Global Scotch Whisky Market

Taille du marché en milliards USD

TCAC :

%

USD

36.47 Billion

USD

48.85 Billion

2025

2033

USD

36.47 Billion

USD

48.85 Billion

2025

2033

| 2026 –2033 | |

| USD 36.47 Billion | |

| USD 48.85 Billion | |

|

|

|

|

Global Scotch Whisky Market Segmentation, By Product Type (Blended, Single Malt, Single Grain, Blended Malt, Blended Grain, and Others), Pricing (Standard, Premium, and Luxury), Packaging Type (Glass Bottles, Plastic Bottles, and Others), Gender (Male and Female), Age Group (18–30, 31–44, and 45+), End User (Individual Consumers and Commercial Establishments), Sales Channel (On-Trade and Off-Trade) - Industry Trends and Forecast to 2033

What is the Global Scotch Whisky Market Size and Growth Rate?

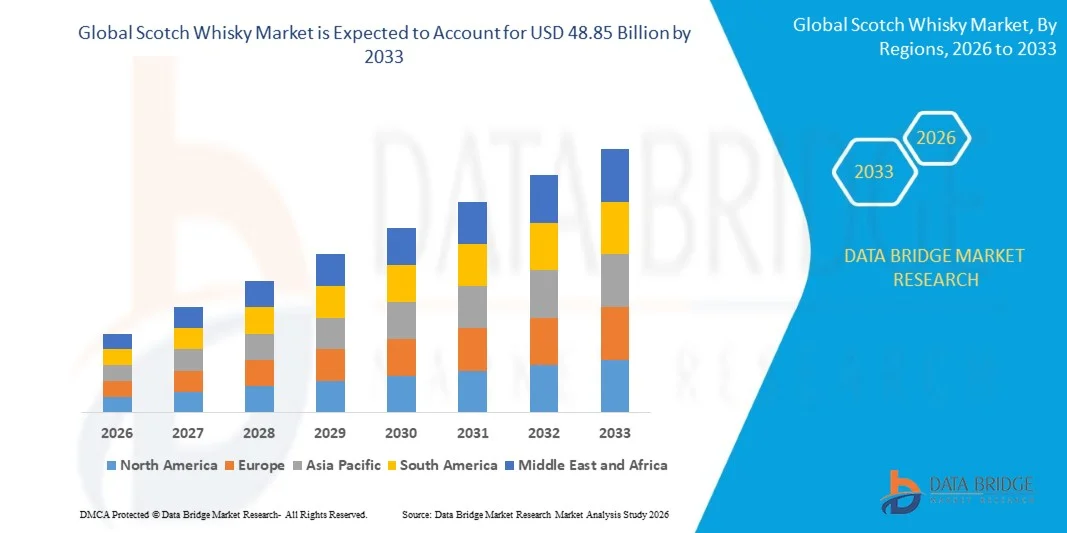

- The global scotch whisky market size was valued at USD 36.47 billion in 2025 and is expected to reach USD 48.85 billion by 2033, at a CAGR of6.02% during the forecast period

- Market growth is driven by rising global demand for premium and luxury alcoholic beverages, increasing preference for aged and single malt whiskies, strong export demand from Europe, North America, and Asia-Pacific, expanding duty-free and travel retail sales, and growing consumption among younger demographics seeking authentic and heritage-rich spirits

What are the Major Takeaways of Scotch Whisky Market?

- Growing disposable income, premiumization trends, expanding cocktail culture, and rising demand from emerging markets such as India, China, and Southeast Asia are creating significant growth opportunities for Scotch whisky manufacturers

- However, factors such as stringent alcohol regulations, high excise duties, supply chain constraints related to aging requirements, and fluctuating raw material costs may act as restraining factors for the overall growth of the Scotch whisky market

- Europe dominated the scotch whisky market with a 39.6% revenue share in 2025, driven by the strong presence of traditional whisky-producing countries, well-established distilleries, and deep-rooted whisky consumption culture across the U.K., France, Germany, and Spain

- North America is expected to register the fastest CAGR of 8.88% from 2026 to 2033, driven by rapid premiumization, rising disposable incomes, and increasing consumer preference for aged and high-quality spirits across the U.S. and Canada

- The Blended Scotch whisky segment dominated the market with a share of approximately 52.6% in 2025, owing to its broad consumer acceptance, consistent flavor profile, and competitive pricing

Report Scope and Scotch Whisky Market Segmentation

|

Attributes |

Scotch Whisky Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Scotch Whisky Market?

“Increasing Shift Toward Premiumization, Craft Innovation, and Sustainable Scotch Whisky”

- The scotch whisky market is witnessing a strong shift toward premium, super-premium, and single malt whiskies, driven by evolving consumer preferences for authenticity, heritage, and superior taste profiles

- Distillers are increasingly focusing on small-batch production, limited editions, and age-statement whiskies, enhancing brand exclusivity and value perception

- Growing emphasis on sustainable distilling practices, including renewable energy use, water efficiency, and eco-friendly packaging, is shaping product development strategies

- For instance, companies such as Diageo, Pernod Ricard, Edrington Group, and William Grant & Sons are expanding premium portfolios and investing in carbon-neutral distilleries and sustainable sourcing

- Rising demand for experiential consumption, including distillery tourism, whisky tastings, and collector releases, is strengthening brand engagement globally

- As consumers increasingly associate scotch whisky with craftsmanship and luxury, premiumization will remain a defining trend driving long-term market growth

What are the Key Drivers of Scotch Whisky Market?

- Rising global consumption of premium alcoholic beverages, supported by increasing disposable incomes and lifestyle upgrades

- For instance, in 2024–2025, leading producers such as Diageo and Pernod Ricard expanded distribution of premium and aged Scotch whiskies across Asia-Pacific and North America

- Growing popularity of single malt and blended malt whiskies among millennials and high-income consumers is boosting category demand

- Expansion of duty-free retail, e-commerce alcohol platforms, and on-trade channels is improving product accessibility

- Increasing export demand from emerging markets, particularly India, China, and Southeast Asia, is strengthening global sales volumes

- Supported by strong branding, heritage positioning, and innovation, the Scotch whisky market is expected to witness steady long-term growth

Which Factor is Challenging the Growth of the Scotch Whisky Market?

- High production costs associated with long aging cycles, oak cask procurement, and storage requirements increase capital intensity

- For instance, during 2024–2025, fluctuations in barley prices, glass packaging costs, and logistics expenses pressured profit margins for several distillers

- Stringent regulatory frameworks, excise duties, and alcohol advertising restrictions limit market penetration in certain regions

- Supply-demand imbalances caused by aging constraints can restrict rapid scalability of premium and aged whisky segments

- Competition from other premium spirits such as bourbon, Irish whiskey, and Japanese whisky intensifies pricing and brand differentiation challenges

- To address these challenges, producers are focusing on portfolio diversification, operational efficiency, and sustainable cost management to strengthen global competitiveness

How is the Scotch Whisky Market Segmented?

The market is segmented on the basis of product type, pricing, packaging type, gender, age group, end user, and sales channel.

- By Product Type

On the basis of product type, the scotch whisky market is segmented into blended, single malt, single grain, blended malt, blended grain, and others. The Blended Scotch whisky segment dominated the market with a share of approximately 52.6% in 2025, owing to its broad consumer acceptance, consistent flavor profile, and competitive pricing. Blended whiskies are widely preferred across mass-market and premium categories and enjoy strong penetration through both on-trade and off-trade channels globally. Their affordability and availability make them the most consumed Scotch whisky type worldwide.

The Single Malt segment is expected to grow at the fastest CAGR from 2026 to 2033, driven by increasing premiumization, rising interest in artisanal spirits, and growing demand from high-income consumers and collectors. Expanding distillery tourism, limited-edition releases, and strong export demand from Asia-Pacific and North America continue to support long-term growth of single malts.

- By Pricing

Based on pricing, the scotch whisky market is segmented into Standard, Premium, and Luxury categories. The Standard pricing segment held the largest market share of around 46.8% in 2025, supported by high consumption volumes, strong presence in blended whiskies, and widespread availability in retail and hospitality channels. Standard-priced Scotch whiskies appeal to price-sensitive consumers and remain popular in emerging markets where affordability drives purchasing decisions.

The Luxury segment is projected to witness the fastest growth during the forecast period, fueled by increasing disposable incomes, growing gifting culture, and rising demand for aged, rare, and limited-edition Scotch whiskies. High-net-worth individuals and collectors are increasingly investing in ultra-premium offerings, particularly in Asia-Pacific, Europe, and duty-free retail channels. Brand storytelling, heritage positioning, and exclusivity further strengthen growth prospects in the luxury segment.

- By Packaging Type

On the basis of packaging type, the market is segmented into Glass Bottles, Plastic Bottles, and Others. The Glass Bottles segment dominated the market with over 88% share in 2025, as glass remains the preferred packaging material due to its premium appeal, preservation of flavor integrity, and strong association with authenticity and heritage. Premium and luxury Scotch whiskies are almost exclusively packaged in glass bottles, reinforcing brand value and consumer trust.

The Others segment, including innovative and sustainable packaging formats, is expected to grow at the fastest CAGR, driven by increasing environmental awareness and experimentation with eco-friendly materials. However, plastic bottles remain limited to select low-cost offerings and travel retail, with minimal penetration in premium categories.

- By Gender

Based on gender, the scotch whisky market is segmented into Male and Female consumers. The Male segment dominated the market with a share of approximately 68.4% in 2025, supported by long-standing consumption patterns, strong association of whisky with traditional male-oriented social and cultural settings, and higher consumption frequency.

The Female segment is anticipated to grow at the fastest CAGR from 2026 to 2033, driven by changing social norms, targeted marketing, smoother flavor profiles, and increased participation of women in premium spirits consumption. Brands are increasingly launching approachable variants and lifestyle-focused campaigns to attract female consumers globally.

- By Age Group

On the basis of age group, the market is segmented into 18–30, 31–44, and 45+. The 45+ age group accounted for the largest market share of about 41.7% in 2025, driven by higher purchasing power, preference for aged and premium whiskies, and strong brand loyalty. This group values heritage, quality, and authenticity, making it a key consumer base for premium Scotch whisky brands.

The 31–44 age group is expected to register the fastest growth, supported by rising disposable incomes, premiumization trends, and growing interest in experiential consumption such as tastings and distillery visits. Younger consumers are increasingly trading up from mass spirits to premium Scotch offerings.

- By End User

Based on end user, the scotch whisky market is segmented into Individual Consumers and Commercial Establishments. The Individual Consumers segment dominated the market with a share of around 57.3% in 2025, driven by strong off-trade sales, home consumption trends, gifting culture, and growth of e-commerce alcohol platforms.

The Commercial Establishments segment is projected to grow at the fastest CAGR, supported by recovery of the hospitality sector, expansion of premium bars, hotels, lounges, and increasing demand for Scotch whisky in cocktail culture and fine-dining environments.

- By Sales Channel

On the basis of sales channel, the market is segmented into On-Trade and Off-Trade. The Off-Trade segment dominated the market with approximately 62.1% share in 2025, driven by supermarkets, specialty liquor stores, duty-free outlets, and online alcohol retail platforms. Convenience, price promotions, and wider product availability support off-trade dominance.

The On-Trade segment is expected to grow at the fastest CAGR from 2026 to 2033, fueled by revival of bars and restaurants, premiumization in hospitality, and rising consumer preference for experiential whisky consumption.

Which Region Holds the Largest Share of the Scotch Whisky Market?

- Europe dominated the scotch whisky market with a 39.6% revenue share in 2025, driven by the strong presence of traditional whisky-producing countries, well-established distilleries, and deep-rooted whisky consumption culture across the U.K., France, Germany, and Spain. Scotland remains the global production hub for Scotch whisky, supported by centuries-old distillation heritage, protected geographical indication (GI) status, and robust export infrastructure. High domestic consumption, premium brand loyalty, and strong tourism-driven sales further strengthen Europe’s market leadership

- Leading Scotch whisky producers in Europe continue to invest in aged expressions, limited editions, sustainable distillation practices, and premium packaging to maintain global competitiveness. Strong distribution networks across retail, hospitality, and duty-free channels reinforce steady demand across the region

- Mature consumer awareness, strong regulatory frameworks, and continued innovation in premium and luxury whisky offerings further support Europe’s dominance in the global Scotch whisky market

U.K. Scotch Whisky Market Insight

The U.K. is the largest contributor within Europe, led by Scotland’s globally recognized distilleries and export-oriented production capacity. Strong demand for single malt and blended Scotch whiskies, extensive distillery tourism, and continuous investment in maturation facilities drive market stability. The U.K.’s role as both a producer and exporter ensures consistent global supply and brand leadership.

France Scotch Whisky Market Insight

France represents one of the largest consumer markets for Scotch whisky in Europe. High per-capita consumption, strong off-trade retail presence, and growing preference for premium and aged whiskies drive sustained demand. The country also plays a key role as a distribution hub for premium Scotch whiskies across continental Europe.

North America Scotch Whisky Market

North America is expected to register the fastest CAGR of 8.88% from 2026 to 2033, driven by rapid premiumization, rising disposable incomes, and increasing consumer preference for aged and high-quality spirits across the U.S. and Canada. Growing interest in single malts, limited-edition releases, and collectible Scotch whiskies is accelerating market growth. Expansion of specialty liquor stores, e-commerce alcohol platforms, and duty-free retail further boosts regional sales.

U.S. Scotch Whisky Market Insight

The U.S. is the largest contributor to North America, supported by strong demand for premium and luxury Scotch whiskies, evolving cocktail culture, and growing whisky enthusiast communities. Rising consumption in urban centers, increasing gifting culture, and strong on-trade recovery across bars and restaurants drive sustained growth.

Canada Scotch Whisky Market Insight

Canada contributes steadily, driven by rising interest in premium spirits, strong off-trade sales, and expanding hospitality channels. Increasing consumer exposure to global whisky brands and growing demand for high-quality imported spirits support long-term market expansion.

Which are the Top Companies in Scotch Whisky Market?

The scotch whisky industry is primarily led by well-established companies, including:

- Diageo plc (U.K.)

- Pernod Ricard S.A. (France)

- Edrington Group Ltd. (U.K.)

- William Grant & Sons Ltd. (U.K.)

- The Glenmorangie Company Ltd. (U.K.)

- International Beverage Holdings Ltd. (Hong Kong)

- Ian Macleod Distillers Ltd. (U.K.)

- Douglas Laing & Co. Ltd. (U.K.)

- J&G Grant (Glenfarclas Distillery) (U.K.)

- Gordon & MacPhail (U.K.)

- Bladnoch Distillery Ltd. (U.K.)

- Arran Distillers Ltd. (U.K.)

- Wemyss Malts (Wemyss Development Co. Ltd.) (U.K.)

- Adelphi Distillery Ltd. (U.K.)

- Scotch Whisky Investments B.V. (Netherlands)

- InchDairnie Distillery Company Ltd. (U.K.)

- The Borders Distillery Company Ltd. (U.K.)

- Kingsbarns Distillery (Wemyss Development) (U.K.)

- Duncan Taylor Scotch Whisky Ltd. (U.K.)

- The Glasgow Distillery Company Ltd. (U.K.)

What are the Recent Developments in Global Scotch Whisky Market?

- In March 2025, Johnnie Walker launched the Vault experience, offering bespoke Scotch whisky blending services starting at GBP 50,000 and targeting ultra-high-net-worth individuals seeking highly personalized luxury offerings, strengthening the brand’s positioning in experiential and ultra-premium spirits

- In November 2024, Diageo introduced FlavorPrintConnect technology, combining curated whisky tasting kits with AI-enabled digital masterclasses to deliver personalized consumer experiences, enhancing direct-to-consumer engagement through digital innovation

- In October 2024, Johnnie Walker unveiled AI-powered bottle designs in collaboration with artist Andy Gellenberg, releasing 5,000 unique collectible bottles exclusively in Germany, demonstrating advanced personalization and technology-led brand differentiation

- In April 2023, Royal Salute launched two luxury blended Scotch whiskies, the Platinum Jubilee Edition and the House of Quinn decanter, and introduced them at the duty-free departures store of Chhatrapati Shivaji Maharaj International Airport in Mumbai, strengthening its luxury presence and visibility in the Indian market

- In September 2022, Thirstie launched an e-commerce liquor platform in partnership with Benriach single malt Scotch whisky, enabling online purchases across the U.S. through integrated retail collaborations, accelerating digital sales adoption and seamless omnichannel consumer experiences

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.