Global Logic Ic Market

Taille du marché en milliards USD

TCAC :

%

USD

170.15 Billion

USD

266.11 Billion

2025

2033

USD

170.15 Billion

USD

266.11 Billion

2025

2033

| 2026 –2033 | |

| USD 170.15 Billion | |

| USD 266.11 Billion | |

|

|

|

|

Global Logic IC Market Segmentation, By Type (General-Purpose Logic ICs and Application-Specific Logic ICs), Technology (Bipolar, CMOS, and BiCMOS), Application (Consumer Electronics, Automotive, IT & Telecommunication, Computer, and Others)- Industry Trends and Forecast to 2033

Logic IC Market Size

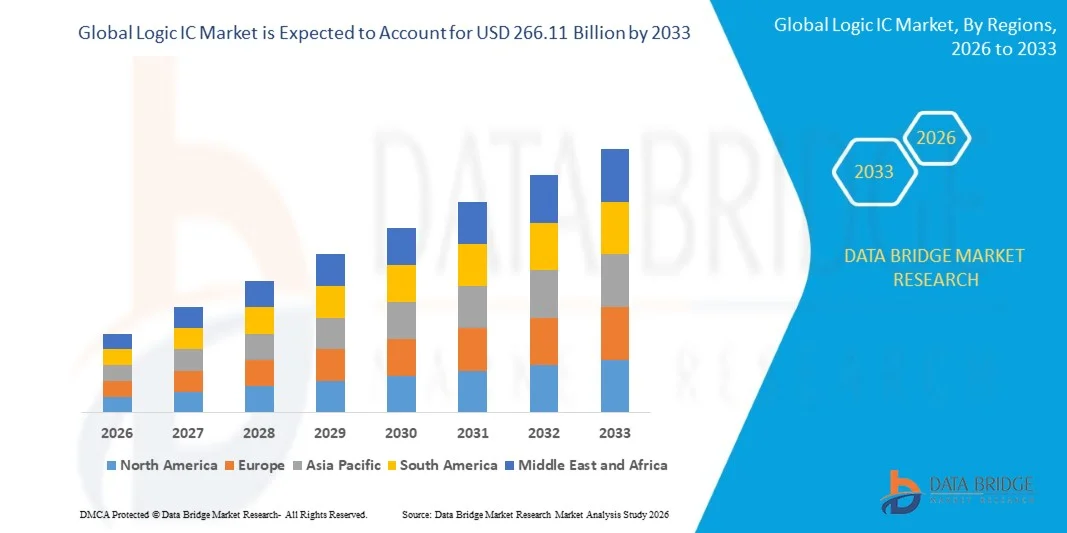

- The global logic IC market size was valued at USD 170.15 billion in 2025 and is expected to reach USD 266.11 billion by 2033, at a CAGR of 5.75% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-performance computing, AI-driven applications, and advanced consumer electronics

- Rapid adoption of cloud computing, data centers, and networking infrastructure is driving the need for efficient and scalable logic IC solutions

Logic IC Market Analysis

- The market is witnessing significant technological advancements, including low-power consumption, miniaturization, and enhanced processing speed, enabling broader applications across multiple industries

- Rising investments in semiconductor R&D, along with government initiatives to boost local semiconductor manufacturing, are strengthening the global logic IC ecosystem

- Asia-Pacific dominated the logic IC market with the largest revenue share in 2025, driven by the rapid growth of consumer electronics, automotive electronics, IT infrastructure, and industrial automation in countries such as China, Japan, South Korea, and India

- North America region is expected to witness the highest growth rate in the global logic IC market, driven by increasing demand for cloud computing, data centers, AI-enabled devices, and advanced automotive systems

- The General-Purpose Logic ICs segment held the largest market revenue share in 2025, driven by their versatility across multiple applications, ease of integration in standard electronic devices, and cost-effectiveness for mass production. These ICs are widely used in consumer electronics, computing systems, and networking equipment, making them a preferred choice for manufacturers

Report Scope and Logic IC Market Segmentation

|

Attributes |

Logic IC Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Logic IC Market Trends

“Rise of High-Performance And Low-Power Logic ICs”

• The growing shift toward high-performance and low-power logic ICs is transforming the semiconductor landscape by enabling faster processing and energy-efficient operation in consumer electronics, data centers, and AI applications. These advancements allow for improved system performance while reducing power consumption, supporting sustainability goals and meeting stringent regulatory energy standards. In addition, demand for miniaturized devices and wearable electronics is further driving innovation in low-power designs

• Increasing demand for logic ICs in cloud computing, networking equipment, and high-performance computing (HPC) is accelerating the development of advanced architectures and optimized chip designs. Companies are adopting multi-core and heterogeneous architectures to handle complex workloads efficiently, while ensuring thermal management and energy optimization. This trend is further reinforced by increasing data traffic and the need for scalable and reliable solutions in large-scale data centers

• The integration of logic ICs in automotive electronics, industrial automation, and IoT devices is expanding market adoption. Manufacturers benefit from more efficient system designs and enhanced computational capabilities, enabling smarter and more connected devices. Growing implementation of autonomous vehicles, smart factories, and AI-enabled IoT applications is driving demand for robust, low-latency, and high-reliability logic IC solutions

• For instance, in 2023, several semiconductor companies launched next-generation low-power logic ICs optimized for AI accelerators and edge computing devices, enhancing performance, reducing energy usage, and improving overall device efficiency. These launches also focused on reducing silicon footprint, improving thermal efficiency, and enabling higher clock speeds for real-time applications. Early adoption by cloud service providers and automotive OEMs is further validating market potential

• While advancements in logic ICs are driving product differentiation and enabling next-generation applications, sustained growth depends on continuous innovation, manufacturing scalability, and cost optimization. Ensuring compatibility with existing platforms, shortening design cycles, and addressing cybersecurity concerns are also key factors influencing long-term adoption and market expansion

Logic IC Market Dynamics

Driver

“Rising Adoption Of Logic ICs Across Consumer Electronics, Data Centers, And Automotive Applications”

• Increasing integration of logic ICs in smartphones, laptops, servers, and networking devices is fueling demand for high-speed, energy-efficient chips. These ICs enable faster processing, reduced latency, and improved device performance, meeting the needs of modern digital applications. In addition, rising consumer expectations for advanced gaming, AR/VR, and AI-enabled devices are driving continuous upgrades and adoption

• Growing investments in AI, machine learning, and cloud computing are driving the adoption of logic ICs in data centers and high-performance computing systems. Companies are prioritizing chips that deliver optimized performance while minimizing power consumption. The deployment of AI inference accelerators and edge computing nodes is further increasing the demand for specialized logic IC designs tailored to workload-specific requirements

• Expansion of the automotive electronics market, including ADAS, infotainment systems, and EVs, is creating additional demand for logic ICs that support advanced processing and connectivity functions. Logic ICs are also critical in vehicle-to-everything (V2X) communication, battery management systems, and electric powertrain control, enhancing overall vehicle intelligence and safety

• For instance, in 2024, major semiconductor manufacturers expanded production of high-speed and low-power logic ICs for AI accelerators and automotive applications, enabling wider adoption and enhancing market growth. These expansions focused on increasing wafer output, improving yield rates, and incorporating advanced packaging solutions for better performance and reliability in end applications

• While technological advancements are boosting adoption, supply chain reliability, cost efficiency, and design flexibility remain critical for sustained expansion. Ensuring robust sourcing of raw materials, reducing dependency on single suppliers, and optimizing fabrication timelines are essential to mitigate risks and maintain consistent market growth

Restraint/Challenge

“High Cost Of Advanced Logic ICs And Complex Manufacturing Processes”

• The high cost of advanced logic ICs, driven by cutting-edge fabrication processes and sophisticated designs, limits accessibility for smaller manufacturers and emerging markets. This impacts widespread adoption across all end-use industries. In addition, R&D expenses, intellectual property licensing, and testing requirements further increase overall costs for market participants

• Complex manufacturing requirements, including advanced lithography and precision wafer handling, increase production expenses and operational challenges for semiconductor companies. Yield management, defect reduction, and integration of new materials add to production complexity, requiring significant capital investment and skilled workforce

• Supply chain disruptions, fluctuations in raw material costs, and fabrication capacity constraints can further affect product availability and pricing, restricting market penetration. Geopolitical factors, natural disasters, and logistical issues may exacerbate these risks, leading to potential delays in product delivery and revenue loss

• For instance, in 2023, global chip shortages led to delayed product launches and higher prices for high-performance logic ICs, affecting multiple technology sectors. Companies were forced to prioritize key customers, impacting smaller players and slowing adoption in emerging markets

• While innovation continues to advance logic IC performance, addressing cost efficiency, supply chain robustness, and scalable manufacturing remains essential for long-term market growth. Manufacturers are increasingly investing in advanced process nodes, automation, and local fabrication facilities to reduce dependency on volatile global supply chains and ensure sustainable growth

Logic IC Market Scope

The logic IC market is segmented on the basis of type, technology, and application.

• By Type

On the basis of type, the market is segmented into General-Purpose Logic ICs and Application-Specific Logic ICs. The General-Purpose Logic ICs segment held the largest market revenue share in 2025, driven by their versatility across multiple applications, ease of integration in standard electronic devices, and cost-effectiveness for mass production. These ICs are widely used in consumer electronics, computing systems, and networking equipment, making them a preferred choice for manufacturers.

The Application-Specific Logic ICs segment is expected to witness the fastest growth rate from 2026 to 2033, driven by increasing demand for customized solutions tailored for AI accelerators, automotive electronics, and industrial automation. Application-specific ICs offer optimized performance, lower power consumption, and enhanced reliability for specialized tasks, boosting adoption in high-performance and emerging applications.

• By Technology

On the basis of technology, the market is segmented into Bipolar, CMOS, and BiCMOS. The CMOS segment held the largest market share in 2025, attributed to its low power consumption, high integration density, and suitability for portable and battery-operated devices. CMOS technology is extensively used in smartphones, laptops, and IoT devices, supporting energy-efficient system designs.

The BiCMOS segment is expected to witness the fastest growth rate from 2026 to 2033, driven by its ability to combine high-speed operation of bipolar transistors with low-power advantages of CMOS. This technology is increasingly adopted in high-frequency and analog-intensive applications such as communication systems, automotive sensors, and AI hardware accelerators.

• By Application

On the basis of application, the market is segmented into Consumer Electronics, Automotive, IT & Telecommunication, Computer, and Others. The Consumer Electronics segment held the largest revenue share in 2025 due to high demand for smartphones, laptops, tablets, and wearable devices, where logic ICs form a critical component for performance and energy efficiency.

The Automotive segment is expected to witness the fastest growth from 2026 to 2033, driven by the increasing integration of logic ICs in EVs, ADAS, infotainment systems, and V2X communication modules. Logic ICs enable smarter, safer, and more connected vehicles, supporting rapid adoption in the automotive industry.

Logic IC Market Regional Analysis

• Asia-Pacific dominated the logic IC market with the largest revenue share in 2025, driven by the rapid growth of consumer electronics, automotive electronics, IT infrastructure, and industrial automation in countries such as China, Japan, South Korea, and India

• Companies in the region are increasingly focusing on high-performance and low-power logic ICs to meet the rising demand for AI accelerators, cloud computing, automotive ADAS systems, and smart devices

• This widespread adoption is further supported by government initiatives promoting semiconductor manufacturing, robust electronics supply chains, and high R&D investment, establishing Asia-Pacific as the global hub for logic IC production and innovation

China Logic IC Market Insight

The China logic IC market captured the largest revenue share in 2025 within Asia-Pacific, fueled by strong domestic electronics manufacturing, rapid adoption of AI, IoT, and automotive electronics, and supportive government policies promoting local semiconductor production. Domestic manufacturers are expanding capacity and investing in advanced fabrication technologies to meet both local and global demand.

Japan Logic IC Market Insight

The Japan logic IC market is expected to witness significant growth from 2026 to 2033, driven by increasing adoption in consumer electronics, robotics, automotive electronics, and AI applications. Japan’s mature semiconductor ecosystem, focus on energy-efficient and high-performance chips, and emphasis on R&D are supporting innovation and higher market penetration.

Europe Logic IC Market Insight

The Europe logic IC market is expected to witness strong growth from 2026 to 2033, primarily driven by the rising demand for automotive electronics, industrial automation, and energy-efficient consumer devices. Investments in advanced semiconductor fabrication and AI-enabled logic ICs are supporting market expansion.

U.S. Logic IC Market Insight

The U.S. logic IC market is expected to witness steady growth from 2026 to 2033, fueled by adoption in data centers, cloud computing, AI accelerators, automotive electronics, and consumer devices. High R&D investment, advanced semiconductor manufacturing infrastructure, and demand for low-power, high-performance logic ICs are propelling market growth in the U.S.

Germany Logic IC Market Insight

The Germany logic IC market is expected to witness notable growth from 2026 to 2033, driven by industrial automation, automotive electronics, and high-performance computing demands. Germany’s emphasis on innovation, energy efficiency, and integration of logic ICs into AI, automotive, and IoT applications supports market expansion.

North America Logic IC Market Insight

North America is expected to witness notable growth from 2026 to 2033, driven by the high adoption of consumer electronics, data centers, and automotive applications, along with growing investments in AI, cloud computing, and high-performance computing systems. Companies in the region are increasingly focusing on energy-efficient, high-performance logic ICs to meet the demand for faster processing, reduced latency, and improved device performance across multiple end-use sectors

U.S. Logic IC Market Insight

The U.S. logic IC market is expected to witness notable growth from 2026 to 2033, fueled by strong demand for smartphones, laptops, servers, and automotive electronics. Companies are prioritizing the production of low-power, high-speed logic ICs for AI accelerators, automotive ADAS systems, and cloud computing infrastructure. Moreover, government and private sector investments in semiconductor research and fabrication are significantly contributing to the market’s expansion.

Logic IC Market Share

The Logic IC industry is primarily led by well-established companies, including:

- Analog Devices, Inc. (U.S.)

- Diodes Incorporated (U.S.)

- Infineon Technologies AG (Germany)

- Intel Corporation (U.S.)

- NXP Semiconductors (Netherlands)

- Renesas Electronics Corporation (Japan)

- Semiconductor Components Industries, LLC (U.S.)

- STMicroelectronics (Switzerland)

- Texas Instruments Incorporated (U.S.)

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION (Japan)

Latest Developments in Global Logic IC Market

- In February 2025, SMIC announced the second phase of its wafer fabrication facility expansion in Beijing, aiming to establish the largest logic IC foundry in the city. The project involves a total investment of approximately USD 6.86 billion (CNY 50 billion) and is expected to begin construction in early 2025. This development is set to enhance SMIC’s semiconductor manufacturing capacity, support the production of advanced logic ICs, and strengthen China’s domestic chip supply chain, positively impacting the regional semiconductor market

- In December 2024, Nexperia launched a series of miniaturized logic ICs in automotive-qualified MicroPak XSON5 leadless packaging. These ICs are designed to reduce PCB area usage by up to 75% while improving manufacturing reliability for automotive applications such as battery monitoring, chassis safety systems, infotainment, and ADAS. The thermally improved plastic package with side-wettable flanks enables automated optical inspection of solder joints, lowering production costs and supporting higher quality standards, thereby driving adoption in space-constrained automotive electronics

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.