Global Dog Food Ingredients Market

Tamaño del mercado en miles de millones de dólares

Tasa de crecimiento anual compuesta (CAGR) :

%

USD

34.85 Billion

USD

57.68 Billion

2025

2033

USD

34.85 Billion

USD

57.68 Billion

2025

2033

| 2026 –2033 | |

| USD 34.85 Billion | |

| USD 57.68 Billion | |

|

|

|

|

Global Dog Food Ingredients Market Segmentation, By Form (Dry Pet Food and Wet Pet Food), Ingredient (Meat and Meat Products, Cereals, Vegetables and Fruits, Fats, and Additives), Source (Animal-Based, Plant Derivatives, and Synthetic Derivatives)- Industry Trends and Forecast to 2033

Dog Food Ingredients Market Size

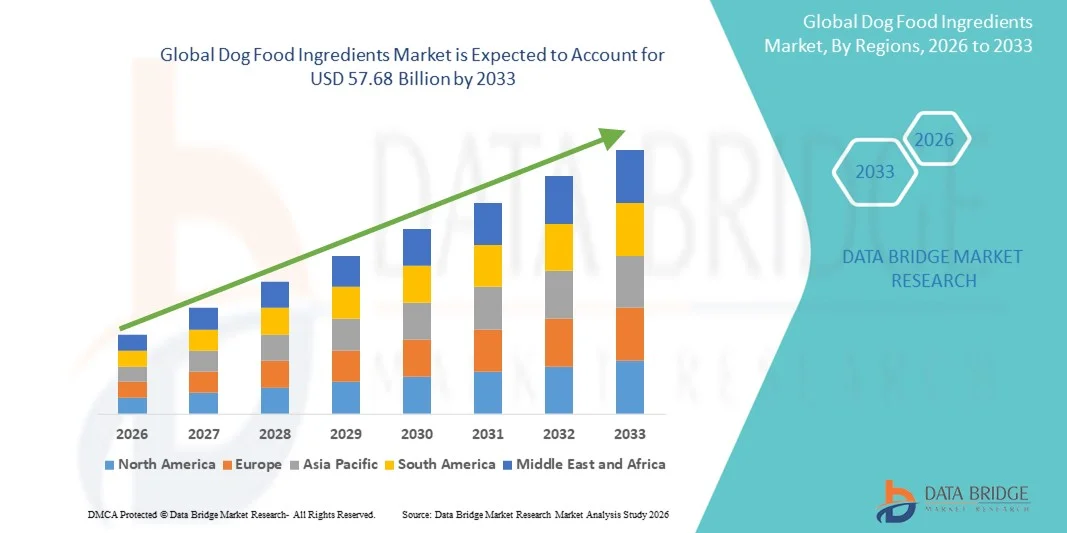

- The global dog food ingredients market size was valued at USD 34.85 billion in 2025 and is expected to reach USD 57.68 billion by 2033, at a CAGR of 6.50% during the forecast period

- The market growth is largely fuelled by the rising adoption of pet dogs, increasing consumer awareness regarding pet nutrition, and demand for premium and functional dog food products

- Growing focus on health-conscious pet care, expansion of organized retail and e-commerce channels for pet food distribution, and the inclusion of natural, organic, and protein-rich ingredients in dog diets are further supporting market expansion

Dog Food Ingredients Market Analysis

- The market is witnessing a shift toward high-quality, specialized ingredients such as proteins, vitamins, minerals, and probiotics to meet the nutritional requirements of dogs and improve overall pet health

- Rising awareness of preventive pet healthcare, growing demand for functional and clean-label dog food, and increasing online sales channels are driving innovation and market competitiveness, leading to stronger product differentiation among manufacturers

- North America dominated the dog food ingredients market with the largest revenue share of 32.45% in 2025, driven by the growing pet population, increasing awareness about pet nutrition, and rising adoption of functional and premium dog food formulations

- Asia-Pacific region is expected to witness the highest growth rate in the global dog food ingredients market, driven by urbanization, expanding middle-class population, rising pet ownership, and growing demand for premium and functional dog food formulations

- The dry pet food segment held the largest market revenue share in 2025, driven by its long shelf life, ease of storage, and convenience for pet owners. Dry formulations are widely preferred for routine feeding and are compatible with a variety of functional and fortified ingredients, making them a popular choice globally

Report Scope and Dog Food Ingredients Market Segmentation

|

Attributes |

Dog Food Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dog Food Ingredients Market Trends

Rise of Functional and Premium Ingredients in Dog Food

- The growing adoption of functional and premium ingredients is transforming the dog food ingredients market by enhancing nutritional quality and overall pet health. Ingredients such as proteins, vitamins, minerals, and probiotics allow pet owners to address specific health concerns and improve longevity, leading to higher demand for fortified formulations. The trend is further supported by increasing awareness of preventive pet healthcare and specialized dietary requirements for different breeds and life stages.

- The rising preference for natural, organic, and plant-based ingredients is accelerating the development of innovative dog food products. Consumers are increasingly seeking products that promote digestion, immunity, and joint health, especially for aging or breed-specific dogs. This shift is boosting investment in research and development for sustainable and high-quality ingredient sourcing.

- The convenience and versatility of modern dog food formulations, including dry, wet, and semi-moist options, are making them attractive for pet owners looking for high-quality nutrition without complex preparation. This is driving frequent purchases and brand loyalty, while also encouraging subscription-based and online pet food delivery models.

- For instance, in 2023, several North American and European pet food manufacturers reported increased sales of protein-rich and probiotic-fortified dog foods, highlighting the growing market for functional ingredients. This demonstrates a strong consumer preference for health-focused products and supports the expansion of premium product lines globally.

- While premiumization and health-focused trends are driving adoption, long-term growth depends on regulatory compliance, ingredient transparency, and affordability for a broader consumer base. Companies are also focusing on improving product labeling, fortification standards, and sustainable ingredient sourcing to strengthen market credibility and trust.

Dog Food Ingredients Market Dynamics

Driver

Rising Pet Ownership and Growing Awareness About Pet Nutrition

- The increasing number of pet dogs globally is pushing pet owners to prioritize nutrition and overall well-being, driving demand for high-quality and functional ingredients in dog food. The growing humanization of pets and rising disposable incomes further support investment in premium and specialty pet food products.

- Consumers are increasingly aware of the link between proper nutrition and dog health, including immunity, digestion, and longevity. This awareness encourages the adoption of fortified and specialty ingredients, promoting the development of breed-specific, age-specific, and condition-specific formulations in the market.

- Pet food manufacturers are investing in research and development to create nutrient-rich and palatable formulations, strengthening brand differentiation and market growth. Innovative approaches such as natural preservatives, probiotics, and superfood additives are being incorporated to enhance functionality and meet evolving consumer preferences.

- For instance, in 2022, several companies introduced breed-specific and age-specific dog foods enriched with vitamins, minerals, and natural extracts, driving greater market adoption. These initiatives also highlight the shift toward preventive health care and functional nutrition in the dog food industry.

- While awareness and innovation are key growth factors, market expansion depends on continuous ingredient innovation, affordability, and alignment with evolving consumer preferences. Manufacturers are increasingly adopting transparent supply chains and sustainable practices to gain consumer trust and strengthen market positioning.

Restraint/Challenge

High Costs of Premium Ingredients and Supply Chain Constraints

- The high cost of natural, organic, and functional ingredients increases production expenses, making premium dog food less accessible to price-sensitive consumers. This limits widespread adoption in emerging markets and may slow down the introduction of innovative formulations.

- Limited availability of high-quality raw materials in some regions and dependence on imports can disrupt supply chains and impact consistent product formulation. Seasonal fluctuations, geopolitical factors, and transportation challenges further exacerbate supply instability, affecting production planning.

- Regulatory requirements for ingredient safety and labeling can slow down product launches and add operational challenges for manufacturers. Compliance with multiple regional regulations increases administrative costs and can delay entry into new markets.

- For instance, in 2023, several manufacturers in Asia-Pacific faced delays in sourcing specialty protein and vitamin ingredients, affecting production schedules and market availability. This highlighted the need for diversified sourcing strategies and localized ingredient production to ensure market stability.

- While innovation continues to fuel product development, addressing cost, supply chain reliability, and regulatory challenges is crucial for sustaining long-term growth in the dog food ingredients market. Companies that successfully manage these challenges are better positioned to capture the premium segment and meet the growing consumer demand for functional and health-focused dog food products.

Dog Food Ingredients Market Scope

The market is segmented on the basis of form, ingredient, and source.

- By Form

On the basis of form, the dog food ingredients market is segmented into dry pet food and wet pet food. The dry pet food segment held the largest market revenue share in 2025, driven by its long shelf life, ease of storage, and convenience for pet owners. Dry formulations are widely preferred for routine feeding and are compatible with a variety of functional and fortified ingredients, making them a popular choice globally.

The wet pet food segment is expected to witness the fastest growth rate from 2026 to 2033, fueled by its higher palatability, moisture content, and appeal to pets with specific dietary requirements. Wet pet foods are increasingly being enriched with proteins, vitamins, and natural extracts to enhance nutrition and cater to premium pet food trends.

- By Ingredient

On the basis of ingredient, the market is segmented into meat and meat products, cereals, vegetables and fruits, fats, and additives. The meat and meat products segment held the largest revenue share in 2025, attributed to high consumer preference for protein-rich diets that support pet health and growth.

The additives segment is expected to witness the fastest growth rate from 2026 to 2033, driven by rising inclusion of probiotics, vitamins, minerals, and flavor enhancers in dog food formulations to improve digestion, immunity, and overall well-being.

- By Source

On the basis of source, the market is segmented into animal-based, plant derivatives, and synthetic derivatives. The animal-based segment held the largest market revenue share in 2025 due to high demand for protein-rich and nutrient-dense ingredients sourced from meat, fish, and poultry.

The plant derivatives segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing consumer awareness about sustainable and organic ingredients, as well as the rising demand for plant-based proteins and fibers in functional dog food products.

Dog Food Ingredients Market Regional Analysis

- North America dominated the dog food ingredients market with the largest revenue share of 32.45% in 2025, driven by the growing pet population, increasing awareness about pet nutrition, and rising adoption of functional and premium dog food formulations

- Consumers in the region are increasingly prioritizing high-quality ingredients that promote pet health, including proteins, vitamins, minerals, and probiotics, encouraging frequent purchases and brand loyalty

- This widespread adoption is further supported by high disposable incomes, rising urbanization, and the growing trend of humanization of pets, establishing functional and premium dog food as a favored choice among pet owners

U.S. Dog Food Ingredients Market Insight

The U.S. dog food ingredients market captured the largest revenue share in 2025 within North America, fueled by the rising number of pet dogs and increasing consumer focus on health and nutrition. Pet owners are increasingly seeking fortified formulations that address specific health concerns such as joint support, digestion, and immunity. The growing presence of specialized pet food brands and online retail channels, along with robust R&D in functional ingredients, is further propelling market expansion.

Europe Dog Food Ingredients Market Insight

The Europe dog food ingredients market is expected to witness the fastest growth rate from 2026 to 2033, primarily driven by increasing pet ownership, stringent regulations on ingredient quality, and rising demand for natural and organic pet food products. Consumers are attracted to eco-friendly and sustainably sourced ingredients, fostering the adoption of functional dog foods. The region is experiencing significant growth across premium and specialty segments, supported by established distribution networks and rising awareness of pet health.

U.K. Dog Food Ingredients Market Insight

The U.K. dog food ingredients market is expected to witness the fastest growth rate from 2026 to 2033, driven by the rising trend of pet humanization and increasing focus on preventive healthcare for pets. Pet owners are opting for breed-specific and age-specific fortified dog foods that enhance longevity and overall well-being. The country’s strong e-commerce infrastructure, coupled with the growing availability of premium pet food products, is expected to continue stimulating market growth.

Germany Dog Food Ingredients Market Insight

The Germany dog food ingredients market is expected to witness the fastest growth rate from 2026 to 2033, fueled by rising awareness of pet nutrition, stringent quality regulations, and a strong preference for natural and functional ingredients. German consumers increasingly prioritize high-quality, sustainable ingredients that support specific health outcomes. The integration of advanced ingredient technologies in pet food formulations and the adoption of eco-conscious practices are significantly contributing to market expansion.

Asia-Pacific Dog Food Ingredients Market Insight

The Asia-Pacific dog food ingredients market is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing pet adoption, rising disposable incomes, and expanding awareness about pet nutrition in countries such as China, Japan, and India. The region’s growing inclination toward premium and functional dog food products, supported by urbanization and government initiatives promoting animal welfare, is driving market adoption. In addition, APAC’s role as a manufacturing hub for pet food ingredients is improving affordability and accessibility, further expanding the consumer base.

Japan Dog Food Ingredients Market Insight

The Japan dog food ingredients market is expected to witness the fastest growth rate from 2026 to 2033 due to the country’s high pet ownership, aging population, and emphasis on pet health and well-being. Pet owners are increasingly selecting functional and premium dog food formulations enriched with vitamins, minerals, and natural extracts. The integration of high-quality ingredients in age- and breed-specific products, along with advanced retail and online distribution channels, is fueling market growth.

China Dog Food Ingredients Market Insight

The China dog food ingredients market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the expanding pet population, rapid urbanization, and increasing consumer focus on pet nutrition. China stands as one of the largest markets for dog food products, with rising adoption of functional and premium ingredients across urban households. The growing availability of affordable and fortified formulations, supported by strong domestic manufacturers, is a key factor propelling market expansion.

Dog Food Ingredients Market Share

The Dog Food Ingredients industry is primarily led by well-established companies, including:

- BASF SE (Germany)

- ADM (U.S.)

- DSM (Netherlands)

- Adisseo (France)

- Darling Ingredients Inc. (U.S.)

- Ingredion Incorporated (U.S.)

- Omega Protein Corporation (U.S.)

- Cargill, Incorporated (U.S.)

- DuPont (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- Roquette Frères (France)

- SunOpta (Canada)

- Lallemand Inc. (Canada)

- Lesaffre (France)

- SARIA A/S GmbH & Co. KG (Germany)

- Nutreco N.V. (Netherlands)

- The Scoular Company (U.S.)

- Kemin Industries, Inc. (U.S.)

- Diana Group (France)

- Pancosma (Switzerland)

SKU-

Obtenga acceso en línea al informe sobre la primera nube de inteligencia de mercado del mundo

- Panel de análisis de datos interactivo

- Panel de análisis de empresas para oportunidades con alto potencial de crecimiento

- Acceso de analista de investigación para personalización y consultas

- Análisis de la competencia con panel interactivo

- Últimas noticias, actualizaciones y análisis de tendencias

- Aproveche el poder del análisis de referencia para un seguimiento integral de la competencia

Metodología de investigación

La recopilación de datos y el análisis del año base se realizan utilizando módulos de recopilación de datos con muestras de gran tamaño. La etapa incluye la obtención de información de mercado o datos relacionados a través de varias fuentes y estrategias. Incluye el examen y la planificación de todos los datos adquiridos del pasado con antelación. Asimismo, abarca el examen de las inconsistencias de información observadas en diferentes fuentes de información. Los datos de mercado se analizan y estiman utilizando modelos estadísticos y coherentes de mercado. Además, el análisis de la participación de mercado y el análisis de tendencias clave son los principales factores de éxito en el informe de mercado. Para obtener más información, solicite una llamada de un analista o envíe su consulta.

La metodología de investigación clave utilizada por el equipo de investigación de DBMR es la triangulación de datos, que implica la extracción de datos, el análisis del impacto de las variables de datos en el mercado y la validación primaria (experto en la industria). Los modelos de datos incluyen cuadrícula de posicionamiento de proveedores, análisis de línea de tiempo de mercado, descripción general y guía del mercado, cuadrícula de posicionamiento de la empresa, análisis de patentes, análisis de precios, análisis de participación de mercado de la empresa, estándares de medición, análisis global versus regional y de participación de proveedores. Para obtener más información sobre la metodología de investigación, envíe una consulta para hablar con nuestros expertos de la industria.

Personalización disponible

Data Bridge Market Research es líder en investigación formativa avanzada. Nos enorgullecemos de brindar servicios a nuestros clientes existentes y nuevos con datos y análisis que coinciden y se adaptan a sus objetivos. El informe se puede personalizar para incluir análisis de tendencias de precios de marcas objetivo, comprensión del mercado de países adicionales (solicite la lista de países), datos de resultados de ensayos clínicos, revisión de literatura, análisis de mercado renovado y base de productos. El análisis de mercado de competidores objetivo se puede analizar desde análisis basados en tecnología hasta estrategias de cartera de mercado. Podemos agregar tantos competidores sobre los que necesite datos en el formato y estilo de datos que esté buscando. Nuestro equipo de analistas también puede proporcionarle datos en archivos de Excel sin procesar, tablas dinámicas (libro de datos) o puede ayudarlo a crear presentaciones a partir de los conjuntos de datos disponibles en el informe.