Uae Specialty Fats Market

Taille du marché en milliards USD

TCAC :

%

USD

116.36 Million

USD

67.58 Million

2024

2032

USD

116.36 Million

USD

67.58 Million

2024

2032

| 2025 –2032 | |

| USD 116.36 Million | |

| USD 67.58 Million | |

|

|

|

|

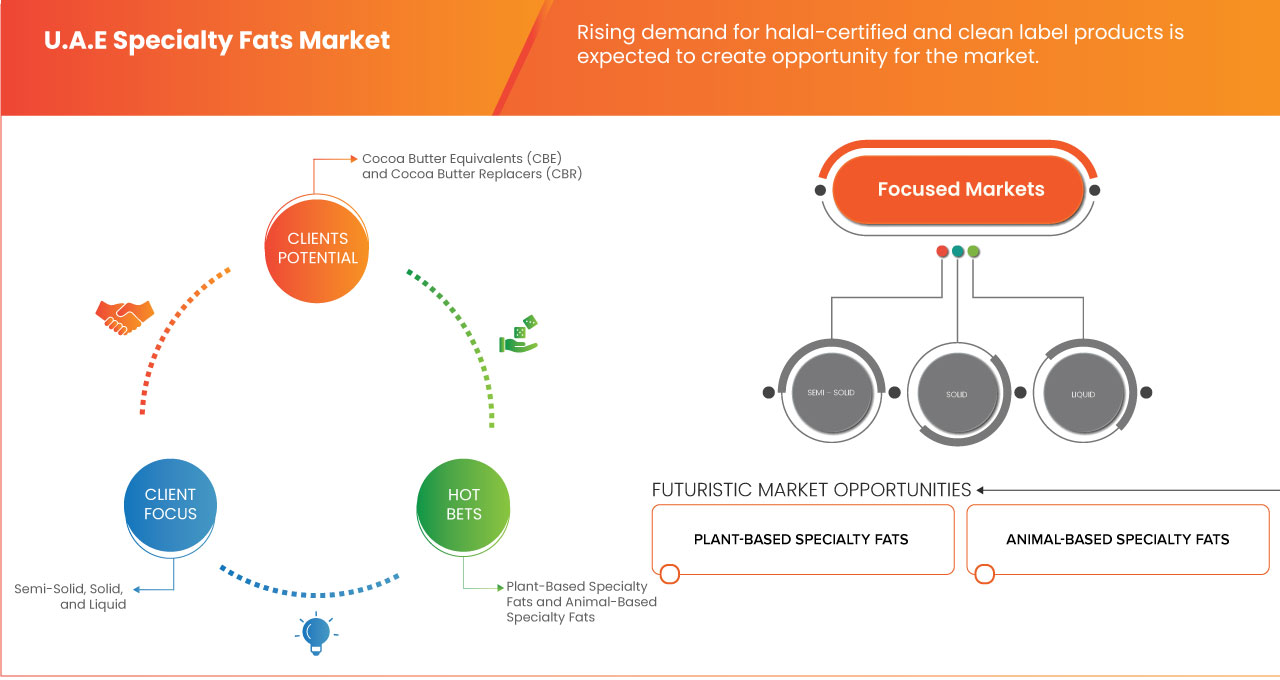

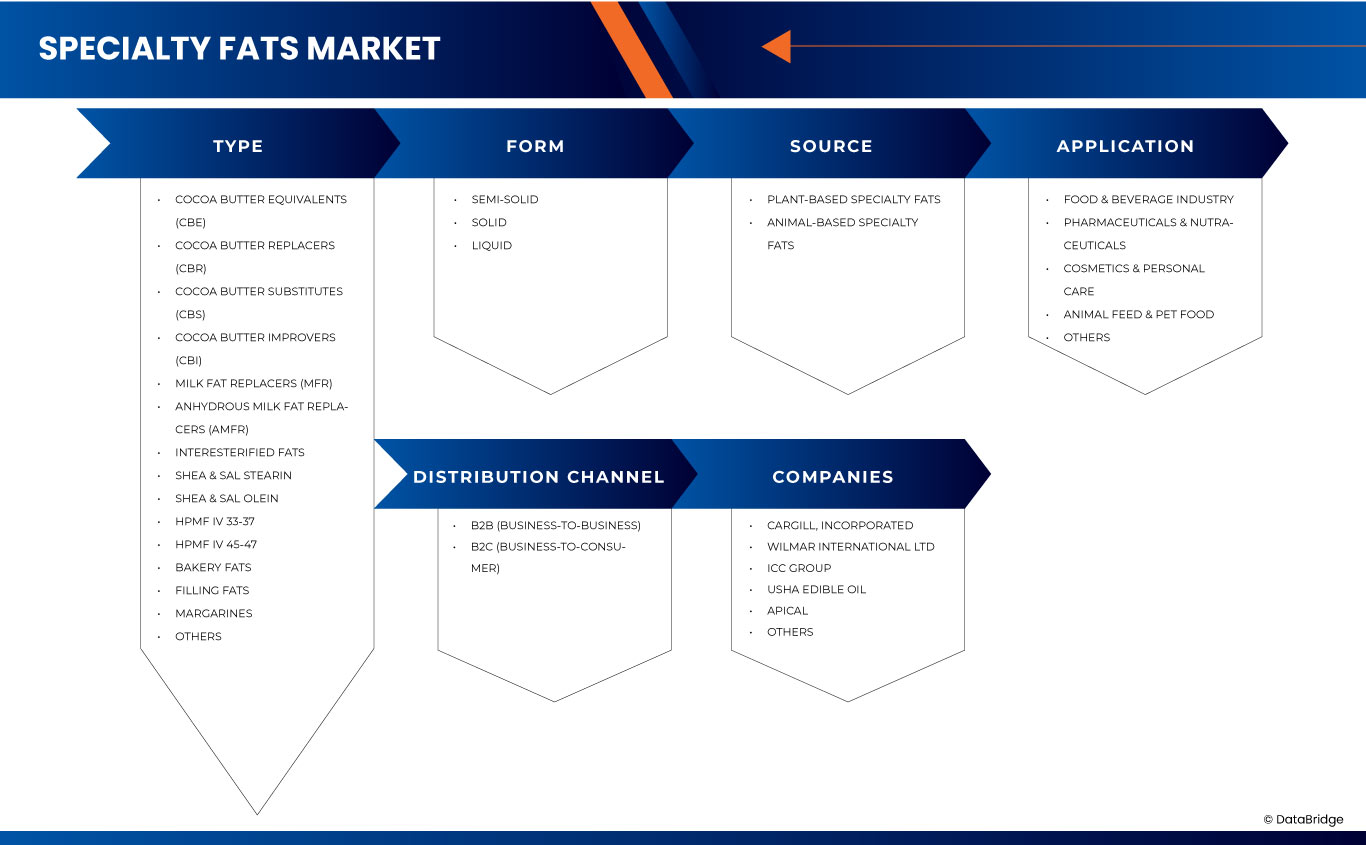

U.A.E Specialty Fats Market Segmentation, By Type (Cocoa Butter Equivalents (CBE), Cocoa Butter Replacers (CBR), Cocoa Butter Substitutes (CBS), Cocoa Butter Improvers (CBI), Milk Fat Replacers (MFR), Anhydrous Milk Fat Replacers (AMFR), Interesterified Fats, Shea & Sal Stearin, Shea & Sal Olein, HPMF IV 33-37, HPMF IV 45-47, Bakery Fats, Filling Fats, Margarines, and Others), Form (Semi-Solid, Solid, and Liquid), Source (Plant-Based Specialty Fats and Animal-Based Specialty Fats), Application (Food & Beverage Industry, Pharmaceuticals & Nutraceuticals, Cosmetics & Personal Care, Animal Feed & Pet Food, and Others), Distribution Channel (B2B (Business-To-Business) and B2C (Business-To-Consumer)) - Industry Trends and Forecast to 2032

Specialty Fats Market Size

- The U.A.E specialty fats market size was valued at USD 116.36 million in 2024 and is expected to reach USD 67.58 million by 2032, at a CAGR of 7.0% during the forecast period

- This growth is driven by factors such as the growing demand from bakery and confectionery industry and rising consumer awareness regarding health and nutrition

Specialty Fats Market Analysis

- The U.A.E specialty fats market is expanding steadily, driven by increasing demand in bakery, confectionery, and processed foods. The market benefits from the country's strong food service sector and rising consumer preference for premium, healthier products.

- Urbanization, tourism growth, and the popularity of Western-style diets are fueling the demand for specialty fats like cocoa butter alternatives, dairy fat replacers, and frying fats.

- The Cocoa Butter Equivalents (CBE) in type segment is expected to dominate the market due to its excellent compatibility with natural cocoa butter, cost-effectiveness, and ability to maintain the desired texture, gloss, and mouthfeel in chocolate and confectionery products.

- The semi-solid in form segment is expected to dominate the market due to its versatility, ease of handling, and widespread use in bakery, confectionery, and dairy applications. Semi-solid fats offer optimal plasticity and spreadability, making them ideal for use in margarine, spreads, and cream fillings.

Report Scope and Specialty Fats Market Segmentation

|

Attributes |

Specialty Fats Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.A.E. |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Specialty Fats Market Trends

“Shift Towards Sustainably Sourced Fats”

- U.A.E. consumers are increasingly seeking healthier alternatives, driving demand for specialty fats rich in omega-3s, antioxidants, and low in trans fats. Oils like avocado, flaxseed, and coconut are gaining popularity due to their perceived health benefits

- In May 2019, as per TechTarget, Inc. leading food companies such as Nestlé, PepsiCo, and Mondelēz International have committed to eliminating industrially produced trans fats from their products by 2023, aligning with the World Health Organization’s (WHO) REPLACE initiative. This move is a direct response to increasing consumer awareness and demand for healthier food options

- There's a growing preference for products with simple, natural ingredients. Consumers favor specialty fats and oils that are non-GMO, organic, and free from artificial additives, reflecting a broader clean-label movement

- Environmental concerns are prompting a shift towards sustainably sourced fats. The demand for products certified by organizations like the Roundtable on Sustainable Palm Oil (RSPO) is on the rise, emphasizing eco-friendly production practices.

- The U.A.E.'s multicultural population and vibrant food scene are fueling demand for diverse specialty fats. High-quality oils such as truffle, walnut, and clarified butter are increasingly used in gourmet cooking, catering to sophisticated palates.

Specialty Fats Market Dynamics

Driver

“Growing Demand From Bakery and Confectionery Industry”

- As consumers increasingly seek out premium, indulgent, and innovative food options, manufacturers are responding by incorporating specialty fats into their formulations to enhance taste, texture, and visual appeal. These fats—such as cocoa butter alternatives, filling fats, and emulsified shortenings—play a crucial role in delivering the softness, creaminess, and shelf stability required in high-quality baked goods and confections

- The U.A.E.’s position as a regional hub for tourism, luxury dining, and food innovation is fueling a steady rise in demand for diverse bakery and dessert offerings. Local production is ramping up to meet both domestic consumption and the growing demand from hospitality and retail channels

- Specialty fats are increasingly being used to create differentiated products that align with regional flavor profiles and performance expectations in high-temperature environments. In addition, the shift towards clean-label, trans-fat-free, and plant-based alternatives is prompting manufacturers to seek customized fat solutions that meet both health and functionality standards

- Specialty fats offer the versatility to reformulate recipes without compromising on quality, making them indispensable in the creation of modern bakery and confectionery products.

For instance,

- In July 2024, William Reed Ltd published an article which states that Cargill has invested USD 50 million to expand its plant in Port Klang, Malaysia, aiming to supply finished specialty fats to consumers throughout Asia-Pacific and semi-finished products to its edible oils facilities in Europe, South America, and North America

- This expansion reflects the company's commitment to meeting the rising demand for specialty fats in regions like the Middle East, where heat resistance is crucial for chocolate products

- According to the New Zealand Institute of Oils and Fats, fats play a crucial role in baking by enhancing the texture, flavor, and shelf-life of baked products. In bread-making, for instance, fats coat the gluten structure, making the dough more extensible and yielding a softer crumb

- This functional importance is driving increased demand for fats, fueled by the rapid growth of the global bakery and confectionery industry

Opportunity

“Expansion in Plant-Based and Vegan Products”

- The specialty fats sector is seeing growing interest in plant-based and vegan products. This opportunity comes from changes in consumer preferences, with more people looking for healthier and more sustainable food options. Plant-based diets are gaining popularity among both locals and expatriates, especially among younger consumers who are more health-conscious and aware of global food trends.

- Food producers and manufacturers are introducing a wider range of plant-based alternatives, including those made with specialty fats that mimic the taste and texture of traditional animal-based products. These specialty fats are used in bakery items, confectionery, and dairy alternatives to improve quality and performance.

- For instance,

- In February 2025, a ResearchGate publication titled "Are Emirati consumers in United Arab Emirates open to alternative proteins" revealed that many Emirati consumers show positive attitudes toward alternative proteins and are willing to replace animal-based sources, driven by health, sustainability, and ethical concerns, highlighting growing openness to plant-based diets

- In September 2024, the Middle East Vegan Society reported a surge in plant-based food adoption across the Middle East, driven by health, sustainability, and ethical concerns. Local innovations and startups are meeting this demand, with increasing availability of vegan products in supermarkets, restaurants, and food delivery platforms throughout the region

Restraint/Challenge

“High Costs of Specialty Fats”

- Despite rising demand across food processing and confectionery segments, the high cost of specialty fats remains a significant barrier to widespread market penetration in the U.A.E. These fats—such as cocoa butter equivalents, structured lipids, and trans-fat alternatives—undergo complex processing and formulation techniques, resulting in elevated production costs compared to conventional fats and oils.

- Moreover, sourcing premium raw materials such as sustainable palm oil, shea butter, and exotic plant-based ingredients often involves import duties, fluctuating exchange rates, and supply chain constraints, further inflating prices for manufacturers and end-users alike.

- This cost burden particularly impacts small and medium-sized food producers and bakeries, who often operate with thinner margins and limited capacity to absorb high ingredient costs. As a result, these businesses may either avoid incorporating specialty fats into their products or opt for cheaper, lower-quality substitutes, ultimately slowing market adoption.

- Additionally, consumers in price-sensitive segments of the U.A.E. population may find products formulated with specialty fats less accessible, especially when faced with premium pricing on health-positioned items.

For instance,

- In September 2024, ICE cocoa futures prices reached USD 9,821 per tonne, more than doubling from USD 3,430 per tonne a year earlier. This significant increase in cocoa prices has led confectionery manufacturers to seek alternatives to cocoa butter, such as specialty fats, to manage costs. However, these alternatives also come with their own cost implications, affecting product pricing and profitability

Specialty Fats Market Scope

The U.A.E. specialty fats market is segmented into five notable segments based on type, form, source, application, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Form |

|

|

By Source |

|

|

By Application

|

|

|

By Distribution Channel

|

|

In 2025, the Cocoa Butter Equivalents (CBE) segment is projected to dominate the market with a largest share in type segment

The Cocoa Butter Equivalents (CBE) segment is expected to dominate the market with a market share of 26.16% due to its excellent compatibility with natural cocoa butter, cost-effectiveness, and ability to maintain the desired texture, gloss, and mouthfeel in chocolate and confectionery products.

In 2025, the semi-solid segment is expected to account for the largest share during the forecast period in form segment

The semi-solid segment is expected to dominate the market with a market share of 51.95% due to its versatility, ease of handling, and widespread use in bakery, confectionery, and dairy applications. Semi-solid fats offer optimal plasticity and spreadability, making them ideal for use in margarine, spreads, and cream fillings.

Specialty Fats Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, regional presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cargill, Incorporated (U.S.)

- Wilmar International Ltd (Singapore)

- ICC Group (Indonesia)

- Usha Edible Oil (U.A.E)

- Apical (Singapore)

- Al Tawun Solyman Services (FZE) (U.A.E)

- Dulzer (U.A.E)

- Saha Edible Oil Trading (U.A.E)

- Shahraan Group (U.A.E)

- United Foods Company (U.A.E)

Latest Developments in U.A.E Specialty Fats Market

- In February 2025, ICC Group participated in Gulfood 2025 at the Dubai World Trade Centre, showcasing its premium palm oil products, including cooking oils, specialty fats, and bakery ingredients. The event provided an opportunity to strengthen global partnerships and highlight the company’s commitment to sustainability and innovation. ICC Group remains dedicated to expanding its global footprint and meeting evolving industry needs.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 DBMR VENDOR SHARE ANALYSIS

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 BARGAINING POWER OF SUPPLIERS

4.1.3 BARGAINING POWER OF BUYERS

4.1.4 THREAT OF SUBSTITUTES

4.1.5 INTERNAL COMPETITION

4.2 IMPORT EXPORT SCENARIO

4.3 PRICING ANALYSIS

4.4 VALUE CHAIN ANALYSIS: U.A.E. SPECIALTY FATS MARKET

4.4.1 PROCUREMENT:

4.4.2 MANUFACTURING:

4.4.3 MARKETING & DISTRIBUTION:

4.5 BRAND OUTLOOK

4.5.1 COMPARATIVE BRAND ANALYSIS

4.5.2 PRODUCT VS BRAND OVERVIEW

4.6 COMPETITIVE ADVANTAGE OF SETTING SPECIALTY FATS PLANT IN U.A.E.

4.6.1 STRATEGIC LOCATION AND LOGISTICS: GATEWAY TO THE GCC AND MENA

4.6.2 ECONOMIC STABILITY AND INVESTOR-FRIENDLY POLICIES

4.6.3 GROWING DOMESTIC DEMAND AND CONSUMER SOPHISTICATION

4.6.4 TOURISM-DRIVEN F&B INNOVATION

4.6.5 INTEGRATION WITH NATIONAL FOOD SECURITY AND INNOVATION GOALS

4.6.6 TECHNOLOGICAL ECOSYSTEM AND SUSTAINABILITY COMMITMENTS

4.6.7 MARKET ACCESS: REACHING THE USD 65 BILLION GCC MARKET

4.6.8 COMPREHENSIVE TRADE AGREEMENTS

4.6.9 RETAIL AND E

4.6.9.1 COMMERCE EXPANSION

4.6.10 CONCLUSION

4.7 EMERGING TRENDS & FUTURE OUTLOOK

4.7.1 HEALTH AND WELLNESS FOCUS

4.7.2 CULINARY DIVERSITY AND PREMIUMIZATION

4.7.3 SUSTAINABILITY AND ETHICAL SOURCING

4.7.4 INNOVATION IN PRODUCT OFFERINGS

4.7.5 FUTURE PROSPECTS

4.8 FACTORS INFLUENCING PURCHASING DECISION OF END-USERS

4.8.1 COST AND PRICING SENSITIVITY

4.8.2 PERFORMANCE AND FUNCTIONALITY

4.8.3 HEALTH AND NUTRITION TRENDS

4.8.4 HALAL CERTIFICATION AND REGULATORY COMPLIANCE

4.8.5 CLEAN LABEL AND INGREDIENT TRANSPARENCY

4.8.6 BRAND REPUTATION AND SUPPLIER RELIABILITY

4.8.7 SUSTAINABILITY AND ETHICAL SOURCING

4.8.8 INNOVATION AND PRODUCT CUSTOMIZATION

4.8.9 CONCLUSION

4.9 GROWTH STRATEGIES ADOPTED BY KEY MARKET PLAYERS

4.9.1 CARGILL, INCORPORATED

4.9.2 WILMAR INTERNATIONAL LTD

4.9.3 ICC GROUP

4.9.4 USHA EDIBLE OIL

4.9.5 APICAL

4.9.6 UNITED FOODS COMPANY

4.1 IMPACT OF ECONOMIC SLOWDOWN

4.10.1 IMPACT OF PRICE

4.10.2 IMPACT ON SUPPLY CHAIN

4.10.3 RISING INPUT COSTS STRAIN PROFIT MARGINS

4.10.4 IMPACT ON COMPANY’S STRATEGIC DECISIONS

4.10.5 CONCLUSION

4.11 INDUSTRY TRENDS AND FUTURE PERSPECTIVE

4.11.1 HEALTH AND WELLNESS FOCUS

4.11.2 REGULATORY COMPLIANCE AND HALAL CERTIFICATION

4.11.3 COMPETITION AND INNOVATION

4.11.4 SUSTAINABILITY AND ETHICAL SOURCING

4.11.5 TECHNOLOGICAL ADVANCEMENTS

4.11.6 FUTURE OUTLOOK

4.11.7 CONCLUSION

4.12 INVESTMENT & COST ANALYSIS FOR SETTING UP A SPECIALTY FATS MANUFACTURING PLANT IN U.A.E.

4.12.1 CAPITAL INVESTMENT BREAKDOWN

4.12.1.1 LAND & INFRASTRUCTURE

4.12.1.2 MACHINERY & EQUIPMENT

4.12.1.3 RAW MATERIAL PROCUREMENT

4.12.1.4 R&D & PRODUCT DEVELOPMENT

4.12.1.5 LABOR & OPERATIONAL COSTS

4.12.1.6 PACKAGING & LOGISTICS

4.12.1.7 COMPLIANCE & CERTIFICATIONS

4.12.1.8 OTHERS

4.13 OVERVIEW OF TECHNOLOGICAL INNOVATIONS

4.13.1 ADVANCED FAT MODIFICATION TECHNOLOGIES

4.13.2 UPCYCLING AND WASTE REDUCTION

4.13.3 CLEAN LABEL AND TRANSPARENCY

4.13.4 SUSTAINABLE SOURCING AND ECO-FRIENDLY PRACTICES

4.13.5 HEALTH-CONSCIOUS PRODUCT DEVELOPMENT

4.13.6 CUSTOMIZATION AND FUNCTIONAL BLENDS

4.13.7 TECHNOLOGICAL INTEGRATION IN PRODUCTION FACILITIES

4.13.8 RESEARCH AND DEVELOPMENT INITIATIVES

4.13.9 CONCLUSION

4.14 PRODUCTION CAPACITY OVERVIEW

4.14.1 OVERVIEW

4.14.2 REGIONAL CAPACITY DISTRIBUTION

4.14.3 KEY PLAYERS & FACILITY FOOTPRINT

4.14.4 CHALLENGES & FUTURE OUTLOOK

4.14.4.1 CHALLENGES

4.14.4.2 OUTLOOK

4.15 RAW MATERIAL SOURCING ANALYSIS

4.15.1 PALM OIL

4.15.2 PALM KERNEL OIL (PKO)

4.15.3 SHEA BUTTER

4.15.4 COCOA BUTTER AND COCOA BUTTER EQUIVALENTS (CBES)

4.15.5 COCONUT OIL

4.15.6 EXOTIC FATS

4.16 SUPPLY CHAIN ANALYSIS

4.16.1 RAW MATERIAL SOURCING

4.16.2 PROCESSING AND MANUFACTURING

4.16.3 QUALITY ASSURANCE AND REGULATORY COMPLIANCE

4.16.4 DISTRIBUTION AND LOGISTICS

4.16.5 END-USE INDUSTRIES

4.16.6 RETAIL AND CONSUMER TRENDS

4.16.7 CHALLENGES AND OPPORTUNITIES

4.16.8 CHALLENGES:

4.16.9 OPPORTUNITIES:

4.16.10 CONCLUSION

4.17 TARIFFS AND THEIR IMPACT ON MARKET

4.17.1 CURRENT TARIFF RATES IN TOP-5 COUNTRY MARKETS

4.17.2 OUTLOOK: LOCAL PRODUCTION V/S IMPORT RELIANCE

4.17.3 VENDOR SELECTION CRITERIA DYNAMICS

4.17.4 IMPACT ON SUPPLY CHAIN

4.17.4.1 RAW MATERIAL PROCUREMENT

4.17.4.2 MANUFACTURING AND PRODUCTION

4.17.4.3 LOGISTICS AND DISTRIBUTION

4.17.4.4 PRICE PITCHING AND POSITION OF MARKET

4.17.5 INDUSTRY PARTICIPANTS: PROACTIVE MOVES

4.17.5.1 SUPPLY CHAIN OPTIMIZATION

4.17.5.2 JOINT VENTURE ESTABLISHMENTS

4.17.6 IMPACT ON PRICES

4.17.7 REGULATORY INCLINATION

4.17.7.1 GCC TRADE ALIGNMENT & FTAS

4.17.7.2 SPECIAL ZONES AND RE-EXPORT MODELS

4.17.7.3 LOCAL SUBSIDY & POLICY RESPONSE

4.17.7.4 DOMESTIC COURSE OF CORRECTION

5 REGULATION COVERAGE

5.1 INDUSTRIAL & TRADE LICENSING

5.2 CHAMBER OF COMMERCE AND MUNICIPALITY REGISTRATION

5.3 FOOD SAFETY AND STANDARDS COMPLIANCE

5.4 HALAL CERTIFICATION

5.5 ENVIRONMENTAL & SUSTAINABILITY PERMITS

5.6 QUALITY AND PROCESS CERTIFICATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FROM BAKERY AND CONFECTIONERY INDUSTRY

6.1.2 RISING CONSUMER AWARENESS REGARDING HEALTH AND NUTRITION

6.1.3 INCREASING EXPAT POPULATION AND WESTERN INFLUENCE

6.1.4 RAPIDLY GROWING ORGANIC FOOD INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH COSTS OF SPECIALTY FATS

6.3 OPPORTUNITIES

6.3.1 EXPANSION IN PLANT-BASED AND VEGAN PRODUCTS

6.3.2 TECHNOLOGICAL ADVANCEMENTS IN FAT MODIFICATION

6.3.3 RISING DEMAND FOR HALAL-CERTIFIED AND CLEAN LABEL PRODUCTS

6.4 CHALLENGES

6.4.1 STIFF COMPETITION FROM STANDARD OILS AND BUTTER

6.4.2 CLIMATE LIMITATIONS FOR LOCAL PRODUCTION

7 U.A.E. SPECIALITY FATS MARKET, BY TYPE

7.1 OVERVIEW

7.2 COCOA BUTTER EQUIVALENTS (CBE)

7.3 COCOA BUTTER REPLACERS (CBR)

7.4 COCOA BUTTER SUBSTITUTES (CBS)

7.5 COCOA BUTTER IMPROVERS (CBI)

7.6 MILK FAT REPLACERS (MFR)

7.7 ANHYDROUS MILK FAT REPLACERS (AMFR)

7.8 INTERESTERIFIED FATS

7.9 SHEA & SAL STEARIN

7.1 SHEA & SAL OLEIN

7.11 HPMF IV 33-37

7.12 HPMF IV 45-47

7.13 BAKERY FATS

7.14 FILLING FATS

7.15 MARGARINES

7.16 OTHERS

8 U.A.E. SPECIALITY FATS MARKET, BY FORM

8.1 OVERVIEW

8.2 SEMI-SOLID

8.3 SOLID

8.4 LIQUID

9 U.A.E. SPECIALITY FATS MARKET, BY SOURCE

9.1 OVERVIEW

9.2 PLANT-BASED SPECIALTY FATS

9.3 ANIMAL-BASED SPECIALTY FATS

10 U.A.E. SPECIALITY FATS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 FOOD & BEVERAGE INDUSTRY

10.3 PHARMACEUTICALS & NUTRACEUTICALS

10.4 COSMETICS & PERSONAL CARE

10.5 ANIMAL FEED & PET FOOD

10.6 OTHERS

11 U.A.E. SPECIALITY FATS MARKET, BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 B2B (BUSINESS-TO-BUSINESS)

11.3 B2C (BUSINESS-TO-CONSUMER)

12 U.A.E. SPECIALTY FATS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: U.A.E.

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 CARGILL, INCORPORATED

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENT

14.2 WILMAR INTERNATIONAL LTD

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 PRODUCT/BRAND PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 ICC GROUP

14.3.1 COMPANY SNAPSHOT

14.3.2 PRODUCT PORTFOLIO

14.3.3 RECENT DEVELOPMENT

14.4 USHA EDIBLE OIL

14.4.1 COMPANY SNAPSHOT

14.4.2 PRODUCT PORTFOLIO

14.4.3 RECENT DEVELOPMENT

14.5 APICAL

14.5.1 COMPANY SNAPSHOT

14.5.2 PRODUCT PORTFOLIO

14.5.3 RECENT DEVELOPMENT

14.6 AL TAWUN SOLYMAN SERVICES (FZE)

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 DULZER

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 SAHA EDIBLE OIL TRADING

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 SHAHRAAN GROUP

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

14.1 UNITED FOODS COMPANY

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPARATIVE BRAND ANALYSIS: KEY PLAYERS

TABLE 2 PRODUCT VS BRAND OVERVIEW

TABLE 3 COMPREHENSIVE ECONOMIC PARTNERSHIP AGREEMENTS

TABLE 4 REGULATORY COVERAGE

TABLE 5 TYPES OF FATS AND THEIR NUTRITIONAL BENEFITS

TABLE 6 U.A.E. SPECIALITY FATS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 U.A.E. COCOA BUTTER EQUIVALENTS (CBE) IN SPECIALTY FATS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 U.A.E. COCOA BUTTER REPLACERS (CBR) IN SPECIALTY FATS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 9 U.A.E. COCOA BUTTER SUBSTITUTES (CBS) IN SPECIALTY FATS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 U.A.E. SPECIALITY FATS MARKET, BY FORM, 2018-2032 (USD THOUSAND)

TABLE 11 U.A.E. SPECIALITY FATS MARKET, BY SOURCE,2018-2032 (USD THOUSAND)

TABLE 12 U.A.E. PLANT-BASED SPECIALTY FATS IN SPECIALTY FATS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 13 U.A.E. ANIMAL-BASED SPECIALTY FATS IN SPECIALTY FATS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 14 U.A.E. SPECIALITY FATS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 U.A.E. FOOD & BEVERAGE INDUSTRY IN SPECIALTY FATS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 16 U.A.E. BAKERY & CONFECTIONERY IN SPECIALTY FATS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 U.A.E. DAIRY ALTERNATIVES & PLANT-BASED FOODS IN SPECIALTY FATS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 U.A.E. FRYING & COOKING OILS IN SPECIALTY FATS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 19 U.A.E. INFANT NUTRITION IN SPECIALTY FATS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 U.A.E. PHARMACEUTICALS & NUTRACEUTICALS IN SPECIALTY FATS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 21 U.A.E. COSMETICS & PERSONAL CARE IN SPECIALTY FATS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 22 U.A.E. ANIMAL FEED & PET FOOD IN SPECIALTY FATS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 23 U.A.E. SPECIALITY FATS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 24 U.A.E. B2C (BUSINESS-TO-CONSUMER) IN SPECIALTY FATS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 U.A.E. SPECIALTY FATS MARKET

FIGURE 2 U.A.E. SPECIALTY FATS MARKET: DATA TRIANGULATION

FIGURE 3 U.A.E. SPECIALTY FATS MARKET: DROC ANALYSIS

FIGURE 4 U.A.E. SPECIALTY FATS MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 U.A.E. SPECIALTY FATS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.A.E. SPECIALTY FATS MARKET: MULTIVARIATE MODELLING

FIGURE 7 U.A.E. SPECIALTY FATS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 U.A.E. SPECIALTY FATS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 U.A.E. SPECIALTY FATS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 U.A.E. SPECIALTY FATS MARKET: SEGMENTATION

FIGURE 12 FIFTEEN SEGMENTS COMPRISE THE U.A.E. SPECIALTY FATS MARKET, BY TYPE (2024)

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 GROWING DEMAND FROM BAKERY AND CONFECTIONERY INDUSTRY IS EXPECTED TO DRIVE THE U.A.E. SPECIALTY FATS MARKET IN THE FORECAST PERIOD (2025-2032)

FIGURE 15 THE COCOA BUTTER EQUIVALENTS (CBE) IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.A.E. SPECIALTY FATS MARKET IN 2025 AND 2032

FIGURE 16 PORTER’S FIVE FORCES

FIGURE 17 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 18 U.A.E. SPECIALTY FATS MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/ KG)

FIGURE 19 VALUE CHAIN ANALYSIS OF THE U.A.E. SPECIALTY FATS MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES FOR THE U.A.E. SPECIALTY FATS MARKET

FIGURE 21 EXPAT POPULATION OF VARIOUS COUNTRIES IN U.A.E.

FIGURE 22 U.A.E. SPECIALITY FATS MARKET: BY TYPE, 2024

FIGURE 23 U.A.E. SPECIALITY FATS MARKET: BY FORM, 2024

FIGURE 24 U.A.E. SPECIALITY FATS MARKET: BY SOURCE, 2024

FIGURE 25 U.A.E. SPECIALITY FATS MARKET: BY APPLICATION, 2024

FIGURE 26 U.A.E. SPECIALITY FATS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 27 U.A.E. SPECIALTY FATS MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.