Europe Charge

Market Size in USD Billion

CAGR :

%

USD

1.32 Billion

USD

2.73 Billion

2024

2032

USD

1.32 Billion

USD

2.73 Billion

2024

2032

| 2025 –2032 | |

| USD 1.32 Billion | |

| USD 2.73 Billion | |

|

|

|

|

Europe Charge-Coupled Device (CCD) Imagers Market Segmentation, By Image Processing (2D and 3D), Application (Endoscopy, X-Ray, and Others), End Use (Hospitals, Diagnostic center, and Others)- Industry Trends and Forecast to 2032

Europe Charge-Coupled Device (CCD) Imagers Market Size

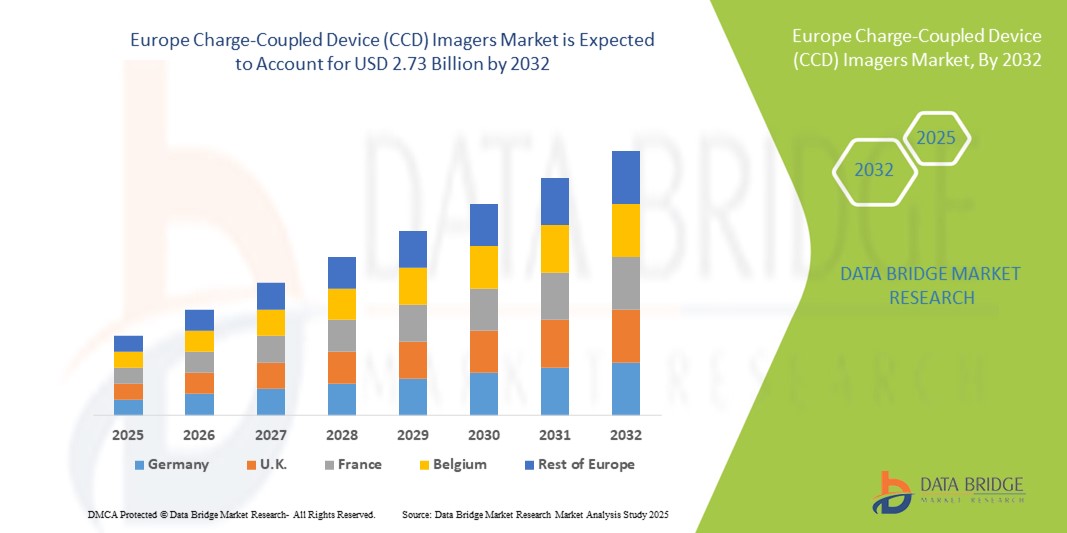

- The Europe Charge-Coupled Device (CCD) imagers market size was valued at USD 1.32 billion in 2024 and is expected to reach USD 2.73 billion by 2032, at a CAGR of 9.55% during the forecast period

- The market growth is largely fueled by technological advancements in medical and industrial imaging applications, including endoscopy, X-ray, astronomy, and machine vision, leading to increased adoption of high-performance CCD imagers across healthcare and industrial sectors

- Furthermore, rising demand for precise imaging solutions, enhanced diagnostics, and advanced research applications is establishing CCD imagers as a critical component in imaging systems across Europe. These converging factors are accelerating the uptake of CCD imaging solutions, thereby significantly boosting the industry's growth

Europe Charge-Coupled Device (CCD) Imagers Market Analysis

- CCD imagers, providing high-performance image capture for medical, industrial, and scientific applications, are increasingly critical components of modern imaging systems across healthcare diagnostics, industrial inspection, and research due to their high sensitivity, low noise, and superior image quality

- The escalating demand for CCD imagers is primarily fueled by technological advancements in imaging applications, growing adoption in precision diagnostics and industrial automation, and a rising preference for reliable, high-resolution imaging solutions over alternative sensor technologies

- Germany dominated the CCD imagers market with the largest revenue share of 37.2% in 2024, characterized by advanced healthcare infrastructure, strong industrial automation adoption, and a robust presence of key industry players, with German hospitals and diagnostic centers experiencing substantial growth in CCD-based imaging systems, particularly in endoscopy and X-ray applications, driven by innovations from both established manufacturers and emerging technology startups

- France is expected to be the fastest-growing country in the CCD imagers market during the forecast period due to increasing investment in healthcare infrastructure, diagnostic centers, and R&D activities

- Endoscopy segment dominated the CCD imagers market with a market share of 43% in 2024, driven by its established reputation for precision, reliability, and adaptability in minimally invasive medical procedures

Report Scope and Europe Charge-Coupled Device (CCD) Imagers Market Segmentation

|

Attributes |

Europe Charge-Coupled Device (CCD) Imagers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Europe Charge-Coupled Device (CCD) Imagers Market Trends

Advancements in 2D/3D Imaging and Integration with AI

- A significant and accelerating trend in the Europe CCD imagers market is the integration of advanced 2D and 3D imaging capabilities with AI-powered image processing algorithms. This fusion of technologies is enhancing image accuracy, resolution, and analytical capabilities across healthcare, industrial, and scientific applications

- For instance, CCD-based endoscopy systems are now equipped with AI-assisted image enhancement, enabling more precise diagnostics and real-time anomaly detection. Similarly, X-ray imaging solutions using CCD sensors are increasingly leveraging AI for automated analysis and reporting, improving workflow efficiency in hospitals and diagnostic centers.

- AI integration in CCD imagers enables features such as adaptive noise reduction, pattern recognition, and predictive analytics for imaging systems. For example, some medical CCD imagers can detect subtle anomalies over time, assisting radiologists in early diagnosis, while industrial CCD cameras can automatically identify defects in high-speed production lines. Furthermore, 3D image processing capabilities allow for more detailed spatial visualization, critical in surgical planning and complex industrial inspection tasks

- The seamless integration of CCD imagers with AI platforms and 3D processing software facilitates centralized control and advanced analytics across medical and industrial facilities. Users can manage imaging systems, analyze data, and generate insights through a single interface, streamlining operations and improving outcomes

- This trend towards more intelligent, high-resolution, and AI-enabled imaging systems is fundamentally reshaping user expectations for diagnostics and precision inspection. Consequently, companies such as Hamamatsu and Teledyne e2v are developing AI-augmented CCD imagers with enhanced sensitivity, 3D imaging compatibility, and real-time processing capabilities

- The demand for CCD imagers that offer advanced 2D/3D imaging and AI integration is growing rapidly across hospitals, diagnostic centers, and research institutions, as stakeholders increasingly prioritize precision, efficiency, and data-driven insights

Europe Charge-Coupled Device (CCD) Imagers Market Dynamics

Driver

Rising Demand for High-Precision Imaging in Healthcare and Industry

- The increasing need for accurate imaging in medical diagnostics, industrial inspection, and scientific research is a significant driver for the heightened demand for CCD imagers

- For instance, in March 2024, Hamamatsu Photonics launched a high-sensitivity CCD imager optimized for endoscopy and X-ray applications, aiming to enhance diagnostic accuracy in European hospitals. Such innovations by key players are expected to drive CCD imager adoption in the forecast period

- As healthcare providers and industrial users seek precise, reliable imaging solutions, CCD imagers offer superior sensitivity, low noise, and high-resolution capabilities, providing a compelling upgrade over alternative sensor technologies

- Furthermore, the growing focus on minimally invasive procedures and automation in manufacturing is making CCD imagers integral to these systems, offering seamless integration with AI analytics and 3D processing tools

- The capability to capture high-quality images for endoscopy, X-ray, and other diagnostic procedures, combined with real-time data processing and analytics, is propelling the adoption of CCD imagers in hospitals, diagnostic centers, and industrial research facilities

Restraint/Challenge

High Cost and Technological Complexity

- The relatively high cost of CCD imagers compared to alternative sensor technologies, such as CMOS, poses a significant challenge to wider market penetration, particularly for smaller diagnostic centers and cost-sensitive industrial users

- For instance, advanced CCD systems with integrated AI and 3D processing capabilities are priced significantly higher than standard imaging solutions, limiting adoption in budget-constrained facilities

- Addressing these cost concerns through scalable solutions, modular designs, and more affordable models is crucial for broader adoption. Companies such as Teledyne e2v and Hamamatsu focus on developing cost-efficient CCD imagers while maintaining high performance. In addition, the complexity of operating and maintaining advanced CCD imaging systems can be a barrier, requiring specialized personnel and training

- While ongoing R&D is gradually simplifying CCD system interfaces and enhancing automation, the perceived technological complexity can still hinder uptake among smaller hospitals and diagnostic centers

- Overcoming these challenges through affordable product offerings, operator training, and simplified integration with AI and 3D imaging platforms will be vital for sustained market growth in Europe

Europe Charge-Coupled Device (CCD) Imagers Market Scope

The market is segmented on the basis of image processing, application, and end use.

- By Image Processing

On the basis of image processing, the CCD imagers market is segmented into 2D and 3D imaging. The 2D segment dominated the market with the largest revenue share of 55% in 2024, driven by its widespread use across medical diagnostics, industrial inspection, and scientific research. 2D CCD imagers offer high resolution and low noise imaging, making them suitable for applications such as endoscopy and X-ray diagnostics. Hospitals and diagnostic centers prefer 2D CCD systems due to their established reliability, cost-effectiveness, and compatibility with existing imaging infrastructure. The extensive adoption of 2D imaging in routine medical procedures and industrial quality control further reinforces its dominant position. Furthermore, advancements in 2D CCD sensors continue to enhance image clarity and processing speed, maintaining strong demand.

The 3D imaging segment is anticipated to witness the fastest growth rate of 14.8% from 2025 to 2032, fueled by increasing adoption in advanced medical imaging, surgical planning, and industrial inspection. 3D CCD imagers allow for volumetric visualization, enabling precise spatial analysis in minimally invasive surgeries and complex manufacturing processes. The growing focus on precision diagnostics, robotic-assisted surgeries, and automated quality control is driving 3D imaging adoption. Research institutions and advanced diagnostic centers are also increasingly investing in 3D imaging solutions for detailed analysis and visualization. Integration with AI and advanced image processing software further enhances the capabilities and appeal of 3D CCD imagers.

- By Application

On the basis of application, the market is segmented into endoscopy, X-ray, and others. The endoscopy segment dominated the market with a revenue share of 43% in 2024, owing to the growing demand for minimally invasive diagnostic procedures in hospitals and diagnostic centers. Endoscopic CCD imagers offer high sensitivity and low noise imaging, which is critical for accurately visualizing internal organs and tissues. Medical professionals prefer CCD-based endoscopy systems due to their precision, reliability, and ability to integrate with advanced visualization software. The increase in surgical procedures requiring minimally invasive techniques, coupled with rising patient awareness, further drives demand. Technological advancements in CCD sensors, including improved resolution and AI-assisted imaging, are also supporting the dominance of the endoscopy segment.

The X-ray segment is expected to witness the fastest CAGR from 2025 to 2032, driven by modernization of radiology departments and increasing adoption of digital radiography. CCD imagers in X-ray systems provide enhanced image quality, higher sensitivity, and lower exposure times compared to traditional imaging detectors. Growing investments in diagnostic infrastructure, particularly in Germany, France, and the U.K., are supporting the rapid adoption of CCD-based X-ray systems. In addition, the integration of AI for automated anomaly detection and workflow optimization is boosting the segment’s growth. Hospitals and diagnostic centers are increasingly replacing older X-ray equipment with CCD-enabled systems to improve diagnostic accuracy and operational efficiency.

- By End Use

On the basis of end use, the CCD imagers market is segmented into hospitals, diagnostic centers, and others. The hospitals segment dominated the market with a revenue share of 48% in 2024, driven by high adoption of CCD imagers for critical diagnostic and surgical procedures. Hospitals prefer CCD imaging systems due to their reliability, superior image quality, and compatibility with existing medical infrastructure. The growing number of hospital-based minimally invasive procedures and increasing focus on patient safety are driving demand. In addition, government initiatives to upgrade healthcare infrastructure in Europe contribute to the strong adoption of CCD imagers in hospitals. Advanced research and training programs within hospitals also encourage the use of high-resolution CCD imaging for education and procedure planning.

The diagnostic centers segment is anticipated to witness the fastest growth rate of 13.9% from 2025 to 2032, fueled by the rising number of standalone diagnostic facilities and outpatient imaging centers. Diagnostic centers are increasingly investing in CCD imagers to provide high-quality imaging services with faster turnaround times. The demand is driven by the growing focus on preventive healthcare and early disease detection, which requires precise and reliable imaging solutions. Integration with AI-assisted diagnostics and cloud-based image management systems is further boosting adoption. The affordability of compact CCD systems and ease of deployment make them an attractive choice for diagnostic centers looking to expand their service offerings.

Europe Charge-Coupled Device (CCD) Imagers Market Regional Analysis

- Germany dominated the CCD imagers market with the largest revenue share of 37.2% in 2024, characterized by advanced healthcare infrastructure, strong industrial automation adoption, and a robust presence of key industry players, with German hospitals and diagnostic centers experiencing substantial growth in CCD-based imaging systems, particularly in endoscopy and X-ray applications, driven by innovations from both established manufacturers and emerging technology startups

- Hospitals, diagnostic centers, and research institutions in Germany highly value the precision, high sensitivity, and low-noise imaging capabilities offered by CCD imagers, which are critical for endoscopy, X-ray, and industrial inspection applications

- This widespread adoption is further supported by substantial investments in healthcare and industrial R&D, a technologically advanced workforce, and strong government initiatives promoting modern diagnostic and imaging solutions, establishing CCD imagers as a preferred choice for high-quality imaging across medical and industrial sectors in the country

The Germany CCD Imagers Market Insight

Germany dominates the Europe CCD imagers market, capturing the largest revenue share of 37.2% in 2024, driven by advanced healthcare infrastructure, strong industrial automation adoption, and the presence of leading CCD imager manufacturers. German hospitals and diagnostic centers highly value CCD imagers for their high sensitivity, low noise, and superior image quality in endoscopy and X-ray applications. The country’s emphasis on precision diagnostics, innovation, and technological advancement supports widespread adoption. Industrial and research sectors are also increasingly using CCD imagers for quality control, laboratory research, and automation applications. Integration with AI and 3D image processing further enhances usability and operational efficiency. Germany’s well-established healthcare and industrial ecosystem ensures it remains the leading country for CCD imager deployment in Europe.

France CCD Imagers Market Insight

The France CCD imagers market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising investments in hospitals, diagnostic centers, and research facilities. French stakeholders adopt CCD imagers for endoscopy, X-ray, and advanced diagnostic applications, attracted by their reliability and precision. Government initiatives promoting modern medical imaging infrastructure and research activities are also fueling growth. Integration with AI-enabled imaging solutions for enhanced performance is further boosting adoption. France’s focus on technological advancement and healthcare quality ensures that CCD imagers remain in high demand.

Italy CCD Imagers Market Insight

The Italy CCD imagers market is poised to grow steadily due to expanding hospital networks, growing diagnostic centers, and rising demand for high-quality imaging. CCD imagers are increasingly adopted for endoscopy and X-ray applications, as well as industrial quality inspection. Integration with AI-assisted image processing and 3D visualization enhances diagnostic accuracy and operational efficiency. Italy’s healthcare modernization initiatives and industrial technology adoption are supporting market expansion.

Spain CCD Imagers Market Insight

The Spain CCD imagers market is gaining momentum from rising demand for high-resolution imaging in hospitals, diagnostic centers, and research institutions. Hospitals and clinics are adopting CCD imagers for endoscopy and X-ray diagnostics due to their precision and low-noise performance. Industrial and research applications are also driving adoption. Integration with AI and 3D image processing improves workflow efficiency and imaging accuracy. Government support and technological awareness are key factors propelling market growth in Spain.

Europe Charge-Coupled Device (CCD) Imagers Market Share

The Europe Charge-Coupled Device (CCD) Imagers industry is primarily led by well-established companies, including:

- Atik Cameras Unipessoal Lda. (Portugal)

- Starlight Xpress Ltd (U.K.)

- Eureca Messtechnik GmbH (Germany)

- Quantum Scientific Imaging (Portugal)

- Oxford Instruments (France)

- Hamamatsu Photonics K.K. and its affiliates (Germany)

- Rigaku Holdings Corporation (Germany)

- Scientific Instruments GmbH (Germany)

- Spectronic CamSpec Ltd (U.K.)

- Teledyne Technologies Incorporated. (U.K.)

- Teledyne Digital Imaging Inc. (Netherlands)

- Semiconductor Components Industries, LLC (Belgium)

- ams-OSRAM AG. (Austria)

- Toshiba Corporation (U.K.)

- Sony (U.K.)

- NXP Semiconductors (Netherlands)

- Samsung (U.K.)

- Honeywell International Inc. (U.K.)

- Fairchild Imaging Inc. (U.K.)

What are the Recent Developments in Europe Charge-Coupled Device (CCD) Imagers Market?

- In August 2025, the European Space Agency's EUMETSAT launched the MetOp-SG-A1 satellite, which includes Teledyne Space Imaging's CCD sensors. These sensors are crucial for the satellite's atmospheric observation instruments, supporting weather forecasting and climate monitoring efforts

- In July 2025, Teledyne Space Imaging in Chelmsford, UK, designed, tested, and manufactured two powerful charge-coupled device (CCD) image sensors delivered to Airbus GmbH for the European Space Agency's Sentinel-4 mission. These sensors are integral to the mission's Ultraviolet-Visible-Near-Infrared (UVN) imaging spectrometer, which aims to monitor atmospheric composition

- In June 2025, Teledyne Space Imaging announced the release of space-qualified industrial CCD sensors. These sensors are designed for use in various space applications, offering high reliability and performance to meet the demanding conditions of space environments

- In November 2024, A scientific article published in the journal Frontiers discusses the development of a digital-correlated double sampling (DCDS) technique for CCDs to improve their performance in astronomy. This demonstrates ongoing academic and research-driven development of CCD technology for specialized scientific applications in Europe

- In February 2022, the European Commission released its Horizon Europe Work Programme 2023-2025, which included a focus on the "Digital, Industry and Space" cluster. This program, part of the EU's broader digital and green transition strategy, emphasizes strengthening the Union's strategic autonomy in key technologies

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。