Global Tackifier Market

Taille du marché en milliards USD

TCAC :

%

USD

4,083,989.40 Thousand

USD

5,679,815.98 Thousand

2021

2029

USD

4,083,989.40 Thousand

USD

5,679,815.98 Thousand

2021

2029

| 2022 –2029 | |

| USD 4,083,989.40 Thousand | |

| USD 5,679,815.98 Thousand | |

|

|

|

|

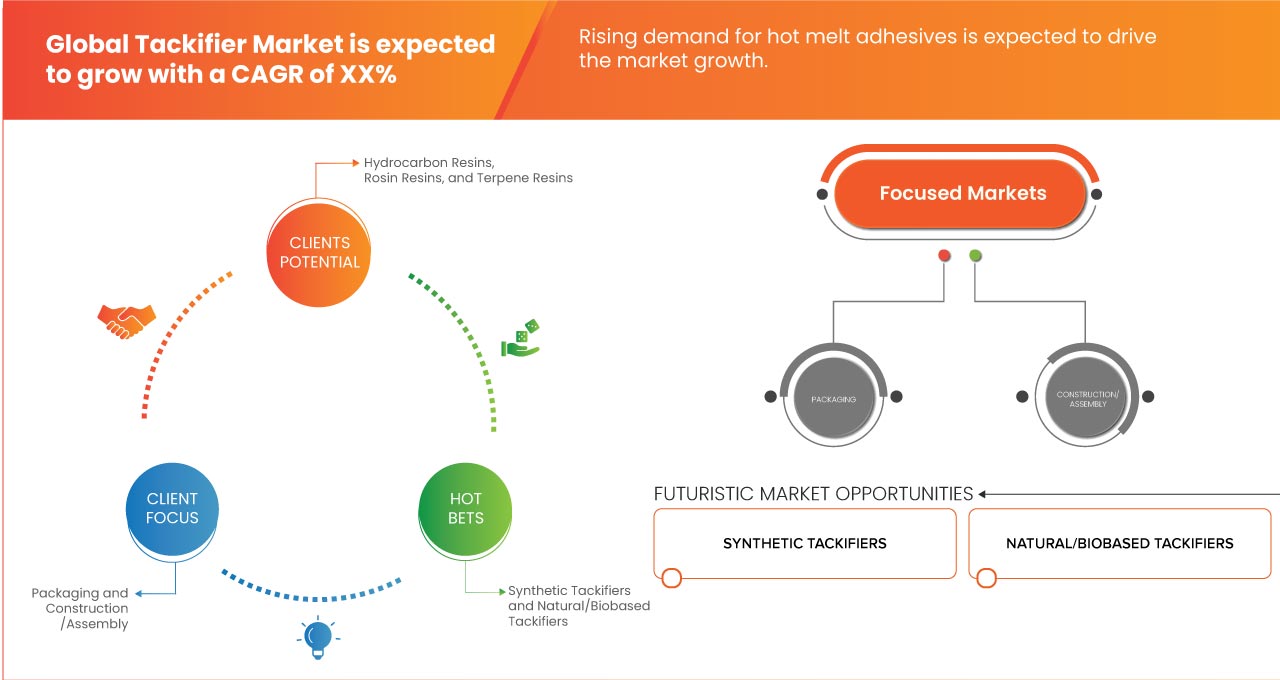

Marché mondial des agents collants, par produit (résines hydrocarbonées, résines de colophane et résines terpéniques), matière première (agents collants synthétiques, agents collants naturels/biosourcés), forme (solide, liquide et dispersion de résine), application ( adhésifs sensibles à la pression (PSA) , adhésifs thermofusibles (HMA) et autres), utilisateur final (emballage, construction/assemblage, non-tissé, reliure et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des agents collants

Le marché mondial des agents collants est sur le point de connaître une croissance robuste, tirée par l'expansion de l'industrie des adhésifs, en particulier dans les économies émergentes, ainsi que par la demande croissante de solutions adhésives respectueuses de l'environnement. Les principaux facteurs de restriction comprennent la volatilité des prix des matières premières et les défis réglementaires associés à certains types d'agents collants. Néanmoins, la sensibilisation croissante à la durabilité et les efforts continus de recherche et développement présentent des pistes prometteuses pour l'innovation dans les agents collants, répondant à diverses applications industrielles. De plus, la concurrence au sein du marché nécessite un positionnement stratégique et une différenciation des produits entre les fabricants pour maintenir un avantage concurrentiel. En résumé, le marché des agents collants présente un fort potentiel de croissance avec des opportunités d'avancées respectueuses de l'environnement, bien que certains défis nécessitent des stratégies prudentes.

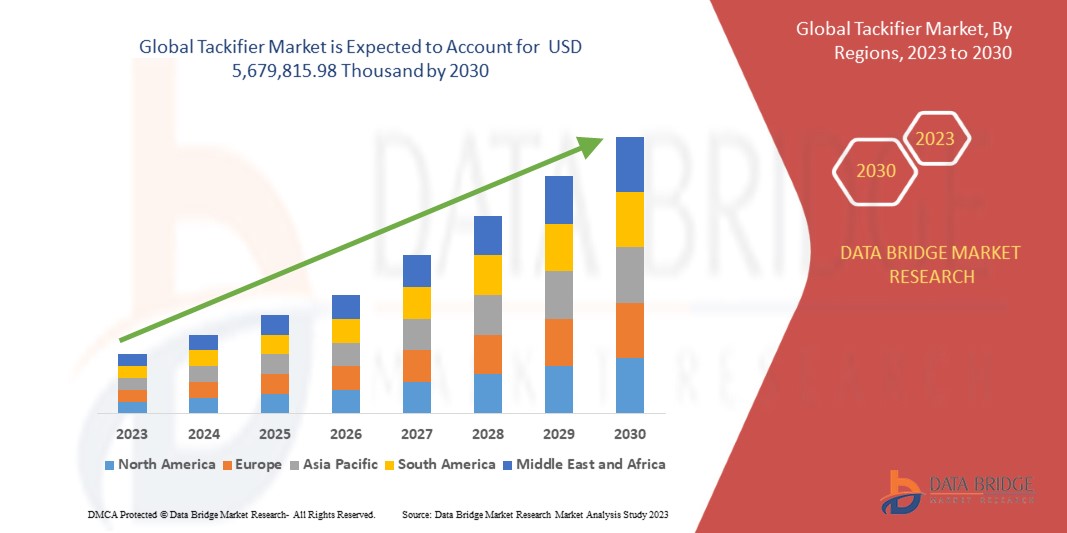

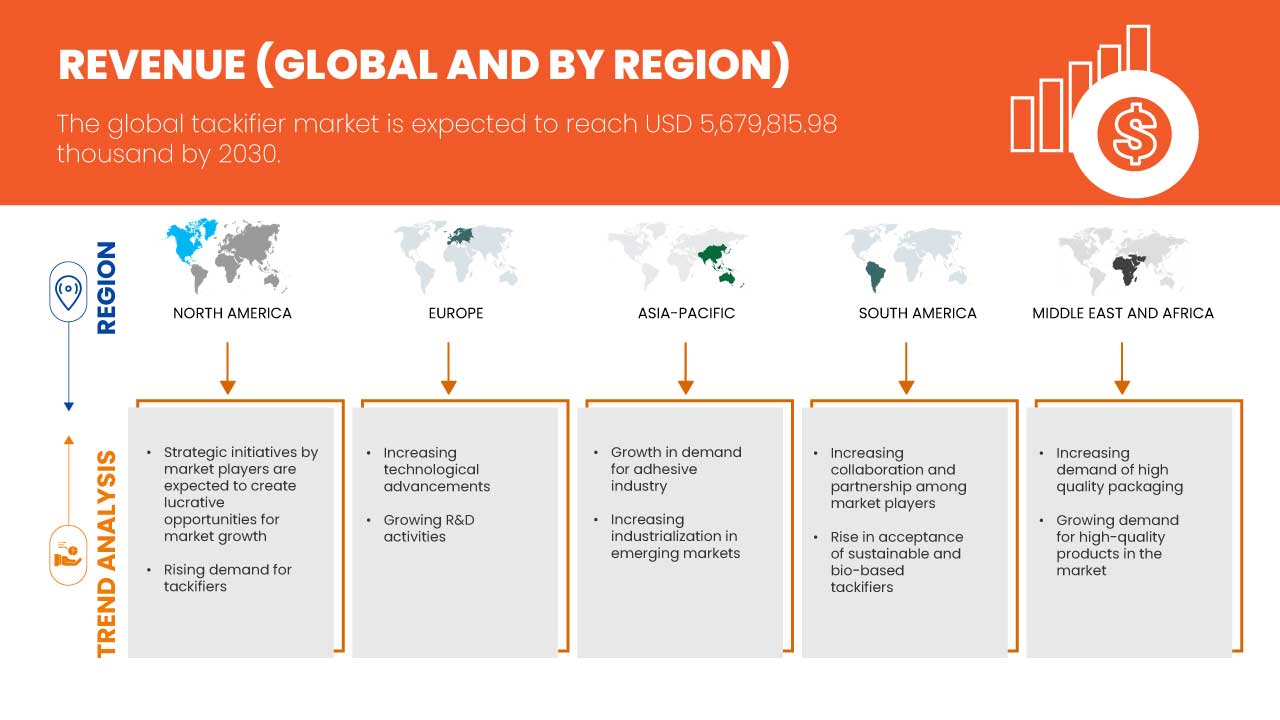

Data Bridge Market Research analyse que le marché mondial des agents collants devrait atteindre 5 679 815,98 milliers USD d'ici 2030, contre 4 083 989,40 milliers USD en 2022, avec un TCAC substantiel de 4,5 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains et volume en tonnes |

|

Segments couverts |

Produit (résines hydrocarbonées, résines colophanes et résines terpéniques), matière première (agents collants synthétiques, agents collants naturels/biosourcés), forme (solide, liquide et dispersion de résine), application (adhésifs sensibles à la pression (PSA), adhésifs thermofusibles (HMA) et autres), utilisateur final (emballage, construction/assemblage, non-tissé, reliure et autres) |

|

Pays couverts |

États-Unis, Canada, Mexique, Allemagne, France, Royaume-Uni, Russie, Italie, Espagne, Pays-Bas, Pologne, Suisse, Belgique, Suède, Turquie, Danemark, Norvège, Finlande, Reste de l'Europe, Chine, Japon, Inde, Corée du Sud, Australie, Nouvelle-Zélande, Singapour, Taïwan, Thaïlande, Indonésie, Malaisie, Philippines, Vietnam, Reste de l'Asie-Pacifique, Brésil, Argentine, Reste de l'Amérique du Sud, Arabie saoudite, Émirats arabes unis, Israël, Afrique du Sud, Égypte, Koweït, Qatar, Oman, Bahreïn et Reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Henkel AG & Co. KGa, ZEON CORPORATION, Eastman Chemical Company, Arkema, Kolon Industries, Inc., HB Fuller Company, BASF SE, Exxon Mobil Corporation, SI Group, Inc., KRATON CORPORATION, Cray Valley, Arakawa Chemical Industries, Ltd., YASUHARA CHEMICAL CO., LTD., Lawter, Harima Chemicals Group, Inc., Lesco Chemical Limited, TECKREZ, INC., Henan Anglxxon Chemical Co., Ltd., et Robert Kraemer GmbH & Co. KG |

Définition du marché

Les agents collants sont des additifs qui améliorent l'adhérence des matériaux adhésifs, facilitant ainsi l'adhésion à différentes surfaces et substrats. Ce marché englobe un large éventail de secteurs, notamment l'emballage, l'automobile, la construction, le travail du bois et la fabrication, où les agents collants sont essentiels pour garantir les performances, la durabilité et la fonctionnalité des produits adhésifs. Le marché mondial des agents collants fait référence à l'industrie collective qui englobe la production, la distribution et l'utilisation d'agents ou de substances collants conçus pour améliorer les propriétés adhésives de divers matériaux, notamment les adhésifs, les produits d'étanchéité, les revêtements et les rubans adhésifs.

Dynamique du marché mondial des agents collants

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

Augmentation de l'utilisation des agents collants dans différentes industries d'utilisateurs finaux

L'utilisation des agents collants a connu une augmentation remarquable, principalement propulsée par les besoins croissants de diverses industries d'utilisateurs finaux (emballage, automobile, électronique et construction). Cette augmentation est particulièrement évidente dans des secteurs clés tels que l'emballage, l'automobile, la construction et l'électronique, qui jouent chacun un rôle essentiel dans la croissance des produits collants sur le marché.

Demande croissante d'adhésifs thermofusibles

Les adhésifs thermofusibles offrent une méthode de collage rapide et fiable, qui non seulement améliore l'efficacité de la production, mais contribue également à la durabilité environnementale. De plus, la polyvalence des adhésifs thermofusibles les rend adaptés à une large gamme d'applications, ce qui alimente encore davantage leur demande. Des industries telles que l'emballage, l'automobile, la construction et l'électronique ont de plus en plus adopté les adhésifs thermofusibles en raison de leur capacité à améliorer les performances des produits, à réduire les déchets et à diminuer les coûts de production.

Retenue

- Fluctuation du prix des matières premières

Les agents collants, un élément clé des formulations adhésives, sont confrontés à un défi de taille sous la forme de la fluctuation des prix des matières premières. Les agents collants sont des composants essentiels des adhésifs qui fournissent l'adhérence et le pouvoir collant nécessaires à diverses industries. Cependant, la volatilité des prix des matières premières clés pour la production d'agents collants pose des contraintes à la croissance de l'industrie.

Opportunité

- Demande croissante d'agents collants dans l'industrie de la colle

La demande croissante d'agents collants dans l'industrie des adhésifs représente une opportunité importante pour les fabricants et les investisseurs. Les agents collants sont des composants essentiels des adhésifs, car ils améliorent les performances adhésives en améliorant l'adhérence, la résistance au pelage et les capacités de collage globales. Avec une gamme d'applications en constante expansion dans divers secteurs, notamment l'automobile, la construction, l'emballage et la santé, l'industrie des adhésifs est prête à connaître une croissance substantielle.

Défi

- Une concurrence intense entre les acteurs du marché

Dans l'environnement commercial dynamique d'aujourd'hui, la concurrence est une caractéristique déterminante de presque tous les secteurs. Cependant, le niveau de concurrence s'est considérablement intensifié ces dernières années dans divers secteurs, ce qui pose un formidable défi aux acteurs du marché du monde entier. Ce phénomène de concurrence de plus en plus intense est un défi à multiples facettes qui exige une attention, une adaptation stratégique et des approches innovantes pour prospérer sur le marché.

Développements récents

- En avril 2023, Cray Valley, filiale de TotalEnergies, a finalisé la vente de trois lignes de produits – Wingtack, PolyBD et Dymalink – à Pacific Avenue Capital Partners. L’acquisition comprend quatre sites de production aux États-Unis, la filiale Cray Valley en Italie et le portefeuille de clients associé. Cette opération s’inscrit dans le cadre des décisions stratégiques de TotalEnergies visant à optimiser son portefeuille d’activités. Elle permet à l’entreprise de se concentrer sur ses activités mondiales de résines C4 de spécialité et de résines monomères pures, qui continueront d’être développées par TotalEnergies.

- En mars 2022, Eastman Chemical Company a finalisé avec succès la vente de son activité de résines adhésives à Synthomer plc. Cette opération stratégique impliquait le transfert de diverses gammes de produits, telles que les résines hydrocarbonées, les résines monomères pures, les polymères polyoléfiniques, les colophanes, les dispersions et les résines oléochimiques et à base d'acides gras, toutes auparavant sous le segment Additifs et produits fonctionnels d'Eastman.

- En mars 2020, Harima Chemicals Group a annoncé un partenariat avec Takasago International Corporation. Dans le cadre de cette collaboration, TAKASAGO a acquis toutes les actions (taux de participation : 2,3 %) précédemment détenues par Mitsubishi Corporation dans la filiale de Harima, LAWTER BV (Pays-Bas). Cette opération a fait de HARIMA et TAKASAGO les actionnaires exclusifs de la filiale. Cette collaboration a aidé l'entreprise à fabriquer de la térébenthine.

Portée du marché mondial des agents collants

Le marché mondial des agents collants est segmenté en cinq segments notables en fonction du produit, de la matière première, de la forme, de l'application et de l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Produit

- Résines d'hydrocarbures

- Résines de colophane

- Résines terpéniques

Sur la base du produit, le marché mondial des agents collants est segmenté en résines hydrocarbonées, résines colophanes et résines terpéniques.

Matières premières

- Agents collants synthétiques

- Agents collants naturels/biosourcés

Sur la base des matières premières, le marché mondial des agents collants est segmenté en agents collants synthétiques et agents collants naturels/biosourcés.

Formulaire

- Solide

- Liquide

- Dispersion de résine

Sur la base de la forme, le marché mondial des agents collants est segmenté en dispersion solide, liquide et résine.

Application

- Adhésifs sensibles à la pression (PSA)

- Adhésifs thermofusibles (HMA)

- Autres

Sur la base de l'application, le marché mondial des agents collants est segmenté en adhésifs sensibles à la pression (PSA), adhésifs thermofusibles (HMA) et autres.

Utilisateur final

- Conditionnement

- Construction/Assemblage

- Non-tissé

- Reliure

- Autres

Sur la base de l'utilisateur final, le marché mondial des agents collants est segmenté en emballage, reliure, non-tissé, construction/assemblage et autres.

Analyse/perspectives du marché mondial des agents collants

Le marché mondial des agents collants est analysé et des informations sur la taille du marché sont fournies par pays, produit, matière première, forme, application et utilisateur final.

Les pays couverts par le rapport sur le marché mondial des agents collants sont les États-Unis, le Canada, le Mexique, l'Allemagne, la France, le Royaume-Uni, la Russie, l'Italie, l'Espagne, les Pays-Bas, la Pologne, la Suisse, la Belgique, la Suède, la Turquie, le Danemark, la Norvège, la Finlande, le reste de l'Europe, la Chine, le Japon, l'Inde, la Corée du Sud, l'Australie, la Nouvelle-Zélande, Singapour, Taïwan, la Thaïlande, l'Indonésie, la Malaisie, les Philippines, le Vietnam, le reste de l'Asie-Pacifique, le Brésil, l'Argentine, le reste de l'Amérique du Sud, l'Arabie saoudite, les Émirats arabes unis, Israël, l'Afrique du Sud, l'Égypte, le Koweït, le Qatar, Oman, Bahreïn et le reste du Moyen-Orient et de l'Afrique.

L'Europe devrait dominer le marché mondial des agents collants en raison de plusieurs facteurs clés, notamment une technologie de pointe, une infrastructure robuste et un engagement fort en faveur du développement durable. Le Royaume-Uni devrait dominer le marché européen des agents collants en raison de l'augmentation de la combinaison de l'expertise technologique, de l'innovation durable et d'un réseau de distribution efficace. La région Asie-Pacifique devrait croître sur le marché mondial des agents collants en raison de la présence de secteurs industriels florissants, de l'essor de la population et de l'importance croissante accordée aux pratiques durables. La Chine, en particulier, joue un rôle central dans la définition de la dynamique du marché des agents collants dans la région Asie-Pacifique. L'Amérique du Nord se distingue comme la deuxième région à la croissance la plus rapide sur le marché mondial des agents collants, affichant une expansion remarquable tirée par plusieurs facteurs, notamment l'industrialisation croissante, les avancées technologiques et l'accent croissant mis sur les solutions adhésives durables. Les États-Unis jouent un rôle central, avec leur secteur manufacturier robuste, leurs technologies adhésives innovantes et leur engagement fort en faveur de produits respectueux de l'environnement.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché mondiales des agents collants

Le paysage concurrentiel du marché mondial des agents collants fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'étendue du produit, la domination des applications et la courbe de vie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Français Certains des principaux acteurs du marché opérant sur le marché mondial des agents collants sont Henkel AG & Co. KGaA, ZEON CORPORATION, Eastman Chemical Company, Arkema, Kolon Industries, Inc., HB Fuller Company, BASF SE, Exxon Mobil Corporation, SI Group, Inc., KRATON CORPORATION, Cray Valley, Arakawa Chemical Industries, Ltd., YASUHARA CHEMICAL CO., LTD., Lawter, A Harima Chemicals, Inc. Company, Lesco Chemical Limited, TECKREZ, INC., Henan Anglxxon Chemical Co., Ltd., et Robert Kraemer GmbH & Co. KG, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE GLOBAL TACKIFIER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MARKET APPLICATION COVERAGE GRID

2.8 MULTIVARIATE MODELLING

2.9 PRODUCT CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PRODUCTION VOLUME ESTIMATES BY TACKIFIER TYPE AND COUNTRY

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE USAGE OF TACKIFIER IN DIFFERENT END-USER INDUSTRIES

5.1.2 GROWING DEMAND FOR HIGH-QUALITY PACKAGING

5.1.3 RISING DEMAND FOR HOT MELT ADHESIVES

5.2 RESTRAINTS

5.2.1 FLUCTUATION IN RAW MATERIAL PRICE

5.2.2 AVAILABILITY OF NON-TACKIFIER ADHESIVES PRODUCTS

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR TACKIFIERS IN THE ADHESIVE INDUSTRY

5.3.2 RISE IN ACCEPTANCE OF SUSTAINABLE AND BIO-BASED TACKIFIERS

5.3.3 INCREASING INDUSTRIALIZATION IN EMERGING MARKETS

5.4 CHALLENGES

5.4.1 INTENSE COMPETITION AMONG MARKET PLAYERS

5.4.2 STRICT REGULATORY COMPLIANCE

6 GLOBAL TACKIFIER MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 HYDROCARBON RESINS

6.3 ROSIN RESINS

6.4 TERPENE RESINS

7 GLOBAL TACKIFIER MARKET, BY FEEDSTOCK

7.1 OVERVIEW

7.2 SYNTHETIC TACKIFIERS

7.3 NATURAL/BIOBASED TACKIFIERS

8 GLOBAL TACKIFIER MARKET, BY FORM

8.1 OVERVIEW

8.2 SOLID

8.3 LIQUID

8.4 RESIN DISPERSION

9 GLOBAL TACKIFIER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 PRESSURE SENSITIVE ADHESIVES (PSA)

9.3 HOT MELT ADHESIVES (HMA)

9.4 OTHERS

10 GLOBAL TACKIFIER MARKET, BY END-USER

10.1 OVERVIEW

10.2 PACKAGING

10.2.1 BY TYPE

10.2.1.1 FOOD AND BEVERAGES

10.2.1.2 CONSUMER GOODS

10.2.1.3 PHARMACEUTICAL AND COSMETICS

10.2.1.4 MEDICAL

10.2.1.5 INDUSTRIAL PACKAGING

10.2.1.6 AUTOMOTIVE

10.2.1.7 OTHERS

10.2.2 BY PRODUCT

10.2.2.1 HYDROCARBON RESINS

10.2.2.2 ROSIN RESINS

10.2.2.3 TERPENE RESINS

10.3 CONSTRUCTION/ASSEMBLY

10.3.1 BY TYPE

10.3.1.1 INDUSTRIAL

10.3.1.2 COMMERCIAL

10.3.1.3 RESIDENTIAL

10.3.2 BY PRODUCT

10.3.2.1 HYDROCARBON RESINS

10.3.2.2 ROSIN RESINS

10.3.2.3 TERPENE RESINS

10.4 NONWOVEN

10.4.1 BY PRODUCT

10.4.1.1 HYDROCARBON RESINS

10.4.1.2 ROSIN RESINS

10.4.1.3 TERPENE RESINS

10.5 BOOKBINDING

10.5.1 BY PRODUCT

10.5.1.1 HYDROCARBON RESINS

10.5.1.2 ROSIN RESINS

10.5.1.3 TERPENE RESINS

10.6 OTHERS

10.6.1 BY PRODUCT

10.6.1.1 HYDROCARBON RESINS

10.6.1.2 ROSIN RESINS

10.6.1.3 TERPENE RESINS

11 GLOBAL TACKIFIER MARKET, BY REGION

11.1 OVERVIEW

11.2 EUROPE

11.2.1 U.K.

11.2.2 GERMANY

11.2.3 FRANCE

11.2.4 SPAIN

11.2.5 ITALY

11.2.6 RUSSIA

11.2.7 NETHERLANDS

11.2.8 SWITZERLAND

11.2.9 DENMARK

11.2.10 SWEDEN

11.2.11 POLAND

11.2.12 BELGIUM

11.2.13 TURKEY

11.2.14 NORWAY

11.2.15 FINLAND

11.2.16 REST OF EUROPE

11.3 NORTH AMERICA

11.3.1 U.S.

11.3.2 CANADA

11.3.3 MEXICO

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 MIDDLE EAST AND AFRICA

11.5.1 SOUTH AFRICA

11.5.2 SAUDI ARABIA

11.5.3 U.A.E.

11.5.4 EGYPT

11.5.5 ISRAEL

11.5.6 QATAR

11.5.7 KUWAIT

11.5.8 OMAN

11.5.9 BAHRAIN

11.5.10 REST OF MIDDLE EAST AND AFRICA

11.6 ASIA-PACIFIC

11.6.1 CHINA

11.6.2 JAPAN

11.6.3 SOUTH KOREA

11.6.4 INDIA

11.6.5 AUSTRALIA

11.6.6 SINGAPORE

11.6.7 THAILAND

11.6.8 MALAYSIA

11.6.9 INDONESIA

11.6.10 TAIWAN

11.6.11 NEW ZEALAND

11.6.12 PHILIPPINES

11.6.13 VIETNAM

11.6.14 REST OF ASIA-PACIFIC

12 GLOBAL TACKIFIER MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

13 EUROPE TACKIFIER MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 ASIA-PACIFIC TACKIFIER MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15 NORTH AMERICA TACKIFIER MARKET, COMPANY

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 HENKEL AG & CO. KGAA

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 ZEON CORPORATION

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 EASTMAN CHEMICAL COMPANY

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 ARKEMA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 KOLON INDUSTRIES, INC

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 SOLUTION PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ARAKAWA CHEMICAL INDUSTRIES, LTD.

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 BASF SE

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 CRAY VALLEY

17.8.1 COMPANY SNAPSHOT

17.8.2 SOLUTION PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 EXXON MOBIL CORPORATION

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 SOLUTION PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 HARIMA CHEMICALS GROUP, INC.

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 SOLUTION PORTFOLIO

17.10.4 RECENT DEVELOPMENT

17.11 H.B. FULLER COMPANY

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 SOLUTION PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 HENAN ANGLXXON CHEMICAL CO.,LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 KRATON CORPORATION

17.13.1 COMPANY SNAPSHOT

17.13.2 SOLUTION PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 LESCO CHEMICAL LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 ROBERT KRAEMER GMBH & CO. KG

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 SI GROUP, INC.

17.16.1 COMPANY SNAPSHOT

17.16.2 SOLUTION PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 TECKREZ, INC.

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENT

17.18 YASUHARA CHEMICAL CO., LTD

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 GLOBAL TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 2 GLOBAL HYDROCARBON RESINS IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 3 GLOBAL ROSIN RESINS IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 4 GLOBAL TERPENE RESINS IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 5 GLOBAL TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 6 GLOBAL SYNTHETIC TACKIFIERS IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 7 GLOBAL NATURAL/BIOBASED TACKIFIERS IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 8 GLOBAL TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 9 GLOBAL SOLID IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 10 GLOBAL LIQUID IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 11 GLOBAL RESIN DISPERSION IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 12 GLOBAL TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 13 GLOBAL PRESSURE SENSITIVE ADHESIVES (PSA) IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 14 GLOBAL HOT MELT ADHESIVES (HMA) IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 15 GLOBAL OTHERS IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 16 GLOBAL TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 17 GLOBAL PACKAGING IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 18 GLOBAL PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 19 GLOBAL PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 20 GLOBAL CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 21 GLOBAL CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 22 GLOBAL CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 23 GLOBAL NONWOVEN IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 24 GLOBAL NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 25 GLOBAL BOOKBINDING IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 26 GLOBAL BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 27 GLOBAL OTHERS IN TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 28 GLOBAL OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 29 GLOBAL TACKIFIER MARKET, BY REGION, 2014-2030 (USD THOUSAND)

TABLE 30 EUROPE TACKIFIER MARKET, BY COUNTRY, 2014-2030 (USD THOUSAND)

TABLE 31 EUROPE TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 32 EUROPE TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 33 EUROPE TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 34 EUROPE TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 35 EUROPE TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 36 EUROPE PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 37 EUROPE PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 38 EUROPE CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 39 EUROPE CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 40 EUROPE NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 41 EUROPE BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 42 EUROPE OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 43 U.K. TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 44 U.K. TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 45 U.K. TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 46 U.K. TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 47 U.K. TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 48 U.K. PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 49 U.K. PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 50 U.K. CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 51 U.K. CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 52 U.K. NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 53 U.K. BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 54 U.K. OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 55 GERMANY TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 56 GERMANY TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 57 GERMANY TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 58 GERMANY TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 59 GERMANY TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 60 GERMANY PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 61 GERMANY PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 62 GERMANY CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 63 GERMANY CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 64 GERMANY NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 65 GERMANY BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 66 GERMANY OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 67 FRANCE TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 68 FRANCE TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 69 FRANCE TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 70 FRANCE TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 71 FRANCE TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 72 FRANCE PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 73 FRANCE PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 74 FRANCE CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 75 FRANCE CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 76 FRANCE NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 77 FRANCE BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 78 FRANCE OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 79 SPAIN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 80 SPAIN TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 81 SPAIN TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 82 SPAIN TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 83 SPAIN TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 84 SPAIN PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 85 SPAIN PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 86 SPAIN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 87 SPAIN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 88 SPAIN NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 89 SPAIN BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 90 SPAIN OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 91 ITALY TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 92 ITALY TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 93 ITALY TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 94 ITALY TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 95 ITALY TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 96 ITALY PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 97 ITALY PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 98 ITALY CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 99 ITALY CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 100 ITALY NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 101 ITALY BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 102 ITALY OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 103 RUSSIA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 104 RUSSIA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 105 RUSSIA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 106 RUSSIA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 107 RUSSIA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 108 RUSSIA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 109 RUSSIA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 110 RUSSIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 111 RUSSIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 112 RUSSIA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 113 RUSSIA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 114 RUSSIA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 115 NETHERLANDS TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 116 NETHERLANDS TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 117 NETHERLANDS TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 118 NETHERLANDS TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 119 NETHERLANDS TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 120 NETHERLANDS PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 121 NETHERLANDS PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 122 NETHERLANDS CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 123 NETHERLANDS CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 124 NETHERLANDS NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 125 NETHERLANDS BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 126 NETHERLANDS OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 127 SWITZERLAND TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 128 SWITZERLAND TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 129 SWITZERLAND TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 130 SWITZERLAND TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 131 SWITZERLAND TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 132 SWITZERLAND PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 133 SWITZERLAND PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 134 SWITZERLAND CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 135 SWITZERLAND CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 136 SWITZERLAND NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 137 SWITZERLAND BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 138 SWITZERLAND OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 139 DENMARK TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 140 DENMARK TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 141 DENMARK TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 142 DENMARK TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 143 DENMARK TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 144 DENMARK PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 145 DENMARK PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 146 DENMARK CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 147 DENMARK CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 148 DENMARK NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 149 DENMARK BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 150 DENMARK OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 151 SWEDEN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 152 SWEDEN TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 153 SWEDEN TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 154 SWEDEN TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 155 SWEDEN TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 156 SWEDEN PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 157 SWEDEN PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 158 SWEDEN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 159 SWEDEN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 160 SWEDEN NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 161 SWEDEN BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 162 SWEDEN OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 163 POLAND TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 164 POLAND TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 165 POLAND TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 166 POLAND TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 167 POLAND TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 168 POLAND PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 169 POLAND PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 170 POLAND CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 171 POLAND CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 172 POLAND NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 173 POLAND BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 174 POLAND OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 175 BELGIUM TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 176 BELGIUM TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 177 BELGIUM TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 178 BELGIUM TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 179 BELGIUM TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 180 BELGIUM PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 181 BELGIUM PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 182 BELGIUM CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 183 BELGIUM CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 184 BELGIUM NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 185 BELGIUM BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 186 BELGIUM OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 187 TURKEY TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 188 TURKEY TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 189 TURKEY TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 190 TURKEY TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 191 TURKEY TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 192 TURKEY PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 193 TURKEY PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 194 TURKEY CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 195 TURKEY CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 196 TURKEY NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 197 TURKEY BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 198 TURKEY OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 199 NORWAY TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 200 NORWAY TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 201 NORWAY TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 202 NORWAY TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 203 NORWAY TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 204 NORWAY PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 205 NORWAY PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 206 NORWAY CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 207 NORWAY CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 208 NORWAY NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 209 NORWAY BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 210 NORWAY OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 211 FINLAND TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 212 FINLAND TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 213 FINLAND TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 214 FINLAND TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 215 FINLAND TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 216 FINLAND PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 217 FINLAND PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 218 FINLAND CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 219 FINLAND CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 220 FINLAND NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 221 FINLAND BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 222 FINLAND OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 223 REST OF EUROPE TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 224 NORTH AMERICA TACKIFIER MARKET, BY COUNTRY, 2014-2030 (USD THOUSAND)

TABLE 225 NORTH AMERICA TACKIFIER MARKET, BY COUNTRY, 2014-2030 (TONS)

TABLE 226 NORTH AMERICA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 227 NORTH AMERICA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 228 NORTH AMERICA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 229 NORTH AMERICA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 230 NORTH AMERICA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 231 NORTH AMERICA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 232 NORTH AMERICA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 233 NORTH AMERICA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 234 NORTH AMERICA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 235 NORTH AMERICA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 236 NORTH AMERICA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 237 NORTH AMERICA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 238 U.S. TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 239 U.S. TACKIFIER MARKET, BY PRODUCT, 2014-2030 (TONS)

TABLE 240 U.S. TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 241 U.S. TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 242 U.S. TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 243 U.S. TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 244 U.S. PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 245 U.S. PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 246 U.S. CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 247 U.S. CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 248 U.S. NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 249 U.S. BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 250 U.S. OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 251 CANADA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 252 CANADA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 253 CANADA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 254 CANADA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 255 CANADA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 256 CANADA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 257 CANADA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 258 CANADA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 259 CANADA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 260 CANADA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 261 CANADA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 262 CANADA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 263 MEXICO TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 264 MEXICO TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 265 MEXICO TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 266 MEXICO TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 267 MEXICO TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 268 MEXICO PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 269 MEXICO PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 270 MEXICO CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 271 MEXICO CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 272 MEXICO NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 273 MEXICO BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 274 MEXICO OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 275 SOUTH AMERICA TACKIFIER MARKET, BY COUNTRY, 2014-2030 (USD THOUSAND)

TABLE 276 SOUTH AMERICA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 277 SOUTH AMERICA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 278 SOUTH AMERICA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 279 SOUTH AMERICA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 280 SOUTH AMERICA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 281 SOUTH AMERICA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 282 SOUTH AMERICA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 283 SOUTH AMERICA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 284 SOUTH AMERICA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 285 SOUTH AMERICA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 286 SOUTH AMERICA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 287 SOUTH AMERICA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 288 BRAZIL TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 289 BRAZIL TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 290 BRAZIL TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 291 BRAZIL TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 292 BRAZIL TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 293 BRAZIL PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 294 BRAZIL PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 295 BRAZIL CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 296 BRAZIL CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 297 BRAZIL NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 298 BRAZIL BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 299 BRAZIL OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 300 ARGENTINA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 301 ARGENTINA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 302 ARGENTINA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 303 ARGENTINA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 304 ARGENTINA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 305 ARGENTINA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 306 ARGENTINA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 307 ARGENTINA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 308 ARGENTINA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 309 ARGENTINA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 310 ARGENTINA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 311 ARGENTINA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 312 REST OF SOUTH AMERICA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 313 MIDDLE EAST AND AFRICA TACKIFIER MARKET, BY COUNTRY, 2014-2030 (USD THOUSAND)

TABLE 314 MIDDLE EAST AND AFRICA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 315 MIDDLE EAST AND AFRICA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 316 MIDDLE EAST AND AFRICA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 317 MIDDLE EAST AND AFRICA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 318 MIDDLE EAST AND AFRICA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 319 MIDDLE EAST AND AFRICA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 320 MIDDLE EAST AND AFRICA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 321 MIDDLE EAST AND AFRICA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 322 MIDDLE EAST AND AFRICA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 323 MIDDLE EAST AND AFRICA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 324 MIDDLE EAST AND AFRICA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 325 MIDDLE EAST AND AFRICA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 326 SOUTH AFRICA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 327 SOUTH AFRICA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 328 SOUTH AFRICA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 329 SOUTH AFRICA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 330 SOUTH AFRICA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 331 SOUTH AFRICA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 332 SOUTH AFRICA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 333 SOUTH AFRICA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 334 SOUTH AFRICA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 335 SOUTH AFRICA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 336 SOUTH AFRICA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 337 SOUTH AFRICA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 338 SAUDI ARABIA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 339 SAUDI ARABIA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 340 SAUDI ARABIA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 341 SAUDI ARABIA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 342 SAUDI ARABIA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 343 SAUDI ARABIA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 344 SAUDI ARABIA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 345 SAUDI ARABIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 346 SAUDI ARABIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 347 SAUDI ARABIA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 348 SAUDI ARABIA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 349 SAUDI ARABIA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 350 U.A.E. TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 351 U.A.E. TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 352 U.A.E. TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 353 U.A.E. TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 354 U.A.E. TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 355 U.A.E. PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 356 U.A.E. PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 357 U.A.E. CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 358 U.A.E. CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 359 U.A.E. NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 360 U.A.E. BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 361 U.A.E. OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 362 EGYPT TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 363 EGYPT TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 364 EGYPT TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 365 EGYPT TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 366 EGYPT TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 367 EGYPT PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 368 EGYPT PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 369 EGYPT CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 370 EGYPT CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 371 EGYPT NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 372 EGYPT BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 373 EGYPT OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 374 ISRAEL TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 375 ISRAEL TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 376 ISRAEL TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 377 ISRAEL TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 378 ISRAEL TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 379 ISRAEL PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 380 ISRAEL PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 381 ISRAEL CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 382 ISRAEL CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 383 ISRAEL NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 384 ISRAEL BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 385 ISRAEL OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 386 QATAR TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 387 QATAR TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 388 QATAR TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 389 QATAR TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 390 QATAR TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 391 QATAR PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 392 QATAR PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 393 QATAR CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 394 QATAR CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 395 QATAR NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 396 QATAR BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 397 QATAR OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 398 KUWAIT TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 399 KUWAIT TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 400 KUWAIT TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 401 KUWAIT TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 402 KUWAIT TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 403 KUWAIT PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 404 KUWAIT PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 405 KUWAIT CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 406 KUWAIT CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 407 KUWAIT NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 408 KUWAIT BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 409 KUWAIT OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 410 OMAN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 411 OMAN TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 412 OMAN TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 413 OMAN TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 414 OMAN TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 415 OMAN PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 416 OMAN PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 417 OMAN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 418 OMAN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 419 OMAN NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 420 OMAN BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 421 OMAN OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 422 BAHRAIN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 423 BAHRAIN TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 424 BAHRAIN TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 425 BAHRAIN TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 426 BAHRAIN TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 427 BAHRAIN PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 428 BAHRAIN PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 429 BAHRAIN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 430 BAHRAIN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 431 BAHRAIN NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 432 BAHRAIN BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 433 BAHRAIN OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 434 REST OF MIDDLE EAST AND AFRICA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 435 ASIA-PACIFIC TACKIFIER MARKET, BY COUNTRY, 2014-2030 (USD THOUSAND)

TABLE 436 ASIA-PACIFIC TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 437 ASIA-PACIFIC TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 438 ASIA-PACIFIC TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 439 ASIA-PACIFIC TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 440 ASIA-PACIFIC TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 441 ASIA-PACIFIC PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 442 ASIA-PACIFIC PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 443 ASIA-PACIFIC CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 444 ASIA-PACIFIC CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 445 ASIA-PACIFIC NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 446 ASIA-PACIFIC BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 447 ASIA-PACIFIC OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 448 CHINA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 449 CHINA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 450 CHINA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 451 CHINA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 452 CHINA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 453 CHINA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 454 CHINA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 455 CHINA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 456 CHINA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 457 CHINA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 458 CHINA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 459 CHINA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 460 JAPAN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 461 JAPAN TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 462 JAPAN TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 463 JAPAN TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 464 JAPAN TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 465 JAPAN PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 466 JAPAN PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 467 JAPAN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 468 JAPAN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 469 JAPAN NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 470 JAPAN BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 471 JAPAN OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 472 SOUTH KOREA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 473 SOUTH KOREA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 474 SOUTH KOREA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 475 SOUTH KOREA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 476 SOUTH KOREA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 477 SOUTH KOREA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 478 SOUTH KOREA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 479 SOUTH KOREA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 480 SOUTH KOREA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 481 SOUTH KOREA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 482 SOUTH KOREA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 483 SOUTH KOREA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 484 INDIA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 485 INDIA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 486 INDIA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 487 INDIA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 488 INDIA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 489 INDIA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 490 INDIA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 491 INDIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 492 INDIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 493 INDIA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 494 INDIA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 495 INDIA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 496 AUSTRALIA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 497 AUSTRALIA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 498 AUSTRALIA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 499 AUSTRALIA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 500 AUSTRALIA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 501 AUSTRALIA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 502 AUSTRALIA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 503 AUSTRALIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 504 AUSTRALIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 505 AUSTRALIA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 506 AUSTRALIA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 507 AUSTRALIA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 508 SINGAPORE TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 509 SINGAPORE TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 510 SINGAPORE TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 511 SINGAPORE TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 512 SINGAPORE TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 513 SINGAPORE PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 514 SINGAPORE CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 515 GLOBAL CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 516 SINGAPORE NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 517 SINGAPORE BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 518 SINGAPORE OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 519 THAILAND TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 520 THAILAND TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 521 THAILAND TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 522 THAILAND TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 523 THAILAND TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 524 THAILAND PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 525 THAILAND PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 526 THAILAND CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 527 THAILAND CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 528 THAILAND NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 529 THAILAND BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 530 THAILAND OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 531 MALAYSIA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 532 MALAYSIA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 533 MALAYSIA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 534 MALAYSIA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 535 MALAYSIA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 536 MALAYSIA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 537 MALAYSIA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 538 MALAYSIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 539 MALAYSIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 540 MALAYSIA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 541 MALAYSIA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 542 MALAYSIA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 543 INDONESIA TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 544 INDONESIA TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 545 INDONESIA TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 546 INDONESIA TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 547 INDONESIA TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 548 INDONESIA PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 549 INDONESIA PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 550 INDONESIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 551 INDONESIA CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 552 INDONESIA NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 553 INDONESIA BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 554 INDONESIA OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 555 TAIWAN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 556 TAIWAN TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 557 TAIWAN TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 558 TAIWAN TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 559 TAIWAN TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 560 TAIWAN PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 561 TAIWAN PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 562 TAIWAN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 563 TAIWAN CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 564 TAIWAN NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 565 TAIWAN BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 566 TAIWAN OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 567 NEW ZEALAND TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 568 NEW ZEALAND TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 569 NEW ZEALAND TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 570 NEW ZEALAND TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 571 NEW ZEALAND TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 572 NEW ZEALAND PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 573 NEW ZEALAND PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 574 NEW ZEALAND CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 575 NEW ZEALAND CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 576 NEW ZEALAND NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 577 NEW ZEALAND BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 578 NEW ZEALAND OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 579 PHILIPPINES TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 580 PHILIPPINES TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 581 PHILIPPINES TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 582 PHILIPPINES TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 583 PHILIPPINES TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 584 PHILIPPINES PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 585 PHILIPPINES PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 586 PHILIPPINES CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 587 PHILIPPINES CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 588 PHILIPPINES NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 589 PHILIPPINES BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 590 PHILIPPINES OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 591 VIETNAM TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 592 VIETNAM TACKIFIER MARKET, BY FEEDSTOCK, 2014-2030 (USD THOUSAND)

TABLE 593 VIETNAM TACKIFIER MARKET, BY FORM, 2014-2030 (USD THOUSAND)

TABLE 594 VIETNAM TACKIFIER MARKET, BY APPLICATION, 2014-2030 (USD THOUSAND)

TABLE 595 VIETNAM TACKIFIER MARKET, BY END-USER, 2014-2030 (USD THOUSAND)

TABLE 596 VIETNAM PACKAGING IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 597 VIETNAM PACKAGING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 598 VIETNAM CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY TYPE, 2014-2030 (USD THOUSAND)

TABLE 599 VIETNAM CONSTRUCTION/ASSEMBLY IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 600 VIETNAM NONWOVEN IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 601 VIETNAM BOOKBINDING IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 602 VIETNAM OTHERS IN TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

TABLE 603 REST OF ASIA-PACIFIC TACKIFIER MARKET, BY PRODUCT, 2014-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 GLOBAL TACKIFIER MARKET: SEGMENTATION

FIGURE 2 GLOBAL TACKIFIER MARKET: DATA TRIANGULATION

FIGURE 3 GLOBAL TACKIFIER MARKET: DROC ANALYSIS

FIGURE 4 GLOBAL TACKIFIER MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 GLOBAL TACKIFIER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 GLOBAL TACKIFIER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 GLOBAL TACKIFIER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL TACKIFIER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 GLOBAL TACKIFIER MARKET: MULTIVARIATE MODELLING

FIGURE 10 GLOBAL TACKIFIER MARKET: PRODUCT

FIGURE 11 GLOBAL TACKIFIER MARKET: SEGMENTATION

FIGURE 12 EUROPE IS EXPECTED TO DOMINATE THE MARKET AND IS THE FASTEST-GROWING REGION IN THE GLOBAL TACKIFIER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 EUROPE IS THE FASTEST-GROWING MARKET FOR GLOBAL TACKIFIER MARKET MANUFACTURERS IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 INCREASE IN USAGE OF TACKIFIER IN DIFFERENT END-USER INDUSTRY IS EXPECTED TO DRIVE THE GROWTH OF THE GLOBAL TACKIFIER MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 15 HYDROCARNON RESIN SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL TACKIFIER MARKET FROM 2023 TO 2030

FIGURE 16 DRIVERS, OPPORTUNITIES, CHALLENGES, AND RESTRAINTS OF THE GLOBAL TACKIFIER MARKET

FIGURE 17 GLOBAL TACKIFIER MARKET: BY PRODUCT, 2022

FIGURE 18 GLOBAL TACKIFIER MARKET: BY FEEDSTOCK, 2022

FIGURE 19 GLOBAL TACKIFIER MARKET: BY FORM, 2022

FIGURE 20 GLOBAL TACKIFIER MARKET: BY APPLICATION, 2022

FIGURE 21 GLOBAL TACKIFIER MARKET: BY END-USER, 2022

FIGURE 22 GLOBAL TACKIFIER MARKET: SNAPSHOT (2022)

FIGURE 23 GLOBAL TACKIFIER MARKET: COMPANY SHARE 2022 (%)

FIGURE 24 EUROPE TACKIFIER MARKET: COMPANY SHARE 2022 (%)

FIGURE 25 ASIA-PACIFIC TACKIFIER MARKET: COMPANY SHARE 2022 (%)

FIGURE 26 NORTH AMERICA TACKIFIER MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche