Global Smart Gas Market

Taille du marché en milliards USD

TCAC :

%

USD

6.50 Billion

USD

12.50 Billion

2024

2032

USD

6.50 Billion

USD

12.50 Billion

2024

2032

| 2025 –2032 | |

| USD 6.50 Billion | |

| USD 12.50 Billion | |

|

|

|

|

Global Smart Gas Market, By Type (Automated Metering Infrastructure (AMI) and Automated Meter Reading (AMR), Component (Sensor, Machine, Vision Systems, Robotics, Control Device, Communication Segment, Other Components), Technology (Information Technology, Enabling Technology), Deployment Mode (Cloud, On-Premises) and End Use (Discrete Industry, Process Industry), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) - Industry Trends and Forecast to 2032

Smart Gas Market Size

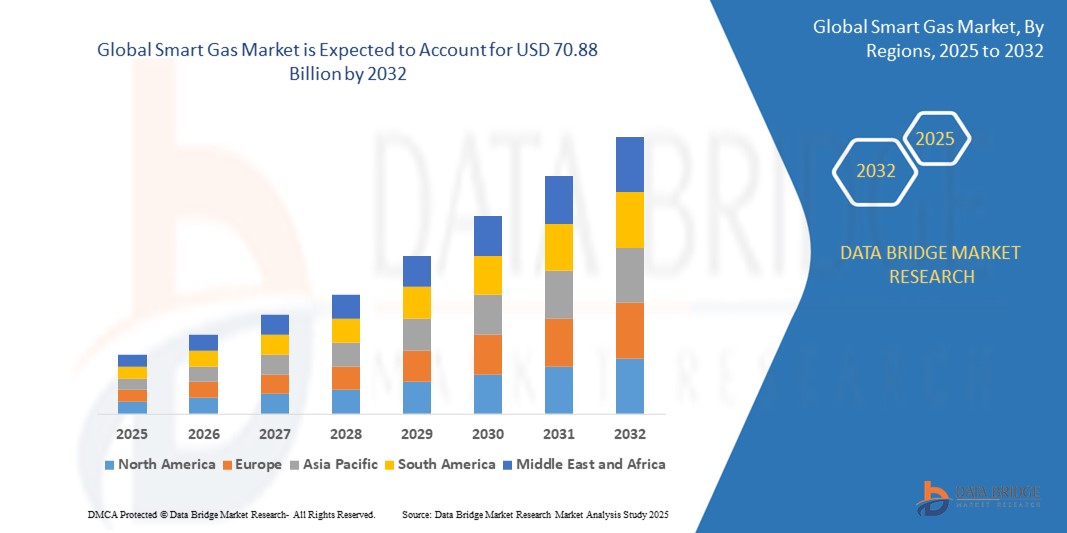

- The Global Smart Gas Market size was valued atUSD 25.2 billion in 2024and is expected to reachUSD 70.88 billion by 2032, at aCAGR of 13.80%during the forecast period

- This growth is driven by factors such as the rapidly increasing of the investments in the smart grid and gas pipeline networks

Smart Gas Market Analysis

- Smart gas systems are critical for modernizing utility infrastructure by enabling real-time monitoring, automated meter reading, leakage detection, and efficient energy management. These systems enhance operational efficiency, reduce energy losses, and support regulatory compliance in gas distribution networks.

- Market growth is driven by the rising adoption of IoT and smart metering technologies, increasing concerns over energy efficiency and safety, and growing investments in smart grid infrastructure.

- North America is expected to dominate the global Smart Gas Market, fueled by the widespread deployment of smart meters, strong regulatory mandates, and early adoption of advanced gas infrastructure.

- The Asia Pacific region is anticipated to witness the fastest growth, owing to rapid urbanization, expanding gas pipeline networks, and increasing government initiatives for smart city development.

- The AMI (Advanced Metering Infrastructure) segment holds the largest market share of 62.80% due to the high demand for two-way communication systems, accurate billing, and proactive outage management in gas utilities.

Report Scope and Smart Gas Market Segmentation

|

Attributes |

Smart Gas Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Gas Market Trends

Integration of IoT, AI, and Smart Metering in Gas Utilities

- A major trend shaping the global smart gas market is the integration of Internet of Things (IoT), artificial intelligence (AI), and advanced metering infrastructure (AMI) to enable intelligent gas distribution, real-time monitoring, and predictive maintenance

- These technologies are transforming conventional gas grids into smart, responsive networks that optimize energy usage, reduce leakage, and enhance billing accuracy

- For instance, In January 2025, gas utilities in Europe launched large scale rollouts of AI-powered smart meters integrated with IoT sensors. These systems provided real-time consumption insights, detected gas leaks instantly, and enabled automated billing reducing technical losses by 18%. This trend is accelerating digital transformation in gas infrastructure worldwide.

- Combined with cloud analytics, these systems support proactive maintenance, improve customer engagement, and strengthen operational safety across gas utilities

Smart Gas Market Dynamics

Driver

“Growing Focus on Energy Efficiency, Safety, and Grid Modernization”

- The increasing need to reduce energy losses, enhance gas network safety, and modernize aging infrastructure is a key driver fueling the adoption of smart gas solutions

- Smart meters and intelligent grid components enable precise consumption tracking, immediate fault detection, and remote shut-off capabilities

- This results in improved service reliability, better resource planning, and higher customer satisfaction

For instance,

- In August 2024, utility providers in the U.S. upgraded thousands of conventional meters with AMI-based smart meters across suburban networks. The transition helped cut down gas leak incidents by 30% and significantly improved emergency response. This growing emphasis on smart infrastructure is boosting market adoption.

- Government mandates for efficient energy use and carbon emission reduction are further driving the deployment of smart gas technologies globally

Opportunity

“Rising Adoption of Cloud-Based Platforms and Data Analytics in Gas Utilities”

- The shift towards cloud-based monitoring platforms and real-time analytics presents a significant opportunity in the smart gas market.

- Utilities are increasingly adopting centralized, cloud-enabled platforms to manage distributed infrastructure, analyze consumption patterns, and ensure regulatory compliance.

- These solutions support scalability, reduce IT overhead, and improve interoperability between devices.

For instance,

- In March 2025, smart gas providers in Southeast Asia adopted cloud-based AMI platforms for managing millions of connected meters across urban and rural regions. These platforms allowed real-time monitoring, predictive leak detection, and analytics-driven decision-making. This shift is creating vast growth potential for vendors offering scalable, data-centric solutions.

- With rising demand for flexible, secure, and cost-effective systems, cloud-based smart gas platforms are poised for strong market growth in both developed and emerging regions.

Restraint/Challenge

“High Initial Investment and Deployment Costs”

- One of the primary challenges in the smart gas market is the high initial investment required for deploying smart gas systems

- The cost of upgrading legacy infrastructure, installing smart meters, and implementing advanced data analytics platforms can be a significant financial burden for many utilities, especially in emerging markets

For instance,

- In January 2025, a utility in India faced delays in rolling out smart gas metering due to the substantial capital required to replace outdated infrastructure. The high cost of implementation led to slower adoption in regions where utilities operate with limited budgets.

- While these investments are expected to pay off over time through increased operational efficiency and energy savings, the upfront financial commitment remains a barrier for many gas providers

Smart Gas Market Scope

The market is segmented on the basis, type, component, technology, deployment mode, end use.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Component |

|

|

By Technology

|

|

|

By Deployment Mode

|

|

|

By End Use |

|

In 2025, The AMI segment is expected to hold the largest market share and dominate the market

The increasing demand for advanced metering systems that provide real-time data collection, remote monitoring, and more accurate billing. AMI enables gas utilities to gain detailed insights into consumption patterns, detect leaks, and improve operational efficiency. The rise of smart grids and the shift towards digital energy management are driving the adoption of AMI systems. As utilities focus on improving service reliability and energy efficiency, AMI continues to be a critical technology for modernizing gas distribution networks.

The sensors is expected to account for the largest share in the components segment during the forecast period.

Sensors are a key component in the smart gas market, as they enable real-time monitoring of gas usage, pressure, and temperature. With the increasing need for automation, data-driven decision-making, and leak detection, sensors play a vital role in ensuring the safety, efficiency, and reliability of gas infrastructure. Their ability to transmit data to centralized systems for analysis is crucial for early fault detection and minimizing energy losses. As the demand for smart gas solutions grows, the sensor segment is expected to maintain a dominant position in the market.

Smart Gas Market Regional Analysis

“North America Holds the Largest Share in the Smart Gas Market”

- North America is expected to dominate the global smart gas market due to its advanced infrastructure, strong adoption of smart grid technologies, and a growing emphasis on energy efficiency and safety. The United States leads the region, driven by a significant push towards digital transformation in utility sectors, including the deployment of smart gas meters, IoT-enabled sensors, and advanced analytics platforms

- The U.S. benefits from a highly developed energy sector, where gas utilities are increasingly investing in modernizing their infrastructure to reduce losses, improve customer service, and comply with stringent environmental regulations

- Government policies aimed at enhancing energy efficiency and sustainability are also bolstering market growth. The region is seeing increased regulatory support for the deployment of smart meters and gas monitoring systems, further driving market demand. Additionally, strong investments in IoT and cloud-based solutions in gas utility operations continue to support the region's market leadership

“Asia-Pacific is Projected to Register the Highest CAGR in the Smart Gas Market”

- The Asia-Pacific region is anticipated to register the highest compound annual growth rate (CAGR) in the global smart gas market, driven by rapid urbanization, growing energy demand, and increased investments in smart grid technologies. Countries such as China, India, and Japan are leading the way in adopting advanced smart gas systems, including smart meters, IoT devices, and data analytics solutions

- China, with its vast population and rapidly expanding urban areas, is investing heavily in smart city initiatives and energy infrastructure modernization.

- Japan, which has long been at the forefront of adopting technological innovations, is driving growth in the Asia-Pacific market by implementing smart gas solutions to optimize its gas distribution systems and enhance safety measures. The region is also witnessing strong government support and regulatory frameworks aimed at accelerating the adoption of smart energy technologies

Smart Gas Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ABB (Switzerland)

- Aclara Technologies (U.S.)

- Badger Meter Inc. (U.S.)

- Capgemini (France)

- CGI Inc. (Canada)

- Diehl Stiftung & Co. KG (Germany)

- Elster Group SE (Germany)

- General Electric Company (U.S.)

- International Business Machines Corporation (U.S.)

- Itron Inc. (U.S.)

- Landis+Gyr (Switzerland)

- Oracle (U.S.)

- Schneider Electric (France)

- Sensus (U.S.)

- Silver Spring Networks (U.S.)

- Verizon (U.S.)

- IBM Corporation (U.S.)

- Emerson Electric (U.S.)

- Honeywell International Inc. (U.S.)

- Yokogawa Electric Corporation (Japan)

Latest Developments in Global Smart Gas Market

- In March 2025, Itron launched its next-generation smart gas metering solution, the Itron Smart Gas Meter. The product is designed to enhance the efficiency of gas utilities by providing real time data on consumption and enabling remote diagnostics. The new meter is equipped with advanced communication technologies such as IoT sensors and cloud connectivity, allowing gas utilities to optimize their infrastructure, detect leaks early, and improve customer service through accurate billing. This launch is part of Itron's ongoing commitment to providing cutting-edge solutions that support smart city initiatives globally.

- In February 2025, Schneider Electric entered into a strategic partnership with Xylem, a leading provider of water and energy solutions, to codevelop smart gas infrastructure solutions. This collaboration will combine Schneider's EcoStruxure platform with Xylem's sensor and monitoring technologies to create smarter, more efficient gas distribution networks. The goal of the partnership is to provide utilities with end to end solutions that enable predictive maintenance, energy optimization, and real-time monitoring of gas networks, ultimately reducing operational costs and improving safety.

- In January 2025, Toshiba Corporation acquired Landis+Gyr, a leading provider of smart metering solutions, for USD 2.5 billion. This acquisition allows Toshiba to expand its footprint in the smart gas market by combining Landis+Gyr's expertise in metering solutions with Toshiba’s advanced technology portfolio. The acquisition aims to strengthen Toshiba's position in the global market for smart grid and smart gas solutions, focusing on enhancing energy efficiency, grid management, and customer service through advanced smart metering infrastructure.

- In December 2024, Honeywell introduced the Honeywell Smart Gas Safety System, an innovative solution aimed at improving safety and leak detection in gas distribution networks. The system integrates IoT based sensors, real-time data analytics, and machine learning to monitor gas pipelines for potential leaks and irregularities. This system is designed to provide early warnings and automatic shutdown capabilities, ensuring a quick response to hazardous situations and reducing risks to both personnel and the environment.

- In November 2024, Badger Meter and Aclara Technologies merged to create a new powerhouse in the smart gas market. The merger combines Badger Meter’s expertise in flow measurement and metering technologies with Aclara’s advanced data analytics and communications solutions. The newly formed entity is expected to offer comprehensive smart gas solutions, focusing on AMI (Automated Metering Infrastructure) and advanced leak detection technologies. The merger is poised to accelerate the adoption of smart gas systems globally and strengthen their market position in providing data-driven insights for gas utilities.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.