Global Soil Testing Equipment Market

Taille du marché en milliards USD

TCAC :

%

USD

5.65 Billion

USD

13.42 Billion

2024

2032

USD

5.65 Billion

USD

13.42 Billion

2024

2032

| 2025 –2032 | |

| USD 5.65 Billion | |

| USD 13.42 Billion | |

|

|

|

|

Global Soil Testing Equipment Market Segmentation, By End-User Industry (Agriculture, Construction, and Others), Type of Tests (Physical, Residual, and Chemical), Site (Lab and On-Site), Degree of Automation (Automatic, Semi-Automatic, and Manual)- Industry Trends and Forecast to 2032

Soil Testing Equipment Market Size

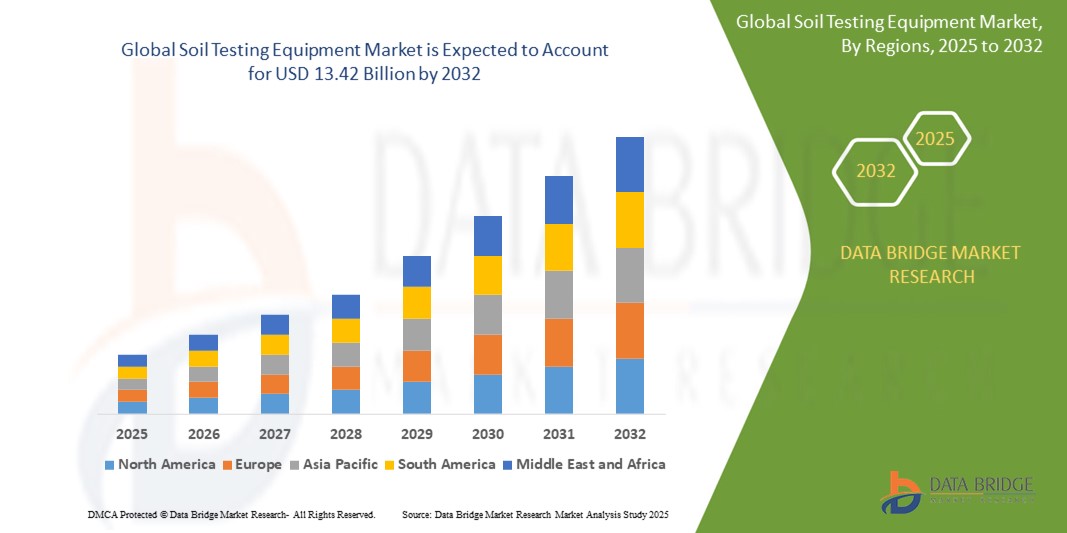

- The global soil testing equipment market size was valued at USD 5.65 billion in 2024 and is expected to reach USD 13.42 billion by 2032, at a CAGR of 11.40% during the forecast period

- The market growth is largely fuelled by the increasing demand for high crop yields and quality agricultural output, the need for soil fertility management, and the rising adoption of precision farming techniques

- In addition, stringent government regulations on environmental protection and the growing need for geotechnical analysis in construction and infrastructure projects are further propelling the market expansion

Soil Testing Equipment Market Analysis

- The market is also benefitting from technological advancements in soil testing sensors, automation tools, and portable testing kits, which offer faster and more accurate soil analysis

- Key players are focusing on product innovation, strategic collaborations, and digital integration to provide comprehensive soil testing solutions tailored to both agricultural and construction sector

- North America dominated the soil testing equipment market with the largest revenue share of 37.6% in 2024, driven by rising investment in sustainable agriculture, regulatory mandates for soil quality monitoring, and advanced construction practices requiring geotechnical assessment

- Asia-Pacific region is expected to witness the highest growth rate in the global soil testing equipment market, driven by expanding agricultural activities, rapid urbanization, and increasing infrastructure projects in countries such as China, India, and Indonesia

- The agriculture segment dominated the market with the largest revenue share in 2024, driven by the rising need for soil fertility analysis, nutrient management, and crop productivity optimization. Farmers and agribusinesses are increasingly using soil testing tools to support precision farming and reduce input costs through targeted application of fertilizers.

Report Scope and Soil Testing Equipment Market Segmentation

|

Attributes |

Soil Testing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of Soil Testing Services in Emerging Agricultural Economies • Integration of AI and Data Analytics in Soil Testing Equipment for Predictive Insights |

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Soil Testing Equipment Market Trends

“Increasing Adoption of Portable and IoT-Enabled Soil Testing Devices”

• Rising demand for compact, easy-to-use soil testing devices with real-time analysis capabilities

• Integration of IoT, GPS, and cloud connectivity enhances remote monitoring and decision-making

• Growing use in agriculture, construction, and environmental monitoring due to increased mobility

• These devices enable cost-effective, on-the-spot soil diagnostics without lab dependency

• For instance, AgroCares’ handheld scanner provides real-time nutrient data to farmers using cloud-based technology, making it ideal for field use in remote areas

Soil Testing Equipment Market Dynamics

Driver

“Rising Demand for Precision Agriculture and Soil Health Monitoring”

• Precision farming practices are driving the need for accurate soil data to improve crop yields

• Soil testing equipment helps optimize fertilizer use, monitor pH levels, and maintain soil health

• Government initiatives such as India’s Soil Health Card Scheme promote regular soil analysis

• Demand extends to construction and environmental sectors for land development and compliance

• For instance, The USDA’s Conservation Innovation Grants support adoption of soil testing technologies to promote sustainable farming in the U.S.

Restraint/Challenge

“High Initial Cost and Limited Access in Developing Regions”

• Advanced soil testing equipment involves high upfront costs, limiting adoption among smallholders

• Lack of internet infrastructure and technical knowledge restricts usage in rural areas

• Many users still rely on manual or traditional testing methods due to affordability concerns

• Inadequate training leads to underutilization of available testing tools and inconsistent results

• For instance, In sub-Saharan Africa, limited access to digital tools causes farmers to use generalized input methods, negatively affecting crop output and soil health

Soil Testing Equipment Market Scope

The market is segmented on the basis of end-user industry, type of tests, site, and degree of automation.

• By End-User Industry

On the basis of end-user industry, the soil testing equipment market is segmented into agriculture, construction, and others. The agriculture segment dominated the market with the largest revenue share in 2024, driven by the rising need for soil fertility analysis, nutrient management, and crop productivity optimization. Farmers and agribusinesses are increasingly using soil testing tools to support precision farming and reduce input costs through targeted application of fertilizers.

The construction segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing demand for geotechnical analysis to assess soil stability and composition for safe building foundations. The growing emphasis on infrastructure development across emerging markets is contributing to the uptake of soil testing solutions in pre-construction assessments and quality control procedures.

• By Type of Tests

On the basis of type of tests, the market is segmented into physical, residual, and chemical tests. The chemical segment held the largest market revenue share in 2024, owing to its crucial role in identifying nutrient levels, salinity, and pH balance—factors essential for crop health and productivity. These tests are widely used in both agriculture and environmental monitoring to ensure soil quality and sustainability.

The physical testing segment is expected to witness the fastest growth rate from 2025 to 2032, supported by its growing use in evaluating soil texture, compaction, and moisture retention properties. These parameters are critical in construction planning, especially for determining load-bearing capacity and drainage suitability.

• By Site

On the basis of site, the soil testing equipment market is segmented into lab and on-site. The lab segment accounted for the largest market share in 2024, due to the high accuracy and standardized testing procedures offered by laboratory-based soil analysis. Labs continue to play a vital role in agricultural advisories, environmental research, and infrastructure assessments requiring precise soil profiling.

The on-site segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the need for immediate results, portability, and reduced dependency on centralized testing facilities. The adoption of field-based testing tools is rising among farmers, consultants, and construction teams seeking timely data to support decision-making in real-time.

• By Degree of Automation

On the basis of degree of automation, the market is segmented into automatic, semi-automatic, and manual. The automatic segment dominated the market in 2024, fuelled by advancements in smart sensors, integration with digital platforms, and the ability to streamline testing workflows. Automated systems are increasingly preferred for their accuracy, repeatability, and reduced operational labor in large-scale testing environments.

The manual segment is expected to witness the fastest growth rate from 2025 to 2032, particularly in developing regions where cost-effectiveness and ease of use are key decision factors. Manual tools remain widely used for basic assessments and educational purposes, especially in areas with limited access to advanced technologies.

Soil Testing Equipment Market Regional Analysis

• North America dominated the soil testing equipment market with the largest revenue share of 37.6% in 2024, driven by rising investment in sustainable agriculture, regulatory mandates for soil quality monitoring, and advanced construction practices requiring geotechnical assessment

• The region shows strong adoption of automated and digital soil testing solutions among both farmers and construction firms, enhancing the accuracy and speed of analysis

• High awareness of environmental impacts, presence of well-established players, and integration of smart farming tools continue to support market growth across agriculture and infrastructure sectors

U.S. Soil Testing Equipment Market Insight

The U.S. soil testing equipment market held the largest share of 82% in North America in 2024, propelled by widespread adoption of precision agriculture and the need for regulatory compliance in infrastructure projects. The demand for real-time soil monitoring and portable devices is increasing, particularly among large-scale farms and civil engineering firms. Strong government support through agricultural subsidies and conservation initiatives such as the USDA’s soil health programs continues to fuel the market. Integration of soil testing with digital farm management systems is also accelerating product demand.

Europe Soil Testing Equipment Market Insight

The Europe soil testing equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by strict environmental standards, emphasis on sustainable land use, and increased demand for high-yield agriculture. Countries such as Germany, France, and the Netherlands are investing heavily in modernizing soil analysis processes. Soil testing is becoming a standard practice not only in agriculture but also in commercial and industrial construction. The growing availability of semi-automated and on-site testing tools is further promoting adoption in both urban and rural applications.

U.K. Soil Testing Equipment Market Insight

The U.K. soil testing equipment market is expected to witness the fastest growth rate from 2025 to 2032, supported by growing concerns over soil degradation, climate change impacts, and the need for environmentally responsible farming. Precision farming techniques are gaining popularity, pushing demand for nutrient testing and moisture analysis tools. In the construction industry, geotechnical assessments using advanced soil testing equipment are a standard requirement for infrastructure development. Government-backed initiatives focused on soil preservation are also encouraging broader use of testing technologies.

Germany Soil Testing Equipment Market Insight

The Germany soil testing equipment market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the country’s commitment to sustainable agriculture and rigorous construction quality norms. Germany is a leader in precision farming, and farmers are increasingly investing in lab and on-site testing solutions to optimize input usage and improve crop yields. The construction sector also relies heavily on physical soil testing to ensure the safety and durability of new infrastructure. The availability of technologically advanced, eco-conscious soil testing tools is further supporting market expansion.

Asia-Pacific Soil Testing Equipment Market Insight

The Asia-Pacific soil testing equipment market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rapid growth of agriculture and construction industries in countries such as China, India, and Indonesia. Government-led programs promoting soil health and fertility are encouraging farmers to adopt regular testing practices. Simultaneously, the surge in infrastructure development and urbanization is boosting demand for geotechnical testing in construction. The rising presence of domestic manufacturers offering affordable solutions is widening access to soil testing technologies across both rural and urban regions.

Japan Soil Testing Equipment Market Insight

The Japan soil testing equipment market is expected to witness the fastest growth rate from 2025 to 2032, supported by advanced agricultural practices, aging farmer demographics, and increasing awareness of sustainable land use. Japanese farmers and researchers prefer precision-driven testing tools that integrate with digital farming platforms. In addition, Japan’s earthquake-prone landscape necessitates thorough soil testing in construction, especially for foundation assessment. The market is witnessing increased demand for automated and compact soil testing devices suitable for both laboratory and field use.

China Soil Testing Equipment Market Insight

The China accounted for the largest revenue share in the Asia-Pacific soil testing equipment market in 2024, driven by its large agricultural sector, rapid industrial expansion, and focus on soil restoration. Soil testing is becoming essential in ensuring food security and protecting the environment. Government policies such as soil pollution control and precision farming support are stimulating adoption. In the construction sector, booming urban development continues to generate demand for site-specific soil analysis. Domestic manufacturers are actively producing low-cost, innovative testing tools to meet widespread demand.

Soil Testing Equipment Market Share

The Soil Testing Equipment industry is primarily led by well-established companies, including:

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Merck KGaA (Germany)

- PerkinElmer Inc. (U.S.)

- Controls S.p.A (Italy)

- LaMotte Company (U.S.)

- Geotechnical Testing Equipment UK Ltd (U.K.)

- Sun Labtek Equipments (I) Pvt. Ltd (India)

- Martin Lishman Ltd ((U.K.)

- S.W.COLE Engineering, Inc (U.K.)

- Ele International (U.K.)

- Gilson Company Inc. (U.S.)

- Humboldt Mfg. Co. (U.S.)

- EIE Instruments Pvt. Ltd (India)

- Eurofins Scientific (Luxembourg)

- Alfa Testing Equipment (U.K.)

- M&L Testing Equipments (U.S.)

- Solvay (Belgium)

- AMVAC Chemical Corporation (U.S.)

- Bayer AG (Germany)

Latest Developments in Global Soil Testing Equipment Market

- In October 2023, the increasing presence of per- and polyfluoroalkyl substances (PFAS) in various products has raised severe environmental concerns due to their persistence and potential for soil and water contamination. Recent research has identified PFAS contamination in ecosystems and wildlife, prompting Agilent Technologies to introduce a comprehensive PFAS testing workflow. This solution includes precise measurement across water, soil, food, and consumer goods, ensuring effective management and data reporting to address the contamination

- In June 2023, IIT Kanpur launched Bhu-Parikshak, a cutting-edge rapid soil testing device. This innovative tool delivers results on soil health within 90 seconds, leveraging Near Infrared Spectroscopy technology. The device is designed to help farmers quickly assess soil conditions and recommend appropriate fertilizer dosages without laboratory visits, enhancing agricultural efficiency

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.