Global Acrylic Adhesives Market

Marktgröße in Milliarden USD

CAGR :

%

USD

42.88 Billion

USD

86.07 Billion

2024

2032

USD

42.88 Billion

USD

86.07 Billion

2024

2032

| 2025 –2032 | |

| USD 42.88 Billion | |

| USD 86.07 Billion | |

|

|

|

|

Global Acrylic Adhesives Market Segmentation, By Product Type (Temporary, Permanent), Product Type (Acrylic Polymer Emulsion, Cyanoacrylic, Methacrylic, UV Curable Acrylic), Application (Paper and Packaging, Construction, Transportation, Medical, Consumer, Electronics, Others), Forms (Liquid, Paste, Tape), Technology (Water-based, Solvent-based, Reactive and Others)- Industry Trends and Forecast to 2032

Acrylic Adhesives Market Size

-

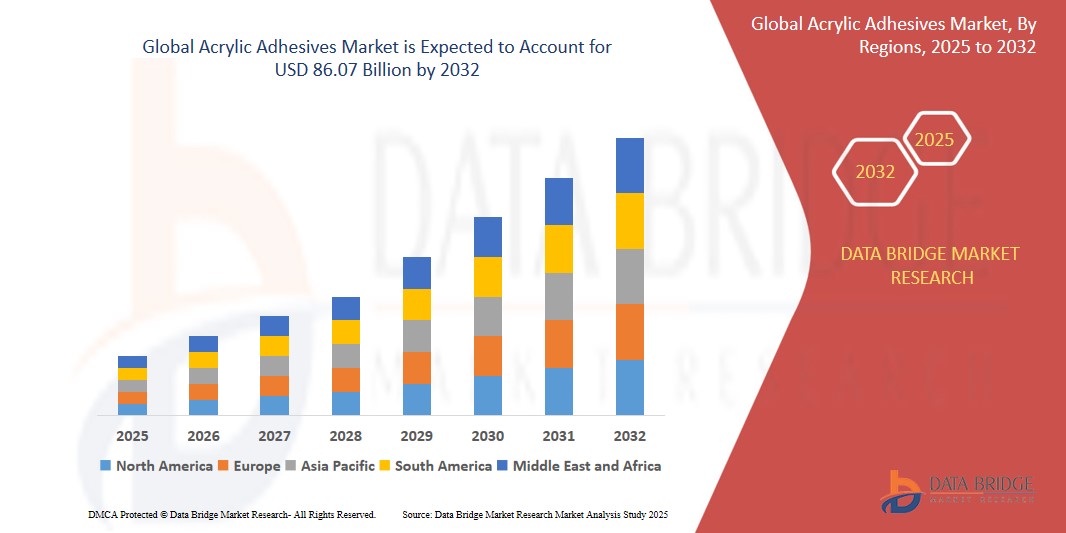

The global Acrylic Adhesives market was valued atUSD 42.88 billion in 2024 and is expected to reachUSD 86.07 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 9.10%, primarily driven by the high consumption of acrylic adhesives

- This growth is driven by factors such as the increase in the economic growth, expansion in the manufacturing industries and the accessibility of cheap labour

Acrylic Adhesives Market Analysis

- Acrylic adhesives are critical materials used across various industries, providing strong bonding, flexibility, and resistance to environmental factors. They are essential in Product Types such as construction, automotive, electronics, and medical devices.

- The demand for these adhesives is significantly driven by the increasing need for lightweight, durable materials and advancements in assembly technologies. Over half of the global demand is fueled by the automotive and construction sectors, with the highest consumption seen in regions experiencing rapid industrialization and infrastructure growth.

- The North America region stands out as one of the dominant regions for acrylic adhesives, driven by its robust manufacturing base, technological advancements, and the presence of key end-user industries.

- For instance, the automotive sector in the U.S. has increasingly adopted acrylic adhesives for lightweight vehicle assembly to meet stringent emission standards. From major OEMs to niche manufacturers, North America not only consumes but also drives innovations in adhesive technologies.

- Globally, acrylic adhesives rank as the second-most widely used adhesive type after epoxy adhesives and play a pivotal role in enabling high-performance bonding solutions across a range of industries.

Report Scope and Acrylic Adhesives Market Segmentation

|

Attributes |

Acrylic Adhesives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Acrylic Adhesives Market Trends

“Shift Toward Sustainable and High-Performance Adhesive Solutions”

- One prominent trend in the global acrylic adhesives market is the shift toward sustainable and high-performance adhesive solutions.

- • This trend is fueled by growing environmental concerns, stricter regulatory standards, and increasing demand for eco-friendly products across industries like automotive, construction, and packaging.

- For instance, manufacturers are developing low-VOC (volatile organic compounds) and solvent-free acrylic adhesives that offer strong bonding performance while minimizing environmental impact. These sustainable formulations are particularly important for sectors aiming to meet green building certifications and corporate sustainability goals.

- High-performance acrylic adhesives are also being engineered for greater heat resistance, chemical durability, and flexibility, expanding their applications in extreme environments and high-tech industries.

- This trend is reshaping the competitive landscape, encouraging innovation and pushing companies to invest in greener, smarter adhesive technologies to meet evolving market expectations

Acrylic Adhesives Market Dynamics

Driver

“Growing Demand Across Key End-Use Industries”

- The rising demand for lightweight, durable, and high-performance bonding solutions across industries such as automotive, construction, electronics, and medical devices is significantly contributing to the growth of the acrylic adhesives market.

- In the automotive sector, the shift towards lightweight vehicles to improve fuel efficiency and meet emission standards has led to increased adoption of acrylic adhesives in place of traditional mechanical fasteners.

- Similarly, the construction industry's focus on energy-efficient buildings and sustainable construction practices has driven demand for low-VOC, high-strength adhesives.

- Ongoing technological advancements in adhesive formulations, including the development of UV-curable and high-temperature-resistant acrylic adhesives, further fuel their widespread application across diverse industries.

- As industries continue to innovate and prioritize performance and sustainability, the demand for acrylic adhesives grows, positioning them as a critical component in modern manufacturing processes.

For instance,

- In September 2024, according to an article published by Adhesives & Sealants Industry (ASI) magazine, the global automotive industry's growing use of multi-material structures has significantly increased the demand for acrylic adhesives, owing to their ability to bond dissimilar materials like metals and composites.

- In June 2023, the Construction Marketing Association (CMA) highlighted that green building trends and regulations are pushing construction companies to adopt adhesives that offer durability and lower environmental impact, with acrylic adhesives leading the way.

- As a result of expanding applications across industries and the push for sustainability, the demand for acrylic adhesives is expected to maintain strong growth momentum globally.

Opportunity

“Innovation in Sustainable and Bio-Based Acrylic Adhesives”

- The growing emphasis on sustainability presents a major opportunity for the development of bio-based and environmentally friendly acrylic adhesives.

- Manufacturers are increasingly investing in research and development to create adhesives derived from renewable raw materials without compromising on performance characteristics such as strength, flexibility, and durability.

- Bio-based acrylic adhesives are especially appealing to industries such as packaging, construction, and automotive, which are under pressure to meet stricter environmental regulations and corporate sustainability targets.

For instance,

- In March 2025, according to a report by Grand View Research, companies like Arkema and Henkel have expanded their product lines to include bio-based acrylic adhesives to cater to eco-conscious markets, anticipating a surge in demand for green alternatives.

- In January 2024, the European Adhesive Association (FEICA) highlighted that sustainable adhesives are one of the fastest-growing segments in the adhesives industry, driven by consumer demand for environmentally responsible products.

- The development and commercialization of sustainable acrylic adhesives not only address environmental concerns but also open new market opportunities, offering companies a competitive advantage in a rapidly evolving regulatory landscape.

Restraint/Challenge

“Fluctuating Raw Material Prices Impacting Profitability”

- The prices of key raw materials used in the production of acrylic adhesives, such as acrylic acid, methyl methacrylate (MMA), and other petroleum-based derivatives, are highly volatile and can significantly impact manufacturing costs.

- Price fluctuations are often driven by factors such as crude oil price movements, supply chain disruptions, geopolitical tensions, and changing trade policies.

- Such variability in input costs can compress profit margins for adhesive manufacturers and lead to higher product prices, making it challenging to maintain competitive pricing in sensitive end-use markets.

For instance,

- In October 2024, according to the Chemical Market Analytics report, the global price of acrylic acid surged by over 20% year-on-year due to raw material shortages and increased energy costs, putting pressure on adhesive manufacturers to raise prices or absorb losses.

- Consequently, fluctuating raw material costs create uncertainties in the supply chain and profitability outlook, posing a major challenge for market players in the acrylic adhesives industry.

Acrylic Adhesives Market Scope

The market is segmented on the basis Product Type, product type, Application, Forms, Technology, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Type |

|

|

By Application

|

|

|

By Forms |

|

|

By Technology

|

|

|

|

|

Acrylic Adhesives Market Regional Analysis

“North America is the Dominant Region in the Acrylic Adhesives Market”

- North America dominates the acrylic adhesives market, driven by a strong manufacturing base, technological advancements, and the presence of key players across industries such as automotive, construction, and electronics.

- The U.S. holds a significant share due to increased demand for lightweight and durable bonding solutions in the automotive and aerospace sectors, as well as the rising emphasis on sustainable construction practices.

- The region benefits from robust R&D activities, high adoption of advanced adhesive technologies, and stringent regulatory standards promoting the use of environmentally friendly products.

- In addition, the presence of major automotive OEMs, increasing demand for electric vehicles (EVs), and rapid technological integration in the construction sector are fueling market expansion across North America.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the acrylic adhesives market, fueled by rapid industrialization, urbanization, and growing investments in infrastructure development.

- Countries such as China, India, Japan, and South Korea are emerging as key markets due to the booming automotive, construction, and electronics industries, as well as increasing demand for lightweight, efficient bonding solutions.

- China, with its large-scale automotive manufacturing sector and rapid growth in renewable energy and consumer electronics, remains a crucial driver for the regional market.

- India is witnessing significant expansion in the construction and packaging sectors, creating new opportunities for acrylic adhesive applications. Additionally, Japan and South Korea, with their focus on technological innovation and high-performance materials, continue to lead in adopting advanced adhesive technologies.

- The expanding presence of global manufacturers, favorable government initiatives, and rising consumer demand for durable and sustainable products are further accelerating market growth in the region.

Acrylic Adhesives Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, Product Type dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

• Henkel Adhesives Technologies India Private Limited (India)

• H.B. Fuller Company (U.S.)

• Arkema (France)

• Illinois Tool Works Inc. (U.S.)

• Sika AG (Switzerland)

• 3M (U.S.)

• Huntsman International LLC. (U.S.)

• Avery Dennison Corporation (U.S.)

• Pidilite Industries Ltd. (India)

• TOAGOSEI CO., LTD. (Japan)

• Permabond LLC. (U.K.)

• Dymax Corporation (U.S.)

• Franklin International (U.S.)

• Parker Hannifin Corp (U.S.)

• RPM International Inc. (U.S.)

• TONSAN Adhesive, Inc. (China)

• Bostik SA (France)

• MAPEI S.p.A. (Italy)

Latest Developments in Global Acrylic Adhesives Market

- In February 2025, Henkel announced the launch of its new Loctite AA 5831, a one-component, UV-curable acrylic adhesive designed for the electronics market. This adhesive offers excellent adhesion to a wide range of substrates, enhanced environmental resistance, and is specially formulated to meet the miniaturization needs of modern electronic devices.

- In December 2024, H.B. Fuller Company introduced a new line of high-performance, low-odor acrylic adhesives for construction and automotive applications under its TEC and Advantra brands. These adhesives are engineered to offer superior bonding strength, fast curing times, and improved environmental profiles, aligning with growing sustainability demands.

- In November 2024, Arkema announced the expansion of its acrylic adhesive manufacturing capacity at its Sartomer facility in China. This strategic investment is aimed at supporting the fast-growing demand in the Asia-Pacific region, especially in electronics, medical, and flexible packaging industries.

- In October 2024, Sika AG launched its new Sikaflex-545 acrylic adhesive for construction and industrial bonding applications. The product offers high initial tack, excellent adhesion to a variety of substrates without the need for primers, and improved weather resistance, supporting green building trends globally.

- In September 2024, 3M unveiled a new line of acrylic structural adhesives under its Scotch-Weld portfolio, offering improved impact resistance, high bond strength, and environmental durability, catering primarily to the automotive and aerospace industries' demand for lightweight material bonding.

SKU-

Erhalten Sie Online-Zugriff auf den Bericht zur weltweit ersten Market Intelligence Cloud

- Interaktives Datenanalyse-Dashboard

- Unternehmensanalyse-Dashboard für Chancen mit hohem Wachstumspotenzial

- Zugriff für Research-Analysten für Anpassungen und Abfragen

- Konkurrenzanalyse mit interaktivem Dashboard

- Aktuelle Nachrichten, Updates und Trendanalyse

- Nutzen Sie die Leistungsfähigkeit der Benchmark-Analyse für eine umfassende Konkurrenzverfolgung

Forschungsmethodik

Die Datenerfassung und Basisjahresanalyse werden mithilfe von Datenerfassungsmodulen mit großen Stichprobengrößen durchgeführt. Die Phase umfasst das Erhalten von Marktinformationen oder verwandten Daten aus verschiedenen Quellen und Strategien. Sie umfasst die Prüfung und Planung aller aus der Vergangenheit im Voraus erfassten Daten. Sie umfasst auch die Prüfung von Informationsinkonsistenzen, die in verschiedenen Informationsquellen auftreten. Die Marktdaten werden mithilfe von marktstatistischen und kohärenten Modellen analysiert und geschätzt. Darüber hinaus sind Marktanteilsanalyse und Schlüsseltrendanalyse die wichtigsten Erfolgsfaktoren im Marktbericht. Um mehr zu erfahren, fordern Sie bitte einen Analystenanruf an oder geben Sie Ihre Anfrage ein.

Die wichtigste Forschungsmethodik, die vom DBMR-Forschungsteam verwendet wird, ist die Datentriangulation, die Data Mining, die Analyse der Auswirkungen von Datenvariablen auf den Markt und die primäre (Branchenexperten-)Validierung umfasst. Zu den Datenmodellen gehören ein Lieferantenpositionierungsraster, eine Marktzeitlinienanalyse, ein Marktüberblick und -leitfaden, ein Firmenpositionierungsraster, eine Patentanalyse, eine Preisanalyse, eine Firmenmarktanteilsanalyse, Messstandards, eine globale versus eine regionale und Lieferantenanteilsanalyse. Um mehr über die Forschungsmethodik zu erfahren, senden Sie eine Anfrage an unsere Branchenexperten.

Anpassung möglich

Data Bridge Market Research ist ein führendes Unternehmen in der fortgeschrittenen formativen Forschung. Wir sind stolz darauf, unseren bestehenden und neuen Kunden Daten und Analysen zu bieten, die zu ihren Zielen passen. Der Bericht kann angepasst werden, um Preistrendanalysen von Zielmarken, Marktverständnis für zusätzliche Länder (fordern Sie die Länderliste an), Daten zu klinischen Studienergebnissen, Literaturübersicht, Analysen des Marktes für aufgearbeitete Produkte und Produktbasis einzuschließen. Marktanalysen von Zielkonkurrenten können von technologiebasierten Analysen bis hin zu Marktportfoliostrategien analysiert werden. Wir können so viele Wettbewerber hinzufügen, wie Sie Daten in dem von Ihnen gewünschten Format und Datenstil benötigen. Unser Analystenteam kann Ihnen auch Daten in groben Excel-Rohdateien und Pivot-Tabellen (Fact Book) bereitstellen oder Sie bei der Erstellung von Präsentationen aus den im Bericht verfügbaren Datensätzen unterstützen.