India Sbs Polymer Market

حجم السوق بالمليار دولار أمريكي

CAGR :

%

USD

342.62 Million

USD

523.04 Million

2025

2033

USD

342.62 Million

USD

523.04 Million

2025

2033

| 2026 –2033 | |

| USD 342.62 Million | |

| USD 523.04 Million | |

|

|

|

|

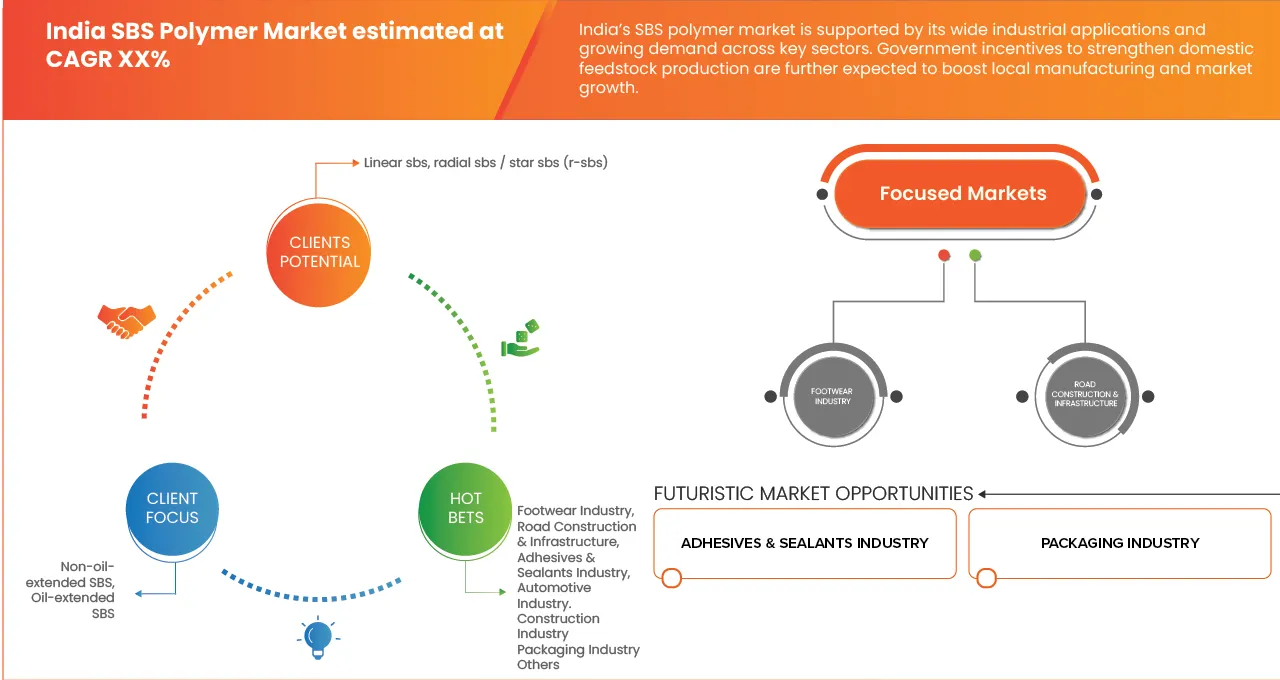

India SBS Polymer Market Segmentation, By Product (Linear SBS and Radial SBS / Star SBS [R-SBS]), By Type (Non-Oil-Extended SBS and Oil-Extended SBS), Styrene Content (Low Styrene SBS, Medium Styrene SBS, and High Styrene SBS), Application (Asphalt Modification, Road Mastics, Shoe Soles & Footwear Components, Polymer Modified Bitumen, Adhesives & Sealants, Construction Chemicals, Roofing Membrane, and Others), End User (Footwear Industry, Road Construction & Infrastructure, Adhesives & Sealants Industry, Automotive Industry, Construction Industry, Packaging Industry, and Others), Distribution Channel (Direct and Indirect) - Industry Trends and Forecast to 2033

India SBS Polymer Market Size

- The India SBS Polymer Market size was valued at USD 523.04 million by 2033 from USD 342.62 million in 2026, growing with a CAGR of 5.6% during the forecast period

- The India SBS Polymer Market is experiencing steady growth, driven by increasing demand from end-use industries such as construction, automotive, footwear, adhesives & sealants, and polymer modification, supported by rapid urbanization and infrastructure development.

- Rising investments in road construction, roofing, and waterproofing applications, along with growth in flexible packaging and consumer goods, are significantly contributing to increased SBS polymer consumption across the country.

- Advancements in polymer processing technologies, expansion of domestic manufacturing capacities, and supportive government initiatives under infrastructure and manufacturing programs are enhancing production efficiency and supporting long-term market scalability.

India SBS Polymer Market Analysis

- The India SBS Polymer Market is experiencing steady growth, driven by rising demand from construction, automotive, footwear, adhesives & sealants, and polymer modification applications, supported by infrastructure development, urbanization, and increasing use of high-performance and flexible materials across industries.

- In 2026, the Linear SBS segment leads the market, holding a 64.31% share, due to its superior elasticity, high tensile strength, ease of processing, and widespread adoption in asphalt modification, adhesives & sealants, and footwear applications, where consistent performance and durability are critical.

- The dominance of the Linear SBS segment is supported by its cost-effectiveness and better compatibility with a wide range of polymers and bitumen, making it the preferred choice for large-scale infrastructure and industrial applications.

Report Scope and India SBS Polymer Market Segmentation

|

Attributes |

India Protective Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

India SBS Polymer Market Trends

“Growing Adoption of Advanced Polymer Modification & Processing Technologies”

- Advanced polymer modification techniques are increasingly being adopted to enhance the elasticity, durability, and thermal resistance of SBS polymers, supporting their use in high-performance applications such as asphalt modification, roofing, and waterproofing.

- Improved compounding and blending technologies enable better compatibility of SBS polymers with bitumen and other polymers, resulting in enhanced product performance and longer service life.

- Automation and precision-controlled processing systems in SBS manufacturing are improving production efficiency, consistency, and quality while reducing material wastage and operational costs.

- Development of customized SBS grades tailored for specific end-use industries, including construction, adhesives, and footwear, is gaining traction to meet evolving performance requirements.

- Integration of digital monitoring and quality-control systems in production facilities supports data-driven optimization, process reliability, and scalability, strengthening the overall competitiveness of the India SBS Polymer Market.

India SBS Polymer Market Dynamics

Driver

“High Growth in Key End-Use Industries”

- Rapid expansion in construction and infrastructure activities across India significantly increases the consumption of SBS polymer, particularly in modified bitumen used for road surfacing, highways, bridges, and roofing applications.

- Large-scale government investments in transportation infrastructure, urban development, and smart city projects have led to higher adoption of polymer-modified bitumen, where SBS is preferred for its ability to enhance elasticity, temperature resistance, and long-term durability.

- At the same time, rising footwear production, supported by growing domestic consumption and export-oriented manufacturing, drives demand for SBS in shoe soles and components that require flexibility, abrasion resistance, and comfort.

For instance:

- In March 2022, according to the article published by Scaff's India Trading Pvt. Ltd., SBS-modified bitumen roofing shingles and membranes offer superior flexibility, impact resistance, and durability under extreme weather conditions, making them suitable for modern buildings and infrastructure. Widespread adoption of SBS-based roofing solutions directly increases polymer consumption, thereby acting as a key driver for growth of the India SBS Polymer Market

- In November 2024, as per the research published by MDPI, Research highlighting the use of high-content SBS-modified bitumen for improving rutting resistance, fatigue life, cracking performance, and recyclability of road pavements underscores growing adoption of advanced materials in infrastructure development. As sustainability-focused road construction and carbon-reduction initiatives gain traction, demand for high-performance SBS-modified asphalt increases, directly driving consumption growth and acting as a key driver for the India SBS Polymer Market.

- Expanding automotive manufacturing further strengthens SBS usage in applications such as interior components, seals, and polymer blends, where performance and resilience are critical. In parallel, steady growth in the adhesives and sealants sector, fueled by construction, packaging, and industrial assembly, increases the use of SBS due to its superior bonding strength and elastic recovery.

- Collectively, sustained demand from these high-growth end-use industries directly drives higher consumption volumes, improved capacity utilisation, and continued market expansion for SBS polymer in India.

Restraint/Challenge

“Regulatory Pressures and Environmental Compliance”

- Increasingly stringent regulations on polymer production, emissions, and lifecycle environmental impact are placing significant challenges on traditional SBS manufacturing in India.

- Compliance with these rules requires manufacturers to adopt advanced emission control technologies, optimize energy consumption, and ensure proper handling and disposal of chemical intermediates. In addition, environmental audits, reporting requirements, and penalties for non-compliance add operational complexity and elevate production costs.

For instance:

- In December 2024, according to the article publsehd by Outlook Publishing India Pvt Ltd., during global negotiations on a legally binding treaty to combat plastic pollution, India opposed regulating the production of primary plastic polymers, citing potential impacts on development rights and trade. Ongoing international regulatory pressures and uncertainty around future polymer production limits increase compliance challenges for SBS manufacturers, adding operational complexity and acting as a key restraint on the growth of the India SBS Polymer Market.

- In June 2025, in line with the article published by Institute for Energy Economics and Finanical Analysis, Since 2022, the UN has been negotiating an international legally binding instrument (ILBI) to regulate plastic pollution across its lifecycle, including polymer production and trade. Resistance from countries like India highlights the potential for future restrictions on petrochemical feedstocks and polymer trade. Such evolving global regulations increase compliance complexity and operational uncertainty, acting as a significant restraint on the growth of the India SBS Polymer Market

- Manufacturers must also consider carbon footprint reduction and sustainability reporting, which often necessitate investment in cleaner technologies or alternative feedstocks.

- These regulatory pressures limit operational flexibility, increase capital and operational expenditures, and restrict rapid scaling of SBS production, thereby acting as a key restraint on the growth of the India SBS Polymer Market.

Opportunity

“Rising Demand from Electric Vehicle (EV) Industry”

- The rapid growth of the electric vehicle (EV) sector in India is driving strong demand for lightweight, high-performance materials that enhance energy efficiency, safety, and durability.

- SBS polymers, with their unique combination of elasticity, flexibility, and thermal stability, are increasingly used in EV components such as wiring insulation, battery encapsulation, seals, gaskets, and interior parts.

For Instance:

- In October 2023, as per the article published by Science Direct, Rising demand for lightweight, sustainable, and flame-retardant materials in electric vehicles is driving the adoption of high-performance polymer composites. SBS polymers, with elasticity, thermal stability, and durability, are ideal for developing EV components that reduce weight, enhance safety, and support circular economy initiatives. This trend creates significant growth opportunities for the India SBS Polymer Market.

- In October 2025, as published by India Brand Equity Foundation, India’s rapidly growing EV ecosystem, with rising domestic demand and significant investments in electric vehicles, batteries, and auto components, is driving expansion in local manufacturing. International players like VinFast are establishing production hubs, boosting component output. This surge in EV production increases the need for lightweight, durable polymers like SBS, directly creating growth opportunities for the India SBS Polymer Market

- Their ability to reduce weight without compromising mechanical performance contributes to improved vehicle range and energy efficiency, which is critical in EV applications. As automakers adopt advanced polymers for next-generation EV designs, SBS polymers gain broader industrial relevance, creating significant growth potential.

- This rising demand for SBS in EV materials acts as a key opportunity for expansion in the India SBS Polymer Market

India SBS Polymer Market Scope

The India SBS Polymer Market is segmented into six notable segments based on the product, type, styrene content, application, end user and distribution channel.

- By Product Type

The Linear SBS segment dominates the India SBS Polymers Market and is expected to account for 64.31% of the total market share in 2026. Its dominance is primarily attributed to widespread availability, cost-effectiveness, simpler molecular structure, and ease of processing, which make Linear SBS highly suitable for large-scale and high-volume applications such as footwear components, general-purpose adhesives, and construction materials.

In addition to its dominant position, the Linear SBS segment is also the fastest-growing segment, projected to grow at a CAGR of 5.4% during the forecast period. This rapid growth is supported by rising demand from the construction and footwear industries, increasing use in adhesives and sealants, and manufacturers’ preference for materials that offer processing efficiency and cost advantages.

- By Type

The Non-Oil-Extended SBS segment dominates the India SBS Polymers Market and is expected to account for 61.02% of the total market share in 2026. Its dominance is driven by superior mechanical strength, better resistance to deformation, and consistent long-term performance, which make it highly suitable for road construction and infrastructure projects where durability and reliability are critical requirements.

In addition to its dominant position, the Non-Oil-Extended SBS segment is also the fastest-growing segment, projected to grow at a CAGR of 5.8% during the forecast period. The growth is supported by increasing investments in highway development, urban infrastructure expansion, and rising demand for high-performance polymer-modified bitumen, further strengthening its adoption across large-scale construction applications.

- By Styrene Content

The Medium Styrene SBS segment dominates the India SBS Polymers Market and is expected to account for 69.93% of the total market share in 2026. Its dominance is attributed to its balanced combination of flexibility and stiffness, which enables broad adoption across multiple applications including footwear, adhesives, construction materials, and asphalt modification.

In addition to its dominant position, the Medium Styrene SBS segment is also the fastest-growing segment, projected to grow at a CAGR of 5.7% during the forecast period. This growth is driven by rising demand for versatile SBS grades, expanding infrastructure and construction activities, and increasing use in adhesives and footwear manufacturing, reinforcing its strong market outlook.

- By Application

The Road Mastics segment dominates the India SBS Polymers Market and is expected to account for 32.09% of the total market share in 2026. Its dominance is primarily driven by the ability of SBS polymers to significantly improve pavement durability, fatigue resistance, and overall service life, making road mastics a preferred solution for high-performance road construction and maintenance applications.

In addition to its dominant position, the Road Mastics segment is also the fastest-growing segment, projected to grow at a CAGR of 5.7% during the forecast period. The growth is supported by increasing investments in road infrastructure, highway modernization projects, and rising demand for long-lasting pavement materials, further strengthening the adoption of SBS polymers in road mastics applications..

- By End User

The Road Construction & Infrastructure segment dominates the India SBS Polymers Market and is expected to account for 32.09% of the total market share in 2026. Its dominance is driven by continued investments in highway expansion, urban road upgrades, and the growing adoption of polymer-modified materials in public infrastructure projects, where durability and long service life are critical.

In addition to its dominant position, the Road Construction & Infrastructure segment is also the fastest-growing segment, projected to grow at a CAGR of 5.8% during the forecast period. This growth is supported by government-led infrastructure development initiatives, increasing focus on quality road performance, and rising demand for SBS-modified asphalt and construction materials, strengthening the segment’s market outlook.

- By Distribution Channel

The Direct distribution channel dominates the India SBS Polymers Market and is expected to account for 78.83% of the total market share in 2026. Its dominance is driven by direct procurement by large contractors and manufacturers, which enables better pricing control, consistent supply, and closer technical collaboration with SBS polymer producers.

In addition to its dominant position, the Direct distribution channel is also the fastest-growing segment, projected to grow at a CAGR of 5.6% during the forecast period. The growth is supported by increasing preference for long-term supply agreements, rising demand from large-scale infrastructure and industrial projects, and the need for customized material solutions, reinforcing the importance of direct sales channels in the market..

India SBS Polymer Market Share

The SBS Polymer industry is primarily led by well-established companies, including:

- DYCON CHEMICALS (India)

- Kumho Petrochemical Co., Ltd. (South Korea)

- DL Chemical (DL Holdings Co., Ltd.) (South Korea)

- SBS POLYCHEM PVT. LTD. (India)

- Entec Polymers (United States)

- LG Chem Ltd. (South Korea)

- Reliance Industries Limited (India)

- Sinopec (China)

- LCY Chemical Corp. (Taiwan)

- Maxwell (United States)

- Amaz Chemicals LLP (India)

- KK Kompounding Tech Giant Limited (India)

- Versalis S.p.A. (Italy)

- Moras Chemicals India Pvt Ltd (India)

- TSRC Corporation (Taiwan)

Latest Developments in India SBS Polymer Market

- In November 2025, Sinopec signed purchase agreements worth US$40.9 billion with 34 partners from 17 countries across crude oil, chemicals, materials, and equipment at the 8th China International Import Expo (CIIE 2025) — highlighting expanded international cooperation, digital innovation, and supply-chain resilience initiatives..

- In October 2024, LG Chem Expands Automotive Adhesive Business Seoul – LG Chem announced plans to scale up its automotive adhesive business into a multi-million-dollar unit by 2030, targeting North American automakers with thermally conductive adhesives for batteries. The company is also expanding its portfolio to adhesives for electronic components, including powertrains, camera sensors, and headlamps.

- In September 2025, a groundbreaking ceremony was held for a new SSBR (Solution-SBR) production line at Shenhua Chemical, marking the start of construction of expanded elastomer manufacturing capacity in response to growing global demand for performance rubber materials used in high-performance tires and industrial applications.

- In May 2025, Arlanxeo and TSRC Corporation jointly announced the inauguration of their new NBR (nitrile butadiene rubber) plant in Nantong, China, representing a strategic expansion of NBR production capacity to meet rising demand for oil-resistant elastomers across automotive, industrial, and consumer markets.

- In January 2026, Eni signed an agreement with SOCAR (State Oil Company of Azerbaijan Republic) for SOCAR to acquire a 10 % stake in the Baleine oil and gas field development off Côte d’Ivoire, expanding Eni’s West African footprint and reinforcing production collaboration.

SKU-

احصل على إمكانية الوصول عبر الإنترنت إلى التقرير الخاص بأول سحابة استخبارات سوقية في العالم

- لوحة معلومات تحليل البيانات التفاعلية

- لوحة معلومات تحليل الشركة للفرص ذات إمكانات النمو العالية

- إمكانية وصول محلل الأبحاث للتخصيص والاستعلامات

- تحليل المنافسين باستخدام لوحة معلومات تفاعلية

- آخر الأخبار والتحديثات وتحليل الاتجاهات

- استغل قوة تحليل المعايير لتتبع المنافسين بشكل شامل

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF INDIA SBS POLYMER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PROUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 VENDOR SELECTION CRITERIA

4.2.1 CERTIFICATION & REGULATORY COMPLIANCE

4.2.2 PRODUCT QUALITY & CONSISTENCY

4.2.3 SUSTAINABILITY PRACTICES

4.2.4 CUSTOMIZATION ABILITY

4.2.5 LOGISTICS RELIABILITY & SUPPLY ASSURANCE

4.2.6 COLLABORATION, INNOVATION & PROGRAM FLEXIBILITY

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATIONS

4.4 COST ANALYSIS BREAKDOWN

4.4.1 RAW MATERIAL COSTS

4.4.1.1 MATERIAL COMPOSITION AND COST IMPLICATIONS

4.4.1.2 RAW MATERIAL PRICE VOLATILITY

4.4.2 DIRECT LABOUR AND MANUFACTURING COSTS

4.4.2.1 LABOUR COST CONSIDERATIONS

4.4.2.2 PRODUCTION TECHNIQUES AND COST EFFICIENCY

4.4.3 OVERHEAD AND INDIRECT COSTS

4.4.3.1 MANUFACTURING OVERHEAD

4.4.3.2 QUALITY CONTROL AND COMPLIANCE COSTS

4.4.4 SUPPLY CHAIN AND LOGISTICS COSTS

4.4.4.1 INBOUND LOGISTICS AND SOURCING

4.4.4.2 WAREHOUSING AND DISTRIBUTION

4.4.5 CUSTOMIZATION AND PRODUCT DIFFERENTIATION COSTS

4.4.6 REGULATORY AND SUSTAINABILITY-RELATED COSTS

4.4.7 STRATEGIC COST MANAGEMENT PRACTICES

4.4.8 CONCLUSION

4.5 INDUSTRY ECOSYSTEM ANALYSIS

4.5.1 PROMINENT COMPANIES

4.5.2 SMALL & MEDIUM SIZE COMPANIES

4.5.3 END USERS

4.6 RAW MATERIAL COVERAGE

4.6.1 STYRENE

4.6.2 BUTADIENE

4.6.3 POLYMERIZATION INITIATORS AND CATALYSTS

4.6.4 SOLVENTS AND REACTION MEDIA

4.6.5 COUPLING AND FUNCTIONALIZING AGENTS

4.6.6 DEACTIVATORS AND TERMINATION AGENTS

4.6.7 STABILIZERS AND PERFORMANCE ADDITIVES

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTIC SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENTS

4.8.1 ADVANCEMENTS IN POLYMERIZATION TECHNIQUES

4.8.2 INNOVATIONS IN MATERIAL CUSTOMIZATION

4.8.3 PROCESS AUTOMATION AND DIGITAL INTEGRATION

4.8.4 SUSTAINABILITY-DRIVEN TECHNOLOGICAL UPGRADES

4.8.5 APPLICATION OF ADVANCED TESTING AND QUALITY ASSURANCE

4.9 VALUE CHAIN ANALYSIS

4.9.1 UPSTREAM RAW MATERIAL SOURCING AND FEEDSTOCK PROCUREMENT

4.9.2 SBS POLYMERISATION AND PRIMARY MANUFACTURING

4.9.3 COMPOUNDING AND FORMULATION

4.9.4 DISTRIBUTION, LOGISTICS, AND CHANNEL MANAGEMENT

4.9.5 END-USE INDUSTRY INTEGRATION AND DEMAND UTILISATION

4.9.6 RECYCLING, END-OF-LIFE AND CIRCULAR INTEGRATION

5 REGULATION COVERAGE

5.1 PRODUCT CODES

5.2 CERTIFIED STANDARDS

5.3 SAFETY STANDARDS

5.4 MATERIAL HANDLING & STORAGE

5.5 TRANSPORT & PRECAUTIONS

5.6 HAZARD IDENTIFICATION

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 HIGH GROWTH IN KEY END-USE INDUSTRIES

6.1.2 DIVERSE INDUSTRIAL APPLICATIONS OF SBS POLYMERS

6.1.3 GOVERNMENT INCENTIVES STRENGTHENING DOMESTIC FEEDSTOCK

6.2 RESTRAINTS

6.2.1 RAW MATERIAL PRICE VOLATILITY

6.2.2 REGULATORY PRESSURES AND ENVIRONMENTAL COMPLIANCE

6.3 OPPORTUNITY

6.3.1 RISING DEMAND FROM ELECTRIC VEHICLE (EV) INDUSTRY

6.3.2 TECHNOLOGICAL INNOVATION IN SBS COMPOUNDING

6.3.3 BIO-BASED AND RECYCLABLE SBS GRADES

6.4 CHALLENGES

6.4.1 TECHNOLOGY & SKILL GAPS IN INDIAN CHEMICAL INDUSTRY

6.4.2 IMPACT OF LOW-COST IMPORTS ON DOMESTIC SBS PRODUCERS

7 INDIA SBS POLYMERS MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 LINEAR SBS

7.3 RADIAL SBS / STAR SBS (R-SBS)

7.4 INDIA SBS POLYMERS MARKET, BY PRODUCT, 2018-2033 (TONS)

7.4.1 LINEAR SBS

7.4.2 RADIAL SBS / STAR SBS (R-SBS)

7.5 INDIA LINEAR SBS IN SBS POLYMERS MARKET, BY FORM , 2018-2033 (USD THOUSAND)

7.5.1 SOLID

7.5.2 GRANULAR

7.5.3 LIQUID

7.6 INDIA LINEAR SBS IN SBS POLYMERS MARKET, BY END USER , 2018-2033 (USD THOUSAND)

7.6.1 ROAD CONSTRUCTION & INFRASTRUCTURE

7.6.2 FOOTWEAR INDUSTRY

7.6.3 ADHESIVES & SEALANTS INDUSTRY

7.6.4 AUTOMOTIVE INDUSTRY

7.6.5 CONSTRUCTION INDUSTRY

7.6.6 PACKAGING INDUSTRY

7.6.7 OTHERS

7.7 INDIA RADIAL SBS / STAR SBS (R-SBS) IN SBS POLYMERS MARKET, BY FORM , 2018-2033 (USD THOUSAND)

7.7.1 SOLID

7.7.2 GRANULAR

7.7.3 LIQUID

7.8 INDIA RADIAL SBS / STAR SBS (R-SBS) IN SBS POLYMERS MARKET, BY END USER , 2018-2033 (USD THOUSAND)

7.8.1 ROAD CONSTRUCTION & INFRASTRUCTURE

7.8.2 ADHESIVES & SEALANTS INDUSTRY

7.8.3 FOOTWEAR INDUSTRY

7.8.4 AUTOMOTIVE INDUSTRY

7.8.5 CONSTRUCTION INDUSTRY

7.8.6 PACKAGING INDUSTRY

7.8.7 OTHERS

8 INDIA SBS POLYMERS MARKET, BY TYPE

8.1 OVERVIEW

8.2 NON-OIL-EXTENDED SBS

8.3 OIL-EXTENDED SBS

8.4 INDIA SBS POLYMERS MARKET, BY TYPE, 2018-2033 (TONS)

8.4.1 NON-OIL-EXTENDED SBS

8.4.2 OIL-EXTENDED SBS

9 INDIA SBS POLYMERS MARKET, BY STYRENE CONTENT

9.1 OVERVIEW

9.2 MEDIUM STYRENE SBS

9.3 LOW STYRENE SBS

9.4 HIGH STYRENE SBS

9.5 INDIA SBS POLYMERS MARKET, BY STYRENE CONTENT, 2018-2033 (TONS)

9.5.1 MEDIUM STYRENE SBS

9.5.2 LOW STYRENE SBS

9.5.3 HIGH STYRENE SBS

10 INDIA SBS POLYMERS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 ROAD MASTICS

10.3 ADHESIVES & SEALANTS

10.4 SHOE SOLES & FOOTWEAR COMPONENTS

10.5 POLYMER MODIFIED BITUMEN

10.6 CONSTRUCTION CHEMICALS

10.7 ASPHALT MODIFICATION

10.8 ROOFING MEMBRANE

10.9 OTHERS

10.1 INDIA SBS POLYMERS MARKET, BY APPLICATION, 2018-2033 (TONS)

10.10.1 ROAD MASTICS

10.10.2 ADHESIVES & SEALANTS

10.10.3 SHOE SOLES & FOOTWEAR COMPONENTS

10.10.4 POLYMER MODIFIED BITUMEN

10.10.5 CONSTRUCTION CHEMICALS

10.10.6 ASPHALT MODIFICATION

10.10.7 ROOFING MEMBRANE

10.10.8 OTHERS

11 INDIA SBS POLYMERS MARKET, BY END USER

11.1 OVERVIEW

11.2 ROAD CONSTRUCTION & INFRASTRUCTURE

11.3 FOOTWEAR INDUSTRY

11.4 ADHESIVES & SEALANTS INDUSTRY

11.5 AUTOMOTIVE INDUSTRY

11.6 CONSTRUCTION INDUSTRY

11.7 PACKAGING INDUSTRY

11.8 OTHERS

11.9 INDIA SBS POLYMERS MARKET, BY END USER , 2018-2033 (TONS)

11.9.1 FOOTWEAR INDUSTRY

11.9.2 ROAD CONSTRUCTION & INFRASTRUCTURE

11.9.3 ADHESIVES & SEALANTS INDUSTRY

11.9.4 AUTOMOTIVE INDUSTRY

11.9.5 CONSTRUCTION INDUSTRY

11.9.6 PACKAGING INDUSTRY

11.9.7 OTHERS

12 INDIA SBS POLYMERS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT

12.3 INDIRECT

12.4 INDIA SBS POLYMERS MARKET, BY DISTRIBUTION CHANNEL , 2018-2033 (TONS)

12.4.1 DIRECT

12.4.2 INDIRECT

12.5 INDIA SBS POLYMERS MARKET, BY DISTRIBUTION CHANNEL , 2018-2033 (USD THOUSAND)

12.5.1 DISTRIBUTORS

12.5.2 AGENTS / DEALERS

12.5.3 OTHERS

13 INDIA SBS POLYMER MARKET: COMPANY LANDSCAPE

13.1 MANUFACTURER COMPANY SHARE ANALYSIS: INDIA

14 SWOT ANALYSIS

15 COMPANY PROFILE MANUFACTURER

15.1 CHINA PETROCHEMICAL CORPORATION (SINOPEC)

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 LG CHEM LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 DL CHEMICALS

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 TSRC CORPORATION

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 ENI S.P.A. (PARENT COMPANY OF VERSALIS S.P.A.)

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AMAZ CHEMICALS LLP

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 DYCON CHEMICALS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ENTEC POLYMERS

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 KK KOMPOUNDING TECH GIANT LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 KUMHO PETROCHEMICAL CO LTD

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 LCY

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 MAXWELL.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 MORAS CHEMICALS INDIA PVT LTD

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 RELIANCE INDUSTRIES LIMITED.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 SBS POLYCHEM PVT. LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

16 COMPANY PROFILE BUYER

16.1 ASIAN PAINTS LTD.

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENT

16.2 BOSTIK

16.2.1 COMPANY SNAPSHOT

16.2.2 PRODUCT PORTFOLIO

16.2.3 RECENT DEVELOPMENT

16.3 PIDILITE INDUSTRIES LTD.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENT

16.4 RELAXO FOOTWEARS LIMITED

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 SHIVAM TAR PRODUCTS

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 INDIA SBS POLYMERS MARKET, BY PRODUCT, 2018-2033 (USD THOUSAND)

TABLE 2 INDIA SBS POLYMERS MARKET, BY PRODUCT, 2018-2033 (TONS)

TABLE 3 INDIA LINEAR SBS IN SBS POLYMERS MARKET, BY FORM , 2018-2033 (USD THOUSAND)

TABLE 4 INDIA LINEAR SBS IN SBS POLYMERS MARKET, BY END USER , 2018-2033 (USD THOUSAND)

TABLE 5 INDIA RADIAL SBS / STAR SBS (R-SBS) IN SBS POLYMERS MARKET, BY FORM , 2018-2033 (USD THOUSAND)

TABLE 6 INDIA RADIAL SBS / STAR SBS (R-SBS) IN SBS POLYMERS MARKET, BY END USER , 2018-2033 (USD THOUSAND)

TABLE 7 INDIA SBS POLYMERS MARKET, BY TYPE, 2018-2033 (USD THOUSAND)

TABLE 8 INDIA SBS POLYMERS MARKET, BY TYPE, 2018-2033 (TONS)

TABLE 9 INDIA SBS POLYMERS MARKET, BY STYRENE CONTENT, 2018-2033 (USD THOUSAND)

TABLE 10 INDIA SBS POLYMERS MARKET, BY STYRENE CONTENT, 2018-2033 (TONS)

TABLE 11 INDIA SBS POLYMERS MARKET, BY APPLICATION, 2018-2033 (USD THOUSAND)

TABLE 12 INDIA SBS POLYMERS MARKET, BY APPLICATION, 2018-2033 (TONS)

TABLE 13 INDIA SBS POLYMERS MARKET, BY END USER , 2018-2033 (USD THOUSAND)

TABLE 14 INDIA SBS POLYMERS MARKET, BY END USER , 2018-2033 (TONS)

TABLE 15 INDIA SBS POLYMERS MARKET, BY DISTRIBUTION CHANNEL , 2018-2033 (USD THOUSAND)

TABLE 16 INDIA SBS POLYMERS MARKET, BY DISTRIBUTION CHANNEL , 2018-2033 (TONS)

TABLE 17 INDIA SBS POLYMERS MARKET, BY DISTRIBUTION CHANNEL , 2018-2033 (USD THOUSAND)

List of Figure

FIGURE 1 INDIA SBS POLYMER MARKET: SEGMENTATION

FIGURE 2 INDIA SBS POLYMER MARKET: DATA TRIANGULATION

FIGURE 3 INDIA SBS POLYMER MARKET: DROC ANALYSIS

FIGURE 4 INDIA SBS POLYMER MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 INDIA SBS POLYMER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 INDIA SBS POLYMER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 INDIA SBS POLYMER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 INDIA SBS POLYMER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 INDIA SBS POLYMER MARKET: MULTIVARIVATE MODELING

FIGURE 10 INDIA SBS POLYMER MARKET: PRODUCT TIMELINE CURVE

FIGURE 11 INDIA SBS POLYMER MARKET: APPLICATION COVERAGE GRID

FIGURE 12 INDIA SBS POLYMER MARKET: SEGMENTATION

FIGURE 13 TWO SEGMENTS COMPRISE THE INDIA SBS POLYMER MARKET, BY PRODUCT (2025)

FIGURE 14 INDIA SBS POLYMER MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 HIGH GROWTH IN KEY END-USE INDUSTRIES IS EXPECTED TO DRIVE THE INDIA SBS POLYMER MARKET DURING THE FORECAST PERIOD OF 2026 TO 2033.

FIGURE 17 PRODUCT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE INDIA SBS POLYMER MARKET IN 2026 & 2033

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 DROC ANALYSIS

FIGURE 20 INDIA SBS POLYMERS MARKET, BY PRODUCT, 2025

FIGURE 21 INDIA SBS POLYMERS MARKET, BY TYPE, 2025

FIGURE 22 INDIA SBS POLYMERS MARKET, BY STYRENE CONTENT, 2025

FIGURE 23 INDIA SBS POLYMERS MARKET, BY APPLICATION, 2025

FIGURE 24 INDIA SBS POLYMERS MARKET, BY END USER, 2025

FIGURE 25 INDIA SBS POLYMERS MARKET, BY DISTRIBUTION CHANNEL, 2025

FIGURE 26 INDIA SBS POLYMER MARKET: COMPANY SHARE 2025 (%)

منهجية البحث

يتم جمع البيانات وتحليل سنة الأساس باستخدام وحدات جمع البيانات ذات أحجام العينات الكبيرة. تتضمن المرحلة الحصول على معلومات السوق أو البيانات ذات الصلة من خلال مصادر واستراتيجيات مختلفة. تتضمن فحص وتخطيط جميع البيانات المكتسبة من الماضي مسبقًا. كما تتضمن فحص التناقضات في المعلومات التي شوهدت عبر مصادر المعلومات المختلفة. يتم تحليل بيانات السوق وتقديرها باستخدام نماذج إحصائية ومتماسكة للسوق. كما أن تحليل حصة السوق وتحليل الاتجاهات الرئيسية هي عوامل النجاح الرئيسية في تقرير السوق. لمعرفة المزيد، يرجى طلب مكالمة محلل أو إرسال استفسارك.

منهجية البحث الرئيسية التي يستخدمها فريق بحث DBMR هي التثليث البيانات والتي تتضمن استخراج البيانات وتحليل تأثير متغيرات البيانات على السوق والتحقق الأولي (من قبل خبراء الصناعة). تتضمن نماذج البيانات شبكة تحديد موقف البائعين، وتحليل خط زمني للسوق، ونظرة عامة على السوق ودليل، وشبكة تحديد موقف الشركة، وتحليل براءات الاختراع، وتحليل التسعير، وتحليل حصة الشركة في السوق، ومعايير القياس، وتحليل حصة البائعين على المستوى العالمي مقابل الإقليمي. لمعرفة المزيد عن منهجية البحث، أرسل استفسارًا للتحدث إلى خبراء الصناعة لدينا.

التخصيص متاح

تعد Data Bridge Market Research رائدة في مجال البحوث التكوينية المتقدمة. ونحن نفخر بخدمة عملائنا الحاليين والجدد بالبيانات والتحليلات التي تتطابق مع هدفهم. ويمكن تخصيص التقرير ليشمل تحليل اتجاه الأسعار للعلامات التجارية المستهدفة وفهم السوق في بلدان إضافية (اطلب قائمة البلدان)، وبيانات نتائج التجارب السريرية، ومراجعة الأدبيات، وتحليل السوق المجدد وقاعدة المنتج. ويمكن تحليل تحليل السوق للمنافسين المستهدفين من التحليل القائم على التكنولوجيا إلى استراتيجيات محفظة السوق. ويمكننا إضافة عدد كبير من المنافسين الذين تحتاج إلى بيانات عنهم بالتنسيق وأسلوب البيانات الذي تبحث عنه. ويمكن لفريق المحللين لدينا أيضًا تزويدك بالبيانات في ملفات Excel الخام أو جداول البيانات المحورية (كتاب الحقائق) أو مساعدتك في إنشاء عروض تقديمية من مجموعات البيانات المتوفرة في التقرير.