Europe Orthopaedic Braces and Supports Market Size, Share, and Trends Analysis Report

Market Size in USD Billion

CAGR :

%

USD

1.50 Billion

USD

2.30 Billion

2024

2032

USD

1.50 Billion

USD

2.30 Billion

2024

2032

| 2025 –2032 | |

| USD 1.50 Billion | |

| USD 2.30 Billion | |

|

|

|

|

Europe Orthopaedic Braces and Supports Market Segmentation, By Product (Ankle Braces and Supports, Foot Walkers and Orthoses, Hip, Back, and Spine Braces and Supports, Knee Braces and Supports, Shoulder Braces and Supports, Elbow Braces and Supports, Hand/Wrist Braces and Supports, Facial Braces and Supports), Type (Soft and Elastic Braces, Hinged Braces, Hard Braces), Application (Preventive Care, Ligament Injury, Post-Operative Rehabilitation, Osteoarthritis, Compression Therapy, Others), Distribution Channel (Orthopaedic Clinics, Retail Pharmacies, Others)- Industry Trends and Forecast to 2032

Orthopaedic Braces and Supports Market Size

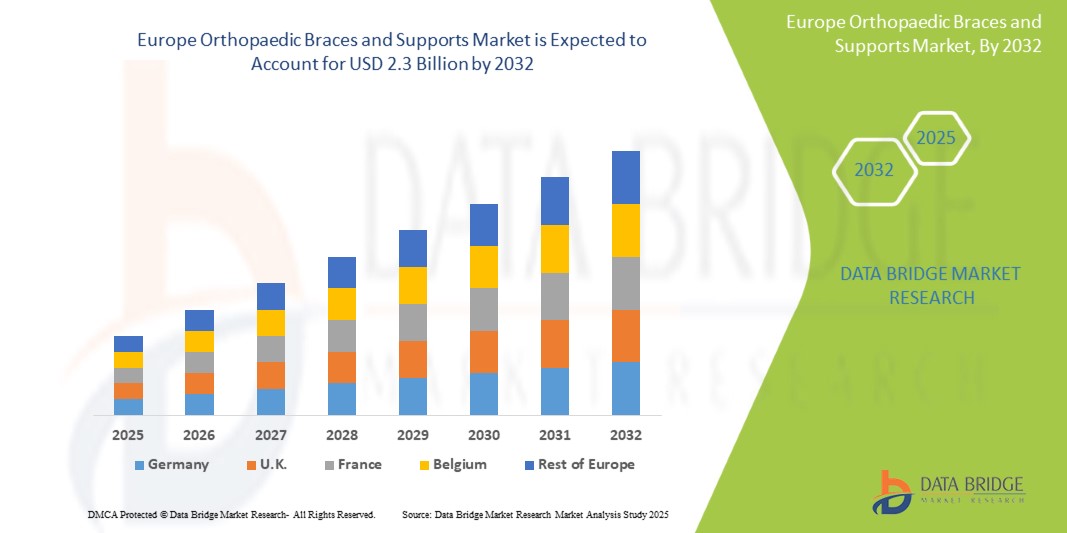

- The Europe Orthopaedic Braces and Supports Market was valued atUSD1.5 Billionin 2024and is expected to reachUSD2.3 Billionby 2032, at a at aCAGR of 5.5%during the forecast period

- The growth of the Europe Orthopaedic Braces and Supports Market is driven by several key factors. Firstly, the rising prevalence of musculoskeletal disorders, including osteoarthritis, ligament injuries, and other degenerative joint conditions—particularly among the aging population—continues to fuel demand for orthopaedic supports.

Europe Orthopaedic Braces and Supports Market Analysis

- Orthopaedic Braces and Supports play a crucial role in musculoskeletal healthcare by providing stability, alignment, pain relief, and injury prevention or post-operative recovery for patients with orthopedic conditions. These devices are widely used across various medical settings including hospitals, rehabilitation centers, sports medicine, and home care.

- The demand for orthopaedic braces and supports in Europe is primarily driven by the rising incidence of musculoskeletal disorders, an aging population, and increasing awareness of preventive healthcare. Conditions such as osteoarthritis, ligament injuries, and spinal disorders are contributing significantly to the growing utilization of these devices across the region.

- Europe holds a significant share of the global orthopaedic braces and supports market, supported by its advanced healthcare infrastructure, rising adoption of non-invasive treatments, and strong presence of leading medical device manufacturers. Countries like Germany, the United Kingdom, and France are at the forefront due to their robust public health systems, favorable reimbursement policies, and growing emphasis on improving patient mobility and quality of life.

- For instance, Germany's aging population and strong orthopaedic care ecosystem have led to a notable increase in the use of braces for knee, ankle, and spinal support.

- The European market is further supported by regulatory bodies such as the European Medicines Agency (EMA) and evolving Medical Device Regulation (MDR) standards, which ensure safety and efficacy of products. Moreover, technological advancements in material science and product design are leading to the development of lightweight, comfortable, and customizable braces, thereby improving patient compliance and outcomes.

- The growing popularity of sports and fitness activities and a rising number of sports-related injuries have also accelerated demand for orthopaedic supports in both professional and recreational athlete populations. Coupled with expanding geriatric care and increasing orthopedic surgeries, the Europe orthopaedic braces and supports market is poised for steady growth in the coming years.

Report ScopeOrthopaedic Braces and SupportsMarket Segmentation

|

Attributes |

Orthopaedic Braces and SupportsKeyMarket Insights |

|

Segments Covered |

|

|

Countries Covered |

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Orthopaedic Braces and Supports Market Trends

“Technological Innovations and Rising Consumer Awareness”

- Technological advancements in 3D printing and customization are revolutionizing the orthopaedic braces market, enabling the creation of braces tailored to an individual's specific anatomy. This trend is improving comfort, fit, and patient outcomes, driving increased adoption, particularly in sports medicine and post-surgical rehabilitation.

- The integration of sensors and wearable technology in orthopaedic braces is gaining traction, allowing for real-time monitoring of joint movement, pressure, and support levels. These innovations are particularly useful in chronic condition management, rehabilitation, and athletic performance enhancement.

- For instance, The increasing awareness about the importance of injury prevention, especially in sports and among the aging population, there is a surge in demand for preventative orthopaedic braces. These devices help in reducing the risk of joint injuries, supporting rehabilitation, and improving mobility for people with chronic conditions.

- There is a clear market shift toward lightweight, breathable, and more comfortable materials for braces and supports, improving user compliance and making them more appealing for long-term wear, particularly in geriatric and rehabilitation care.

Orthopaedic Braces and Supports Market Dynamics

Driver

“Rising Incidence of Musculoskeletal Disorders and Growing Focus on Preventive Care”

- The Europe orthopaedic braces and supports market is primarily driven by the increasing prevalence of musculoskeletal disorders such as osteoarthritis, sports injuries, and spinal conditions, particularly among the aging population and active sports enthusiasts.

- Healthcare systems in Europe are prioritizing non-invasive treatment options, including orthopaedic braces, to reduce healthcare costs, encourage quicker recovery, and avoid invasive surgeries. This trend is especially evident in countries with aging populations, such as Germany, Italy, and France.

- With growing awareness about the benefits of early intervention and injury prevention, there is a surge in demand for braces and supports, particularly in sports medicine, rehabilitation, and post-surgery care. Athletes, as well as individuals with chronic conditions, are increasingly adopting these devices to improve mobility and prevent further damage.

- Technological advancements in materials, design, and customization are making braces more comfortable and effective, driving higher adoption rates among patients. Additionally, the shift towards personalized orthopaedics, where braces are tailored to individual needs, is further propelling market growth.

For instance,

- In 2023, Össur hf. (Iceland) launched a new line of lightweight, smart orthopaedic braces that integrate sensors to monitor joint movement and provide data for enhanced rehabilitation, marking a significant milestone in the market

- This trend is further supported by increasing investments in healthcare infrastructure, the expansion of homecare solutions, and favorable reimbursement policies across Europe, making orthopaedic braces more accessible to a broader range of patients.

Opportunity

“Integration of Orthopaedic Braces and Supports into Decentralized and Home-Based Rehabilitation Models”

- The growing shift toward decentralized healthcare, including outpatient rehabilitation centers, community clinics, and in-home recovery programs, is creating significant opportunities for orthopaedic braces and supports that are portable, self-adjusting, and user-friendly across Europe.

- • Increased focus on early mobility and self-managed recovery—particularly after orthopaedic surgeries or injury treatments—is driving demand for braces that support safe and guided movements in non-hospital settings, including at home or in tele-physiotherapy environments.

- • The move toward community-based care and virtual rehabilitation services is accelerating innovation in compact, adjustable orthopaedic devices with digital features that allow healthcare professionals to remotely monitor patient progress, adjust therapy protocols, and ensure adherence to prescribed brace use.

For instance,

- In March 2024, Thuasne Group launched a connected lumbar support brace with Bluetooth functionality, designed for decentralized rehabilitation. The device integrates with a mobile app to provide posture tracking, usage feedback, and remote physiotherapy integration—demonstrating a strategic response to Europe’s evolving healthcare delivery models

- This trend is further supported by increasing healthcare digitization, cost-containment initiatives, and the need to reduce pressure on tertiary hospitals—boosting demand for smart, wearable orthopaedic devices suitable for diverse settings and personalized recovery pathways.

Restraint/Challenge

“High Product Costs and Stringent Medical Device Regulations”

- The high cost of advanced orthopaedic braces and supports, particularly those incorporating smart technologies, personalized fittings, and premium materials, poses a challenge to widespread adoption—especially among patients in lower-income brackets and publicly funded healthcare systems in Europe.

- Complex and time-intensive regulatory approval processes under the European Union Medical Device Regulation (EU MDR) add to manufacturers' burden, often requiring extensive clinical validation, post-market surveillance, and documentation, which delays product launches and increases compliance costs.

- For smaller companies and new entrants, navigating these regulatory complexities can limit innovation and slow market expansion, especially in price-sensitive regions and among healthcare providers with limited procurement budgets.

For instance,

- In 2024, a report from MedTech Europe noted that over 50% of small and mid-sized medical device companies faced delays or withdrew planned product launches due to the added financial and administrative pressures of EU MDR compliance.

- These challenges can lead to limited product accessibility in rural and underserved areas, reduced patient choice, and competitive disadvantages for SMEs compared to established multinational corporations, ultimately restraining overall market growth in Europe

Orthopaedic Braces and Supports Market Scope

The market is segmented on the basis, product, type, application, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Application |

|

|

ByDistribution Channel |

|

In 2025, the Ankle Braces and Supports is projected to dominate the market with a largest share in product segment

The ankle braces and supports segment is expected to dominate the Orthopaedic Braces and Supports Market with the largest share of 56.22% in 2025 driven by the increasing incidence of ankle injuries, sprains, and fractures, particularly in sports and active lifestyles. Ankle braces play a crucial role in stabilizing the joint, reducing swelling, and providing support during the recovery phase. The growing focus on injury prevention in athletes and the rising awareness of the benefits of early intervention are major factors fueling demand for ankle braces.

The Orthopaedic Clinics is expected to account for the largest share during the forecast period in Distribution Channel market

In 2025, the Orthopaedic Clinics are expected to dominate the market with the largest market share of 51.31% due to its high patient volume and the critical role of these institutions in managing complex musculoskeletal conditions. Orthopaedic Clinics, particularly in Germany, France, and the U.K., continue to invest in advanced orthopaedic solutions to support post-surgery recovery, injury management, and chronic pain treatment. The adoption of high-tech orthopaedic braces, coupled with better reimbursement policies for rehabilitation treatments, enhances the accessibility of these devices in hospital settings. Additionally, the increasing focus on outpatient rehabilitation and the growing trend of home-based recovery programs are further supporting the dominance of this segment.

Orthopaedic Braces and Supports Market Regional Analysis

“Germany is the Dominant Country in the Orthopaedic Braces and Supports Market”

- Germany leads the Europe Orthopaedic Braces and Supports Market, holding the largest share due to its advanced healthcare infrastructure, high demand for musculoskeletal treatments, and significant investments in medical technologies.

- The country’s strong emphasis on post-operative rehabilitation, injury recovery, and chronic pain management drives the adoption of orthopaedic braces and supports across hospitals, rehabilitation centers, and outpatient facilities.

- With a growing aging population and high levels of physical activity, particularly in sports and fitness, the need for preventive care and injury rehabilitation solutions is contributing to the market’s growth.

- Germany’s favorable reimbursement policies and well-established healthcare system, along with key industry players such as Bauerfeind AG and Ottobock, further enhance its market leadership.

- The expansion of tele-rehabilitation services and integration of smart orthopaedic devices also plays a key role in strengthening Germany’s position as a hub for orthopaedic innovations in Europe.

“U.K. is Projected to Register the Highest Growth Rate”

- The U.K. is expected to witness the fastest growth in the Europe Orthopaedic Braces and Supports Market, driven by its robust healthcare system, increasing prevalence of musculoskeletal disorders, and focus on improving rehabilitation and post-surgery care.

- The UK government’s push toward digital health integration, along with an emphasis on improving access to healthcare services, is fostering the adoption of smart orthopaedic braces and supports. This includes growing investments in wearable health technologies and tele-rehabilitation platforms.

- Strategic initiatives to expand the availability of orthopaedic care across rural and underserved areas are further contributing to market growth, along with a growing awareness of preventive care, especially in the aging population.

- The presence of leading healthcare providers and academic collaborations between research institutions and industry players is accelerating the development and adoption of advanced orthopaedic support devices across the UK.

Orthopaedic Braces and Supports Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Bauerfeind AG (Germany)

- Otto Bock Healthcare GmbH (Germany)

- Thuasne Group (France)

- DJO Global, Inc. (U.S.)

- Össur hf. (Iceland)

- Tynor Orthotics Pvt. Ltd. (India)

- BSN medical GmbH (Germany, part of Essity AB)

Latest Developments in Orthopaedic Braces and Supports Market

- In September 2023, Össur hf launched a new knee brace in Europe tailored for osteoarthritis patients. The brace utilizes advanced materials and a customizable fit system to enhance comfort and support for individuals suffering from knee osteoarthritis, providing a more effective solution for pain relief and mobility.

- In June 2023, Ottobock expanded its production facilities in Germany to boost the manufacturing capacity of its orthopaedic braces and supports. This expansion aims to meet the increasing demand for orthopaedic products across Europe, improving production efficiency and reducing delivery times for customers

- In March 2023, Bauerfeind AG introduced a new line of smart ankle braces in Europe. These innovative braces feature integrated sensors that track movement and provide real-time feedback to users and healthcare providers via a mobile app, enhancing the monitoring and recovery process for ankle injuries.

SKU-

世界初のマーケットインテリジェンスクラウドに関するレポートにオンラインでアクセスする

- インタラクティブなデータ分析ダッシュボード

- 成長の可能性が高い機会のための企業分析ダッシュボード

- カスタマイズとクエリのためのリサーチアナリストアクセス

- インタラクティブなダッシュボードによる競合分析

- 最新ニュース、更新情報、トレンド分析

- 包括的な競合追跡のためのベンチマーク分析のパワーを活用

調査方法

データ収集と基準年分析は、大規模なサンプル サイズのデータ収集モジュールを使用して行われます。この段階では、さまざまなソースと戦略を通じて市場情報または関連データを取得します。過去に取得したすべてのデータを事前に調査および計画することも含まれます。また、さまざまな情報ソース間で見られる情報の不一致の調査も含まれます。市場データは、市場統計モデルと一貫性モデルを使用して分析および推定されます。また、市場シェア分析と主要トレンド分析は、市場レポートの主要な成功要因です。詳細については、アナリストへの電話をリクエストするか、お問い合わせをドロップダウンしてください。

DBMR 調査チームが使用する主要な調査方法は、データ マイニング、データ変数が市場に与える影響の分析、および一次 (業界の専門家) 検証を含むデータ三角測量です。データ モデルには、ベンダー ポジショニング グリッド、市場タイムライン分析、市場概要とガイド、企業ポジショニング グリッド、特許分析、価格分析、企業市場シェア分析、測定基準、グローバルと地域、ベンダー シェア分析が含まれます。調査方法について詳しくは、お問い合わせフォームから当社の業界専門家にご相談ください。

カスタマイズ可能

Data Bridge Market Research は、高度な形成的調査のリーダーです。当社は、既存および新規のお客様に、お客様の目標に合致し、それに適したデータと分析を提供することに誇りを持っています。レポートは、対象ブランドの価格動向分析、追加国の市場理解 (国のリストをお問い合わせください)、臨床試験結果データ、文献レビュー、リファービッシュ市場および製品ベース分析を含めるようにカスタマイズできます。対象競合他社の市場分析は、技術ベースの分析から市場ポートフォリオ戦略まで分析できます。必要な競合他社のデータを、必要な形式とデータ スタイルでいくつでも追加できます。当社のアナリスト チームは、粗い生の Excel ファイル ピボット テーブル (ファクト ブック) でデータを提供したり、レポートで利用可能なデータ セットからプレゼンテーションを作成するお手伝いをしたりすることもできます。