Global Intelligent Battery Sensor Market

Taille du marché en milliards USD

TCAC :

%

USD

6.82 Billion

USD

15.85 Billion

2025

2033

USD

6.82 Billion

USD

15.85 Billion

2025

2033

| 2026 –2033 | |

| USD 6.82 Billion | |

| USD 15.85 Billion | |

|

|

|

|

Global Intelligent Battery Sensor Market Segmentation, By Type of Sensor (Voltage Sensors, Current Sensors, Temperature Sensors, and Integrated Sensors), By Vehicle Type (Passenger Vehicle, Commercial Vehicle, and Electric Vehicles), By Sales Channel (OEM and Aftermarket), By Application (Battery Management Systems (BMS), Telematics, and Start-Stop Systems), By End Use (Automotive Manufacturers, Fleet Operators, Telecommunications Companies, Renewable Energy Providers, Aerospace & Defense, and Consumer Electronics) - Industry Trends and Forecast to 2033

Intelligent Battery Sensor Market Size

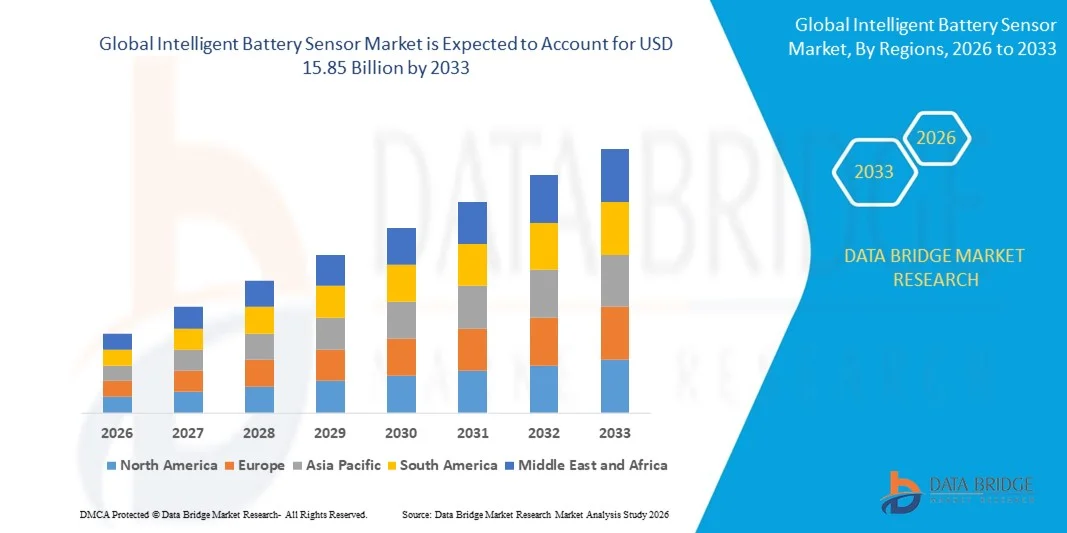

- The global intelligent battery sensor market size was valued at USD 6.82 billion in 2025 and is expected to reach USD 15.85 billion by 2033, at a CAGR of 11.12% during the forecast period

- The market growth is largely driven by the increasing adoption of electric and hybrid vehicles, along with continuous technological advancements in battery management systems, which are accelerating the need for accurate real-time monitoring of battery voltage, current, and temperature across automotive and energy storage applications

- Furthermore, rising emphasis on vehicle safety, battery longevity, and energy efficiency is encouraging OEMs and fleet operators to integrate intelligent battery sensors, positioning them as a critical component for reliable battery performance and predictive maintenance, thereby supporting sustained market expansion

Intelligent Battery Sensor Market Analysis

- Intelligent battery sensors, designed to monitor and manage battery health parameters in real time, play a crucial role in modern automotive electrical architectures by enhancing battery safety, optimizing energy utilization, and enabling advanced diagnostics in passenger, commercial, and electric vehicles

- The growing demand for intelligent battery sensors is primarily fueled by rapid electrification of vehicles, increasing integration of connected vehicle technologies, and stricter regulations focused on battery safety and efficiency, driving widespread adoption across automotive and related end-use industries

- Asia-Pacific dominated the intelligent battery sensor market with a share of 32.5% in 2025, due to rapid adoption of electric vehicles, increasing demand for advanced battery management systems, and a strong presence of automotive manufacturing hubs

- North America is expected to be the fastest growing region in the intelligent battery sensor market during the forecast period due to robust adoption of electric vehicles, advanced battery management technologies, and stringent vehicle safety standards

- Voltage sensors segment dominated the market with a market share of 39% in 2025, due to their critical role in monitoring battery voltage levels accurately and ensuring optimal battery performance. Vehicle manufacturers prefer voltage sensors due to their reliability in preventing overcharging or deep discharging, which enhances battery life and safety. Their integration with modern battery management systems allows for precise real-time monitoring, making them indispensable in passenger and commercial vehicles. The segment also benefits from widespread adoption across electric and hybrid vehicles due to the growing need for efficient battery health management

Report Scope and Intelligent Battery Sensor Market Segmentation

|

Attributes |

Intelligent Battery Sensor Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Intelligent Battery Sensor Market Trends

Integration with Advanced Battery Management Systems

- A key trend in the intelligent battery sensor market is the increasing integration of sensors with advanced battery management systems, driven by the growing need for precise real-time monitoring of voltage, current, and temperature in modern vehicles. This integration is strengthening the role of intelligent battery sensors as core components in optimizing battery efficiency, safety, and overall system reliability across automotive and energy storage applications

- For instance, companies such as NXP Semiconductors and Infineon Technologies supply advanced sensing and monitoring solutions that are widely used within battery management architectures for electric and hybrid vehicles. These solutions enhance data accuracy and enable continuous battery health assessment under demanding operating conditions

- The adoption of intelligent battery sensors is rising rapidly in electric vehicles, where seamless integration with BMS supports range optimization, thermal control, and predictive maintenance. This is positioning intelligent battery sensors as critical enablers for next-generation electric mobility platforms

- Automotive manufacturers are increasingly incorporating intelligent battery sensors to support start-stop systems and energy recovery functions in passenger and commercial vehicles. This trend improves fuel efficiency and reduces emissions by ensuring optimal battery performance during frequent charge and discharge cycles

- The market is also witnessing growing integration of intelligent battery sensors in connected vehicle and telematics systems, where real-time battery data supports remote diagnostics and fleet management. This enhances operational efficiency and reduces unexpected downtime for vehicle operators

- Overall, the rising incorporation of intelligent battery sensors into advanced battery management systems is reinforcing their importance in supporting vehicle electrification, energy efficiency, and long-term battery reliability across global markets

Intelligent Battery Sensor Market Dynamics

Driver

Rising Adoption of Electric and Hybrid Vehicles

- The increasing adoption of electric and hybrid vehicles is a primary driver for the intelligent battery sensor market, as these vehicles rely heavily on accurate battery monitoring to ensure safety and optimal performance. Intelligent battery sensors enable precise control of charging, discharging, and thermal behavior, which is essential for maintaining battery health in electrified powertrains

- For instance, automotive OEMs such as DENSO and Bosch integrate intelligent battery sensors into EV platforms to support advanced battery management and energy optimization strategies. These integrations help manufacturers meet performance expectations and regulatory requirements related to battery safety and efficiency

- The global push toward reducing carbon emissions and dependence on fossil fuels is accelerating investments in electric mobility, directly increasing demand for intelligent battery sensors. Governments and regulatory bodies are supporting this shift through incentives and stricter emission norms

- Hybrid vehicles also contribute to market growth, as start-stop systems and regenerative braking applications require reliable battery monitoring to function efficiently. Intelligent battery sensors play a vital role in managing frequent power fluctuations in these vehicles

- The continuous expansion of EV charging infrastructure and battery manufacturing capacity is further reinforcing the need for advanced sensing solutions. This sustained growth in electric and hybrid vehicle adoption is strongly supporting the expansion of the intelligent battery sensor market

Restraint/Challenge

High Cost and Complexity of Sensor Integration

- The intelligent battery sensor market faces challenges related to the high cost and complexity associated with integrating advanced sensing technologies into vehicle electrical systems. These sensors require precise calibration, robust design, and compatibility with existing battery management architectures, increasing development and implementation costs

- For instance, integrating multifunctional sensors that simultaneously measure voltage, current, and temperature demands sophisticated electronics and software alignment, raising system complexity for manufacturers. This can slow adoption, particularly in cost-sensitive vehicle segments

- The need for stringent testing and validation to ensure safety and reliability under varying operating conditions further adds to production timelines and expenses. Manufacturers must meet automotive-grade quality standards, which increases overall cost pressures

- In addition, retrofitting intelligent battery sensors into existing vehicle platforms can be challenging due to space constraints and wiring complexity. This limits adoption in older vehicle models and certain aftermarket applications

- These factors collectively constrain market growth by increasing the financial and technical barriers for widespread deployment. Addressing integration complexity and cost efficiency remains a key challenge for market participants seeking to scale intelligent battery sensor adoption globally

Intelligent Battery Sensor Market Scope

The market is segmented on the basis of sensor, vehicle type, sales channel, application, and end use.

- By Type of Sensor

On the basis of type, the Intelligent Battery Sensor market is segmented into voltage sensors, current sensors, temperature sensors, and integrated sensors. The voltage sensors segment dominated the market with the largest revenue share of 39% in 2025, driven by their critical role in monitoring battery voltage levels accurately and ensuring optimal battery performance. Vehicle manufacturers prefer voltage sensors due to their reliability in preventing overcharging or deep discharging, which enhances battery life and safety. Their integration with modern battery management systems allows for precise real-time monitoring, making them indispensable in passenger and commercial vehicles. The segment also benefits from widespread adoption across electric and hybrid vehicles due to the growing need for efficient battery health management.

The integrated sensors segment is anticipated to witness the fastest growth rate from 2026 to 2033, fueled by increasing demand for compact, multifunctional sensors that can monitor voltage, current, and temperature simultaneously. Integrated sensors reduce wiring complexity and installation time, which is particularly advantageous for electric vehicles and high-voltage battery packs. OEMs are increasingly adopting integrated sensor solutions to provide a holistic approach to battery monitoring while optimizing vehicle space and reducing production costs. In addition, the ability of integrated sensors to interface seamlessly with telematics and battery management systems further drives their adoption in advanced vehicle models.

- By Vehicle Type

On the basis of vehicle type, the Intelligent Battery Sensor market is segmented into passenger vehicles, commercial vehicles, and electric vehicles. Passenger vehicles held the largest market revenue share in 2025 due to the high adoption of advanced battery monitoring systems in modern cars and SUVs. Manufacturers focus on passenger vehicles for integrating IBS technology to enhance battery reliability, reduce maintenance costs, and improve overall vehicle efficiency. The segment also benefits from increasing consumer awareness of vehicle safety, fuel efficiency, and performance optimization through precise battery monitoring.

The electric vehicles segment is expected to witness the fastest growth from 2026 to 2033, driven by the rapid expansion of the EV market globally and the increasing need for battery performance optimization. For instance, companies such as Tesla are integrating advanced IBS technology in EVs to ensure longer battery life, prevent power loss, and support smart energy management systems. Growing government incentives and mandates for electric mobility further accelerate the adoption of IBS in EVs. The demand is fueled by the requirement for real-time battery diagnostics and predictive maintenance in high-capacity EV batteries.

- By Sales Channel

On the basis of sales channel, the Intelligent Battery Sensor market is segmented into OEM and aftermarket. The OEM segment dominated the market with the largest revenue share in 2025, driven by automakers integrating IBS directly into vehicles during production for enhanced battery performance and safety. OEM adoption ensures compatibility with vehicle electrical systems and reduces warranty-related issues, which is crucial for maintaining brand reliability and consumer trust. Vehicle manufacturers are increasingly prioritizing IBS as a standard feature in new models to comply with safety and efficiency regulations.

The aftermarket segment is projected to register the fastest growth from 2026 to 2033, fueled by the rising need for battery monitoring solutions in existing vehicles. For instance, companies such as Bosch provide aftermarket IBS kits that enable fleet operators and individual consumers to retrofit older vehicles with advanced battery monitoring capabilities. The growth is further supported by the increasing replacement cycle of lead-acid and lithium-ion batteries, along with the rising adoption of connected vehicle technologies. Aftermarket solutions offer flexibility and cost-effective maintenance for both commercial and passenger vehicles.

- By Application

On the basis of application, the Intelligent Battery Sensor market is segmented into battery management systems (BMS), telematics, and start-stop systems. The BMS segment dominated the market with the largest revenue share in 2025 due to the essential role of IBS in maintaining battery health, monitoring charge/discharge cycles, and providing critical data for energy management. BMS applications are particularly significant in electric and hybrid vehicles, where battery efficiency directly impacts vehicle performance and driving range. Automotive manufacturers rely on IBS-enabled BMS for predictive diagnostics, safety compliance, and extending battery lifespan.

The telematics segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing integration of IBS with connected vehicle technologies for real-time monitoring and data analytics. For instance, Continental AG leverages IBS in telematics solutions to provide fleet operators with actionable insights on battery performance and maintenance schedules. Telematics integration enhances predictive maintenance, reduces downtime, and improves operational efficiency for commercial fleets. The growth is also supported by rising demand for data-driven decision-making in vehicle management and smart mobility solutions.

- By End Use

On the basis of end use, the Intelligent Battery Sensor market is segmented into automotive manufacturers, fleet operators, telecommunications companies, renewable energy providers, aerospace & defense, and consumer electronics. Automotive manufacturers dominated the market with the largest revenue share in 2025 due to the widespread adoption of IBS for improving vehicle safety, battery efficiency, and compliance with emission and energy regulations. Vehicle OEMs leverage IBS technology to provide value-added features such as predictive maintenance alerts, battery diagnostics, and energy optimization.

The fleet operators segment is projected to register the fastest growth from 2026 to 2033, driven by increasing adoption of IBS to manage large fleets efficiently. For instance, companies such as Daimler Fleet Management are integrating IBS into commercial trucks and buses to monitor battery health, prevent unexpected downtime, and optimize operational costs. Fleet operators benefit from real-time battery monitoring, predictive maintenance, and data-driven insights to enhance overall fleet efficiency. Rising demand for electrification in commercial fleets further accelerates IBS adoption in this segment.

Intelligent Battery Sensor Market Regional Analysis

- Asia-Pacific dominated the intelligent battery sensor market with the largest revenue share of 32.5% in 2025, driven by rapid adoption of electric vehicles, increasing demand for advanced battery management systems, and a strong presence of automotive manufacturing hubs

- The region’s cost-effective manufacturing landscape, rising investments in automotive electronics, and growing exports of EV components are accelerating market expansion

- The availability of skilled labor, favorable government policies supporting EV adoption, and rapid industrialization across developing economies are contributing to increased deployment of intelligent battery sensors

China Intelligent Battery Sensor Market Insight

China held the largest share in the Asia-Pacific Intelligent Battery Sensor market in 2025, owing to its status as a global leader in automotive manufacturing and electric vehicle production. The country's strong industrial base, supportive government incentives for EV adoption, and extensive export capabilities for automotive electronics are major growth drivers. Demand is also bolstered by ongoing investments in connected vehicles, battery management systems, and renewable energy integration.

India Intelligent Battery Sensor Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, fueled by increasing EV penetration, rising production of commercial and passenger vehicles, and investments in automotive electronics infrastructure. Government initiatives promoting electric mobility and battery manufacturing are strengthening the demand for intelligent battery sensors. In addition, the growing focus on fleet electrification, renewable energy storage solutions, and domestic R&D in battery technology are contributing to robust market expansion.

Europe Intelligent Battery Sensor Market Insight

The Europe Intelligent Battery Sensor market is expanding steadily, supported by stringent automotive safety and emission regulations, high adoption of electric and hybrid vehicles, and growing investments in sustainable battery technologies. The region emphasizes efficiency, reliability, and safety in battery management systems, particularly for commercial and passenger vehicles. Increasing integration of intelligent battery sensors with connected vehicle technologies is further enhancing market growth.

Germany Intelligent Battery Sensor Market Insight

Germany’s market is driven by its leadership in automotive manufacturing, strong R&D ecosystem, and focus on electric and hybrid vehicle production. The country has well-established partnerships between automotive OEMs and electronics suppliers, fostering continuous innovation in battery monitoring technologies. Demand is particularly strong for fleet vehicles and commercial EVs, where intelligent battery sensors improve battery life, safety, and operational efficiency.

U.K. Intelligent Battery Sensor Market Insight

The U.K. market is supported by a mature automotive industry, rising adoption of electric and hybrid vehicles, and increasing investments in smart battery management solutions. Academic-industry collaborations and government incentives for EVs and sustainable energy projects are encouraging deployment of advanced battery sensors. With growing focus on connected vehicles and predictive maintenance, the U.K. continues to play a significant role in the European IBS market.

North America Intelligent Battery Sensor Market Insight

North America is projected to grow at the fastest CAGR from 2026 to 2033, driven by robust adoption of electric vehicles, advanced battery management technologies, and stringent vehicle safety standards. Increasing investment in EV infrastructure, connected vehicle systems, and renewable energy storage solutions is boosting demand. In addition, reshoring of automotive electronics manufacturing and growing collaboration between OEMs and tech companies are supporting market expansion.

U.S. Intelligent Battery Sensor Market Insight

The U.S. accounted for the largest share in the North America market in 2025, underpinned by its expansive automotive industry, strong R&D infrastructure, and significant investment in electric and hybrid vehicle technologies. The country’s focus on battery safety, efficiency, and integration with connected vehicle solutions is encouraging the adoption of intelligent battery sensors. Presence of key players and a mature distribution network further solidify the U.S.'s leading position in the region.

Intelligent Battery Sensor Market Share

The intelligent battery sensor industry is primarily led by well-established companies, including:

- Murata Manufacturing Co., Ltd. (Japan)

- Texas Instruments Inc. (U.S.)

- Continental AG (Germany)

- Current Ways Inc. (U.S.)

- Infineon Technologies AG (Germany)

- Midtronics, Inc. (U.S.)

- DENSO Corporation (Japan)

- Delphi Technologies (U.K.)

- TE Connectivity Ltd. (Switzerland)

- Robert Bosch GmbH (Germany)

- Valence Technology, Inc. (U.S.)

- Analog Devices, Inc. (U.S.)

- HELLA GmbH & Co. KGaA (Germany)

- NXP Semiconductors N.V. (Netherlands)

- Eberspaecher Vecture Inc. (Germany)

Latest Developments in Global Intelligent Battery Sensor Market

- In November 2023, NXP introduced a next-generation Battery Cell Controller IC designed to enhance safety and extend battery lifetime in electric vehicles and energy storage systems. The controller’s high-precision cell measurement capability improves battery management accuracy, enabling better utilization of lithium-ion cells and reducing degradation risks. This development strengthens the intelligent battery sensor market by advancing BMS performance, supporting higher energy density requirements, and reinforcing safety standards in e-mobility and stationary storage applications

- In May 2022, Continental expanded its intelligent battery sensing portfolio with the launch of the Current Sensor Module (CSM) and Battery Impact Detection (BID) system for electric vehicles. These solutions improve real-time battery monitoring and enable rapid detection of physical battery damage, helping prevent safety incidents and performance loss. The introduction enhances market growth by addressing safety-critical requirements and increasing adoption of advanced battery sensing technologies in EV platforms

- In March 2022, Bosch announced enhancements to its intelligent battery sensor solutions aimed at improving state-of-charge and state-of-health estimation for automotive batteries. The upgraded sensors support more accurate energy management and predictive maintenance, enabling vehicle manufacturers to optimize battery performance and lifecycle costs. This development contributes to market expansion by increasing the reliability and intelligence of battery monitoring systems across passenger and commercial vehicles

- In September 2021, Infineon Technologies launched an advanced battery monitoring and sensing solution tailored for electric and hybrid vehicles. The solution integrates high-precision current and voltage sensing to improve battery efficiency and thermal management. This innovation supports the intelligent battery sensor market by enabling safer high-voltage battery operation and meeting the growing demand for efficient EV powertrain architectures

- In June 2021, Texas Instruments introduced a new battery monitoring IC portfolio focused on scalable and modular battery management systems. These solutions allow OEMs to design flexible battery packs with enhanced monitoring accuracy and functional safety. The launch positively impacts the market by accelerating IBS adoption in electric vehicles and energy storage systems, where scalable and reliable battery sensing is critical

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.