Asia Pacific Tax It Software Market

Taille du marché en milliards USD

TCAC :

%

USD

6.19 Billion

USD

10.74 Billion

2024

2032

USD

6.19 Billion

USD

10.74 Billion

2024

2032

| 2025 –2032 | |

| USD 6.19 Billion | |

| USD 10.74 Billion | |

|

|

|

Asia-Pacific Tax IT Software Market Segmentation, By Offering (Software and Services), Tax Type (Income Tax, Corporate Tax, and Property Tax), Deployment Mode (Cloud and On-Premises), Organization Size (Small & Medium-Sized Enterprises and Large Enterprises), Revenue Model (One-Time Purchase and Subscription Based), Industry (Banking, Financial Services, And Insurance (BFSI), IT & Telecommunications, Manufacturing, Retail & Consumer Goods, Healthcare, Energy & Utilities, and Media & Entertainment) - Industry Trends and Forecast to 2032

Asia-Pacific Tax IT Software Market Analysis

The Asia-Pacific tax IT software market is growing rapidly, driven by the increasing complexity of Asia-Pacific tax regulations and the need for businesses to ensure compliance across multiple jurisdictions. This market encompasses solutions that automate tax calculations, reporting, and filing processes while integrating with enterprise systems to reduce manual efforts and minimize errors. Advancements in technologies like AI and cloud computing are enhancing software capabilities, offering real-time updates, scalability, and improved accuracy. The market is further bolstered by rising adoption among SMEs and large enterprises seeking operational efficiency.

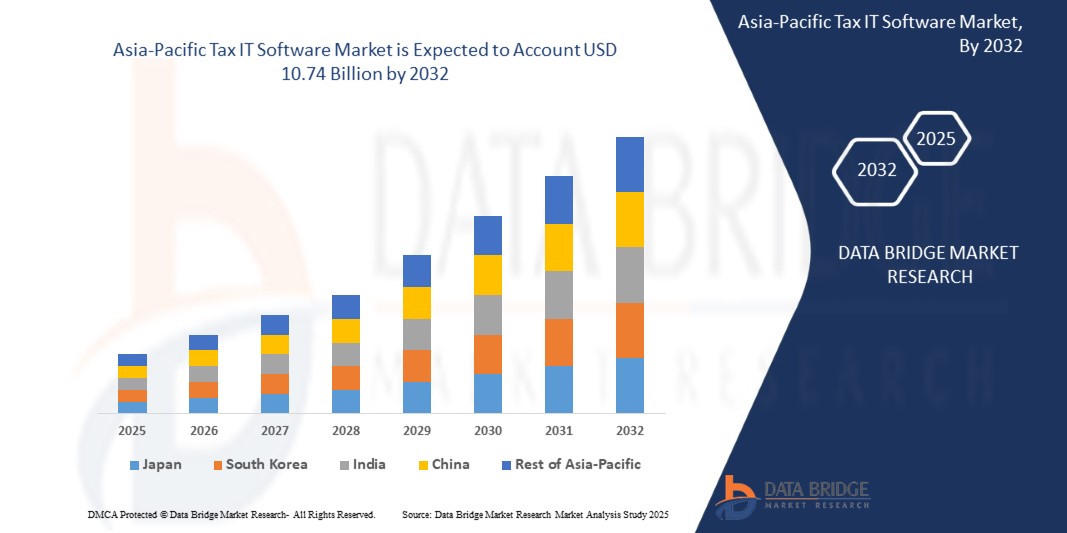

Asia-Pacific Tax IT Software Market Size

Data Bridge Market Research analyses that the tax the Asia-Pacific tax IT software market is expected to reach USD 10.74 billion by 2032 from USD 6.19 billion in 2024 growing with a CAGR of 7.2% in the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Asia-Pacific Tax IT Software Market Trends

“Increased Financial Crimes Detection Efforts”

Increased financial crimes detection efforts have intensified scrutiny on anti-money laundering (AML) measures, focusing on enhancing compliance and monitoring systems. Financial institutions are implementing more rigorous procedures to identify suspicious transactions and patterns indicative of money laundering. These measures include strengthening internal controls, improving transaction reporting practices, and enhancing collaboration with regulatory bodies. The push for greater transparency and accountability aims to disrupt financial crime networks and reduce illicit financial flows. By adopting comprehensive AML frameworks, organizations seek to mitigate risks and protect the integrity of the financial system. This proactive approach reflects a broader commitment to combatting financial crime and maintaining regulatory compliance.

Report Scope and Asia-Pacific Tax IT Software Market Segmentation

|

Report Metric |

Asia-Pacific Tax IT Software Market Insights |

|

Segments Covered |

IT & Telecommunications, Manufacturing, Retail & Consumer Goods, Healthcare, Energy & Utilities, and Media & Entertainment |

|

Countries Covered |

China, Japan, India, South Korea, Australia & New Zealand, Singapore, Malaysia, Thailand, Indonesia, Philippines, Taiwan, Vietnam, and Rest of Asia-Pacific |

|

Key Market Players |

Microsoft (U.S.), ADP, Inc. (U.S.), Yayoi Co., Ltd. (Japan), Wolters Kluwer N.V (Netherland), Stripe (U.S.), SAP (U.S.), Thomson Reuters (U.S.), Oracle (U.S.), NTT data (Japan), QUICKBOOKS (INTUIT INC.) (U.S.), SAGE GROUP PLC (U.K.), Vertex (U.S.), TKC Corporation (Japan), SOVOS Compliance, LLC (U.S.), Avalara (U.S.), Money Forward, Inc.(Japan), freee K.K (Japan), TaxDiva (India), Esker (France), PCA Corporation (Japan), and Epicor Software Corporation (U.S.) |

|

Market Opportunities |

|

|

Value Added Data |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Asia-Pacific Tax IT Software Market Definition

The tax IT software refers to specialized technology solutions designed to automate and streamline tax management processes, including tax calculation, compliance, reporting, and filing. These systems integrate with enterprise platforms to ensure accurate handling of sales tax, use tax, VAT, and other tax types across multiple jurisdictions. By leveraging advanced features such as real-time rate updates, exemption certificate management, and detailed reporting, Tax IT Software reduces manual workloads, minimizes compliance risks, and enhances operational efficiency for businesses navigating complex tax regulations.

Asia-Pacific Tax IT Software Market Dynamics

Drivers

- Increasing Adoption of Tax IT Software among Small and Medium-Sized Businesses

As SMBs face increasing complexities in managing tax compliance, they are turning to automated solutions that simplify processes, reduce errors, and ensure accuracy. The need for these businesses to navigate varying tax regulations, including sales tax, VAT, and other local tax laws, has led to a surge in the use of tax IT software. These solutions streamline tax calculations and also integrate seamlessly with financial systems, offering a more efficient way to manage taxes while staying compliant with ever-evolving regulations.

Moreover, the growing shift toward digitalization and cloud-based solutions is accelerating the adoption of tax IT software in the SMB sector. These businesses are increasingly seeking scalable, cost-effective solutions that allow them to manage tax operations without the need for extensive in-house resources. By automating routine tax tasks such as reporting, filing, and compliance monitoring, SMBs can reduce administrative burdens, save time, and focus on strategic growth initiatives. This trend is expected to continue as tax IT software becomes more accessible, user-friendly, and integrated into broader financial management platforms, making it an essential tool for SMBs worldwide.

For instance,

In November 2024, according to an article published by The Indian Express, a Deloitte India survey shows that 81% of small organizations plan to digitize their tax operations within the next five years, highlighting a shift toward technology-driven tax functions. Despite challenges such as integration issues and a shortage of tax tech professionals, there is a strong push for adopting tax IT solutions supported by government digitalization initiatives. This growing interest among small businesses to modernize their tax processes signals an increasing demand for tax IT software, driving market growth and innovation to meet the specific needs of smaller organizations.

- AI and Machine Learning Integration in Tax and Accounting Software

The integration of AI and machine learning (ML) into tax and accounting software is transforming the tax IT software market by automating complex processes and enhancing decision-making capabilities. AI-powered tools simplify tasks such as data extraction, tax calculation, and compliance monitoring, reducing the reliance on manual intervention. ML algorithms improve the accuracy of tax audits and fraud detection by analyzing large datasets and identifying anomalies in real-time. These advancements help businesses ensure compliance with ever-changing tax regulations while streamlining their operations and saving time.

The adoption of AI and ML in tax software is particularly advantageous for addressing regulatory complexities faced by businesses of all sizes. Small and medium-sized businesses (SMBs) benefit from intelligent features such as predictive analytics and adaptive tax planning, enabling them to make informed decisions and optimize their financial strategies. This shift toward smarter, AI-driven tax solutions is driving the market's growth as companies increasingly prioritize efficiency, accuracy, and scalability in their tax management processes.

For instance,

In May 2024, according to an article published by Arizent, Wolters Kluwer has introduced an AI-powered corporate performance management platform, CCH Tagetik. The platform includes features such as Ask AI, AI Automapping, AI Anomaly Detection, and AI Driver-Based Analysis to improve reporting, data governance, and financial analysis. This marks a significant shift towards AI and machine learning in tax and accounting software, enhancing automation, data integrity, and analytical efficiency, which aligns with the growing demand for AI-driven solutions in the Tax IT Software industry.

Opportunities

- Expansion of Cloud Services for Business

As businesses continue to embrace digital transformation, the demand for scalable, flexible, and cost-effective solutions has driven the growth of cloud-based platforms. Cloud services allow tax professionals and businesses to access advanced tools and software without the need for heavy infrastructure investments. This flexibility enables companies to quickly adapt to changing regulatory requirements, streamline operations, and improve overall efficiency. Furthermore, cloud platforms offer real-time data access, collaboration, and seamless integration with other enterprise systems, making them increasingly attractive to firms seeking to enhance their tax and accounting functions.

クラウドベースの税務 IT ソリューションの台頭により、データ セキュリティ、コンプライアンス、拡張性などの重要な問題も解決されています。クラウド サービス プロバイダーは、堅牢なセキュリティ対策に多額の投資を行っており、税務の機密データが保護されると同時に、国内および海外のデータ プライバシー規制に準拠しています。これにより、リスクを軽減し、コア業務に集中したい企業にとって、クラウド サービスは現実的な選択肢となります。クラウドに移行する企業が増えるにつれて、税務 IT ソフトウェア市場では、プロバイダーが革新を続け、業界の進化するニーズに合わせた専門的なソリューションを提供することで、採用が拡大すると予想されます。

例えば、

2020 年 10 月、Economic Times が発表した記事によると、クラウド コンピューティングと Everything-as-a-Service (XaaS) が税務環境を一変させ、税務と進化する規制へのコンプライアンスの面で企業に複雑さをもたらしています。この変化により、税務 IT ソフトウェア市場における企業向けクラウド サービスの拡大の機会が生まれます。企業は、クラウド ベース サービスの特有の課題を管理し、アジア太平洋地域の税法へのコンプライアンスを確保するために、高度な税務ソフトウェア ソリューションを必要としているからです。

- 企業全体でデジタルコンプライアンスソフトウェアの導入を促進する政府の取り組みが増加

世界中の政府は、デジタル コンプライアンス ソフトウェアの使用をますます推進しており、政策では、企業が税務報告とコンプライアンスにデジタル ツールを採用することを奨励しています。これらの取り組みには、多くの場合、企業が手動プロセスからデジタル プラットフォームに移行するためのインセンティブ、補助金、または義務付けが含まれています。デジタル変革の推進は、企業が複数の管轄区域にまたがって税金を管理しなければならない複雑な規制要件を持つ業界で特に強くなっています。

こうした政府の支援拡大は、企業が新しい規制や基準に準拠するためのソフトウェア ソリューションを求めていることから、税務 IT ソフトウェア市場にとって大きなチャンスとなります。政府がより厳格な税務コンプライアンスおよび報告ルールを導入するにつれ、企業は正確でタイムリーかつ効率的な税務プロセスを確保するためにデジタル ツールを導入するケースが増えています。デジタル コンプライアンス ソフトウェアへの移行により、革新的なソリューションの需要が高まり、ソフトウェア プロバイダーに利益をもたらし、市場全体の潜在性が高まることが期待されます。

例えば、

PKF Smith Cooper が発表した記事によると、英国の Making Tax Digital (MTD) イニシアチブでは、企業、自営業者、家主にデジタル記録の保持と、納税申告用のサードパーティ ソフトウェアの使用が義務付けられています。所得税自己申告 (ITSA) 用の MTD は、所得基準を満たした上で 2026 年までに段階的に導入されます。このイニシアチブは、進化する税規制に対応するために企業がデジタル ソリューションを必要とするため、税務 IT ソフトウェア プロバイダーにとってチャンスとなります。

制約/課題

- 高度な税務・会計ソフトウェアの利用には高額なコストと初期投資の制約がある

最新の税務および会計ソフトウェアには多くの利点がありますが、これらのシステムの取得、導入、および維持にかかるコストの高さは、特に中小企業にとって大きな障害となる可能性があります。組織が財務業務を合理化し、競争力を維持しようとしている場合、このようなソフトウェアに必要な初期投資は、特に追加のカスタマイズおよび統合料金が含まれている場合は、多くの組織が躊躇する可能性があります。

中小企業にとって、複雑な税務および会計ソフトウェアの取得と導入に必要な多額の初期費用は、しばしば大きな障壁となります。複雑な財務活動を実行するために構築されたこれらのシステムは、多くの場合、非常に高価です。さらに、個々の会社の要求に合わせて変更したり、現在のエンタープライズ リソース プランニング (ERP) または顧客関係管理 (CRM) システムと接続したりすると、費用が増加する可能性があります。多くの小規模組織にとって、これらのコストは法外に高く、複雑なソリューションを実装する能力を制限し、開発の可能性を妨げます。この問題は、リソースが限られている企業にとって特に深刻であり、大規模なカスタム構築システムよりも安価な既製のソリューションを選択する可能性があります。

例えば、

2024 年 5 月に Attract Group が発表した記事によると、ERP ソフトウェアの開発コストは 25,000 ~ 350,000 ドルで、業務を合理化することで現代のビジネス効率に重要な役割を果たしています。これらのコストは、複雑さ、カスタマイズ、展開モデル、統合要件などの要因によって決まります。対照的に、ERP システムは長期的な運用上の利点を提供しますが、開発および実装の費用が高いため、特に中小企業にとっては課題となります。多額の初期投資に加え、カスタマイズ、統合、保守、アップグレード、ライセンスの継続的なコストが、財務上のハードルとなります。これらの障壁は、特に予算に敏感な企業にとって、高度な税務および会計ソフトウェアの導入に対する顕著な制約となっています。

- サイバーセキュリティとデータプライバシーの懸念が税務・会計ソフトウェアの導入を妨げている

企業が財務業務をデジタル化するにつれ、サイバーセキュリティの懸念が最新の税務および会計ソフトウェアの使用に対する大きな障害となっています。企業は機密性の高い財務データを管理するためにデジタル プラットフォームに大きく依存するようになり、データ漏洩、サイバー攻撃、プライバシー侵害のリスクが増大しています。これらの問題により、企業がデジタル財務管理システムを完全に導入できないことがよくあります。

さらに、金融データのデジタル化が進むと、スピードと利便性がもたらされる一方で、データのプライバシーとセキュリティに関する深刻な問題も生じます。企業は、税務記録、従業員の給与データ、その他の秘密情報などの機密性の高い金融情報を、潜在的なサイバー攻撃から保護する必要があります。データ漏洩やサイバー攻撃は、データ セキュリティ要件に準拠していない企業にとって、多大な経済的損失、評判の失墜、法的影響をもたらす可能性があります。その結果、企業は高いセキュリティ基準を満たしていない税務および会計ソフトウェアの使用をためらう可能性があり、デジタル金融ソリューションの広範な採用が制限されます。さらに、暗号化や安全な認証手順などの適切なセキュリティ対策がないと、ソフトウェアへの信頼が損なわれる可能性があります。

例えば、

- 2024年3月、国際公認会計士協会が発表した記事によると、CPAと企業が顧客データを保護する上で直面する課題は、サイバーセキュリティの脅威、規制の変更、プライバシー基準の進化によってさらに深刻化しています。世界的なデータプライバシー法へのコンプライアンスを維持する複雑さやサイバー攻撃のリスクなど、これらの懸念は、税務ITソフトウェア市場における「サイバーセキュリティとデータプライバシーの懸念が税務および会計ソフトウェアの採用を妨げている」という制約を浮き彫りにしています。企業は、データ侵害、コンプライアンスコスト、信頼の維持を恐れて、新しいテクノロジーの採用をためらっています。

アジア太平洋地域の税務ITソフトウェア市場の範囲

税務 IT ソフトウェア市場は、提供内容、税務タイプ、導入モード、組織規模、収益モデル、業界に基づいて 6 つの主要なセグメントに分割されています。これらのセグメントの成長は、業界のわずかな成長セグメントの分析に役立ち、ユーザーに貴重な市場概要と市場洞察を提供して、コア市場アプリケーションを特定するための戦略的決定を下すのに役立ちます。

提供

- ソフトウェア

- サービス

- タイプ

- トレーニングとコンサルティング

- サポート

税金の種類

- 所得税

- 法人税

- 固定資産税

- その他

展開モード

- 雲

- オンプレミス

組織規模

- 大企業

- 中小企業

収益モデル

- サブスクリプションベース

- 1回限りの購入

業界

- 銀行、金融サービス、保険 (BFSI)

- ITおよび通信

- 製造業

- 小売・消費財

- 健康管理

- メディアとエンターテイメント

- エネルギーと公共事業

- その他

アジア太平洋地域の税務ITソフトウェア市場の地域分析

税務 IT ソフトウェア市場は、国、提供内容、税金の種類、導入モード、組織規模、収益モデル、および業界に基づいて、6 つの主要なセグメントに分割されています。

税務 IT ソフトウェア市場レポートで取り上げられている国は、中国、日本、インド、韓国、オーストラリアとニュージーランド、シンガポール、マレーシア、タイ、インドネシア、フィリピン、台湾、ベトナム、およびその他のアジア太平洋諸国です。

Japan dominates the Asia Pacific tax IT software market due to its advanced technological infrastructure, strong regulatory compliance culture, and high adoption of automation in tax processes. The country's focus on digital transformation and e-governance drives the demand for innovative tax solutions. Additionally, Japan's robust economy and large corporate base further contribute to its leadership in the region.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific tax IT software brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Asia-Pacific Tax It Software Market Share

Tax IT software market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Asia-Pacific tax IT software market .

Asia-Pacific Tax IT Software Market Leaders Operating in the Market are:

- Microsoft (U.S.)

- ADP, Inc. (U.S.)

- Yayoi Co., Ltd. (Japan)

- Wolters Kluwer N.V (Netherland)

- Stripe (U.S.)

- SAP (U.S.)

- Thomson Reuters (U.S.)

- Oracle (U.S.)

- NTT data (Japan)

- QUICKBOOKS (INTUIT INC.) (U.S.)

- SAGE GROUP PLC (U.K.)

- Vertex (U.S.)

- TKC Corporation (Japan)

- SOVOS Compliance, LLC (U.S.)

- Avalara (U.S.)

- Money Forward, Inc.(Japan)

- freee K.K (Japan)

- TaxDiva (India)

- Esker (France)

- PCA Corporation (Japan)

- Epicor Software Corporation (U.S.)

Latest Developments in Asia-Pacific Tax IT Software Market

- In September 2024, Wolters Kluwer has partnered with OneTeam Services Group to enhance CCH Integrator. The collaboration will expand tax compliance, data management, and collaborative workflows, improving efficiency for tax firms and corporations across multiple tax domains

- In October, ADP has acquired Workforce Software, a leading provider of workforce management solutions for global enterprises. This acquisition expands ADP's offerings, enhancing global workforce management capabilities and driving future innovation to meet evolving business needs

- In June, Stripe appears to be signaling preparations for an IPO, despite non-committal statements from its co-founders. Actions such as publishing financial performance reports and conducting tender offers have fueled speculation. These developments drive Stripe to enhance transparency and financial reporting, bolstering trust in its Tax and Accounting Software solutions and aligning with its mission to help businesses streamline compliance, potentially attracting a broader user base

- In June, Avalara has enhanced its presence in India to support the country’s export ambitions by providing cloud-based tax compliance solutions that simplify cross-border tax processes. This move bolsters Avalara’s position in the tax and accounting software market by expanding its footprint in a rapidly growing region, catering to diverse industries, and demonstrating its proficiency in automating global indirect tax compliance

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA-PACIFIC TAX IT SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OFFERING TIMELINE CURVE

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 REGULATORY STANDARDS

4.2 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

4.2.1 INDUSTRY ANALYSIS

4.2.2 FUTURISTIC SCENARIO

4.2.3 COMPETITIVE LANDSCAPE

4.3 PENETRATION AND GROWTH PROSPECT MAPPING

4.4 TECHNOLOGY ANALYSIS

4.5 COMPANY COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF TAX IT SOFTWARE AMONG SMALL AND MEDIUM-SIZED BUSINESSES

5.1.2 AI AND MACHINE LEARNING INTEGRATION IN TAX AND ACCOUNTING SOFTWARE

5.1.3 GROWING NEED FOR STREAMLINING ACCOUNTING OPERATIONS TO REDUCE MANUAL ERRORS

5.1.4 RISING DEMAND FOR REAL-TIME FINANCIAL INSIGHTS

5.2 RESTRAINTS

5.2.1 HIGH COSTS AND INITIAL INVESTMENT RESTRICTIONS FOR THE USE OF ADVANCED TAX AND ACCOUNTING SOFTWARE

5.2.2 CYBERSECURITY AND DATA PRIVACY CONCERNS HINDER ADOPTION OF TAX AND ACCOUNTING SOFTWARE

5.3 OPPORTUNITIES

5.3.1 EXPANSION OF CLOUD SERVICES FOR BUSINESS

5.3.2 RISING GOVERNMENT INITIATIVES TO PROMOTE DIGITAL COMPLIANCE SOFTWARE ADOPTION ACROSS BUSINESSES

5.4 CHALLENGES

5.4.1 FREQUENT TAX UPDATES CREATE CHALLENGES FOR SOFTWARE

5.4.2 CHALLENGES IN INTEGRATING LEGACY SYSTEMS FOR BUSINESSES ASIA-PACIFIC LY

6 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOFTWARE

6.3 SERVICES

6.3.1 SERVICE, BY TYPE

6.4 TRAINING AND CONSULTING

6.5 SUPPORT

7 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY TAX TYPE

7.1 OVERVIEW

7.2 INCOME TAX

7.3 CORPORATE TAX

7.4 PROPERTY TAX

7.5 OTHERS

8 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE

8.1 OVERVIEW

8.2 CLOUD

8.3 ON-PREMISES

9 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

10 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY REVENUE MODEL

10.1 OVERVIEW

10.2 SUBSCRIPTION-BASED

10.3 ONE-TIME PURCHASE

11 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY INDUSTRY

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

11.3 IT AND TELECOMMUNICATIONS

11.4 MANUFACTURING

11.5 RETAIL AND CONSUMER GOODS

11.6 HEALTHCARE

11.7 MEDIA AND ENTERTAINMENT

11.8 ENERGY AND UTILITIES

11.9 OTHERS

12 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 JAPAN

12.1.2 CHINA

12.1.3 INDIA

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 INDONESIA

12.1.7 THAILAND

12.1.8 MALAYSIA

12.1.9 SINGAPORE

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA-PACIFIC TAX IT SOFTWARE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 MICROSOFT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SERVICE PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 ADP,INC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 YAYOI CO., LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 WOLTERS KLUWER N.V.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENT

15.5 STRIPE, INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 SERVICE PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 AVALARA, INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 EPICOR SOFTWARE CORPORATION

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ESKER

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SOLUTION PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 FREEE KK

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENT

15.1 INTUIT INC

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 MONEY FORWARD, INC

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 NTT DATA GROUP CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 SERVICE PORTFOLIO

15.12.4 RECENT DEVELOPMENT

15.13 ORACLE

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 SERVICE PORTFOLIO

15.13.4 RECENT DEVELOPMENT

15.14 PCA CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 SAGE GROUP PLC

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 SAP SE

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENT

15.17 SOVOS COMPLIANCE, LLC

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 TAXDIVA

15.18.1 COMPANY SNAPSHOT

15.18.2 SERVICE PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 THOMSON REUTERS

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 SERVICE PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 TKC CORPORATION

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENT

15.21 VERTEX, INC

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 SERVICE PORTFOLIO

15.21.4 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATIONS AND STANDARDS FOR ASIA-PACIFIC TAX IT SOFTWARE MARKET

TABLE 2 AWI TAX CONSULTING TAX SOFTWARE PRICE (IN USD)

TABLE 3 TRENDS IN THE TOTAL SALES OF THE MANUFACTURING INDUSTRY (IN USD BILLION)

TABLE 4 TECHNOLOGY MATRIX

TABLE 5 COMPARATIVE ANALYSIS

TABLE 6 THE OVERALL ERP IMPLEMENTATION PRICING

TABLE 7 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY OFFERING 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC SOFTWARE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC SERVICES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC INCOME TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC CORPORATE TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC PROPERTY TAX IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC OTHERS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC CLOUD IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC ON-PREMISE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC LARGE ENTERPRISES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC SMALL AND MEDIUM-SIZED ENTERPRISES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC SUBSCRIPTION BASED IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC ONE-TIME PURCHASE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI), BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC IT AND TELECOMMUNICATIONS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC MANUFACTURING IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC RETAIL AND CONSUMER GOODS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC HEALTHCARE IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC MEDIA AND ENTERTAINMENT IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC ENERGY AND UTILITIES IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC OTHERS IN TAX IT SOFTWARE MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 42 JAPAN TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 43 JAPAN SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 JAPAN TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 JAPAN TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 46 JAPAN TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 47 JAPAN TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 48 JAPAN TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 49 CHINA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 50 CHINA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 CHINA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 CHINA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 53 CHINA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 54 CHINA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 55 CHINA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 56 INDIA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 57 INDIA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 INDIA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 INDIA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 60 INDIA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 61 INDIA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 62 INDIA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 63 SOUTH KOREA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 64 SOUTH KOREA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 SOUTH KOREA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 SOUTH KOREA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 67 SOUTH KOREA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 68 SOUTH KOREA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 69 SOUTH KOREA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 70 AUSTRALIA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 71 AUSTRALIA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 AUSTRALIA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 AUSTRALIA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 74 AUSTRALIA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 75 AUSTRALIA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 76 AUSTRALIA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 77 INDONESIA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 78 INDONESIA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 INDONESIA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 INDONESIA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 81 INDONESIA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 82 INDONESIA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 83 INDONESIA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 84 THAILAND TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 85 THAILAND SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 THAILAND TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 THAILAND TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 88 THAILAND TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 89 THAILAND TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 90 THAILAND TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 91 MALAYSIA TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 92 MALAYSIA SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 MALAYSIA TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 MALAYSIA TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 95 MALAYSIA TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 96 MALAYSIA TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 97 MALAYSIA TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 98 SINGAPORE TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 99 SINGAPORE SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SINGAPORE TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SINGAPORE TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 102 SINGAPORE TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 103 SINGAPORE TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 104 SINGAPORE TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 105 PHILIPPINES TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 106 PHILIPPINES SERVICES IN TAX IT SOFTWARE MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 PHILIPPINES TAX IT SOFTWARE MARKET, BY TAX TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 PHILIPPINES TAX IT SOFTWARE MARKET, BY DEPLOYMENT MODE, 2018-2032 (USD THOUSAND)

TABLE 109 PHILIPPINES TAX IT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2032 (USD THOUSAND)

TABLE 110 PHILIPPINES TAX IT SOFTWARE MARKET, BY REVENUE MODEL, 2018-2032 (USD THOUSAND)

TABLE 111 PHILIPPINES TAX IT SOFTWARE MARKET, BY INDUSTRY, 2018-2032 (USD THOUSAND)

TABLE 112 REST OF ASIA-PACIFIC TAX IT SOFTWARE MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 ASIA-PACIFIC TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC TAX IT SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC TAX IT SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC TAX IT SOFTWARE MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC TAX IT SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC TAX IT SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC TAX IT SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC TAX IT SOFTWARE MARKET: MULTIVARIATE MODELING

FIGURE 9 ASIA-PACIFIC TAX IT SOFTWARE MARKET: OFFERING TIMELINE CURVE

FIGURE 10 ASIA-PACIFIC TAX IT SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 ASIA-PACIFIC TAX IT SOFTWARE MARKET: SEGMENTATION

FIGURE 12 ASIA-PACIFIC TAX IT SOFTWARE MARKET: EXECUTIVE SUMMARY

FIGURE 13 TWO SEGMENTS COMPRISE ASIA-PACIFIC TAX IT SOFTWARE MARKET:

FIGURE 14 ASIA-PACIFIC TAX IT SOFTWARE MARKET: STRATEGIC DECISIONS

FIGURE 15 INCREASING ADOPTION OF TAX IT SOFTWARE AMONG SMALL AND MEDIUM-SIZED BUSINESSES IS EXPECTED TO DRIVE THE ASIA-PACIFIC TAX IT SOFTWARE MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 16 SOFTWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC TAX IT SOFTWARE MARKET IN 2025 & 2032

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA-PACIFIC TAX IT SOFTWARE MARKET

FIGURE 18 ASIA-PACIFIC TAX IT SOFTWARE MARKET: BY OFFERING, 2024

FIGURE 19 ASIA-PACIFIC TAX IT SOFTWARE MARKET: BY TAX TYPE, 2024

FIGURE 20 ASIA-PACIFIC TAX IT SOFTWARE MARKET: BY DEPLOYMENT MODE, 2024

FIGURE 21 ASIA-PACIFIC TAX IT SOFTWARE MARKET: BY ORGANIZATION SIZE, 2024

FIGURE 22 ASIA-PACIFIC TAX IT SOFTWARE MARKET: BY REVENUE MODEL, 2024

FIGURE 23 ASIA-PACIFIC TAX IT SOFTWARE MARKET: BY INDUSTRY, 2024

FIGURE 24 ASIA-PACIFIC TAX IT SOFTWARE MARKET: SNAPSHOT (2024)

FIGURE 25 ASIA-PACIFIC TAX IT SOFTWARE MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.