Global Respiratory Care Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

23.82 Billion

USD

47.47 Billion

2024

2032

USD

23.82 Billion

USD

47.47 Billion

2024

2032

| 2025 –2032 | |

| USD 23.82 Billion | |

| USD 47.47 Billion | |

|

|

|

|

Global Respiratory Care Devices Market Segmentation, By Product (Therapeutic Devices, Monitoring Devices, Consumables and Accessories), End User (Hospitals, and Homecare Settings) -Industry Trends and Forecast to 2032

Respiratory Care Devices Market Size

- The global respiratory care devices market size was valued atUSD 23.82 billion in 2024and is expected to reachUSD 47.47 billion by 2032, at aCAGR of 9.00%during the forecast period

- This growth is driven by factors such as the rising prevalence of respiratory diseases, aging population, growing air pollution levels, and technological advancements

Respiratory Care Devices Market Analysis

- Respiratory care devices are essential tools used in the diagnosis, monitoring, and treatment of respiratory conditions, providing critical support for patients suffering from diseases such as asthma, chronic obstructive pulmonary disease (COPD), and sleep apnea. They include devices such as ventilators, oxygen concentrators, nebulizers, and continuous positive airway pressure (CPAP) machines

- The demand for these devices is significantly driven by the rising prevalence of respiratory disorders globally, technological advancements in portable and homecare solutions, and the growing aging population that is more susceptible to chronic respiratory diseases

- North America is expected to dominate the global respiratory care devices market with a market share of approximately 58.5%, driven by advanced healthcare infrastructure, widespread adoption of cutting-edge medical technologies, and the strong presence of key market players

- Asia-Pacific is expected to be the fastest growing region in the respiratory care devices market with market share of 19.9%, driven by rapid expansion in healthcare infrastructure, increasing awareness about respiratory health, and rising patient volumes

- The therapeutic devices segment is expected to dominate the respiratory care devices market with the largest share of 58.5% in 2024 due to the increasing prevalence of chronic respiratory diseases such as COPD, asthma, and sleep apnea.

Report Scope and Respiratory Care Devices Market Segmentation

|

Attributes |

Respiratory Care Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

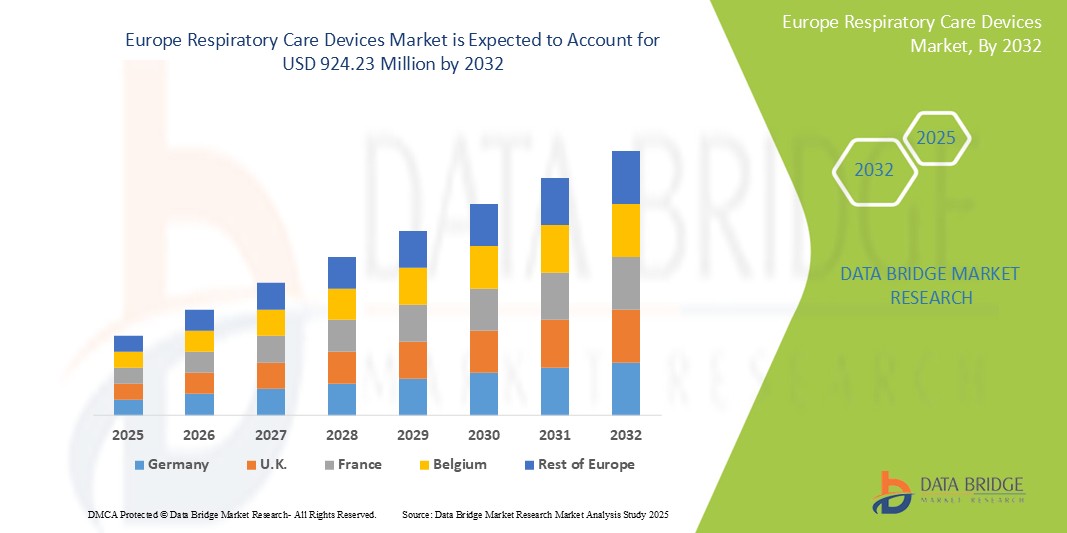

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Respiratory Care Devices Market Trends

“Integration of Smart Technologies Transforming Respiratory Care Devices”

- One prominent trend in the evolution of respiratory care devices is the increasing integration of smart technologies, such as artificial intelligence (AI), Internet of Things (IoT), and advanced sensor technologies into respiratory monitoring and therapeutic systems

- These innovations enhance patient care by offering real-time monitoring, automated adjustments, and personalized treatment plans, thereby improving the management of chronic respiratory conditions and acute respiratory distress

- For instance, modern ventilators and CPAP devices are now equipped with AI algorithms that adapt ventilation parameters automatically based on the patient's breathing patterns, enhancing comfort and reducing the risk of complications

- These advancements are revolutionizing respiratory care, leading to better patient outcomes, reducing hospital readmissions, and driving the demand for next-generation respiratory care devices with intelligent, patient-centric functionalities

Respiratory Care Devices Market Dynamics

Driver

“Rising Prevalence of Respiratory Diseases Fuels Demand”

- The increasing global incidence of chronic respiratory diseases such asasthma, chronic obstructive pulmonary disease (COPD), and sleep apnea is a major driver of growth in the respiratory care devices market

- Factors such as rising pollution levels, tobacco use, occupational hazards, and aging populations are contributing to the growing burden of respiratory conditions that require ongoing monitoring and therapeutic support

- This growing patient population is driving the adoption of respiratory care devices, including ventilators, nebulizers, oxygen concentrators, and CPAP/BiPAP machines, to enhance respiratory function and improve patient outcomes

For instance,

- In September 2024, the World Health Organization (WHO) reported that over 339 million people worldwide suffer from asthma, and more than 3 million deaths annually are attributed to chronic respiratory diseases, highlighting the urgent need for effective respiratory care solutions

- The need to manage these conditions both in clinical and home settings is pushing healthcare systems to invest in advanced respiratory technologies to reduce hospital admissions and support long-term care

Opportunity

“Emergence of AI-Enabled and Connected Respiratory Devices”

- Integration of artificial intelligence (AI) and Internet of Things (IoT) into respiratory care devices offers new opportunities to deliver personalized, data-driven treatment for patients

- These smart devices can monitor respiratory parameters in real time, alert healthcare providers to abnormal patterns, and automatically adjust settings for optimized therapy

- AI algorithms enhance diagnostic capabilities and enable early detection of respiratory deterioration, helping to prevent complications and hospitalizations

For instance,

- In January 2025, according to a study published in The Lancet Digital Health, AI-enabled portable spirometers and smart inhalers demonstrated superior accuracy in detecting airflow limitations and adherence trends among asthma and COPD patients. These tools are paving the way for precision respiratory medicine and proactive patient management

- Smart technologies not only enhance therapeutic efficacy but also promote remote patient monitoring, a key factor in expanding access to care in rural or underserved areas

Restraint/Challenge

“High Cost and Limited Access in Low-Income Regions”

- The relatively high cost of advanced respiratory care devices remains a significant barrier, particularly in low- and middle-income countries where healthcare resources are limited

- Devices such as mechanical ventilators, portable oxygen concentrators, and smart CPAP systems can be prohibitively expensive for both healthcare providers and patients

- As a result, access to life-saving respiratory care technologies is often restricted, leading to disparities in treatment and higher morbidity rates in under-resourced settings

For instance,

- According to a 2024 report by the Global Alliance Against Chronic Respiratory Diseases (GARD), many countries in Asia and Africa report severe shortages in ventilators and oxygen delivery systems, especially during healthcare crises such as the COVID-19 pandemic, underscoring the need for cost-effective innovations

- To overcome this challenge, manufacturers and governments must invest in affordable alternatives, innovative financing models, and localized manufacturing to improve accessibility and reduce healthcare inequities

Respiratory Care Devices Market Scope

The market is segmented on the basis of product and end user.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By End User |

|

In 2025, the therapeutic devices are projected to dominate the market with a largest share in product segment

The therapeutic respiratory care devices segment is expected to dominate the respiratory care devices market with the largest share of 58.5% in 2024 due to the increasing prevalence of chronic respiratory diseases such as COPD, asthma, and sleep apnea. As the primary solution for managing these conditions, advancements in therapeutic devices such as CPAP devices, ventilators, nebulizers, inhalers, and oxygen concentrators enhance patient outcomes, driving market growth. The growing global burden of respiratory diseases further contributes to its market dominance.

The hospitals are expected to account for the largest share during the forecast period in end user market

In 2025, the monitoring respiratory care devices segment is expected to dominate the market with the largest market share of 55% due to the high patient volumes, availability of advanced medical infrastructure, and the increasing need for intensive care and emergency services. As the primary solution for continuous monitoring of respiratory conditions, advancements in monitoring devices enhance patient outcomes, driving market growth. The rising demand for critical care and emergency support further contributes to its market dominance.

Respiratory Care Devices Market Regional Analysis

“North America Holds the Largest Share in the Respiratory Care Devices Market”

- North America dominates the global respiratory care devices market with a market share of58.5%,with the U.S. holding about45% of the global market share in 2024

- North America dominates the respiratory care devices market, driven by advanced healthcare infrastructure, widespread adoption of cutting-edge medical technologies, and the strong presence of key market players

- U.S. holds a significant share due to the increasing demand for advanced respiratory care devices, a high prevalence of chronic respiratory diseases such as COPD and sleep apnea, and continuous technological advancements in respiratory treatments

- The availability of well-established reimbursement policies, growing investments in research & development by leading medical device companies, and robust healthcare systems further strengthen the market

- In addition, the growing demand for intensive care, emergency services, and homecare solutions in the region contributes to market growth

“Asia-Pacific is Projected to Register the Highest CAGR in the Respiratory Care Devices Market”

- Asia-Pacific is expected to witness the highest growth rate in the respiratory care devices market with market share of 19.9%, driven by rapid expansion in healthcare infrastructure, increasing awareness about respiratory health, and rising patient volumes.

- Countries such as China, India, and Japan are emerging as key markets due to the growing aging population, which is more susceptible to chronic respiratory diseases such as COPD, asthma, and sleep apnea.

- Japan, with its advanced medical technology and healthcare system, remains a crucial market for respiratory care devices. The country is expected to continue leading in the adoption of high-precision ventilators and CPAP devices for effective respiratory management.

- India is projected to register the highest CAGR of 7.56% in the respiratory care devices market, driven by expanding healthcare infrastructure, rising awareness about respiratory conditions, and increasing healthcare access across urban and rural regions

Respiratory Care Devices Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Drägerwerk AG & Co. KGaA(Germany)

- Fisher & Paykel Healthcare Limited(New Zealand)

- General Electric Company(U.S.)

- Getinge(Sweden)

- Inogen, Inc.(U.S.)

- Masimo. (US)

- Medtronic (Ireland)

- Koninklijke Philips N.V. (Netherlands)

- ResMed (U.S.)

- VYAIRE (US)

- 3B Medical Inc. (US)

- Inspiration Healthcare Group plc. (US)

- Compumedics (Austria)

- Wellell Inc. (Taiwan)

- Besco Medical Limited (China)

- Bio-Med Devices (US)

- BPL Medical Technologies (India)

- CAIRE Inc. (US)

- Teleflex Incorporated (US)

- Nonin (US)

- Precision Medical, Inc. (US)

- SERVONA GmbH (Germany)

- Flight-Medical Innovations Ltd. (Israel)

- CONTEC MEDICAL SYSTEMS CO.,LTD (China)

Latest Developments in Global Respiratory Care Devices Market

- In January 2025, ResMed announced the launch of its latest CPAP device, the AirSense 11, which features advanced AI technology for better personalized therapy. The device offers enhanced user comfort by automatically adjusting pressure levels based on the patient’s breathing patterns, optimizing therapy throughout the night. The AirSense 11 also integrates with ResMed’s myAir app, allowing patients to track their therapy progress and receive real-time feedback on their treatment

- In December 2024, Medtronic introduced its new Puritan Bennett 980 ventilator, designed to deliver high-frequency oscillatory ventilation (HFOV) for patients with severe acute respiratory distress syndrome (ARDS). The ventilator features enhanced monitoring systems and adaptive support modes, improving clinical outcomes by providing more precise ventilation support for critically ill patients in intensive care units (ICUs)

- In October 2024, Philips Healthcare unveiled its new Series 3000 portable oxygen concentrator (POC), which is designed for patients with chronic obstructive pulmonary disease (COPD) and other respiratory conditions. The device offers lightweight portability, long battery life, and enhanced user-friendly features, providing patients with greater mobility and flexibility while managing their respiratory needs at home

- In September 2024, Fisher & Paykel Healthcare launched the SleepStyle 600 CPAP machine, featuring a redesigned user interface with advanced connectivity capabilities. The device includes a new mask fit technology and personalized pressure adjustments, allowing for enhanced comfort and better patient compliance. It also includes cloud connectivity to monitor and manage patient therapy remotely

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.