Global Angiography Devices Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

12.83 Billion

USD

22.17 Billion

2024

2032

USD

12.83 Billion

USD

22.17 Billion

2024

2032

| 2025 –2032 | |

| USD 12.83 Billion | |

| USD 22.17 Billion | |

|

|

|

|

Global Angiography Devices Market Segmentation, By Product (Angiography Systems, Angiography Contrast Media, Vascular Closure Devices, Angiography Balloons, Angiography Catheters, Angiography Guidewires, and Angiography Accessories), Technology (X-Ray Angiography, Computed Tomography Angiography, Magnetic Resonance Angiography, and Other Angiography Technologies), Procedure (Coronary Angiography, Endovascular Angiography, Neuroangiography, Onco-Angiography, and Other Angiography Procedures), Indication (Coronary Artery Disease, Valvular Heart Disease, Congenital Heart Disease, Congestive Heart Failure, and Other Indications), Application (Diagnostics and Therapeutics), End-User (Hospitals and Clinics, Diagnostic and Imaging Centres, and Research Institutes) - Industry Trends and Forecast to 2032

Angiography Devices Market Size

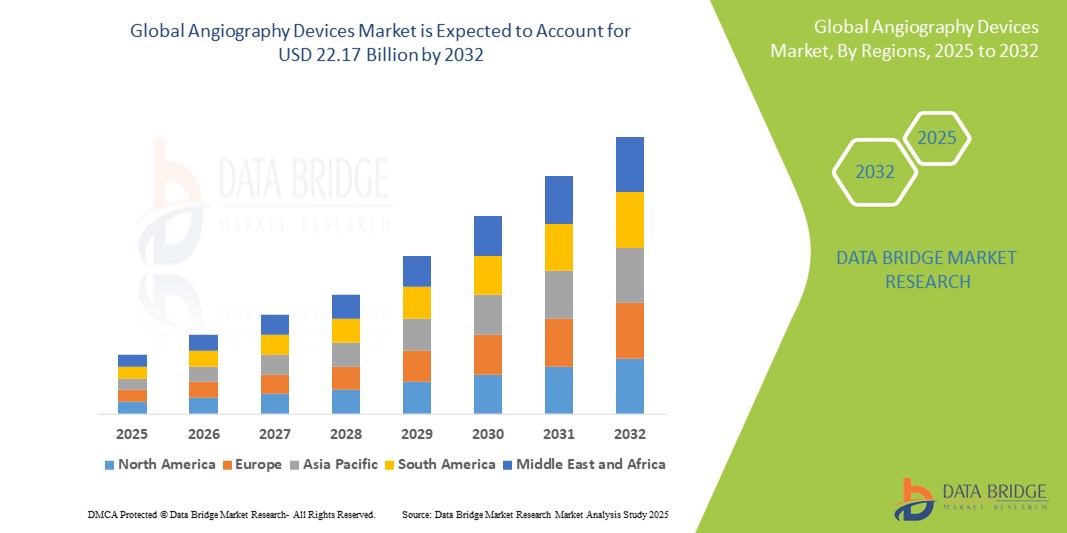

- The global angiography devices market size was valued atUSD 12.83 billion in 2024and is expected to reachUSD 22.17 billion by 2032, at aCAGR of 7.07%during the forecast period

- This growth is driven by factors such as the increasing prevalence of cardiovascular diseases, rising demand for minimally invasive procedures, technological advancements in imaging systems, and growing awareness regarding early disease diagnosis

Angiography Devices Market Analysis

- The angiography devices market is experiencing steady growth due to the increasing integration of advanced imaging technologies that improve visualization during procedures, leading to more accurate diagnoses and treatment planning

- Market participants are focusing on innovation and product development, with newer systems offering improved precision, reduced radiation exposure, and enhanced workflow efficiency across healthcare settings

- North America is expected to dominate the angiography devices market due to the presence of advanced healthcare infrastructure, high adoption of innovative technologies, and strong healthcare reimbursement policies.

- Asia-Pacific is expected to be the fastest growing region in the angiography devices market during the forecast period due to increasing healthcare investments, rising prevalence of cardiovascular diseases, and expanding healthcare access in emerging economies

- The angiography systems segment is expected to dominate the angiography devices market with the largest share of 27% in 2025 due to its essential role in diagnostic and interventional procedures, offering advanced imaging capabilities and widespread adoption in various healthcare settings.

Report Scope and Angiography Devices Market Segmentation

|

Attributes |

Angiography Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Angiography Devices Market Trends

“Integration of Artificial Intelligence (AI) and Machine Learning (ML) into Imaging Systems”

- Artificial intelligenceis being increasingly integrated into angiography systems to enhance diagnostic precision and streamline procedures

- For instance, these systems help reduce human error by automating image recognition and interpretation tasks in real time

- AI algorithms assist in identifying subtle anomalies in blood vessels that may be missed during manual assessment

- For instance, Siemens Healthineers has integrated AI into its angiography solutions to assist cardiologists in detecting arterial blockages more accurately

- Machine learning models enable personalized diagnostics by analyzing vast datasets and predicting outcomes based on patient history

- For instance, GE Healthcare’s CardioGraphe, when paired with AI software, provides highly tailored cardiovascular imaging for better treatment planning

- Radiation exposure is reduced significantly as AI optimizes imaging parameters and eliminates unnecessary scans

- For instance, Shimadzu Corporation’s Trinias system uses AI-based deep learning to cut X-ray doses by over 40%, enhancing patient safety during procedures

- Clinical workflows are becoming more efficient with AI handling repetitive imaging tasks and generating instant, actionable reports

Angiography Devices Market Dynamics

Driver

“Increasing Prevalence of Cardiovascular Diseases”

- Advancements in imaging technologies such as 3D rotational angiography and AI integration are significantly enhancing procedural accuracy and efficiency

- For instance, Philips’ Azurion platform enables real-time image guidance, improving intervention outcomes and reducing procedure times

- New contrast agents with better biocompatibility and reduced nephrotoxicity are making angiography safer for patients with renal issues

- For instance, GE Healthcare’s contrast agent Visipaque is widely used for its lower risk in sensitive patients, thereby expanding patient eligibility

- The growing shift toward outpatient and image-guided procedures is creating high demand for compact, mobile angiography systems

- For instance, Siemens Healthineers’ Artis one system is a notable instance, designed for small spaces while maintaining high-quality imaging

- Research on imaging biomarkers and automated image interpretation is helping streamline clinical workflows and enable faster diagnosis

- For instance, Canon Medical’s AI-based software that assists in detecting vascular anomalies more efficiently

- The healthcare industry's digital transformation is favoring smart, connected angiography systems, offering providers a competitive edge

Opportunity

“Technological Advancements in Imaging and Contrast Agents”

- Advancements in imaging technologies such as three-dimensional rotational angiography and hybrid operating rooms are enhancing diagnostic precision and improving procedural outcomes

- New contrast agents with enhanced biocompatibility and reduced nephrotoxicity are expanding the use of angiography in high-risk patients, improving safety and accessibility

- The shift toward outpatient and minimally invasive surgeries is increasing demand for compact, mobile angiography units that deliver high-definition imaging in varied clinical settings

- Integration of artificial intelligence in imaging workflows is streamlining operations, reducing interpretation time, and enabling quicker decision-making for patient care

- Companies that invest in connected, AI-driven angiography systems are gaining a competitive edge by supporting digital transformation and reducing healthcare costs

- For instance, GE Healthcare introduced its Allia IGS 7 system, combining AI and robotic assistance to optimize space and improve workflow in hybrid ORs

- For instance, Bracco Diagnostics developed a new iodine-based contrast agent designed for improved renal safety, benefiting patients with kidney concerns

Restraint/Challenge

“High Cost and Maintenance of Equipment”

- The high capital investment required for angiography devices, including imaging units, injector systems, and software, makes adoption difficult for small and mid-sized healthcare facilities

- Ongoing operational costs such as maintenance, calibration, and technical support of advanced systems such as digital subtraction angiography units place additional financial strain on providers

- Reimbursement policies in various countries often fail to adequately cover the high procedural and equipment costs, limiting access to these technologies

- Consumable costs such as contrast agents, catheters, and protective gear further increase the expense of angiographic procedures

- The shortage of trained professionals to operate complex systems and accurately interpret imaging results leads to suboptimal use and procedural risks

- For instance, A study published in the Journal of Health Economics highlighted how small clinics in India struggle to afford and maintain angiography units due to lack of financial subsidies

- For instance, in sub-Saharan Africa, several public hospitals report delays in adoption of modern imaging tools because of insufficient trained radiologic technologists and limited reimbursements

Angiography Devices Market Scope

The market is segmented on the basis of product technology, procedure, indication, application, end-user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Technology |

|

|

By Procedure |

|

|

By Indication |

|

|

By Application |

|

|

By End-User |

|

In 2025, the angiography systems is projected to dominate the market with a largest share in product segment

The angiography systems segment is expected to dominate the angiography devices market with the largest share of 27% in 2025 due to its essential role in diagnostic and interventional procedures, offering advanced imaging capabilities and widespread adoption in various healthcare settings.

The coronary angiography is expected to account for the largest share during the forecast period in procedure market

In 2025, the coronary angiography segment is expected to dominate the market with the largest market share of 46.3% due to its high prevalence of coronary artery disease and the critical need for accurate diagnosis and treatment planning in cardiovascular care.

Angiography Devices Market Regional Analysis

“North America Holds the Largest Share in the Angiography Devices Market”

- North America is expected to dominate the angiography devices market with a market share of approximately 41% due to its advanced healthcare infrastructure and high adoption rates of cutting-edge technology

- The presence of key market players such as General Electric and Philips ensures the continuous development and distribution of angiography devices

- Strong reimbursement policies in the U.S. make advanced devices more accessible to healthcare providers, increasing their market adoption

- North America has a large patient base requiring diagnostic services, particularly for cardiovascular diseases, driving the demand for angiography devices

- The region's dominance is also supported by an ongoing focus on minimally invasive procedures, which is increasing the need for advanced angiography technologies

“Asia-Pacific is Projected to Register the Highest CAGR in the Angiography Devices Market”

- Asia-Pacific is expected to be the fastest-growing region in the angiography devices market during the forecast period

- Rapidly growing healthcare investments in countries such as China and India are increasing the availability of angiography devices

- The rising geriatric population in Asia-Pacific countries is leading to higher demand for diagnostic tools such as angiography devices

- Government initiatives to improve healthcare access, such as subsidies and infrastructure development, are fuelling market growth

- The region is seeing a rapid adoption of digital imaging technologies in medical diagnostics, which enhances the demand for advanced angiography systems

Angiography Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Terumo Corporation(Japan)

- Abbott(U.S.)

- B. Braun Melsungen AG(Germany)

- AngioDynamics(U.S.)

- Medtronic(Ireland)

- Shimadzu Corporation (Japan)

- Cardinal Health. (U.S.)

- Boston Scientific Corporation (U.S.)

- Canon Inc. (Japan)

- Siemens Healthcare GmbH (Germany)

- Koninklijke Philips N.V. (Netherlands)

- GENERAL ELECTRIC COMPANY (U.S.)

- Merit Medical Systems (U.S.)

- MEDI TECH DEVICES PVT LTD (India)

- ST. STONE MEDICAL DEVICES PVT. LTD. (India)

- MEDTRON AG (Germany)

- InterMed Medical (India)

- Abbvie Inc. (U.S.)

- Hologic, Inc. (U.S.)

Latest Developments in Global Angiography Devices Market

- In October 2024, Shimadzu Corporation introduced the SMART Voice function for its Trinias series with SCORE Opera angiography systems. This voice recognition feature enables physicians to control key functions such as fluoroscopic imaging and stent visualization through simple voice commands. By reducing the need for manual input, it enhances procedural efficiency and allows clinicians to maintain focus on the patient. The integration of SMART Voice is expected to streamline catheterization procedures, contributing to improved patient outcomes and reduced procedural times. This innovation aligns with the Japanese Ministry of Health, Labour and Welfare's workstyle reform initiatives, aiming to alleviate physician workload and improve work-life balance. The SMART Voice function is available as part of the SCORE Link subscription service, with a microphone set sold separately

- In June 2024, NIDEK Co., Ltd. launched the RS-1 Glauvas Optical Coherence Tomography (OCT) system, designed for high-speed, high-resolution retinal and glaucoma diagnostics. The system features a scan speed of up to 250,000 A-scans per second, enhancing workflow efficiency. It incorporates deep learning-based analytics for early detection of retinal changes and includes a normative database for improved glaucoma assessment. This innovation streamlines diagnostics, offering enhanced care for patients, especially in high-volume practices

- In February 2024, Philips launched the AI-enabled CT 5300 scanner at ECR 2024, aimed at enhancing diagnostic accuracy and workflow efficiency. The scanner features advanced AI capabilities, including automated patient isocentering, and a new detector to improve imaging precision while reducing radiation exposure. This innovation is designed to provide high-quality, cost-effective CT imaging, making it accessible to a broader range of healthcare providers and patients. The CT 5300 will streamline procedures, improve patient outcomes, and offer significant benefits in diagnostic and interventional settings

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.