Global Geospatial Imagery Analytics Market

Taille du marché en milliards USD

TCAC :

%

USD

5.60 Billion

USD

12.50 Billion

2024

2032

USD

5.60 Billion

USD

12.50 Billion

2024

2032

| 2025 –2032 | |

| USD 5.60 Billion | |

| USD 12.50 Billion | |

|

|

|

|

Global Geospatial Imagery Analytics Market Segmentation, By Type (Imagery Analytics, Video Analytics), Application (Disaster Management, Construction and Development, Exhibition and Live Entertainment, Energy and Resource Management, Surveillance and Monitoring, Conservation and research, Others), Collection Medium (Geographic Information System (GIS), Satellites, Unmanned Aerial Vehicles (UAVs), Others), Industry Verticals (Defense and Security, Government, Environmental Monitoring, Energy, Utility, and Natural Resources, Engineering and Construction, Mining and Manufacturing, Insurance, Agriculture, Healthcare and Life Sciences, Others), Deployment Mode (On-Premises, Cloud), Organization Size (Small and Medium-sized Enterprises (SMEs), Large Enterprises) - Industry Trends and Forecast to 2032

Geospatial Imagery Analytics Market Size

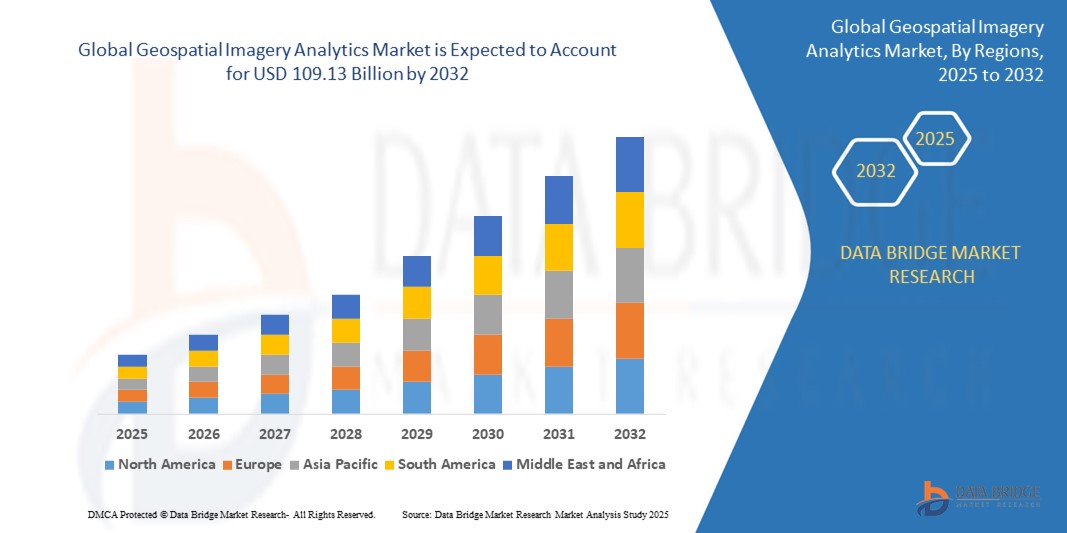

- The global Geospatial Imagery Analytics market size was valued atUSD 19.39 billion in 2024and is expected to reachUSD 109.13 billion by 2032, at aCAGR of 24.11%during the forecast period.

- This significant growth is driven by factors such as the increasing adoption of satellite and aerial imagery in urban planning, defense and intelligence applications, environmental monitoring, and disaster management

Geospatial Imagery Analytics Market Analysis

- Geospatial Imagery Analytics solutions are critical tools used across a wide range of industries including agriculture, defense, urban planning, disaster management, environmental monitoring, and energy. These tools help organizations extract actionable insights from high-resolution satellite, drone, and aerial imagery.

- The demand for geospatial imagery analytics is significantly driven by the increased availability of remote sensing data, advancements in machine learning and AI for image processing, and the growing need for real-time geospatial intelligence.

- North America is expected to dominate the Geospatial Imagery Analytics market, owing to its robust geospatial infrastructure, early adoption of AI-based technologies, and a strong presence of key industry players such as ESRI, Maxar Technologies, and Orbital Insight.

- The Asia-Pacific region is projected to be the fastest-growing region in the Geospatial Imagery Analytics market during the forecast period, driven by rapid urbanization, increasing investments in smart city initiatives, and government programs focused on geospatial mapping and surveillance in countries like China and India.

- The Imagery Analytics segment is expected to dominate the market with a market share of 56.22%, due to its widespread application in agriculture yield forecasting, infrastructure development, and security operations. As demand for precision mapping and predictive insights continues to grow, technological innovations in data acquisition and processing will further boost this segment.

Report Scope and Geospatial Imagery Analytics Market Segmentation

|

Attributes |

Geospatial Imagery Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Geospatial Imagery Analytics Market Trends

“Integration of Cloud-Based Platforms and Real-Time Data Processing”

- A key trend in the market is the integration of geospatial analytics with cloud computing, enabling real-time data access and faster decision-making across industries like agriculture, defense, disaster management, and urban planning.

- Cloud-based geospatial solutions allow organizations to manage and analyze large volumes of imagery data without heavy infrastructure investments.

- For instance, in February 2025, Esri announced the expansion of its ArcGIS Image for ArcGIS Online, a cloud-native solution enabling users to host, analyze, and stream imagery at scale. This allows easier deployment for governments and commercial users, especially in smart cities and environmental monitoring.

- These capabilities enhance operational efficiency, accelerate data processing, and broaden access to advanced geospatial intelligence, fueling market adoption globally

Geospatial Imagery Analytics Market Dynamics

Driver

“Increased Demand Across Defense and Security Applications”

- The growing need for surveillance, terrain mapping, and threat detection in defense has significantly boosted the demand for geospatial imagery analytics.

- Government agencies rely on real-time geospatial data for mission planning, situational awareness, and border security.

- For instance, in September 2024, L3Harris Technologies secured a U.S. Department of Defense contract to deliver advanced geospatial solutions for improved situational analysis in military operations.

- The rise in geopolitical tensions and cross-border conflicts has increased government spending on geospatial intelligence, making it a critical tool in modern warfare strategies

Opportunity

“Satellite Launches Fueling Market Growth”

- With the increasing number of satellite launches by both government and private entities, the availability of high-resolution imagery has expanded, driving demand for analytics platforms that can process and extract insights from vast datasets.

- For instance, in January 2025, Planet Labs launched 36 new SuperDove Earth imaging satellites, further enhancing their daily image capture capabilities. These satellites offer multispectral imaging that improves agricultural monitoring, deforestation tracking, and disaster response.

- The continuous influx of data opens new opportunities for analytics companies to build specialized solutions for sectors such as agriculture, energy, and insurance.

Restraint/Challenge

“Data Privacy and Security Concerns”

- The collection and use of geospatial data raise concerns about data privacy and national security, particularly when it involves sensitive locations or personal information.

- Regulations like GDPR in Europe and evolving data governance norms globally create compliance challenges for geospatial companies operating across regions.

- For instance, in October 2024, Nokia halted its location-based analytics pilot program in the EU due to regulatory pushback over real-time tracking of mobile users in urban environments.

- Addressing these concerns while ensuring data utility is crucial for sustained market growth and maintaining stakeholder trust.

Geospatial Imagery Analytics Market Scope

The market is segmented on the basis type, application, collection medium, industry verticals, deployment mode and organization size.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By collection medium |

|

|

By Industry Verticals

|

|

|

By deployment mode |

|

|

By organization size

|

|

In 2025, the defense & security segment is projected to dominate the market with the largest share in the industry vertical segment

The defense & security segment is expected to dominate the Geospatial Imagery Analytics market with the largest share of 56.22% in 2025 due to the increasing need for real-time surveillance, intelligence gathering, and threat monitoring. As nations continue to strengthen their border security and defense capabilities, geospatial imagery plays a vital role in mission planning, reconnaissance, and tactical operations. Rising global tensions and increased defense budgets are further fueling the demand for advanced geospatial analytics tools.

The imagery analytics segment is expected to account for the largest share during the forecast period in the application segment

In 2025, the imagery analytics segment is expected to dominate the market with the largest market share of 51.31% due to the growing need for high-resolution image processing and pattern recognition in sectors such as agriculture, urban planning, and environmental monitoring. Advancements in satellite technologies and AI-powered image analytics are enhancing the ability to extract actionable insights, leading to faster and more accurate decision-making. Increased investments in remote sensing and satellite imaging also support the growth of this segment.

Geospatial Imagery Analytics Market Regional Analysis

“North America Holds the Largest Share in the Geospatial Imagery Analytics Market”

- North America dominates the Geospatial Imagery Analytics market, driven by a well-established infrastructure for geospatial data collection and analysis, high adoption of advanced analytics technologies, and the presence of key market players.

- The U.S. holds a significant share due to its increasing demand for precision in military defense, urban planning, and environmental monitoring. Additionally, the region’s advancements in satellite imaging, remote sensing technologies, and artificial intelligence (AI) have accelerated the adoption of geospatial analytics across various sectors.

- The availability of strong government support and funding for defense, space exploration, and infrastructure projects further strengthens the market.

- The high rate of digital transformation and the integration of geospatial data into business operations across industries like agriculture, logistics, and urban planning are driving market expansion across the region.

“Asia-Pacific is Projected to Register the Highest CAGR in the Geospatial Imagery Analytics Market ”

- The Asia-Pacific region is expected to witness the highest growth rate in the Geospatial Imagery Analytics market, driven by rapid infrastructure development, increasing demand for precision agriculture, and advancements in urban planning and disaster management.

- Countries such as China, India, and Japan are emerging as key markets due to significant investments in satellite systems, remote sensing, and geospatial technologies. Additionally, the growing number of smart cities, along with major infrastructure projects, is boosting the adoption of geospatial analytics.

- Japan remains a crucial market for advanced geospatial technologies, driven by its leadership in robotics, AI, and smart city development. The country is also focusing on improving disaster management systems through enhanced geospatial analytics.

- China and India, with their large populations and increasing government and private sector investments in satellite imaging and analytics platforms, are witnessing rapid growth. The demand for high-resolution geospatial data is expected to increase across various sectors, such as agriculture, construction, and urban planning.

Geospatial Imagery Analytics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Trimble Inc. (U.S.)

- GENERAL ELECTRIC (U.S.)

- Hexagon AB (Sweden)

- RMSI (India)

- BENTLEY SYSTEMS, INCORPORATED (U.S.)

- Esri (U.S.)

- MDA (Canada)

- Fugro (Netherlands)

- L3Harris Technologies, Inc. (U.S.)

- SNC-Lavalin (Canada)

- American Axle & Manufacturing, Inc. (U.S.)

- TomTom International BV (Netherlands)

- DigitalGlobe – now part of Maxar Technologies (U.S.)

- Critigen (U.S.)

- Nokia (Finland)

- Autodesk, Inc. (U.S.)

- Pitney Bowes, Inc. (U.S.)

- Planet Labs, Inc. (U.S.)

- PrecisionHawk, Inc. (U.S.)

Latest Developments in Global Geospatial Imagery Analytics Market

- In December 2024, Hexagon AB announced the launch of its HxGN Content Program, expanding its satellite imagery and aerial mapping portfolio with new, high-resolution geospatial data products. The platform aims to provide more accurate data for environmental monitoring, agriculture, and urban planning, marking a significant development in geospatial analytics. These advancements are expected to improve decision-making for industries relying on geospatial data for planning and monitoring.

- In October 2024, Esri introduced its new suite of AI-powered geospatial analysis tools at the 2024 Esri User Conference. These tools leverage machine learning to automate the analysis of geospatial data, allowing for faster, more accurate decision-making in industries such as disaster response, environmental management, and urban development. The advancements in AI integration enhance the overall capabilities of Esri's ArcGIS platform, enabling users to unlock deeper insights from their geospatial datasets.

- In September 2024, Planet Labs launched a new series of high-resolution satellite imagery products tailored to support climate research, disaster recovery, and urban planning. This new offering is aimed at improving the precision of environmental monitoring and providing critical data for climate change mitigation strategies. These satellites will capture detailed images of earth’s surface, enabling geospatial imagery analytics to drive more impactful decision-making in environmental conservation and disaster response.

- In August 2024, L3Harris Technologies rolled out its Geospatial Analytics Platform designed to support defense and intelligence operations. This platform integrates real-time geospatial data from satellite, airborne, and terrestrial sensors, providing advanced analytic capabilities for tactical operations and defense planning. The platform's ability to fuse diverse data sources will enhance situational awareness and decision-making capabilities, pushing forward the application of geospatial imagery analytics in national security.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.