs drives local and export market expansion.

Japan Nano GPS (Global Positioning System) Chip Market Insight

Japan shows steady growth, supported by advanced electronics infrastructure, precision manufacturing, and modernization of automotive and industrial systems. Adoption of premium, high-accuracy Nano GPS Chips for robotics, automotive navigation, and industrial applications strengthens market presence.

India Nano GPS (Global Positioning System) Chip Market Insight

India is emerging as a key growth hub, driven by semiconductor design centers, IoT adoption, and government-backed electronics initiatives. Increasing demand for automotive, drone, and wearable applications accelerates adoption of Nano GPS Chips in testing, prototyping, and production environments.

South Korea Nano GPS (Global Positioning System) Chip Market Insight

South Korea contributes substantially due to strong demand for high-performance consumer electronics, automotive telematics, and UAVs. Rapid development of AI servers, EV electronics, and smart devices drives adoption of Nano GPS Chips with high sensitivity and low power consumption. Advanced manufacturing capabilities and innovation ecosystems support sustained growth.

Which are the Top Companies in Nano GPS (Global Positioning System) Chip Market?

The Nano GPS (Global Positioning System) Chip industry is primarily led by well-established companies, including:

- OriginGPS Ltd (Israel)

- Dragon Bridge (SZ) Tech Co., Ltd (China)

- VLSI Solution Oy (Finland)

- Analog Devices, Inc. (U.S.)

- FUJITSU (Japan)

- OLinkStar Co., Ltd (China)

- Microchip Technology Inc. (U.S.)

- Broadcom (U.S.)

- Intel Corporation (U.S.)

- FURUNO ELECTRIC CO., LTD. (Japan)

- Qualcomm Technologies, Inc. (U.S.)

- UNICORE COMMUNICATIONS, INC (U.S.)

- STMicroelectronics (Switzerland)

- MediaTek Inc. (Taiwan)

- u-blox AG (Switzerland)

- Skyworks Solutions, Inc. (U.S.)

- ABS (U.S.)

- Hemisphere GNSS, Inc. (U.S.)

- Quectel Wireless Solutions Co., Ltd. (China)

- Navika Electronics (India)

What are the Recent Developments in Global Nano GPS (Global Positioning System) Chip Market?

- In December 2024, u-blox launched the UBX-M10150-CC, an ultra-low-power GNSS chip designed for compact wearables and mobile health devices. The chipset enhances urban-canyon signal tracking, incorporates onboard noise reduction, and optimizes wake-up management to extend battery life for continuous monitoring applications. Its compact design enables flexible device form factors, empowering manufacturers to create lightweight products such as fitness trackers, smart rings, and medical monitors with reliable location awareness, strengthening the market for precision wearable GNSS solutions

- In October 2024, Septentrio expanded its industrial GNSS hardware ecosystem through a partnership with the GNSS OEM Store to provide advanced evaluation boards based on its mosaic™ module technology. These boards, aimed at UAVs, AMRs, and agricultural robotics, facilitate seamless integration of high-precision positioning with improved anti-jamming and anti-spoofing performance. The collaboration broadens access to centimeter-level accuracy for automation markets, enabling safe navigation and autonomous decision-making in emerging industries

- In February 2024, Qualcomm Technologies introduced the Snapdragon X80 5G Modem-RF System, incorporating the industry’s first AI-enhanced GNSS Location Gen 3 technology. Utilizing an embedded tensor accelerator, the system improves positioning precision, reduces energy consumption in dense urban and weak-signal areas, and optimizes satellite signal processing and interference mitigation. This innovation advances location-based services for smartphones, connected vehicles, and IoT devices worldwide, reinforcing Qualcomm’s leadership in next-generation GNSS solutions

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.